- Submissions

Full Text

Strategies in Accounting and Management

Assessing Green Shipping Investment Strategies in Bangladesh’s Maritime Logistics Sector

Muhammad Misbahul Islam1, Md Al Sani2, Hadi Sayham Sabbir3, Waheed Ullah Shah4*

11Business School, Shandong Normal University, Shandong Jinan, China

22Business School, Shandong Normal University, Shandong Jinan, China

3School of economics and management, Chongqing University of post and Telecommunication, China

4School of Management and Economics; Kunming University of Science and Technology, China

*Corresponding author:Waheed Ullah Shah, School of Management and Economics; Kunming University of Science and Technology, China

Submission:August 07, 2025;Published: September 18, 2025

ISSN:2770-6648Volume5 Issue 3

Abstract

As global efforts to decarbonize maritime transport intensify, emerging economies like Bangladesh face growing pressure to align their shipping and port operations with green investment strategies. This study investigates the key determinants influencing green shipping investments within Bangladesh’s maritime logistics sector, focusing on the perceptions and readiness of core stakeholders. A structured survey was administered to approximately 100 respondents (graduate’s student) about four categories: port authorities, shipping companies, maritime financiers, and industry experts. Using Likert-scale measures, we evaluated five latent constructs: Perceived Environmental Pressure (PEP), Financial Readiness (FR), Technology Adoption (TA), Regulatory Support (RS), and Performance Outcomes (PO). Ordinary Least Squares (OLS) regression analysis reveals that TA and FR are the strongest predictors of green performance outcomes, followed by PEP and RS. Stakeholder-specific models further highlight variation: port authorities prioritize regulatory clarity, shipping firms emphasize financial feasibility, while investors respond most to risk-adjusted technological returns. The findings suggest that while international decarbonization targets shape strategic perceptions, actual investment outcomes hinge on access to capital and tangible technological capabilities. Policy implications include the need for concessional finance instruments, innovation subsidies, and enforceable green port regulations. Overall, this study offers timely insights into how Bangladesh can strategically navigate the green maritime transition by aligning policy, finance, and technology in a coordinated investment ecosystem.

Keywords: Green shipping; Maritime logistics; Investment readiness; Technology adoption; Bangladesh

Introduction

Bangladesh’s maritime logistics sector is vital to its economy, with the Port of Chittagong handling 70% of trade and the Port of Mongla also playing a key role. The new Matarbari Deep-Sea Port aims to boost regional connectivity. Globally, shipping accounts for about 3% of greenhouse gas emissions, expected to rise sharply without action. Bangladesh is committed to IMO’s targets of cutting emissions by 20-30% by 2030 and reaching net-zero by 2050, launching a National Action Plan and securing international funding to modernize ports. Green investments like shore-side power, energy-efficient machinery, and digital technologies are key to reducing emissions and improving efficiency. Major global operators are exploring sustainable projects in Bangladesh, supported by government and private incentives to drive green financing.

Bangladesh’s maritime logistics sector plays a critical role in the country’s economic growth, international trade, and regional connectivity, particularly through its key ports such as Chittagong, Mongla, and Payra [1,2]. As the global maritime industry faces increasing pressure to reduce environmental impacts, Bangladesh is gradually shifting toward a sustainable Blue Economy that integrates renewable energy, conservation, and responsible maritime management [3,4]. However, this transition remains challenged by infrastructural limitations, regulatory gaps, and environmental concerns such as overfishing, pollution, and maritime emissions.

Green shipping investments, which focus on reducing emissions and improving fuel efficiency, are critical for aligning Bangladesh’s maritime sector with international environmental targets, such as the IMO’s goal to cut greenhouse gas emissions by 50% by 2050. The adoption of innovative technologies, including Artificial Intelligence (AI) for route optimization and energy management, presents significant opportunities for enhancing sustainability and operational efficiency in shipping and port management. However, economic and technological barriers, including high costs and outdated infrastructure, pose challenges to widespread implementation.

Despite governmental efforts to promote blue growth through renewable energy and sustainable coastal management, governance structures remain centralized and often exclude coastal communities, limiting the inclusiveness and effectiveness of sustainable maritime development. Furthermore, Bangladesh’s maritime digitalization, crucial for transparent and efficient green logistics, is hindered by inadequate strategy and stakeholder engagement, requiring urgent reforms. In the context of Bangladesh’s emerging circular economy and the vital role of green human capital and logistics, integrating sustainable production practices is essential for fostering long-term environmental and economic benefits in the maritime sector [5,6].

This study aims to assess green shipping investment strategies within Bangladesh’s maritime logistics sector, evaluating current challenges and opportunities while providing strategic recommendations to align the sector with global sustainability objectives and national development goals [7-15]. There is limited empirical research explaining how stakeholder perceptions in Bangladesh shape green shipping investments, especially through quantitative surveys or regression models evaluating financial, regulatory, and technological factors.

The key contributions of this research are as follows: First, this study systematically identifies and assesses the economic, technological, environmental, and governance factors influencing green shipping investments in Bangladesh, providing a holistic understanding of sector-specific challenges and opportunities. Second, by highlighting the role of AI and digitalization, this research explores innovative solutions to improve efficiency, transparency, and sustainability in shipping and port operations within Bangladesh’s context. Third, this study emphasizes the need for decentralized and inclusive governance frameworks that incorporate coastal community participation and stakeholder collaboration to ensure equitable and effective implementation of green shipping initiatives.

Overall, the findings indicate that while international decarbonization commitments-such as the IMO 2050 target-shape strategic intent within Bangladesh’s maritime logistics sector, the realization of green shipping investments largely depends on access to affordable capital and the availability of appropriate technological solutions. This underscores the urgent need for concessional financing instruments, targeted innovation subsidies, and the enforcement of robust green port regulations. To effectively support the green transition, the study also recommends establishing integrated capacity-building programs and a dedicated national maritime sustainability hub to coordinate multi-stakeholder efforts. These strategic measures offer a timely and actionable pathway for Bangladesh to align policy, finance, and technology in building a sustainable and resilient maritime logistics ecosystem. The remainder of the study is organized as follows: Section 2 provides a comprehensive review of the relevant literature, while Section 3 details the data sources and methodological framework. Section 4 presents and analyzes the key findings, and Section 5 concludes the study with a discussion of policy implications and recommendations.

Literature Review

The integration of green shipping strategies into Bangladesh’s maritime logistics sector has become increasingly important due to rising global climate concerns, trade expansion, and environmental degradation. With Bangladesh’s Chittagong Port managing over 3.10 million TEUs in 2020-21 and the under-construction Matarbari Deep-Sea Port promising greater connectivity, there is a growing need to align national shipping practices with global green logistics standards. Several studies underscore both the opportunities and challenges involved in this transition.

Jin et al. [11] establish a dynamic long-run relationship between the ocean economy, green exchange mechanisms such as debt-for-nature swaps, and inclusive growth within Belt and Road Initiative (BRI) countries. This linkage emphasizes the importance of integrated maritime strategies where environmental policies intersect with economic imperatives. While countries like Bangladesh show potential, the study also highlights the underdevelopment of marine structures, which can restrict the full realization of green shipping benefits.

The environmental inefficiencies in South Asia’s freight transport, particularly road-based cargo movement, contribute to high Green House Gas (GHG) emissions and congestion. Saha et al. [16] reveal that Bangladesh’s reliance on carbon-intensive freight systems is not only unsustainable but also limits trade competitiveness. They advocate for expanding river-based freight transport, which could provide a greener alternative aligned with global environmental goals. In terms of institutional practices, Mahmud et al. [12] assess 12 Asian ports using the fuzzy DEMATEL model, with Singapore leading in green port practices. The study finds “Pollution Control Measures” and “Automation and Digitalization” as the most influential and causal drivers for sustainability. However, ports like Chittagong lag due to infrastructural and policy limitations, underscoring the need for strategic investments in digital and pollution-reduction technologies.

The broader scope of the blue economy, particularly its role in sustainable development and job creation, also intersects with green maritime logistics. Bhuyan et al. [14] and Islam et al. [15] emphasize that while Bangladesh’s marine resources are vast, structural challenges like weak governance and inadequate policy frameworks hinder progress. Both studies underscore the importance of Marine Spatial Planning (MSP), regulatory reforms, and integration with the Sustainable Development Goals (SDGs), particularly SDG 14 (Life Below Water).

Hossain et al. [13] use advanced econometric techniques (CSARDL, PCSE, and GMM) to analyze 25 Indian Ocean countries and find that GHG emissions and economic growth positively influence the blue economy in the long run. In contrast, trade-often linked with unsustainable practices-shows a negative impact [14-17]. These findings suggest that green investments in logistics must be closely aligned with broader environmental and economic policies. Khan & Emon [17] provide a systematic review of Bangladesh’s blue economy from 2000 to 2020, highlighting key development in maritime transport, tourism, and fisheries. Their analysis reflects that although there is policy momentum, regulatory complexity and lack of coordinated investment strategies impede sustainable growth. A similar argument is echoed by Sheikh et al. [18] who propose a comprehensive sustainability performance model to measure and improve maritime logistics in Bangladesh.

From a regional logistics perspective, Sikder et al. (2024) examine 16 Asian economies and conclude that trade and economic growth improve logistics performance, while improved customs and services reduce CO₂ emissions. Their study highlights the potential of renewable energy in decarbonizing the logistics sector-a strategy Bangladesh could emulate to achieve green shipping goals. Hamid et al. (2023) assess green productivity in South Asia’s transport sector and find a declining trend between 2000 and 2019 due to a lack of green innovation. This decline is particularly relevant for Bangladesh, where green technologies remain underutilized in port operations and logistics chains. Investment strategies in green infrastructure, coupled with emission standards, could reverse this trend.

An et al. (2021) further highlight how Chinese outward Foreign Direct Investment (FDI) in BRI host countries enhances green logistics quality and efficiency through improved infrastructure, renewable energy, and institutional reforms. For Bangladesh, aligning with BRI’s green investment agenda could present significant opportunities, particularly through technology transfer and institutional support. Lastly, the global trend in green shipping research has intensified, as shown in the bibliometric analysis by Mi et al. (2024). With China and Asia-Pacific countries leading in publications, the focus areas include sustainable development, green energy, and ports. The study identifies future research trends in AI, big data, and international collaboration-areas that Bangladesh’s maritime logistics sector must adopt to remain competitive. The literature clearly shows that while Bangladesh has made progress in green maritime logistics, significant gaps remain in infrastructure, policy, technology adoption, and stakeholder coordination. Investment strategies must be multidimensionalfocusing on port modernization, cleaner fuel usage, renewable energy integration, and digital transformation. Lessons from leading Asian ports, green FDI practices, and econometric evidence of sustainability linkages suggest that green shipping in Bangladesh can be both economically viable and environmentally imperative if strategic reforms and investments are effectively implemented.

Data & Methods

Data

A sample of approximately (distributed 133, and received 101) business graduate students was surveyed to gather insights into the perceived views of four key stakeholder categories in the maritime sector: port authorities (specifically from Chittagong and Mongla), shipping companies, investors and financiers, and maritime industry experts. The survey utilized a Likert-scale format, with responses ranging from 1 (Strongly disagree) to 5 (Strongly agree), and was administered either online or through in-person sessions to encourage comprehensive participation and contextually grounded responses. The questionnaire was structured around five core variables, each consisting of 3-4 stakeholder-specific items. The first variable, Perceived Environmental Pressure (PEP), assessed how respondents believed stakeholders prioritized environmental and regulatory concerns, using statements such as: “IMO’s 2050 de-carbonization target is critical to organizational planning,” “Environmental concerns significantly impact operational strategy,” and “Pressure from international regulations shapes investment decisions.”

The second variable, Financial Readiness (FR), examined respondents’ perceptions of stakeholders’ willingness and access to funding for green initiatives, including statements like: “Organizations are willing to invest in green retrofits/logistics within 3 years,” “They have access to concessional or green finance,” and “Financiers view green investments in maritime logistics as low risk.” The third variable, Technology Adoption (TA), explored perceptions of stakeholders’ engagement with innovative technologies such as shore-side power, AI, and IoT, along with alternative fuels and low-emission vessels. Statements included: “Firms plan to adopt shore-side power within the next 5 years,” “There is active exploration of AI and IoT for operations,” and “Pilot programs for low-emission technologies are underway.”

The fourth variable, Regulatory Support (RS), measured perceptions of governmental and regulatory backing for sustainable maritime practices, through items like: “Government incentives make green shipping feasible,” “Policy frameworks are supportive and predictable,” and “Regulations are enforced consistently in ports and shipping.” Finally, Performance Outcomes (PO) captured perceptions regarding the effectiveness of green initiatives, using statements such as: “Green investments have improved operational efficiency,” “Organizations track measurable CO₂ emissions reductions,” and “Green strategies enhance market competitiveness.” Question wording was carefully adapted to reflect the roles and contexts of the stakeholder categories as perceived by the student respondents.

Regression models and analysis

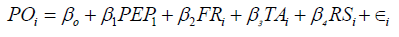

We estimate the relationship between stakeholders’ green shipping investment strategies (measured by Performance Outcomes) and four key determinants: Perceived Environmental Pressure (PEP), Financial Readiness (FR), Technology Adoption (TA), and Regulatory Support (RS). The baseline regression model is given below;

Where: POᵢ = Performance Outcomes score for stakeholder I; PEPᵢ = Perceived Environmental Pressure; FRᵢ = Financial Readiness; TAᵢ = Technology Adoption; RSᵢ = Regulatory Support and ϵᵢ = Error term.

variables are constructed by averaging responses to 3-4 Likert-scale survey items designed to capture each construct. These Likert items range from 1 (Strongly disagree) to 5 (Strongly agree).

Discussion of Results

This section interprets the regression results reported in Tables 1- 3, providing insight into how various drivers-perceived environmental pressure, financial readiness, technology adoption, and regulatory support-affect stakeholders’ performance outcomes in green shipping investment decisions across Bangladesh’s maritime logistics sector.

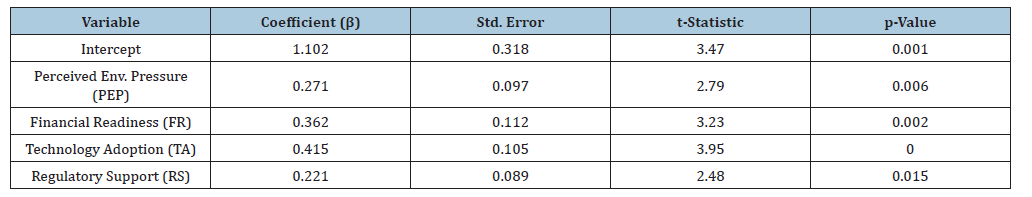

Table 1:OLS Regression results-impact on Performance Outcomes (PO).

Model Summary: R-squared = 0.67, Adjusted R-squared = 0.65, F-statistic = 24.81, Prob (F-statistic) = 0.000, Observations = 100.

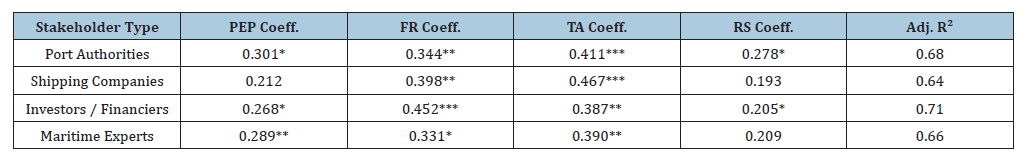

Table 2:Subgroup regression results-key coefficients on PO.

Notes: *p < 0.10, **p < 0.05, ***p < 0.01.

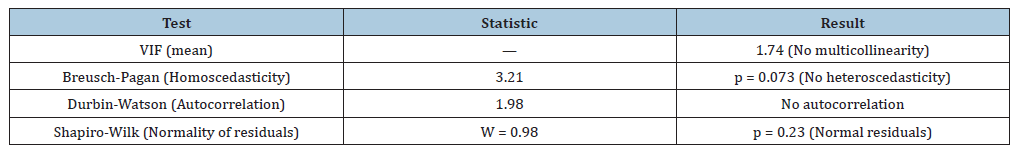

Table 3:Diagnostic tests for baseline model./p>

Main drivers of performance outcomes

Table 1 presents the baseline regression results estimating the impact of key independent variables on Performance Outcomes (PO). The model exhibits strong explanatory power with an adjusted R-squared of 0.65, indicating that 65% of the variance in green performance outcomes is explained by the four included factors.

All four independent variables-Perceived Environmental Pressure (PEP), Financial Readiness (FR), Technology Adoption (TA), and Regulatory Support (RS)-are positively and significantly associated with performance outcomes. Notably, Technology Adoption (TA) shows the strongest effect (β = 0.415, p < 0.001), suggesting that organizations with active technology-driven initiatives-such as trials with low-emission vessels or digital systems-are more likely to report improved operational efficiency, emissions reductions, and market competitiveness. This finding reinforces the idea that tangible, innovation-led transitions, especially involving alternative fuels and smart port systems, drive measurable sustainability outcomes.

Financial Readiness (FR) also plays a critical role (β = 0.362, p < 0.01). Stakeholders with access to concessional or green finance and a willingness to invest within a 3-year timeframe demonstrate significantly higher performance outcomes. This confirms that even in emerging economies like Bangladesh, green investments can flourish when financial pathways-especially from development partners or ESG-oriented capital-are accessible and aligned with short- to medium-term investment plans.

Perceived Environmental Pressure (PEP), while relatively moderate in its effect size (β = 0.271, p < 0.01), still significantly predicts positive outcomes. This finding aligns with the idea that regulatory foresight, especially pressure from international mechanisms like the IMO 2050 decarbonization agenda, creates institutional momentum for aligning with sustainability standards. Interestingly, even in a developing maritime context, global regulatory narratives appear to shape strategic behavior and signal the importance of green preparedness.

Finally, Regulatory Support (RS) shows a statistically significant, albeit slightly lower, effect (β = 0.221, p < 0.05). This suggests that predictable policies and consistent enforcement at ports and in shipping operations do support green investment outcomes, although their influence may still be constrained by perceived implementation gaps or inconsistency in incentive delivery.

Stakeholder-specific insights

Table 2 disaggregates the regression model by stakeholder category to better understand how perceptions and drivers differ among port authorities, shipping companies, investors/financiers, and maritime experts. For port authorities, all four variables are statistically significant. Particularly, Technology Adoption (β = 0.411, p < 0.01) and Regulatory Support (β = 0.278, p < 0.10) emerge as key factors. This suggests that ports are most responsive to policy incentives and technological innovations (e.g., shoreside electrification, AI-enabled berthing), as they often serve as demonstration points for national decarbonization efforts.

Shipping companies show a pronounced response to Technology Adoption (β = 0.467, p < 0.01) and Financial Readiness (β = 0.398, p < 0.05). This reflects operational realities: shipping firms face high capital expenditures for green retrofits and must be financially agile to navigate these changes. The relatively weak coefficient on PEP (β = 0.212, ns) for this group implies that external environmental pressure may not yet be fully internalized unless linked directly to cost-benefit structures or tangible market penalties.

For investors and financiers, Financial Readiness remains the strongest determinant (β = 0.452, p < 0.01), which is intuitiveinvestment decisions are inherently risk-return driven. This group also shows a strong association with Technology Adoption (β = 0.387, p < 0.05), suggesting growing interest in financing innovation-oriented projects in maritime logistics, especially if they demonstrate decarbonization potential. The responsiveness to PEP (β = 0.268, p < 0.10) underscores that financiers are increasingly aware of regulatory and reputational risks from climateincompatible portfolios.

Finally, maritime experts-including consultants, scholars, and NGO actors-prioritize PEP (β = 0.289, p < 0.05) and Technology Adoption (β = 0.390, p < 0.05). This aligns with their role as system observers and advocates, often promoting innovation and longterm planning. Interestingly, they also see Financial Readiness (β = 0.331, p < 0.10) as moderately important, reflecting recognition of the financing gap in the Bangladeshi maritime transition. The adjusted R² values across subgroups range from 0.64 to 0.71, indicating strong explanatory power and robustness across diverse stakeholder perspectives.

Model validity and diagnostics

Table 3 presents results from regression diagnostics to assess multicollinearity, heteroscedasticity, autocorrelation, and residual normality. The diagnostic tests conducted support the robustness and reliability of the regression model. The mean Variance Inflation Factor (VIF) of 1.74 indicates that multi-collinearity among the independent variables is not a concern, ensuring that each predictor contributes distinct information to the model. The Breusch-Pagan test yields a p-value of 0.073, suggesting no significant heteroscedasticity, which in turn supports the validity of the standard error estimates. Furthermore, the Durbin-Watson statistic of 1.98 confirms the absence of autocorrelation in the residuals, satisfying the assumption of independence. Lastly, the Shapiro-Wilk test for normality produces a p-value of 0.23, indicating that the residuals are normally distributed and thereby reinforcing the appropriateness of the Ordinary Least Squares (OLS) inference framework. Collectively, these diagnostics confirm the statistical soundness of the model and support the interpretation of the regression coefficients.

The analysis provides a few critical insights for policymakers, port administrators, and private investors. First, the high explanatory power of technology adoption and financial readiness underscores the urgency of enhancing capital access and piloting innovative green logistics technologies at both ports and fleet levels. Secondly, while international environmental pressure does have a measurable effect, its impact is amplified when coupled with domestic policy incentives and enforceable regulations. Lastly, subgroup differences signal the need for targeted green investment policies: shipping firms require financing guarantees, port authorities need infrastructure incentives, and financiers seek predictable regulatory frameworks to derisk investment decisions.

Conclusion and Policy Implications

This study provides an empirical assessment of the key drivers influencing green shipping investment strategies in Bangladesh’s maritime logistics sector. Drawing on survey data from approximately 100 stakeholders-spanning port authorities, shipping companies, financiers, and maritime experts-the analysis sheds light on how various institutional, financial, technological, and regulatory factors contribute to performance outcomes in decarbonization and environmental innovation efforts.

The results reveal that Technology Adoption and Financial Readiness are the most significant predictors of positive green performance outcomes. Organizations with access to green finance and active technology pilots-such as alternative fuels, shore-side electrification, and digital logistics-report higher operational efficiency, measurable CO₂ reductions, and improved market competitiveness. These findings suggest that the green transformation in maritime logistics is not only a policy imperative but also a source of strategic and economic value when supported by innovation and finance.

Moreover, Perceived Environmental Pressure, particularly international mandates such as the IMO 2050 decarbonization agenda, influences strategic planning and investment behavior. Even in a Global South context like Bangladesh, regulatory foresight and global compliance pressures are beginning to reshape institutional outlooks. Lastly, Regulatory Support, though statistically significant, was less influential than the other factors-indicating that while policy environments do matter, their effectiveness depends heavily on clarity, predictability, and enforcement.

Policy Implications: The empirical evidence points to several actionable policy implications for Bangladesh as it seeks to decarbonize and modernize its maritime logistics system: The strong role of financial readiness in predicting successful green outcomes highlights the need for accessible, affordable capital. The government, in collaboration with international financial institutions and private investors, should develop green maritime finance platforms that offer concessional loans, blended finance instruments, and credit guarantees for green shipping retrofits and port-side technology upgrades. Special focus should be given to de-risking early investments in cleaner fuels, emission control technologies, and digital systems that improve energy efficiency.

To accelerate technology diffusion, Bangladesh should introduce tax incentives, R&D subsidies, and import duty waivers for firms investing in energy-efficient vessels, AI-powered port operations, and alternative fuel infrastructure. Innovation accelerators or demonstration zones-particularly at key ports like Chittagong-can provide proof of concept and generate local capabilities in green maritime technologies. Public-Private Partnerships (PPPs) can also be used to incubate scalable models for smart port ecosystems and digital logistics chains.

Although stakeholders recognize the importance of regulatory support, the relatively modest coefficient in the regression suggests gaps in implementation. There is a need for predictable and enforceable environmental regulations across ports and shipping corridors. The Ministry of Shipping, in coordination with the Department of Environment and port authorities, should develop a Green Port Certification Framework that sets clear benchmarks for emissions, energy use, and vessel retrofitting, with periodic audits and compliance incentives.

Given the heterogeneity of stakeholders, capacity-building programs must be tailored to the specific needs of each group. Port operators require training in green infrastructure maintenance; shipping firms need operational and financial modeling tools for retrofitting decisions; and investors need ESG-aligned maritime risk assessment frameworks. Establishing a National Maritime Sustainability Knowledge Hub-supported by universities, industry associations, and international agencies-can help bridge technical and informational gaps.

Finally, green shipping strategies must be embedded within broader national and regional development priorities, such as the Bangladesh Delta Plan 2100 and the upcoming Five- Year Plans. Integrating maritime decarbonization into climate finance frameworks, blue economy strategies, and regional transport corridors will ensure long-term alignment and resource mobilization. This also opens doors for multilateral funding under the Global Maritime Forum, Green Climate Fund, and similar mechanisms.

While this study provides novel insights into green shipping investment determinants in Bangladesh, several limitations should be noted. First, the sample size-although diverse-remains relatively small (~100 respondents), and results may not be fully generalizable to all maritime stakeholders or regions within the country. Second, the data relies on perceptual self-reports rather than objective investment or emissions performance metrics, introducing possible response biases.

Future research can address these limitations by using longitudinal data to assess how perceptions translate into actual investment behavior and emissions outcomes over time. Expanding the study to include additional ports and regional logistics clusters, as well as triangulating survey responses with case studies or administrative data, would enrich the analysis. Furthermore, future studies could explore gender, governance, and global supply chain dynamics as mediating variables in shaping green maritime transition pathways in Bangladesh and other developing coastal economies.

References

- Ahmad H, Jose F, Islam MS, Jhara SI (2023) Green energy, blue economy: integrating renewable energy and sustainable development for Bangladesh. Marine Technology Society Journal 57(4): 52-69.

- Saha RC (2023) The role of Chittagong Port Authority to develop other national ports in Bangladesh to provide maritime logistics support in South Asia. Sustainable Marine Structures 5(1): 24-36.

- Shammi M, Halder PK, Tareq SM, Rahman MM, Kabir Z (2022) From environmental impact assessment to strategic environmental assessment in Bangladesh: Evolution, perspective, governance and challenges. Environmental Impact Assessment Review 97: 106890.

- Bashir O (2024) Harnessing digitalization in maritime governance: A systematic review strategic challenges and opportunities for Bangladesh.

- Das J, Govender M, Irfanullah HM, Selim SA, Glaser M (2024) Stakeholder perceptions of blue economy governance networks and their equity implications in Bangladesh. Marine Policy 170: 106359.

- Durlik I, Miller T, Kostecka E, Łobodzińska A, Kostecki T (2024) Harnessing AI for sustainable shipping and green ports: Challenges and opportunities. Applied Sciences 14(14): 5994.

- Li Y, Yuen KF, Zhou Y (2024) Risk assessment of achieving greenhouse gas emission reduction target in the maritime industry. Transport Policy 155: 29-46.

- Mannan B, Rizvi MJ, Dai YM (2024) Ship recycling in developing economies of South Asia: Changing liability to acommodity. Green Technologies and Sustainability 2(2): 100064.

- Mondal MA, Abit LY, Siddiqui AA (2024) Fish to finance: unraveling the economic threads of Bangladesh's blue economy. Asian Journal of Medical and Biological Research 10(1): 9-41.

- Cheng Y, Masukujjaman M, Sobhani FA., Hamayun M, Alam SS (2023) Green logistics, green human capital, and circular economy: the mediating role of sustainable production. Sustainability 15(2): 1045.

- Jin Y, Li H, Yu Y, Ahmad US (2024) Liner shipping connectivity: A dynamic link between energy trade, green exchange and inclusive growth using advanced econometric modelling. Ocean & Coastal Management 255: 107239.

- Mahmud KK, Chowdhury MM, Shaheen MM (2024) Green port management practices for sustainable port operations: a multi method study of Asian ports. Maritime Policy & Management 51(8): 1902-1937.

- Hossain MA, Islam MN, Fatima S, Kibria MG, Ullah E (2024) Pathway toward sustainable blue economy: Consideration of greenhouse gas emissions, trade, and economic growth in 25 nations bordering the Indian ocean. Journal of Cleaner Production 437: 140708.

- Bhuyan MS, Islam MN, Ali MM, Rashed N, Alam M, et al. (2022) Blue economy prospects, opportunities, challenges, risks, and sustainable development pathways in Bangladesh. Global Blue Economy, pp. 147-194.

- Islam MS, Ahmed Z, Habib MA, Masud O (2024) Blue economy of Bangladesh and Sustainable Development Goals (SDGs): A comparative scenario. Discover Sustainability 5(1): 349.

- Saha RC, Sabur HM, Saif TM (2023) Environmental sustainability of inland freight transportation systems in Bangladesh. International Supply Chain Technology Journal 9(9): 1-21.

- Khan T, Emon MH (2024) Exploring the potential of the blue economy: A systematic review of strategies for enhancing international business in Bangladesh in the context of Indo-pacific region. Review of Business and Economics Studies 12(2): 55-73.

- Sheikh W, Chowdhury MM, Mahmud KK (2023) A comprehensive performance measurement model for maritime logistics: Sustainability and policy approach. Case Studies on Transport Policy 14: 101097.

© 2025 Waheed Ullah Shah. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)