- Submissions

Full Text

Novel Research in Sciences

The Effective Use of New Infrastructure Investment Fund

Utpal Dutta Ph.D, P.E*

Professor and Chair Civil, Architectural & Environmental Engineering E262, University of Detroit Mercy 4001 W. McNichols Road, Detroit, MI 48221

*Corresponding author: Utpal Dutta Ph.D, P.E Professor and Chair Civil, Architectural & Environmental Engineering E262, University of Detroit Mercy 4001 W. McNichols Road, Detroit, MI 48221

Submission: April 24, 2022;Published: April 28, 2022

.jpg)

Volume11 Issue1April, 2022

Mini Review

The primary source of road infrastructure funding is the gas tax which varies 40 cents to 60 cents per gallon depending on the state. The inflation has no impact on gas tax which is always per gallon. This is the only tax which goes down per miles of travel over the time. The cost of construction as well as maintenance has been going upward every year, at the same time the gas tax which is the primary source of road construction is down per miles of travel. At the same time there is societal unfairness. For example, low-income drivers mostly drive older cars which yield lower mileage (15-20miles) per gallon. On the other hand, high income groups mostly drive newer cars, electric cars or hybrid cars. These cars can travel from 35 miles to nearly 100 miles per gallon of gas. Due to this fact, low-income drivers will pay more tax per mile of travel than high income drivers. Thus, the existing road infrastructure funding is not sustainable. The time has come to explore other source of infrastructure funding. Therefore, we should look for avenues which are more equitable for all drivers but also provide additional funds for infrastructure repair, maintenance, and upkeep. Every year all of us must register our vehicles with our state for a flat fee between $70-$120 depending on the type of vehicle. It could be adopted that the flat fee registration is good for a certain number of miles of travel, such as 12,000miles per year. Any owner whose car/truck traveled more than 12,000 miles during the previous year, would have to pay additional fees for extra miles of travel at the next registration time. Driving more than 12,000 miles per year by older cars is not common. The illegal adjustment of the odometer for newer cars is a very complex process thus will not take place very often. This process would bring fairness to drivers irrespective of their income, car type, model etc. Please note that the technology is available right now to find remotely the mileage of any car equipped with ONSTAR.

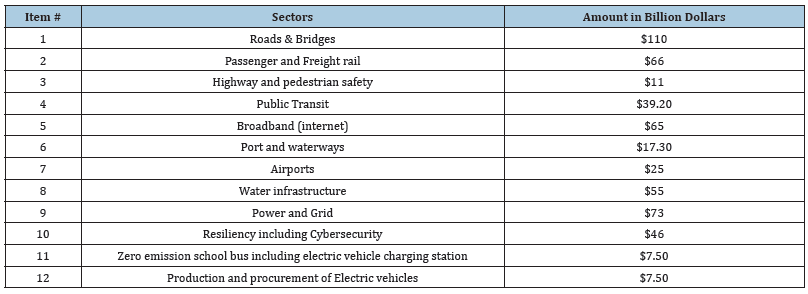

However, for the next five years, additional road funding will be available. On November 15, President Biden signed the Infrastructure Investment and Job Act (IIJA). The IIJA provides $973 billion over five years from Fiscal Year (FY) 2022 through FY 2026, including $550 billion in new investments for transportation, water, power and energy, environmental remediation, public lands, broadband and resilience. The distribution of this fund by sectors is presented in (Table 1). As a part of this act, the State Department of Transportation will get $1.5 billion every year for the next five years. The issue is where to spend this influx of funding?

Table 1: Distribution of funds by sectors.

i. Do we in increase lane miles of road?

ii. Do we improve the road condition by doing appropriate

and timely repair so that the rating of the infrastructure will change

from “D” grade to a better grade?

iii. Do we invest in the smart operational infrastructure?

It is to be noted that these extra funds are only for five years.

Thus, attempt should be made to make proper use of these

funds considering long term impact. One idea is to create smart

operational infrastructure. The smart infrastructure should include

a) 5G platform

b) Adoption of Augmented Reality (AR) in all design and

construction of infrastructure

c) Adoption and implementation of Building Information

Modeling (BIM360)

d) Digital inventory of underground and above ground

infrastructure

e) Complete elimination of hardcopy drawings as well as

notes.

The adoption of Smart operational infrastructure will be meaningless without proper upgrade of hardware and software. Thus, proper allocation of fund should be planned for the system upgrades. The proposed upgrades are not possible using DOT’s regular fund and will not be accepted by the elected officials. They are more interested in short-term improved road condition. The elected officials are willing to come up with the emergency repair fund to minimize public noise.

Other things should be considered

a) Consider Public Private Partnership (PPP).

b) For any construction/design work cost is the dominant

deciding factor. But the benefit of Public Vs Private finance for the

project including matching fund should be explored.

c) The cap of private activity bond should be doubled (raised

from the existing $15 billion to more than $30 billion).

Finally, the key is for both public and private sectors not to

waste this once-in-a lifetime opportunity (Table 1); [1].

References

© 2022 Daniel Shorkend. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)