- Submissions

Full Text

Research in Medical & Engineering Sciences

Environmental Regulation: Externalities and Markets

Benjamin Garcia-Paez1* and Elvira B. Rodriguez-Rios2*

1Professor of Economics, UNAM, and Fellow of Clare Hall College Cambridge, England

2Professor and Researcher of the University Laica Eloy Alfaro, and Technical University, Manabi-Ecuador

*Corresponding author:Benjamin Garcia-Paez, Professor of Economics, UNAM, and Fellow of Clare Hall College Cambridge, England, Email: garpaez@unam.mx

Submission: January 17, 2024;Published: February 05, 2024

ISSN: 2576-8816Volume10 Issue5

Abstract

This paper examines normative and positive aspects of environmental regulation. It also discusses the properties of several environmental instruments such as emissions taxes, tradable emission permits, and command-and-control regulation. The main theoretical foundations of environmental regulation are also emphasized although references on contemporary issues related to the discussion of the possibility of having a practice-oriented profile is treated. Beyond brief introduction, the second section defines the externality problem and makes a taxonomy of externalities. The third section deals with externalities and the First-Welfare Theorem, i.e., in a perfect competitive market without government intervention except to keep a Pareto-optimal situation. Other functional concepts such as missing markets and Coase’s theorem are also addressed. The fourth section covers optimal environmental regulation through means such as taxes, emission-trading-system, and standards all these in a Second-Best World. The fifth section treats emission reduction policy by analysing carbon pricing alternatives and other solutions. The sixth section delineates a frame of reference to evaluate the relative effectiveness of taxes in emissions abatement. The seventh section rises discussion about diverse instruments to lower emissions. In the eight section some concluding remarks stemming from the tried analysis are drawn.

Keywords:Externality problem; First-best theorem; Second-best approach; Carbon pricing; Optimal policy; JEL: Q11

Introduction

The objective of this work is to help in the understanding of benefits and costs of different forms of environmental regulation and to appreciate the implications for government policy towards environment.

The underpinning research questions are: Why does a perfectly competitive economy fail to produce a Pareto optimal allocation of resources in the presence of environmental pollution? How can pollution problems be regulated most effectively when the government does not have precise information about abatement technology and environmental damage costs? What is the best method for emissions to be reduced? [1,2].

To answer these questions this research analyses the taxonomy of externalities1, incomplete markets, Lindahl markets, the Coase Theorem [3,4] and basic Pigouvian taxes [5], likewise other economic incentive-based instruments such as control-demand instruments, the least cost property, and permit trading, and then discusses carbon pricing and the key features of an optimal policy in real terms, i.e., taxes and emissions trading in imperfect economies and other regulatory mechanisms such as standards and subsidies.

Throughout the first part of this research, the standing assumption is that the regulator has the “right” intentions, in other words, that governments want to regulate economic activity to restore Pareto efficiency or to maximise social welfare, it is maintained, whereas in the second part the paper discusses the principle underlying the externality taxation in a second-best world [6], and the political economy aspects of environmental regulations so that the former assumption are relaxed. This paper research was conducted throughout February 2020 and March 2022 in Mexico City.

The externality problem

An externality is present when economic agents’ welfare (a consumer´s utility or a producer´s profit or cost) are directly affected by a choice made by others similar agents engaged in line with their inherent socioeconomic functions. Thus, two types of externalities could be distinguished: consumption externality when the choices of some agents (consumers or producers) affect the utility of others and production o externality when the choices of some agents (consumers or producers) affect the profit (or cost) of other producers (Figure 1).

Figure 1:Sources and Receivers of Externalities.

By way of illustration, combinations matching sources of externalities and receivers of externalities in Figure 1 are as follows: industrial pollution and agriculture or fisheries (externality type PP)2, particle waste, waste dumping, congestion, ozone depletion and global warming (externality type PC), congestion (externality type CP), and envy, congestion, noise, and smoking (externality type CC).

Externalities in a perfect competitive market

A competitive equilibrium is Pareto efficiency whenever the

following situations are fulfilled,

A. Perfect competition in all markets.

B. Absence of externalities (or public goods), i.e., complete set of

markets.

C. and the prevailing of perfect and symmetric information.

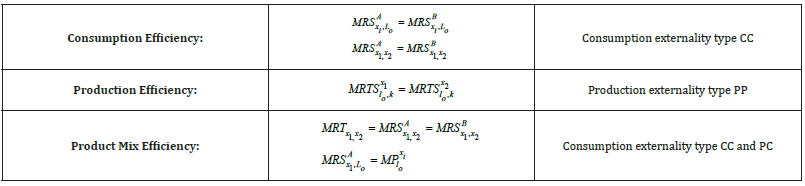

The possible outcomes of the first welfare theorem are shown

below (Table 1): The solution of externality problems is context

dependant. In the first-best world, externality problems might be

siphoned off in three ways:

a) by the so-called Lindahl market in which the invisible hand

completes the set of markets,

b) by bargaining between the affected parties as the Coasian

antidote prescribes,

c) and by centralized intervention in the form of an externality

tax as the Pigouvian medicine postulates3. Whereas in the

second-best world, the problems are minimised either,

by information wherever were impossible to observe the

externality generating activity directly and/or distortionary

taxes which should interact within the overall tax system.

Table 1:The three pareto conditions.

The First Welfare Theorem

Under such conditional framework, the regulation of

externalities in the first-best world assumes:

two commodities 1 x and 2 x one input I0 , with consumers prices

q = (q0 , q1, q2 ) and with producer prices P=(P0,P1,P2) ,

A. perfect competition and constant returns to scale.

B. no taxes levied for optimal tax reasons and more

importantly,

C. an observable and quantifiable externality.

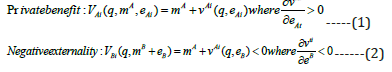

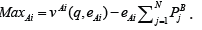

In this way, considering one array of two types of consumers,

A and B the consumption of A (i =1,2,3………n)generates an

externality of eAi< while the consumption of B (i =1,2,3………n)

receives an externality which is non-depletable:

The assignations stemmed from the above features lead to the following sort of nirvana state (Figure 2).

Figure 2:Allocations.

The Lindahl market

The Lindahl market tries to depict the interaction between externalities and missing markets. For instance, one missing market is that of smoking in special places - a dining room for instance- which are significantly difficult to be banned. For this kind of market, the market structure is made of smokers which are consumers type A and non-smokers which are consumers type B. Thus, to assign the property right to one consumer type B, i.e., a situation in which each receiver gets the right to decide the total amount of the externality derived from smokers A. Likewise, to emit one unit of emission each smoker A needs to buy a unit-permit from each consumer type B at the personalised price of PBi.

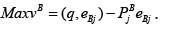

Permit trading in carbon emissions

The basic idea underlying permit trading (or cap-and-trade) is

simple. Government must decide one fundamental thing: how much

carbon dioxide (CO2) should human be permitted to emit? Once

this portion is determined upon several permits amounting to total

quantity is issued. Then agents are allowed to buy and sell permits

at the market rate to match their productive plans. As from the

demand side of the permit market, each type A consumer demand

the same number of permits from each type B consumer. Profit

maximization is depicted as follows:  .

At the equilibrium point: marginal benefit equals marginal costs,

.

At the equilibrium point: marginal benefit equals marginal costs,

. The source i of demand for permits in market j will

be:

. The source i of demand for permits in market j will

be: . As for the supply side of the permit market, each

consumer is implicitly deciding on the total number of permits. So

that, profit maximization here implies:

. As for the supply side of the permit market, each

consumer is implicitly deciding on the total number of permits. So

that, profit maximization here implies: .

.

The market equilibrium point is reached at when marginal

benefit is equals marginal cost, . The total supply of

permits from the perspective of the receiver of externalities will be:

. The total supply of

permits from the perspective of the receiver of externalities will be:

. Once the exchanging conditions are set up for both supply

and demand, it is possible to establish the clearance of the missing

permits market, i.e., to determine the price of permit for both types

of consumers:

. Once the exchanging conditions are set up for both supply

and demand, it is possible to establish the clearance of the missing

permits market, i.e., to determine the price of permit for both types

of consumers: . Total demand is the same

in all markets: eBj B = e for all j. So, in equilibrium the above market

is given by: eBj B = e , there for:

. Total demand is the same

in all markets: eBj B = e for all j. So, in equilibrium the above market

is given by: eBj B = e , there for: for the market demand

side. From the supply side,

for the market demand

side. From the supply side, .

.

As a result, it is shown that a set of N competitive externality

markets can restore Pareto optimality i.e.,  .

.

Notwithstanding, in dealing with externalities in a first-best

world without government intervention encounters problems such

as:

A. Enforceable property rights to the receptor need to be defined,

B. There are high transaction costs associated with these markets

and

C. With only one supplier in each market, the assumption of

perfect competition is dubious.

So, remaining in the first best-world there are other solutions that work out in restoring equilibrium such as the Coasian Theorem and the Pigouvian tax approaches.

The Second-Best World

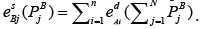

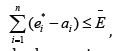

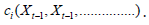

Standard and charge approach

In the first instance an acceptable standard (E)is not related to a given damage. Then, how can this standard be implemented at least cost when abatement technologies are not known to the regulator? Abatement (ai) is correlated to cost (ci) so that when the total cost eventually increases the abatement amount becomes less significate. Considering this basic relationship, then * ei=ei−ai where ei is emission in absence of abatement effort. Therefore:

Least cost solution

As the aim is:  subject to:

subject to: , the solution

expected will be:

, the solution

expected will be: where λ = shadow price of emission.

Therefore, E(λ )=E . So that, the marginal abatement is equalized

across all firms (Figure 3).

where λ = shadow price of emission.

Therefore, E(λ )=E . So that, the marginal abatement is equalized

across all firms (Figure 3).

Figure 3:The marginal cost of abatement.

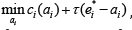

Emissions taxes

The textbook solution to the problem of pollution by a stock

of CO2 emissions is for the government to intervene in the free

market and taxing CO2. Taxes are a powerful economical means

for correcting externalities. Thus, if the regulator levies a uniform

emission tax () on each firm: min  , the solution is

given by:

, the solution is

given by:  and then marginal costs are equalized too. E(τ)=E

only if τ = λ

and then marginal costs are equalized too. E(τ)=E

only if τ = λ

However, without knowing the shadow price of emission, the regulator cannot set the correct tax ex-ante. To achieve it, he must follow an iterative process of trial and error, learning about distribution of costs. Due to that difficulty, a uniform emission tax can implement a given standard at the least cost, but this may involve an adjustment period.

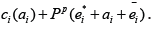

Emission trading system (ETS)

An alternative to price carbon4 is a cap-and-trade scheme.5

As aforementioned, a permit gives the right to emit one unit of

pollution to certain economic agent. In fact, CO2 emissions permits

can be now freely traded. So, if Pp is the equilibrium price in the

resulting competitive market for CO2 emission permits, and ei

permits are given to firm i; the standard is achieved as follows:

, therefore the overall budget composed largely of costs

of abatement and the equilibrium prices of permits will be as

follows: min

, therefore the overall budget composed largely of costs

of abatement and the equilibrium prices of permits will be as

follows: min  . The obtained solution assumes

the following identity equation:

. The obtained solution assumes

the following identity equation:

The equation (5) implies that the marginal costs are equalized. It also shows that an ETS can implement the standard at least cost without the need for an adjustment period. Assuming that the market is competitive and that transaction costs are sufficiently low, the least-cost theorem postulates that a system of tradable permits can implement any aggregate CO2 emission reduction target at least cost. The achievement of efficiency is independent of the initial allocation of permits. However, is pertinent to separate efficiency from equity considerations.

Standards

If e is a sstandard uniform, E=ne constitutes the standard obtained. But at what cost?

In this context, the least cost solution cannot be implemented. Even worst, it does not provide any dynamic incentives for emission reduction whatsoever (Figure 4). So, the less cost solution is less attractive than emission taxes and tradeable permits on these grounds. Thus, incentive-based instruments can be used to implement an acceptable environmental standard at the least cost without having precise information on abatement costs and while also providing dynamic incentives for CO2 emission reduction. By the opposite, command-and-control instruments cannot do that.

Figure 4:Performance standards.

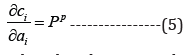

Carbon Pricing

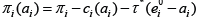

Taxes

To delineate a frame of reference let us evaluate the relative

effectiveness of taxes in reducing CO2 emissions. Suppose the

government taxes every ton of CO2e emissions an amount of $τ *, where τ * = SCC . Consider a firm with an optimized profit

where πi

is revenue minus other costs e0i is pre-regulation emissions (tCO2e), i a is abatement and ci(ai)

is total cost of reducing emissions. Furthermore, if the marginal

average costs, ' MACi = ci'>0 , since abatement is costly and that

might be achieved through input substitution (using more labour,

more green energy, etcetera); output reduction (deciding less output,

investing in new production technology (e.g., changing production

function), the problem of firm es: max

where πi

is revenue minus other costs e0i is pre-regulation emissions (tCO2e), i a is abatement and ci(ai)

is total cost of reducing emissions. Furthermore, if the marginal

average costs, ' MACi = ci'>0 , since abatement is costly and that

might be achieved through input substitution (using more labour,

more green energy, etcetera); output reduction (deciding less output,

investing in new production technology (e.g., changing production

function), the problem of firm es: max  , where the first-order condition is: ' ci(ai) =τ and this is true for

all firms, so we have that the marginal average cost of firm equal to

social cost of carbon, i.e. i i MACi = SCCi . Hence, short marginal costs

equal to short marginal benefits SMC = SMB of abatement, and the

economy supplies the efficient amount (Figure 5).

, where the first-order condition is: ' ci(ai) =τ and this is true for

all firms, so we have that the marginal average cost of firm equal to

social cost of carbon, i.e. i i MACi = SCCi . Hence, short marginal costs

equal to short marginal benefits SMC = SMB of abatement, and the

economy supplies the efficient amount (Figure 5).

Figure 5:Carbon pricing: taxes.

Thus, we have internalized the externality, and reduce emissions efficiently as firms that can easily reduce emissions ( ci , flat) will do lots of abatement and firms that cannot easily abate, will do less ( ci , steep).

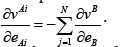

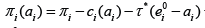

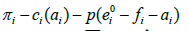

Emissions trading

As an alternative to taxes, the government could create e0 − a* permits, each entitling the holder to emit 1 to CO2e; inducing the allocation of permits somehow, e.g., give for free an amount fi to each firm I (where Σfi =e0 − a*). Firms are then allowed to buy and sell permits, which will reach some equilibrium price p.

In this scenario, the firm´s problem max  The first order condition is:

The first order condition is: . And for *

. And for *

, an

equilibrium price must be p =τ * (Figure 6) Again, we therefore

have MACi = SCCi , and hence efficient abatement. Notice that fi

does not impact abatement choice as initial allocation does not

matter for efficiency. But initial permit allocation gives rent fi pto

firm i.

, an

equilibrium price must be p =τ * (Figure 6) Again, we therefore

have MACi = SCCi , and hence efficient abatement. Notice that fi

does not impact abatement choice as initial allocation does not

matter for efficiency. But initial permit allocation gives rent fi pto

firm i.

Figure 6:Carbon pricing: emissions trading.

Carbon pricing vs standards

Another way to induce abatement a* is to tell each firm it must abate some amount. In theory that could give each firm targets ai* that solves ci'= SCC , but in practice it is not informationally feasible as each MACi it is not known. Hence, to give all firms the same a* such that * Σi ai = a , it shall be advisable, i.e., like CO2 emissions trading without the trading (Figure 7). The expected result is to achieve abatement a* but not in an efficient way since we do not have MACi = SCCi , for all i .

Figure 7:Carbon pricing vs standards.

Optimal policy of regulation

In fact, there is a lot more going on in the real world than

just unpriced carbon. Hence, climate policy is more than just

internalising the carbon externality, even if this the single most

important thing. When choosing between taxes and emissions

trading economic instruments, which other consideration matter

in practice? It is advisable to do a balancing act between the pros

and cons inherent of taxes and CO2 emissions according to,

a) Efficiency when the abatement costs are uncertain.

b) Commitment versus flexibility.

c) Political economy, and

d) Volatility and policy interaction.

Uncertain abatement costs

As aforementioned, under certainty price (tax) and quantity (emissions trading) instruments are equivalent. [7] looked at the economic costs of each instrument when the position of the MAC is uncertain. So that, to settle which instrument is better it depends on relative slope of the MAC and SCC [8]. Applied to climate change, this suggests taxes may be better over short time periods, but emissions trading over longer periods (Figure 8).

Figure 8:Uncertain abatement costs.

Commitment vs flexibility

In many areas of economic policy making (e.g., monetary policy) there is a trade-off between commitment and flexibility. Distinctly, emissions trading tends to be less flexible as permit allowances are legally agreed well in advance, whereas taxes easily adjusted. Flexibility used to bring some benefits such as the possibility to adjust policies if current information about the SCC or MAC comes to light (e.g., falling renewable costs), alike their adjustment to changing macroeconomic conditions.

Notwithstanding, commitment has two benefits: the so-called ratchet effect, i.e., firms do less today with the expectation of weaken policy tomorrow, and the potential that revenues based on forthcoming carbon prices could be lowered as governments might take this away.

Political economy

The political economy trumps all consideration in practice. Pricing and externality generate rents equal to e times p, where e is the total final CO2 emissions and p is carbon price (tax or permit price). Who gets these rents is crucial for the political economy of the emissions reduction policy? Most efficient options opt to give rents to the government (tax or auction permits) due to governments can reduce distorting taxation or spend on other socially valuable things such as health, climate R&D. However, rents can be and often are used to buy off opposition from voters or special interest groups.

Buying off firms might be done easier in CO2 emissions trading process as the governmental offices entitled could give some permits for free (fi) to each firm generating rent fip (Hepburn 2013). Some organizations used this technique in its early phases and since have gradually moved to auctions. Buying off voters is seen in some countries as Sweden and Canada which have given revenues back to taxpayers. The Conservative Case for Carbon Dividends (2017) advocates a direct “dividend” to US taxpayers.

Volatility and policy interactions

The interaction with other policies may cause that other carbon reduction policies become pointless in an economy regulated by CO2 emissions trading, i.e., the “waterbed effect”, whereas a tax will reinforce other policies. Volatility, by its side, could provoke that some ETS induce volatile prices in practice. This seriously hinders firms’ ability to invest based on carbon price. What is the possible solution to these and other problems? Hybrid instruments such as carbon price floor, carbon price ceiling and to get most out of the benefits of both tax and emission trading, for instance.

Standards and subsidies

When are standards/technology subsidies good in practice? Standards (also known as “direct regulation” or command and control) and technology-specific subsidies are not as efficient as carbon pricing in the simple setting we considered earlier. Standards and subsidies are similar in that both specify a particular technological solution. But can play a significant role in an optimal policy mix, for at least two reasons:

Firstly, learning by-doing cost reductions as a unit cost today

depends on industry-wide past production  . If

the technology is going to be socially beneficial, then subsidies are

justified today because they lower future costs which, incidentally,

are not captured by a single firm. [9] for instance, quantifies this

effect and finds considerable solar photovoltaic-cells subsidies

(separate to the carbon price) become feasible viable.8

. If

the technology is going to be socially beneficial, then subsidies are

justified today because they lower future costs which, incidentally,

are not captured by a single firm. [9] for instance, quantifies this

effect and finds considerable solar photovoltaic-cells subsidies

(separate to the carbon price) become feasible viable.8

Secondly, if prices are not working, standards can step in. Energy cost myopia9 is an example of prices not being acted on and therefore not aligning social costs and benefits correctly therefore consumers under-invest in energy efficiency, i.e., fuel prices do not to guiding choices “like it should”. If energy efficiency standards can solve this, they will work better than carbon prices at solving such problem. (Nordhaus 2013) chapter 22 discusses car fuel efficiency standards in the USA (CAFF). Assuming no energy cost myopia, abatements using standards costs $85/t. At this cost, a carbon price is a better policy but with energy cost myopia, standard cost $22/t.

Thence, standards and subsidies can be especially useful at solving specific problems, but they will unlikely be able to guide the whole economy through serious decarbonisation strategy before the probability of not being efficient enough and requires the regulator to pick specific technologies. By contrast a carbon-price policy guides the economy to take the most efficient abatement opportunities, and to develop new ones.

Discussion

Fossil fuels are burnt to produce useful energy. However, this process releases CO2 into the atmosphere, which is thought to be contributing to a change in global climate. Before that, one option is complete lack of regulation, i.e., to leave the energy market as it is right now, synchronised mostly by market forces without any regard for the carbon pollution generated. But the very nature of global pollution means that nobody can pop-out.

If neither free market nor government decree is the option, then what is? One alternative to be pick up is that of permit trading able to gather and use that would otherwise be kept by individuals and firms, eventually, it is used to zoom in on an efficient outcome. Notwithstanding, stressing direct emission control does not mean that government has no role to fulfil in reducing emissions process. By contrary, government intervention is necessary at least for two reasons: firstly, the system should be universal, secondly, careful monitoring of CO2 emissions is a sine-qua-none condition. Briefly, governmental action is essential in helping to manage the coordination problem of the price system.

However, the price system can be derailed by many practical drawbacks. Regardless of whether fighting CO2 emissions through permit trading or something else, determining how much CO2 humans should be allowed to release is a tough question as involve solving a conflict of interests between those who take the burden of climate change with those who benefit from inexpensive energy. Therefore, it is worthy to apprise permit-trading and incentivecompatible system as because of CO2 emissions are controlled as allowing the discovering of such level in the process itself.

Is a tax the best way to price pollution? How does government share the burden of CO2 emissions reduction between countries and people and firms within countries while keeping fairness considerations? What is the marginal damage of an extra tone of CO2 in terms of extra global warming? A further complicating factor is that the marginal damage depends on the timing of emissions and economic agents’ expectations about the future, i.e., when the government reduces CO2. Thus, as the marginal damage of CO2 is a state dependent issue, are government able to overcome the problem of setting optimal tax rates?

Furthermore, what if emissions could not be observed or verified? It cannot be taxed what is not measured. In addition, it is often costly to install and run monitoring equipment, though technology constantly improving too. However, problems of asymmetric information persist. One possible alternative might be to tax something that is indirectly related to pollution. For instance, the emissions generated by the firm should be levied by a Pigouvian tax (τ ) , whilst both the goods supplied and the inputs utilized on them can be altogether subjected to a green tax, (τ Y ) and (τ I ) , respectively (Figure 9).

Nevertheless, the principle of targeting postulated that in a competitive economy, the optimal policy should address the source of the distortion as directly as possible as indirect instruments create deadweight losses that could be avoided.

So, in its simple setting taxes and emissions trading are equivalent. Setting a tax τ * induces abatement a* , while creating permits requiring abatement a* induce permit price τ * . They are efficient because marginal abatement costs equalized across all firms. Unlike standards which are inefficient. Both taxes and permits require exactly same (very large) amount of information, to calculate either τ * or a* . For instance, need to know economy´s MAC =ΣiMACi . Need to know SCC. But in imperfect real economies, there are important differences as it has been [10].

An influential attempt to construct an economy-wide MAC is the so-called McKinsey Curve that even though is weakened because the exact number probably are not right, it shows what we mean by a MAC, and how much information it summarizes [11]. A supplementary insight is that stated by the report State and Trends of Carbon Pricing of the [12] which shows that a lot of countries are pricing carbon and that the evidence show that emissions trading is more popular than tax, but tax also has overspread its usage. Nevertheless, the problem that carbon price is less than the SCC is a distinctive feature everywhere. The world´s biggest carbon pricing scheme is EU Emissions Trading launched in 2005 but faces two drawbacks, firstly, that after tax does not work out and that the permit price has not been stable [13].

On the other hand, recent experience with market-based environmental regulation has brought green taxes and the “doubledividend” approach to the fore since climate change became selfevident. An argument often used in favour of environmental tax reform is that it might produce a double dividend: environmental quality is improved and by substituting distortion taxes on labour and capital with taxes on pollution the efficiency costs of raising a given revenue can be lowered. This proposition, however, theoretically, and empirically should be evaluated [14].

From a global perspective, climate policy is a public goods game and then a prisoner’s dilemma in which international environmental agreements work by transforming the game to get a better equilibrium. In fact, there are big gains to cooperation but achieving those means finding a way to deter free riding. However, that is hard because punishment must be credible. Without external punishment, often only small/shallow coalitions sustained. So that, there is much room to be fulfilled in that perspective, even more when it is known that only with trade sanctions is possible to full cooperative outcome [15].

Conclusion

Incentive-based instruments are superior to command-andcontrol policies whenever the regulator has imperfect information. Indirect instruments used to create distortions that should be traded off against the benefits of internalizing the externality.

Carbon prices are the most important single policy for reducing emissions and therefore for tackling climate change. Taxes and emissions trading both have their advantages and disadvantages, which is best? That is contingent upon our own perspectives. [15] categorically assure “either one”, [16], however, pronounces “all” (including standards).

Notwithstanding, there are other important market failures, so a carbon price alone (even at the correct SCC curve) would not solve the problem, for instance, research, development, and deployment (RD&D), imperfect capital markets, co-benefits, and energy- cost myopia, which must also be addressed when making climate change policy. Political economy considerations trumps everything else in practice, but that does not mean society should not think about efficiency [17-25].

The government has several potential policy instruments to encourage reductions in CO2 emissions. In that endeavour, government must procure that users face the correct kind of incentives to reduce emissions in an efficient way. Policy could be changed to reduce the differences -e.g., across households’ carbon prices and/or taxes on energy consumption, while addressing other policy concerns to achieve the emissions reductions targets in a less costly fashion. An effective policy should not assume otherwise perfect economy is stated [26-33].

Statements and Declarations

We, the authors, declare that we have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Acknowledgment

This work is a token of teamwork at its best results in a synergy that can be very productive. However, this study would not be possible at all without the support from the universities we belong to. Also, the authors express their gratitude to financial support from the universities we belong to, and without the vivid analyses addressed at the institutional seminar of the Economics Department of the Faculty of Economics in the National University of Mexico, which, since 2019, was established for the interchange of new ideas and approaches on environmental regulation.

Author Contribution

Benjamín García-Páez performed the literature review, analysed, and interpreted the data, prepared, and edited the manuscript draft. Elvira B. Rodriguez Ríos helped in the interpretation and analysis of data. Likewise, she has to do with manuscript preparation and manuscript editing.

Highlights

A. Dealing with externalities in a first-best world without

government intervention, and their solutions.

B. Discussing the least-cost property, the observability problems,

and the principle of targeting.

C. Delving into the principle underlying externalities taxation in a

second-best world and discussing how green taxes can be used

to resolve environmental problems.

D. Making de breakdown of an emissions abatement policy given

emphasis to carbon pricing and portrays an optimal policy in

practice.

Forwarding political economy considerations as they used to grant concession to some parties in both the law-making process and in its enforcement. However, it stands for none allowance of gross inefficiency in the handling of environmental pollution.

References

- Cropper ML, Oates WE (1992) Environmental economics: A survey. Journal of economic literature 30(2): 675-740.

- Hindriks J, Myles GD (2013) Intermediate public economics. MIT press, Cambridge, Massachusetts, USA.

- Coase RH (1960) The problem of social cost. Journal of Law and Economics 3: 1-44.

- Farell J (1987) Information and the coase theorem. Journal of Economic Perspectives 1(2): 113-129.

- Barnett AH (1980) The Pigouvian tax rule under monopoly. American Economic Review 70(5): 1037-1041.

- Cremer H, Gahvari F (2001) Second-best taxation of emissions and polluting goods. Journal of Public Economics 80(2): 169-197.

- Weitzman ML (1974) Prices vs. Quantities. The Review of Economic Studies 41(4): 477-491.

- Baumol WJ, Oates WE (1988) The theory of environmental policy. Cambridge university press, Cambridge, United Kingdom.

- Newbery D (2018) Evaluating the case for supporting renewable electricity. Energy Policy 120: 684-696.

- Xepapadeas A (1998) Advanced principles in environmental policy. Books.

- Enkvist PA, Naucler T (2007) A cost curve for greenhouse gas reduction, McKinsey Quarterly.

- World Bank (2019) State and trends of carbon pricing. Open Knowledge Repository.

- (2019) EU Emissions Trading System (ETS) cornerstone of EU climate policy.

- Goulder LH (1995) Environmental taxation and the “double dividend”: a reader´s guide. International Tax and Public Finance 2(2): 157-83.

- Nordhaus WD (2013) The climate casino: Risk, uncertainty, and economics for a warming world. Yale University Press, New Haven, Connecticut, USA.

- Stern N (2015) Why are we waiting? The Logic, Urgency, and Promise of Talking Climate Change. (Lionel Robbins Lectures) Reprint, MIT Press, Cambridge, Massachusetts, USA.

- Aidt TS, Dutta J (2004) Transitional politics: emerging incentive-based instruments in environmental regulation. Journal of Environmental Economics and Management 47(3): 458-479.

- Dasgupta P (1982) The control of ResourcesHarvard University Press, Massachusetts, USA.

- Auerbach AJ (1985) Handbook of Public Economics. Volume 1.

- Hepburn CJ, Quah JKH, Ritz RA (2013) Emissions trading with profit-neutral permit allocations. Journal of Public Economics 98: 85-99.

- Hepburn C (2006) Regulation by prices, quantities, or both: A Review of Instrument Choice. Oxford Review of Economic Policy 22(2): 226-247.

- Laing T, Sato M, Grubb M, Comberti C (2013) Assessing the effectiveness of the EU emissions trading system. Economic Review 67(3): 297-308.

- Montgomery WD (1972) Markets in licenses and efficient pollution control programs. Journal of Economic Theory 5(3): 395-418.

- McKinsey & Company (2020) 2020 global report: The state of new-business building. Survey.

- Mueller DC (2003) Public choice III. Cambridge University Press, UK.

- Nordhaus WD (2015) Climate clubs: Overcoming free riding in international climate policy. American Economic Review 105(4): 1339-1370.

- Seabright P (1993) Managing local commons: theoretical issues in incentive design. The Journal of Economic Perspectives 7(4): 113-134

- Stavins RN (2019) The future of USS carbon pricing policy. NBER Working paper.

- Stavins RN (1995) Transaction costs and tradeable permits. Journal of Environmental Economics and Management 29(2): 133-148.

- (2021) The EU Emissions Trading System: An Introduction. Climate Policy Info Hub. Scientific Knowledge for Decision-Makers.

- Tietenberg TH (1998) Tradable permit approaches to pollution control: Faustian bargain or paradise regained?

- Tietenberg TH (1993) Economic instruments for environmental regulation. In: Helm D, Economic policy towards the environment, (1st edn), Blackwell, Oxford, England.

- Baker JA, Paulson HM, Feldstein M, Shultz GP, Halstead T, et al. (2017) The conservative for carbon dividends: How a new climate strategy can strengthen our economy, reduce regulation, help working-class Americans, shrink government & promote national security.

© 2024 Benjamin Garcia-Paez and Elvira B. Rodriguez-Rios. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)