- Submissions

Full Text

Strategies in Accounting and Management

Integrating Sustainability into Corporate Reporting: A Pathway to Transparency and Value Creation

Manoj Kumar Vandanapu1* and Amrita Choudhary2

1Corporate Finance and Transformations Expert, USA

2Accounting Manager, Wasabi Technologies, USA

*Corresponding author:Manoj Kumar Vandanapu, Corporate Finance and Transformations Expert, USA

Submission:April 29, 2024;Published: June 18, 2024

ISSN:2770-6648Volume5 Issue1

Abstract

This article explores the critical role of sustainability reporting in today’s corporate landscape, emphasizing its necessity for transparency, accountability, and stakeholder engagement. It navigates through the evolution of reporting standards, underscoring the shift towards mandatory disclosures and the impact of frameworks like GRI, SASB, and TCFD. Practical steps for integrating sustainability into corporate reporting are outlined, addressing challenges such as data collection and standardization, and highlighting solutions like leveraging technology and stakeholder engagement. Future trends predict a more regulated, technology-driven landscape. The article serves as a comprehensive guide for organizations aiming to enhance their sustainability reporting practices and contribute to a sustainable future.

Introduction

In today’s rapidly evolving business landscape, the imperative for sustainability has become more pronounced than ever before. Amidst growing environmental concerns, societal shifts, and an increasing demand for transparency, businesses are recognizing the critical role sustainability plays in their long-term viability and success. This heightened focus on sustainability is not just about adhering to regulatory requirements or mitigating environmental impacts; it’s about embedding sustainable practices into the core of business strategies to drive innovation, enhance brand reputation, and secure a competitive advantage. Sustainability reporting emerges as a pivotal element in this paradigm, providing a structured way for companies to communicate their Environmental, Social, and Governance (ESG) performance. Far from being a mere statutory obligation, sustainability reporting signifies a company’s commitment to transparency, accountability, and continuous improvement in its sustainability endeavors. It serves as a vital tool for stakeholders, including investors, customers, and employees, to assess a company’s sustainability credentials and make informed decisions. The significance of sustainability reporting has evolved, reflecting a broader understanding of business impacts on sustainable development. It encapsulates not just the environmental aspect but also social and governance dimensions, offering a holistic view of a company’s sustainability performance. In the quest to fortify the principles of sustainability within the corporate fabric, the emergence of the International Financial Reporting Standards (IFRS) S1 on sustainability reporting marks a pivotal evolution. This global benchmark underscores the paramount importance of embedding Environmental, Social, and Governance (ESG) considerations directly into the heart of financial reporting. By adhering to such standards, organizations are not merely aligning with a set of guidelines; they are engaging in a transformative process that enhances transparency, fosters accountability, and promotes sustainable development. This article endeavors to decode the complexities of integrating sustainability into corporate reporting, with a particular focus on the alignment with IFRS S1 standards. Our aim is to furnish companies with a roadmap for seamlessly infusing sustainability practices into their reporting frameworks. By delving into the historical context, the significance of sustainability reporting, and offering a step-by-step guide to integration, we strive to equip organizations with the knowledge and tools necessary to meet stakeholder expectations in sustainability reporting.

The evolution of sustainability reporting

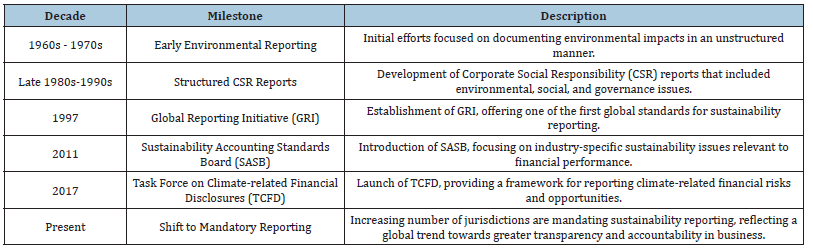

The evolution of sustainability reporting is a testament to the increasing recognition of Environmental, Social, and Governance (ESG) factors as integral components of business success and accountability. This journey, spanning several decades, has witnessed the transition from rudimentary environmental disclosures to comprehensive frameworks that guide the reporting of a wide spectrum of sustainability metrics. In its nascent stages, sustainability reporting was primarily focused on environmental conservation efforts, emerging in response to the environmental movements of the 1960s and 1970s. Companies began to document their impact on the natural environment, albeit in an unstructured manner. It wasn’t until the late 1980s and early 1990s that the concept began to take a more structured form, with the introduction of Corporate Social Responsibility (CSR) reports that included social and governance issues alongside environmental impacts.

The pivotal moment in the history of sustainability reporting came with the establishment of global initiatives and frameworks designed to standardize and guide the reporting process. Among these, the Global Reporting Initiative (GRI), founded in 1997, stands out as a pioneering organization that developed one of the first global standards for sustainability reporting. The GRI guidelines have enabled companies worldwide to report their economic, environmental, and social performance in a consistent and credible manner. Following the footsteps of GRI, other frameworks and standards have emerged, each addressing different aspects of sustainability reporting. The Sustainability Accounting Standards Board (SASB), established in 2011, focuses on industry-specific sustainability issues that are most relevant to financial performance. Meanwhile, the Task Force on Climate-related Financial Disclosures (TCFD), introduced in 2017, provides companies with a framework to report climate-related financial risks and opportunities. These initiatives have significantly contributed to the normalization and credibility of sustainability reporting, providing stakeholders with meaningful and comparable data. A notable trend in the evolution of sustainability reporting is the shift from voluntary to mandatory reporting in various jurisdictions. Recognizing the critical role of transparency in sustainable development, governments and regulatory bodies across the globe have started to mandate sustainability reporting for companies. The European Union, for instance, adopted the Non-Financial Reporting Directive (NFRD) in 2014, requiring large companies to disclose information on their social and environmental impacts. Similarly, other countries have introduced regulations that necessitate sustainability reporting, reflecting a global move towards greater accountability and transparency. This shift towards mandatory reporting underscores a broader acknowledgment of the significance of sustainability issues in assessing a company’s performance and risk profile. It highlights a growing consensus that sustainable business practices are not just ethically imperative but also crucial for long-term financial stability and success. This table encapsulates the evolution from the rudimentary beginnings of environmental reporting to the current emphasis on comprehensive, structured, and, increasingly, mandatory sustainability reporting practices (Table 1).

Table 1:

The importance of sustainability reporting

The significance of sustainability reporting in the contemporary business landscape cannot be overstated. It serves as a linchpin for enhancing corporate transparency and accountability, pivotal aspects that have increasingly come under the scrutiny of a wide array of stakeholders. By disclosing their operations’ Environmental, Social, and Governance (ESG) impacts, companies not only demonstrate their commitment to ethical practices but also foster a culture of trust and openness. This transparency is vital in today’s market, where consumers and investors are more inclined to associate with organizations that can clearly articulate their sustainability journey and achievements. Moreover, sustainability reporting directly aligns with the evolving expectations of investors, customers, and other key stakeholders. Investors, in particular, are channeling their capital towards businesses that exhibit a robust sustainability ethos, recognizing that such companies are better positioned to navigate the complexities of the modern economic and environmental landscape. Customers, too, are increasingly leaning towards brands that prioritize sustainability, making it a critical factor in building brand loyalty and market competitiveness. Beyond meeting stakeholder expectations, sustainability reporting plays a crucial role in contributing to sustainable economic development. By systematically addressing and reporting on ESG factors, companies not only mitigate their adverse impacts on the environment and society but also uncover opportunities for innovation and growth in the green economy. This proactive approach to sustainability can drive systemic changes across industries, leading to more resilient and sustainable economic models. Lastly, the practice of sustainability reporting is instrumental in risk management and future-proofing businesses. It enables companies to identify potential sustainability-related risks early on, from regulatory changes to environmental disasters, and devise strategic responses. This forward-looking approach ensures that businesses remain resilient in the face of future challenges and uncertainties, securing their long-term viability and success. In essence, sustainability reporting is not just about compliance or marketing; it is about embedding sustainability into the core of business strategies, thereby ensuring long-term resilience, competitiveness, and alignment with broader societal goals (Figure 1).

Figure 1:

Frameworks and standards for sustainability reporting

In the realm of sustainability reporting, the landscape is rich with diverse frameworks and standards, each designed to guide organizations in articulating their sustainability initiatives and impacts. These frameworks serve as the backbone for transparent, reliable, and comparable sustainability disclosures. Here, we delve into an overview of key frameworks, compare their methodologies, and provide insights on selecting the most appropriate framework for your organization.

Key sustainability reporting frameworks and standards

Global Reporting Initiative (GRI): Established in the late

1990s, GRI is one of the first and most widely adopted sustainability

reporting standards globally. It offers a comprehensive set

of guidelines that apply to corporations across all industries,

emphasizing the economic, environmental, and social impacts of

business operations.

Sustainability Accounting Standards Board (SASB): Focused

primarily on the financial impacts of sustainability, SASB provides

industry-specific standards that help businesses disclose material

information to investors. SASB standards are designed to be

integrated into financial filings, making them particularly relevant

for investor communications.

Task Force on Climate-related Financial Disclosures

(TCFD): TCFD recommendations guide organizations in reporting

climate-related financial risks and opportunities. Its forwardlooking

approach emphasizes scenario analysis and strategic

planning to address climate change’s impact on business.

Integrated Reporting Framework (IR): The IR framework

advocates for integrating financial and sustainability information

into a single, cohesive report. It emphasizes the interconnectedness

of various capital forms and how they affect the value creation

process over time.

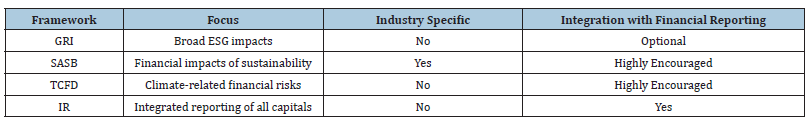

Comparison of frameworks

Each framework brings a unique perspective to sustainability reporting, with some focusing on broad sustainability impacts (GRI), while others home in on the financial implications of ESG factors (SASB, TCFD) or advocate for a holistic integration of financial and non-financial information (IR) (Table 2).

Table 2:

Choosing the right framework for your organization

Selecting an appropriate sustainability reporting framework

involves considering several factors:

Industry relevance: Determine whether your industry has

specific sustainability issues that are better addressed by certain

standards (e.g., SASB’s industry-specific guidelines).

Stakeholder needs: Consider the information needs of your

primary stakeholders. For investor-focused reporting, SASB or

TCFD might be more appropriate, while GRI could be better for

broader stakeholder engagement.

Integration with financial reporting: If your goal is to

integrate sustainability into financial reporting, IR or SASB

standards, which emphasize this integration, could be beneficial.

Complexity and resources: Assess your organization’s

capacity to comply with the reporting standards. Some frameworks

may require more extensive data collection and analysis than

others [1-5].

Integrating sustainability into corporate reporting: practical steps

Integrating sustainability into corporate reporting is a strategic

process that requires careful planning, stakeholder engagement,

and a commitment to transparency and continuous improvement.

The journey towards comprehensive sustainability reporting can

be broken down into several practical steps:

Preparatory steps: identifying material sustainability issues and

stakeholder engagement

Identifying material issues

A. Conduct a materiality assessment to pinpoint the

sustainability issues that are most significant to your business

operations and stakeholders. This involves analyzing internal

and external factors, including industry trends, regulatory

landscapes, and stakeholder concerns.

B. Use a materiality matrix to visualize and prioritize these

issues based on their impact on the business and importance to

stakeholders.

Stakeholder engagement

A. Engage with a broad range of stakeholders, including

investors, customers, employees, and communities, to gather

insights on their sustainability expectations and concerns.

B. Incorporate stakeholder feedback into your sustainability

strategy and reporting process to ensure it is responsive and

relevant.

Data collection and performance measurement

A. Establish robust mechanisms for collecting data on key

sustainability indicators, ensuring accuracy and consistency

across all operations.

B. Develop performance metrics aligned with identified

material issues and reporting standards (e.g., GRI, SASB) to

measure progress effectively.

C. Implement regular monitoring and review processes to

assess performance against sustainability goals and objectives.

Embedding sustainability into corporate strategy and reporting

A. Integrate sustainability considerations into the core

business strategy, demonstrating how they contribute to longterm

value creation.

B. Ensure alignment between sustainability goals and overall

business objectives, embedding ESG factors into decisionmaking

processes at all levels of the organization.

C. Prepare sustainability reports that are comprehensive,

transparent, and aligned with international standards,

showcasing the organization’s commitment to sustainable

development.

Case Studies of successful integration by leading companies

Company a leading renewable energy sector company

Material Issues: Identified renewable energy development

and community impact as key material issues through extensive

stakeholder engagement.

Performance Measurement: Implemented advanced analytics

to track energy production efficiency and community investment

impacts.

Integration: Embedded these priorities into their corporate

strategy, leading to increased investments in renewable projects

and community development programs.

Outcome: Enhanced reputation, attracted eco-conscious

investors, and reported a significant positive impact on local

communities.

Company B leading consumer goods

Material issues: Focused on sustainable sourcing and reducing

carbon footprint as material sustainability issues, driven by

consumer and investor feedback.

Data collection: Leveraged supply chain tracking technologies

to ensure sustainable sourcing and implemented a carbon

accounting system.

Integration: Developed a sustainability-linked financing

framework, tying loan interest rates to achieving carbon reduction

targets.

Outcome: Achieved cost savings through improved energy

efficiency, enhanced brand loyalty among environmentally

conscious consumers, and increased attractiveness to sustainabilityfocused

investors.

Integrating sustainability into corporate reporting is not just about compliance or risk management; it’s a strategic initiative that can drive innovation, enhance stakeholder relationships, and create long-term value. By following these practical steps and learning from the successes of leading companies, organizations can develop a robust approach to sustainability reporting that aligns with their strategic goals and meets the evolving expectations of their stakeholders.

Challenges and solutions

Integrating sustainability into corporate reporting is fraught with challenges, yet overcoming these obstacles is essential for organizations aiming to demonstrate their commitment to sustainable development. Key challenges include difficulties in data collection, the standardization of reporting, and overcoming stakeholder skepticism. However, with the right approach, these challenges can be addressed effectively.

Common challenges

Data Collection: Gathering accurate and comprehensive data

on sustainability performance across different operations can be

daunting. This challenge is compounded by the need for consistent

data collection methodologies that align with international

standards.

Standardization of Reporting: With various sustainability

frameworks and standards available, achieving consistency

and comparability in reports can be challenging. This lack of

standardization can hinder stakeholders’ ability to assess and

compare sustainability performance accurately.

Stakeholder Skepticism: Stakeholders may doubt the

authenticity of sustainability reports, questioning whether they

reflect genuine sustainability efforts or are merely a form of

greenwashing.

Practical solutions and best practices

Leveraging technology: Advanced data management systems

and sustainability software can streamline data collection and

analysis, ensuring accuracy and efficiency. Implementing such

technologies can help organizations manage their sustainability

data more effectively.

Adopting recognized frameworks: Organizations should

consider adopting widely recognized sustainability reporting

frameworks, such as GRI or SASB, which can help standardize

reporting practices. Utilizing these frameworks not only enhances

report credibility but also facilitates comparability across

industries.

Transparent Reporting and Third-party Verification:

To combat stakeholder skepticism, companies should prioritize

transparency in their sustainability reporting, providing clear,

comprehensive information about their sustainability initiatives and

challenges. Engaging third-party auditors to verify sustainability

reports can further enhance credibility and stakeholder trust.

Continuous Engagement with Stakeholders: Regularly

engaging with stakeholders to gather feedback and understand

their concerns can help tailor sustainability efforts and reporting

to meet their expectations. This ongoing dialogue is crucial for

maintaining transparency and building trust.

By embracing these solutions and best practices, companies can navigate the complexities of integrating sustainability into corporate reporting. Overcoming these challenges not only strengthens the credibility of sustainability reports but also underscores an organization’s commitment to genuine sustainable development.

The future of sustainability reporting

The future of sustainability reporting is poised to be shaped by

several emerging trends, technological innovations, and regulatory

changes, each contributing to its evolution towards greater

efficiency, integration, and impact.

Emerging trends: Digital reporting and integrated reporting

are at the forefront of these trends. Digital platforms are

increasingly being used to make sustainability reporting more

accessible and interactive, allowing stakeholders to engage with

the data in real-time. Integrated reporting is gaining traction for its

holistic approach, merging financial and non-financial performance

to present a unified view of a company’s overall impact and value

creation process.

Role of technology: Technology plays a pivotal role in

enhancing the efficiency and effectiveness of sustainability

reporting. Advanced data analytics, blockchain, and artificial

intelligence are transforming how data is collected, analyzed, and

reported. These technologies enable more accurate and timely

reporting, improve transparency, and facilitate the alignment of

sustainability reporting with international standards.

Regulatory changes: The regulatory landscape is also

evolving, with an increasing number of jurisdictions implementing

mandatory sustainability reporting requirements. These changes

are expected to standardize sustainability reporting practices

further, ensuring a level playing field for businesses worldwide. As

regulations become more stringent, companies will need to adapt

their reporting processes to comply with new norms, reinforcing the

importance of sustainability in corporate governance. As we look

to the future, these developments suggest a more interconnected,

technology-driven, and regulated era for sustainability reporting,

underscoring its critical role in driving sustainable business

practices and societal progress.

Conclusion

In conclusion, integrating sustainability into corporate reporting is a strategic imperative that enhances transparency, accountability, and stakeholder engagement. Through the adoption of recognized frameworks, leveraging technology for efficient data management, and navigating the evolving regulatory landscape, organizations can effectively communicate their sustainability endeavors. This integration not only underscores a commitment to sustainable development but also builds a resilient and sustainable business model poised for long-term success. Companies are encouraged to either embark on or continue their sustainability reporting journey, recognizing its vital role in aligning business practices with the broader goals of environmental stewardship and social responsibility. Embracing sustainability reporting is not just about compliance; it’s about leading with purpose and driving meaningful change.

References

- Frameworks and Standards.

- Global Reporting Initiative (GRI).

- Sustainability Accounting Standards Board (SASB).

- Task Force on Climate-related Financial Disclosures (TCFD).

- International Integrated Reporting Council (IIRC) - Integrated Reporting.

© 2024 Manoj Kumar Vandanapu. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)