- Submissions

Full Text

Strategies in Accounting and Management

Digitalization of Accounting Learnings, and the Challenges of Gen Z Students

Agim Mamuti1*, Alborena Bakiu2 and Robert W McGee3

1Faculty of Technical Sciences, Mother Teresa University in Skopje, North Macedonia, USA

2University of Michigan, USA

3Fayetteville State University, USA

*Corresponding author:Agim Mamuti, Faculty of Technical Sciences, Mother Teresa University in Skopje, North Macedonia, USA

Submission:August 08, 2025;Published: September 18, 2025

ISSN:2770-6648Volume5 Issue 3

Abstract

The modern business world relies heavily on financial strategy, vision, and their implementation. Accounting is a crucial step in this process because the modern corporate world places a lot of emphasis on their financial strategy and it is part of it. The International Financial Reporting Standards (IFRS), one of the most significant standards implemented in 2001, are one of the frameworks that have been built over time to govern and standardize accounting procedures. However, the approach to accounting education has been revolutionized and has given rise to the digitalization of accounting learning because of technology’s rapid development, particularly in the areas of information and communication.

With a specific focus on Generation Z students, who were born after 1997 and are characterized by early exposure to technology, short attention spans, multitasking skills, and a preference for instant feedback, this research paper aims to explore the prospects and challenges of digitalizing accounting education. The goal is to pinpoint methods for improving the caliber and efficacy of online accounting education and to address the challenges that Generation Z students in this digital age encounter

The first step in the study is to emphasize the significance of accounting digitalization owing to digital improvements, and its impact on the future of accounting professionals. We present an overview of the unique obstacles that the Generation Z students face as they develop their sense of identity and belonging in society. In the meantime, the literature review section explores the findings and research that can serve as a steppingstone to an efficient and optimized digitalization process. The mixed approach of both quantitative and qualitative data used is described in the methodology section.

The study’s conclusion highlights how crucial it is to modernize and enhance accounting instruction in order to prepare students for successful careers. To deliver an efficient and interesting accounting education, it’s critical to use digital learning methodologies, update course material, and take into account Generation Z students’ particular needs. Accounting educators and institutions can better educate students for the dynamic world of accounting and finance by adjusting to the demands of technology and the workforce.

Keywords: Accounting; Digitalization; Gen Z

Introduction

The very backbone of modern business stands on its financial strategy and vision, and their implementation. Accounting is part of this “spine,” which runs the global economic system. In 1887 the American Association of Public Accountants (AAPA) was established and in 1896 the accounting profession was recognized, which came with the establishment of the Certified Public Accountant (CPA) title. Along the way frameworks were set to place in order to regulate and direct the proper path to standardized, honest, and confident accounting. One of these sets of standards is International Financial Reporting Standards (IFRS), which were implemented for the first time by the International Accounting Standards Board in January 2001, which is the successor to the International Accounting Standards Committee, which was formed in 1973. We have come a long way, especially with the rapid growth of technology (especially in terms of information and communications), which has transformed the way accounting is approached during everyday work and especially, looking further at the core and genesis, the technique followed to deliver and revive accounting education. Accounting learning refers to the efficient and practical use of modern tools to enhance, enrich, and make more accessible the actual education delivered. The range and array of these tools can start from online courses, e-books, simulations, AI integration, gamification, and other methods. However, these methods do not come without some significant challenges and barriers along the way, and especially the Generation Z (referred to as Gen Z) students, a generation born after 1997 and characterized by a high and early life exposure to technology, a short attention span, and the inclination for multitasking and instant gratification and feedback. In this research paper the aim is to explore the prospects and hurdles of the digitalization of accounting learning with a focus on Generation Z students and to provide some recommendations for improving the effectiveness and optimization of modern accounting education in the current digital era.

The Study’s Framework

The Importance of the Study

The digitalization of accounting learning has turned, with time, into a vital topic to research, develop, and observe further. This vitality has arrived as a by-product of technological development (referred to as a by-product, since the main technological developments that have happened during these times were not aimed at improving accounting, or accounting learning, but affected it marginally as with a lot of other aspects in the global business, trade, and economy). What this means is that there is a very current and actual need for improving and updating accounting education for future generations of students, especially for those belonging to Generation Z [1-5].

In addition, of course it cannot be denied that constant developments and updates have been happening in the meantime, and the education system is being transformed by the use of digital technologies such as AI, cloud computing, data analytics, blockchain, etc. However, technology has been growing at a much faster rate and it is the duty of the institutions, be these institutions small or large, to follow and catch up in order for the frameworks, studies, and methodologies to stay relevant and updated in order to move forward in the proper direction. By researching and studying this topic there are many valuable insights to be gained into the emerging trends and challenges to the accounting profession, as well as equip each individual with the right set of skills and tools to succeed in the digital era [6-11].

On the other hand, Generation Z students face unique obstacles when it comes to the digitalization of accounting education. Some of these obstacles, which are very “recent” in essence are the need to balance their digital and non-digital lives, be able to handle, categorize, and cope with a constant and systematic information overload. cyber risks and security, the adaptation to changing expectations and demands from employers and clients, and the essential fostering of an identity and belonging in a diverse and already globalized world. Therefore, it is important for accounting practitioners and educators to gain a deep understanding and insight, in order to address these challenges, so an effective and engaging learning experience that serve to the needs and preferences of Generation Z students are provided.

The objective of the study

The primary objective of the study is to delve deeper in order to explore the digitalization of accounting learning and address the aforementioned specific challenges faced by Generation Z students in the context of a digital and/or even to be called online education. Accounting, as a discipline in itself, requires a complete suite of theoretical and practical skills. These two variables may pose some difficulties down the road to transitioning and integrating to digital methods and techniques, for learners and educators alike.

Particular emphasis and significance are placed on Generation Z students, who are considered as digitally natives (considered as such due to their characteristics of being inherently proficient with digital technology), therefore harbouring different expectations and preferences for learning in contrast to previous generations. However, challenges such as the higher likelihood of experiencing digital fatigue, distraction, and disengagement in online settings are all part of the reality of a Generation Z student. Consequently, this study aims to identify the best practices and strategies for enhancing the quality and effectiveness of digital accounting learning, and in addition the array of factors that affect the motivation and satisfaction of Generation Z students.

Literature review

In response to the rapid advancements and changes in business and technology, the phenomenon of digitalization of accounting learning has emerged. Digitalization refers to the use of digital technologies to change a business model and provide new revenue and value-producing opportunities [10-12]. Digitalization has affected various aspects of accounting, such as the use of big data, cloud computing, artificial intelligence, and blockchain technology, which pose new challenges and opportunities for the accounting profession [13,14]. Digitalization also has implications for accounting education, as it requires accounting students to develop new skills and competencies to cope with the demands of the digital era [11].

One of the problems that accounting educators face is how to achieve high engagement and motivate Generation Z students, who are undergraduate students born after 1997 [15]. The Generation Z students are highly literate in technology (digital natives), who have been growing up with technology throughout their life and are quite accustomed to instant access to communication and information [2]. In addition, they have also been associated with characteristics such as being diverse, pragmatic, resilient, and socially conscious [16]. Additionally, Generation Z students face an array of issues and challenges, such as gun violence, political unrest, immigration issues, sexual harassment, discrimination, worries about the future, stress and wellbeing, engagement decline, and financial uncertainty due to the COVID-19 pandemic [1].

As a result, accounting educators need to go down pedagogical pathways and use strategies that can come to and cater to the needs and preferences of Generation Z students. Some of the suggested strategies are:

A. Using a blended platform that combines online and

face-to-face learning modes, which can offer flexibility and

convenience for students [1].

B. Incorporating videos, narratives from resilient individuals,

and reflective practice as teaching methods that can enhance

students’ interest and learning outcomes.

C. Providing real-world examples and case studies that can

demonstrate the relevance and applicability of accounting

concepts and skills in the digital context [11].

D. Encouraging collaborative learning and peer feedback

among students, which can foster social interaction and critical

thinking skills [16].

E. Providing timely and constructive feedback to students,

which can help them monitor their progress and improve their

performance.

F. Introducing resilience training that can help students

cope with academic adversities and challenges in the digital era

[1].

Methodology

The aim and purpose of this study is to delve deeper into the challenges faced by Generation Z students regarding the digitalization of accounting learning. To achieve this goal, a combination of methods and a mixed approach was utilized, combining both quantitative and qualitative research methods. First, a comprehensive literature review (from which the results, highlights, and relevant data are expressed above) was conducted to gather more information on the actual situation and state of the digitalization process in accounting education, and especially the problematic areas faced by Generation Z students.

To follow the above step, a questionnaire was carefully designed to gather primary data from university students undergoing some relevant form of accounting education (this includes majors such as finance, economics, accounting, business administration, etc.). The questionnaire consists of questions directly related to accounting learning and students, and knowledge of the International Financial Reporting Standards (IFRS). To measure participants’ knowledge, views, attitudes, and experiences towards digital learning, accounting learnings, IFRS, and their perception of challenges faced in the digitalization of accounting learnings, the questionnaire will include both closed-ended and Likert-scale items. The questionnaire will be sent electronically via an online survey platform, allowing participants to complete it at their leisure within the time range specified.

As aforementioned, the student’s knowledge on IFRS was a major part of the questionnaire as a variable of interest. Within the questions, the participants’ knowledge and grasp of principles and implementation, and their perceived difficulties in learning about IFRS in a digitalized educational environment will be assessed. Demographic data like age, gender, and academic major will also be collected to give context for the analysis. As for the population of this study, it consists of university students of relevant majors indulged in accounting learning and affected by the digitalization process. Another major reason university students were chosen for the sample group is because the current majority demographic consists of Generation Z students.

The questionnaire data was analyzed using descriptive and inferential statistics. To summarize the data and offer an overview of the sample characteristics, descriptive statistics were utilized. To test the correlations between variables and establish the significance of the results, inferential statistics were used. Exploratory factor analysis was also used in the data analysis to find underlying elements that may influence students’ views towards digital learning. The results of the literature research and questionnaire were then synthesized to provide a thorough knowledge of the obstacles that Gen Z students experience in the digitalization of accounting learning. The findings were analyzed considering existing accounting education ideas and frameworks. The study also included a discussion of the findings’ significance for educators and policymakers in devising successful measures to serve Gen Z accounting students.

It is critical to recognize the study’s potential shortcomings. The use of a convenience sample may create sampling bias, reducing the findings’ generalizability. Because the data acquired by the questionnaire is self-reported, it may be prone to response bias. Furthermore, the study’s scope is limited to a single university and may not capture the whole range of issues faced by Gen Z students in various educational contexts.

Result Overview and Analysis

General findings

In this section a comprehensive overview of the findings will be provided, in order to shed light on various aspects such as demographics, IFRS learning, knowledge and experience, opinions on IFRS incorporation, importance and coverage, learning tools and materials, challenges in learning IFRS, keeping up with IFRS changes, and Gen Z students’ digital learning perceptions. About the demographic, the study sample consisted of 100 people, the majority being female (73%), predominantly of Albanian nationality (75.8%); however other nationalities were also represented, including the USA (16.1%), EU (1.6%), Kosovo (1.6%), and Others (4.8%). When it comes to the study level of the participants, the largest proportion were postgraduate students (54%), followed by undergraduate students (42.9%). What is surprising is that more than half of the participants reported not taking any courses regarding IFRS specifically, suggesting a potential gap in IFRS education opportunities.

Among the students who had taken IFRS related or specific courses, only 19.4% had passed one or two courses, which serves as an indicator of the limited exposure to IFRS material. However, notably a majority (95.2%) reported not failing any IFRS courses, highlighting the fact that most of the students have either not taken any specific or related IFRS course or that they are still undergoing one of them. Shifting focus to the extent of knowledge, the responses were more diversified. While a significant portion (20.6%) claimed to have no knowledge at all, 33.3% felt that they were reasonably knowledgeable about the subject [17-22].

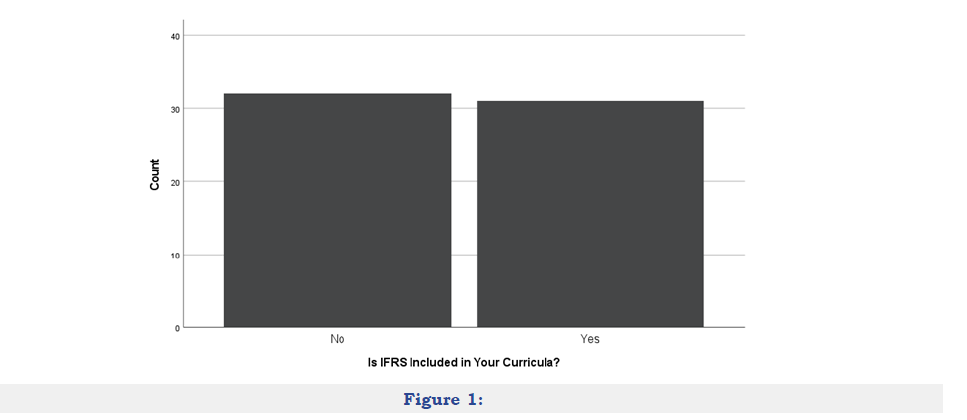

The conducted survey revealed a strong interest in learning IFRS, with 85.5% of the respondents expressing a desire to learn more. In addition, a significant majority (88.7%) were supportive to the possibility of IFRS being incorporated into the accounting curricula. Nevertheless, a concern was found as the survey revealed that only half of the participants reported having an IFRS course (specific or related) integrated and included in their curriculum, and even less (41.4%) indicated that the course was mandatory for their graduation. This accumulated data sheds light on a potential misalignment between the perceived importance of IFRS and its actual inclusion in academic programs. This can be because of two factors, one being the fact that IFRS in itself is first of all everchanging. Even though the core principles and standards are not updated or changed in such a way to create major differentiation through time, creating an IFRS module could prove difficult and creates the possibility of leading to outdated information for the student to retain, which means it is left as mostly the student’s responsibility to stay on top of the relevant changes. The second factor, even though less likely, could be that IFRS is quite a practical “skill” and is one of the two major standards (U.S. GAAP being the other), so the individual is better off learning more about IFRS and updating their knowledge of it later on during their career.

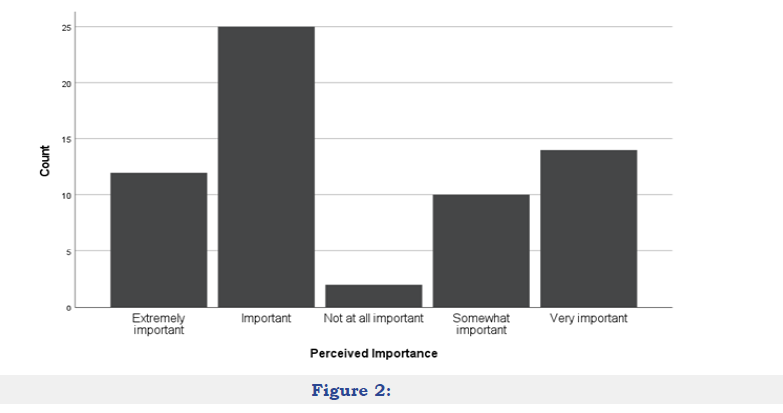

To keep up with IFRS updates or changes, participants relied primarily on internet materials, IFRS related books, and domestic conferences. These were perceived as valuable information channels, indicating the need for accessible and up-to-date resources to stay on top of the ever-changing, complex, and dynamic nature of IFRS (Figure 1). The participants who were part of the study recognized the importance of an IFRS education, with 62% considering it important or very important. When asked about the academic level at which IFRS should be integrated, almost half of the respondents (49.2%) were leaning toward it being included in both undergraduate and postgraduate programs. This is an indicator, again, of the perceived importance of the IFRS education by students, and the need for a comprehensive coverage across different educational levels or stages (Figure 2).

Figure 1:

Figure 2:

Nonetheless, to better understand the reason where the current knowledge owned by student comes from, we analyze the learning tools and materials used by them. Textbooks and case studies were highlighted as the most useful resources for IFRS learning. PowerPoint presentations, videos, webcasts, and specific software were also deemed helpful but with a differentiation in their level of usefulness. These findings reveal the importance of incorporating diverse and engaging learning materials to improve the effectiveness of an integrated IFRS education.

The study identified several problematic areas faced by students (especially Generation Z students) in learning IFRS. Participants expressed concerns related to the lack of well-recognized learning materials, the limited learning hours, insufficient training opportunities, and a lack of examples and exercises that better illustrate the differences (such as between National Standards and IFRS). The importance of addressing resource limitations, providing adequate learning support, and facilitating practical application to enhance IFRS comprehension are revealed as some of the challenges.

Generation Z students’ perceptions towards digital learning indicated positive attitudes and sentiments. They are quite aware and acknowledge that digital learning is a method that could enhance their comprehension, teamwork, and career development. Participants expressed that digital accounting learning is perceived as simple and they found themselves more eager to use it, provided they were going to receive some assistance. Moreover, the study is a clear demonstration of the influence of social factors, as peers, friends, highly influential individuals, and academic institutions and their staff were regarded as the major motivating forces behind the adaptation to a digital learning pathway.

Correlations

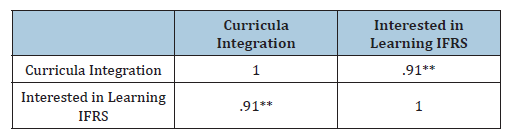

Table 1:

** Correlation is significant at the 0.01 level (2-tailed).

Based on the data collected from the questionnaire, the following correlations were obtained using SPSS software. A number of correlations can be pulled from the data received from the study. To begin with, as stated above the data shows a great interest in learning IFRS (with 85.5% of participants expressing the desire to learn more). Similarly to it, the aforementioned 88.7% support the incorporation of IFRS into the accounting curricula. The correlation between the two variables above highlights the significance of educational programs being aligned with student interests and aspirations. Integrating IFRS based on student demand into the accounting curricula can create a higher level of engagement, participation, and motivation for learning. Furthermore, for the students’ preferences to be considered means leading towards a comprehensive and relevant IFRS course development that can fulfill their professional needs and enhance career prospects. Table 1 shows some of the relevant data.

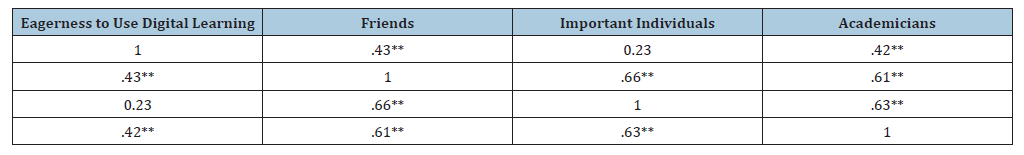

Table 2:

**Correlation is significant at the 0.01 level (2-tailed).

Focusing again on what the data revealed to us, Generation Z students show positive attitudes towards digital learning, perceived as a valuable tool to enhance comprehension, teamwork, and career development. In addition, the social factors (peers, friends, influential individuals, academic institutions, etc.) seem to have a significant impact on the adaptation of the digital learning experience. The importance of a supportive and motivating learning environment, as well as the potential role of peer interactions and mentorship are highlighted by this correlation as partaking in the positive adoption of the digital accounting learning by Generation Z students. Leveraging these social influences can lead to the successful integration of digital learning methods, platforms, and technologies in accounting education, thereby enriching the learning experience provided to the current and future generations. Table 2 shows some additional relationships.

Conclusion

This study, on the digitalization of accounting learning with a focus on Generation Z students, has revealed important aspects related to the integration of technology in accounting education. The findings have shed light over the increasing need and significance of digitalization as a by-product of on-going and rapid advancements in technology, which impact the global economy. This highlights the urgent need to update and improve the accounting education delivered, to equip students, especially Generation Z, with the important and useful skills and tools to succeed in the digital era.

The findings show that participants have a keen interest in learning IFRS, with the majority supporting its inclusion in accounting courses. It is significant, though, that only 50% of respondents said they had an IFRS course in their curriculum, and even fewer said it was necessary to pass in order to graduate. This discrepancy between perceived importance and actual integration emphasizes the necessity for educational institutions to adapt and offer pertinent, current, and useful IFRS courses that take into account students’ requirements and preferences.

The favorable attitudes of Generation Z students toward digital learning suggest that it has the ability to improve understanding, teamwork, and career growth. The study emphasizes how social factors, like peer support and academic institutions’ emphasis on digital learning, contribute to students’ favorable adoption of new technologies. Teachers must take into account blended learning platforms, add engaging teaching strategies like videos and narratives, and offer real-world examples and case studies in order to successfully deploy digital accounting learnings.

The study also cites difficulties that Generation Z students encounter, such as a lack of training opportunities and learning resources and examples that show how different accounting standards differ. In order to provide an interesting and successful learning experience, these issues must be resolved. Students may be able to handle the demands of a digital accounting education if they have access to a variety of practical learning tools, receive fast feedback, and receive resilience training.

In conclusion, this study offers insightful information about the issues and new trends in accounting education in the digital age, with an emphasis on Generation Z students. The results highlight the significance of ongoing accounting education adaptation and improvement to meet the changing demands of technology and the workforce. Accounting educators and institutions can promote a more effective and engaging learning experience, preparing students to thrive in the quickly changing environment of accounting and finance, by integrating digital learning strategies, updating course content, and attending to the particular needs of Generation Z students.

References

- Affinity Magazine (2021) The 5 most serious challenges faced by gen Z.

- Ang EJ (2021) Teaching with technology for Generation Z learners in higher education: A theoretical framework and implications for teaching practice. Educational Technology Research and Development 69(2): 649-670.

- Asif R (2020) Digital skills in accounting education: Exploring the readiness of Gen Z learners. International Journal of Accounting and Information Management 28(2): 221-238.

- Board IA (2023) IFRS Standards. Retrieved from International Accounting Standards Board, UK.

- Brown LE (2023) Generation Z in online learning: Addressing digital fatigue and enhancing engagement. Journal of Educational Technology 15(2): 210-230.

- Chan SK (2020) Digital learning adoption in accounting education: A case study of university students in Hong Kong. The International Journal of Management Education 18(3): 100408.

- Duncan L (2022) The future of accounting education: Preparing Generation Z for a Digital World, Accounting today.

- Ernst & Young (2019) Bridging the gap: A practical guide to Generation Z in the workforce.

- Groth EC (2021) The integration of Generation Z into accounting firms: Perspectives from firm leaders. Accounting Education 30(4): 441-463.

- Gulin A (2019) Digitalization in Accounting: A Case Study of Accounting Firms in Sweden. Lund University Publication, Sweden.

- IFAC (2020) PAO Digital Transformation Series.

- Kara OB (2020) The effects of digital learning materials on accounting students' academic performance: A case study in Turkey. Journal of Applied Research in Higher Education 12(4): 879-893.

- Möller J (2020) The impact of digitalization on accounting. Research in Accounting Regulation 32(1).

- Paul J (2019) The effects of digital learning tools on accounting students' motivation and performance. Issues in Accounting Education.

- Pew Research Center (2020). Defining generations: Where Millennials end and Generation Z begins.

- Schukei A (2020) What You Need to Understand About Generation Z Students. The Art of Education University.

- Slepkov A (2021) Digitalization in accounting: Teaching technology to accounting students. Journal of Accounting Education 59: 100753.

- Smith JA (2022) Exploring the challenges of digitalization in accounting education. Journal of Accounting Education 45: 78-79.

- Varshneya G (2021) Accounting education for generation Z: Strategies and best practices. Journal of Higher Education Theory and Practice 21(5): 96-108.

- Yoon HS (2021) Understanding generation Z's learning preferences in accounting courses. Journal of Accounting Education 56: 100776.

- Young SM (2019) Generation Z's perception of the accounting profession. Journal of Accounting Education 47: 100671.

- Young SM (2021) Generation Z's perception of the accounting profession. Journal of Accounting Education 56: 100776.

© 2025 Agim Mamuti. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)