- Submissions

Full Text

Evolutions in Mechanical Engineering

Overview of the Recovery Trend in Global Nuclear Power Engineering and Construction

An Xian1, Yan Xiu1,2*, Guan Meizhou3, Wang Pengfei1 and Guo Dengke4

1 China Institute of Nuclear Industry Strategy, China

2 Research Institute of Physical and Chemical Engineering of Nuclear Industry, China

3 China Nuclear Engineering & Construction Corporation, China

4 China Nuclear Industry 23 Construction co., LTD, China

*Corresponding author:Yan Xiu, China Institute of Nuclear Industry Strategy, Beijing 100048, China

Submission: September 10, 2025;Published: September 26, 2025

ISSN 2640-9690 Volume6 Issue3

Introduction

The global nuclear power construction is showing a significant recovery trend, with the construction scale rising to the peak in the past three decades and investment growing strongly. Driven by policy shifts, the focus of construction and the dominance of technology are accelerating their transfer to emerging economies. Faced with challenges of cost and construction period, innovative technologies such as modular construction have become core breakthrough points. Against the backdrop of accelerated low-carbon energy transition and evolving geopolitical patterns, nuclear power, as a reliable low-carbon base-load power source, is profoundly reshaping the global energy landscape and boasting broad prospects for future development.

New Pattern of Global Nuclear Power Construction: Driven by Policy Shifts, Led by Emerging Markets

Construction scale reaches a 30-year peak, with strong investment growth

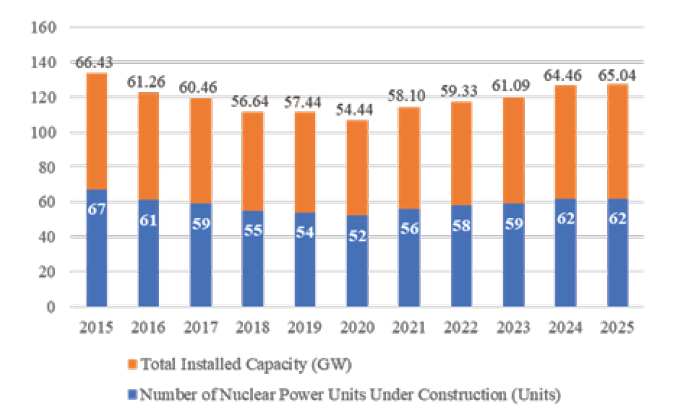

Figure 1:Summary of the number and total installed capacity of global nuclear power units under construction in the past decade. Source: IAEA PRIS.

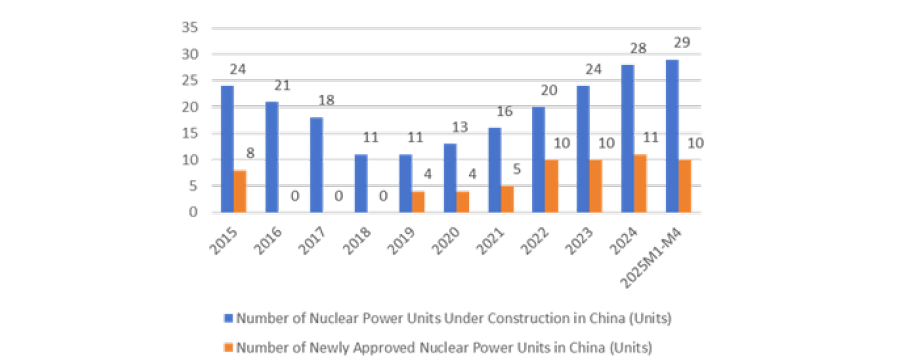

By the end of 2024, there were 62 nuclear reactors under construction worldwide (with a total installed capacity of approximately 65 gigawatts), marking the highest scale since 1990. This growth momentum has received significant financial support: since 2020, the annual global investment in nuclear energy (covering new construction and life extension projects) has increased by nearly 50%, exceeding 60 billion US dollars. The International Energy Agency (IEA) predicts that to achieve the rapid expansion scenario, global nuclear energy investment will need to nearly double by 2030, reaching approximately 120 billion US dollars. During the 2024-2050 period, the cumulative investment scales under different policy scenarios are as follows: 1.7 trillion US dollars under the Stated Policies Scenario (STEPS), 2.5 trillion US dollars under the Announced Pledges Scenario (APS) and 2.9 trillion US dollars under the Net Zero Emissions by 2050 Scenario (NZE) (Figure 1) (Table 1). As the absolute main force in global nuclear power construction, according to IAEA data, by April 2025, the number of nuclear power units under construction in China had reached 29 and the completed investment in nuclear power engineering construction amounted to 146.9 billion yuan, a yearon- year increase of 52 billion yuan, hitting a record high (Figure 2).

Table 1:Status of nuclear power units under construction in various countries and regions worldwide (as of august 11, 2025).

Figure 2:Summary of the number of nuclear power units under construction and newly approved in China in the past decade. Source: IAEA PRIS, China nuclear energy association, China Nuclear engineering & construction corporation announcements.

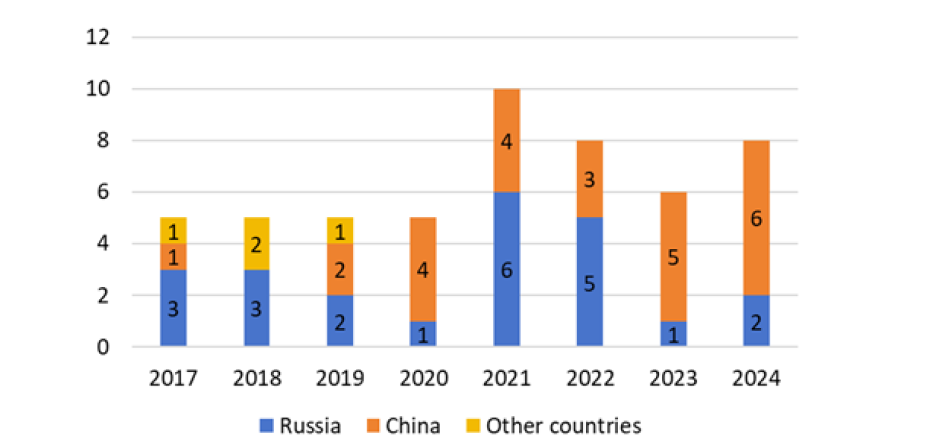

Eastward shift of technology-leading countries, China and Russia leading new projects

The global pattern of nuclear power construction has undergone profound changes. Although developed economies hold two-thirds of the global nuclear power installed capacity, Emerging Markets and Developing Economies (EMDEs) have become the main force in new projects, and the source of technology is highly concentrated in China and Russia. Among the 52 new nuclear power plants started worldwide between 2017 and 2024, 25 adopted Chinese technology, 23 used Russian technology and only 4 were from developed countries (2 in the United Kingdom and 2 in South Korea). The growth rate of China’s nuclear power installed capacity has significantly outpaced that of developed economies and the IEA predicts that China will surpass the United States to become the world’s largest by around 2030. By 2050, China’s nuclear power installed capacity will increase from 57 gigawatts in 2023 to: 190 gigawatts under the STEPS scenario, 280 gigawatts under the APS scenario and 320 gigawatts under the NZE scenario (Figure 3 & 4).

Figure 3:On-site of the dome hoisting operation of unit 4 of xudapu nuclear power plant (a Sino Russian cooperative project). Source: Xinhua news client

Figure 4:Number of nuclear power units started construction by country of technology origin (2017-2024). Source: IEA (2025) the path to a new era for nuclear energy.

Differentiated regional layouts, with policy-driven focuses varying

Europe and the United States are promoting the revival of nuclear power through strategic planning. The United States plans to start the construction of 10 large-scale nuclear power plants by 2030. In Europe, the United Kingdom provided 19.3 billion US dollars in funding for the Hinkley Point C nuclear power plant in June 2025, which is expected to create approximately 10,000 jobs during its construction period. France plans to build 6 new advanced Pressurized Water Reactors (EPR2) by 2030, demonstrating its determination to revitalize the nuclear energy industry. Emerging market countries are accelerating the layout of the nuclear power industry. India has an ambitious plan to add 12 nuclear reactors by 2030. Vietnam is re considering resuming its nuclear power development plan and Indonesia is actively exploring the path of nuclear power development. Saudi Arabia in the Middle East continues to advance its nuclear energy plan. According to statistics from the International Atomic Energy Agency (IAEA), approximately 30 emerging market countries around the world are considering, planning or have launched nuclear power construction projects, highlighting the huge enthusiasm of emerging markets for nuclear energy (Figure 5).

Figure 5:In December 2024, Unit 3 of the Flaman Ville nuclear power plant in Northern France was successfully connected to the national power grid. Source: Electricité de France (EDF).

Focus of International Competition: Cost Control and Construction Period Management

Construction costs: Dilemmas in developed economies and advantages in emerging economies

Nuclear power projects in developed economies frequently experience severe cost overruns. The initial budget (at 2023 prices) for the Vogtle 3&4 project in the United States (the first AP1000 reactor type) was 5,600 US dollars/kW. Due to contractor replacement and labor management issues, the final cost soared to 14,700 US dollars/kW, with a cost overrun of 162%. The Flamanville 3 project in France (using EPR technology) suffered from design flaws that led to rework of the containment vessel welding, causing the cost to surge from 3,200 US dollars/kW to 11,000 US dollars/ kW. In contrast, emerging economies have shown significantly better performance. The Saeul 1&2 project in South Korea adopted the mature OPR1000 design and the life extension project only had a cost overrun of 30%. China’s “HPR1000” (Hualong One) has achieved mass production, with an average construction cost significantly lower than that in developed economies.

Construction period challenges: The “Time dilemma” in global nuclear power construction

Globally, the average construction time of a nuclear power plant is 7 years, but projects in developed economies are generally delayed, often taking more than 10 years to complete. For example, the Vogtle 3&4 project in the United States is expected to take 10 years to build. The Flamanville 3 project in France, which started construction in 2007 and was put into operation in 2024, was delayed by 12 years, making it the most delayed nuclear power project in the world.

Future Outlook for Global Nuclear Power Engineering and Construction

Generation III nuclear power units are about to enter a peak construction period

The IAEA has raised its forecast for global nuclear power development for four consecutive years. Thirty-one countries and regions have signed the Triple Nuclear Energy Declaration, and global interest in nuclear energy has reached its highest level since the 1970s oil crisis. According to IEA predictions, under the current policy scenario, the global nuclear power installed capacity will increase by more than 50% by 2050, reaching 650 gigawatts; under a more aggressive scenario, the nuclear power installed capacity will double to 870 gigawatts. With their advanced safety and economic efficiency, Generation III nuclear power units will become the main force in future nuclear power construction, leading the global nuclear power engineering and construction into a new stage of development.

Reshaping of the regional pattern of nuclear power plant construction: Emerging economies leading the trend

In developed economies, due to the weak construction of new nuclear power projects, coupled with the aging of existing reactors and the shutdown of some units, the proportion of nuclear energy in power supply has continuously declined from approximately 24% in 2001 to around 17% in 2023. The European Union’s peak proportion (34%) has decreased by 11 percentage points so far. China and emerging economies will play an important role in the construction of nuclear power plants. It is expected that by 2030, China’s nuclear power installed capacity will surpass that of the United States and Europe, becoming the world’s largest nuclear power market. Relying on their rapidly developing economies, growing electricity demand and emphasis on clean energy, emerging economies will make collective efforts to further change the global nuclear power landscape.

Modular construction: A key technology to shorten the construction period

Modular construction is widely regarded as a revolutionary approach to solving the problems of long construction periods and high costs in nuclear power construction. As early as the 1980s, Bechtel Corporation of the United States applied the modular construction experience of nuclear submarines to the nuclear power field, reducing the unit construction period from 62 months to 48 months. Westinghouse Electric Corporation of the United States systematically introduced the modular design concept in the R&D of AP1000, clarifying the overall construction concept of modular design, factory prefabrication and on-site assembly from the source of design. Although the nuclear power plants that have been put into operation in China have not yet widely adopted overall modular construction (mostly local small modules), the largemodule concept introduced in the AP1000 project has accumulated valuable experience. As an important construction mode for Generation III nuclear power plants, the successful experience of modular construction is expected to be widely promoted in future projects, becoming a key technical support for improving the efficiency of global nuclear power engineering and construction.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)