- Submissions

Full Text

Clinical Research in Animal Science

How Food Consumption Trends are Changing the Direction of Donkey Breeding in China

Wu Pan, Wang Xiaoyu, Shen We, Wang Chengli, Li Jiahua, Wang Di and Yue Wanfu*

College of Animal Science and Technology College of Animal Medicine, Zhejiang A&F University, China

*Corresponding author:Yue Wanfu, College of Animal Science and Technology College of Animal Medicine, Zhejiang A&F University, China

Submission: April 23, 2025;Published: May 27, 2025

ISSN: 2770-6729Volume 3 - Issue 5

Abstract

This paper examines how trends in food consumption may influence the trajectory of farming within the Chinese donkey industry, with a particular focus on the shift in breeding purposes. Historically, donkeys in China were primarily bred for draft work. Smaller and more economical than horses and other livestock, they have traditionally served as a means of transport in rural areas. However, with the widespread adoption of agricultural machinery and an increasing demand for donkey products, donkeys are gradually being phased out of service roles. Consequently, breeding practices are shifting towards meat production and pharmaceutical applications. As China hosts the only comprehensive donkey industry chain globally, there exists significant potential for development within this sector alongside China’s sheep meat industry. This paper discusses the current state and varietal objectives of donkey husbandry in China, summarizes the factors driving changes in breeding practices within this field, and explores how economic development impacts donkey husbandry across the nation.

Keywords:Trends in food; Donkey breeding; Donkey meat market

Introduction

In China, donkeys generally have two uses, one is used as labor or transportation, and the other is to eat. With the development of transportation and the improvement of production mechanization, the donkey gradually withdrew from the historical stage as a means of labor and transportation. With the continuous improvement of people’s pursuit of material life, the role of donkeys as food and medicine has been deepened. Both donkey meat products and ejiao products as health food are increasingly popular with Chinese consumers, and the donkey industry is gradually heating up. The donkey industry in China mainly includes the breeding industry based on breeding, the traditional processing industry such as donkey skin and donkey meat, and the innovative technology-intensive industry based on biological agents. It is worth noting that China is the only country in the world that has a whole industrial chain integrating donkey breeding, slaughtering, intensive processing and sales, and the donkey industry is the only industry in China that has no international competition. Donkeys have important values of servitude, meat and medicine, so they are valued by people. It is a typical high-protein and low-fat food, which is rich in trace elements and vitamins needed by the human body [1].

In Traditional Chinese Medicine (TCM), donkey meat is flat and has the effect of tonifying blood and benefiting qi. It is mainly used for strain, wind dizziness and upsetting. Donkey milk tastes sweet, cold, indications for jaundice, wind-heat red eyes, etc. It contains animal glue; bone collagen can provide a good nutritional supplement for people who are weak and recuperated after illness. Donkey skin is the main raw material for the manufacture of rare traditional Chinese medicine donkey-hide, which has the functions of tonifying blood, stopping bleeding, nourishing Yin and moistening the lung. Donkey products have high development value [2-5]. In recent years, the donkey industry of China develops slowly the situation has changed the rigid growth of the donkey product market demand brings the huge potential for the donkey industry development.

Overview of the Development of China’s Donkey Industry

In China, donkey is mainly concentrated in the north and southwest farming and grazing areas. At present, the donkey industry chain in China is not perfect and the supply and demand are misaligned [6]. On this basis, the transformation of donkey industry and the development of donkey meat industry have been promoted, but there are still many problems at this stage. At present, the number of donkeys in China shows a downward trend, and regionalization is prominent. According to the data of the National Bureau of Statistics in 2018, the total number of donkeys in China in 2017 was 2.678 million, of which Inner Mongolia, Liaoning, Gansu and Xinjiang provinces had 755,000, 499,000, 366,000 and 208,000 respectively. The total number of donkeys in four provinces accounted for 68.3% of the total number of donkeys in China [7].

An overview of donkey breeds in China

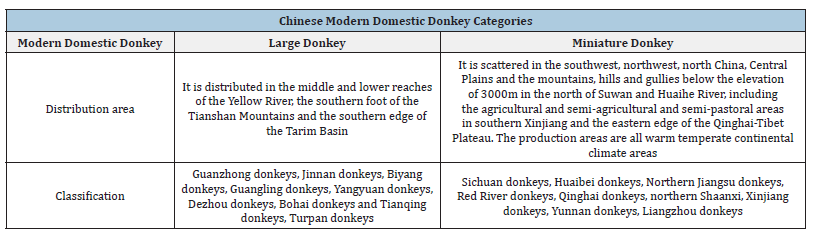

According to investigation, the oldest remains of domestic donkeys come from Egypt 6 to 5 thousand years ago. Donkeys in China are homologous to Croatian populations in Europe and gradually spread to the north and northwest areas of China from northeast Africa. The raising of donkeys in China began in the Yin- Shang period [8-10] Modern domestic donkeys are usually divided into large donkeys and small donkeys. The biological classification of domestic donkeys includes African wild donkeys, Asian wild donkeys and Tibetan wild donkeys [11-14] (Table 1).

Table 1:Modern domestic donkeys in China [8-10].

Overview of donkey industry in China

Donkeys have the characteristics of long breeding cycle, wide adaptability and high commercial value. In recent years, the development of donkey industry has been characterized by a rapid decline in stock, an increase in the proportion of large-scale breeding, an increase in regional aggregation, a weak breeding system and an improvement in processing capacity. From the perspective of farming scale, the donkey farming industry can be subdivided into large, medium and small farms [15,16]. Large farms are famous for their large-scale and intensive breeding methods, usually equipped with advanced breeding equipment and technology, able to raise many donkeys and achieve efficient production management. For example, on large farms in some areas, thousands or even tens of thousands of animals can be kept on. In contrast, medium and small farms are smaller.

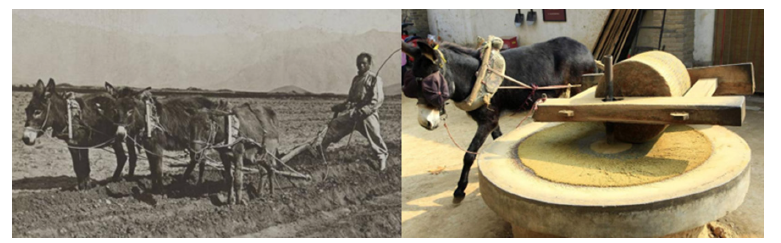

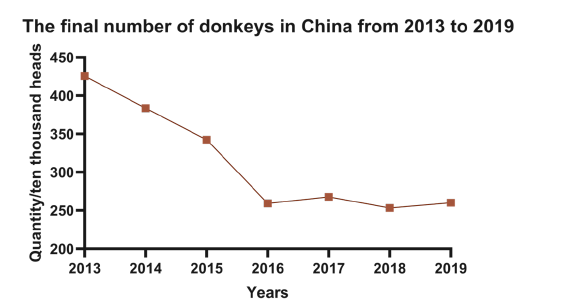

At present, the donkey industry in China mainly includes the traditional processing industry based on the processing of animal husbandry products such as donkey skin, donkey meat and donkey milk, the breeding industry based on breeding, and the innovative technology-intensive industry based on biological agents such as pregnant donkey serum estrogen. In China, the donkey is mainly raised free range. In the early stage, the farmers were mainly used as labor; for example, the donkey is used to grind grain and the iron plow is used to plow the land (Figure 1). With the continuous improvement of the level of agricultural mechanization, the value of donkey service has gradually been replaced by commercial value. In recent years, the number of donkeys in China has decreased significantly. In 2019, the number of donkeys in China was 2.607 million, a decrease of 1.6564 million compared with 2013. Among them, eastern Inner Mongolia, western Liaoning Province and Gansu Province had the largest number of breeding [17] (Figure 2).

Fgure 1:An example of donkey draught. The left side is the donkey used to plow the land and the right side is the donkey used to pull and grind.

Fgure 2:The number of donkeys at the end of the term in China from 2013 to 2019. Data source: National bureau of statistics.

Donkey slaughter volume and price trend of live donkeys

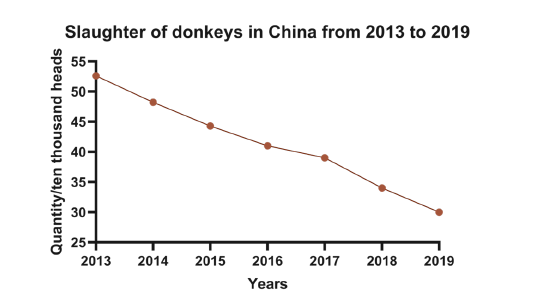

Donkey meat has less fat, delicious taste and high nutritional value. The related industry of donkey meat has also developed rapidly and the production and processing capacity of donkey products has been continuously enhanced. At present, donkey meat breeding has become a part of traditional animal husbandry. Consistent with the declining trend of donkey stock, the number of donkeys slaughtered in China decreased year by year. In 2021, the number of donkeys slaughtered in China was only 280,000, a reduction of 298,000 compared with 2012. The market price of donkey meat has increased steadily. After the outbreak of African swine fever in 2019, the price of donkey meat jumped sharply following the price of pigs, cattle and sheep. Pork, lamb and beef prices fell in 2021, while donkey meat prices continued to rise, mainly due to strong demand and weak supply of donkey meat and a relative reduction in imports. According to statistics, China slaughtered 300,000 donkeys in 2019, down 11.76% from 2018 (Figure 3).

Fgure 3:Changes of donkey slaughter volume in China from 2013 to 2019. Data source: China animal husbandry donkey industry branch.

The Change of Focus of China’s Donkey Industry

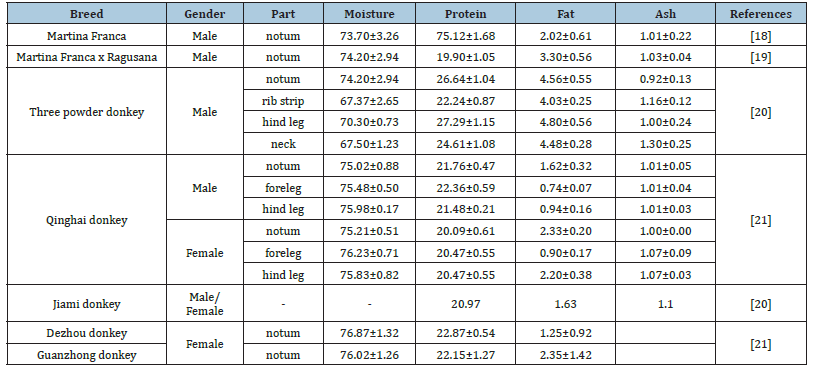

Chinese donkey has unique performance and economic research value. The donkey germplasm resources have a unique position in the livestock and poultry germplasm resources. With the disappearance of the donkey’s drafting function, the breeding amount of the donkey in China decreases sharply, and many excellent local donkey breeds are facing the danger of degradation and EXTINCTION. Among them, the breeding amount of the Dezhou mule Monkhead purebred group was less than 1000 in China more than ten years ago. As a primitive local breed, donkeys have not been systematically bred in the direction of skin, meat and milk, and its production performance is not prominent. In the protection, development and utilization of donkey germplasm resources, efficient breeding, large-scale breeding, feeding management and slaughtering processing technologies are almost blank at home and abroad. In foreign countries, donkeys are still mainly raised in the free-range and individual pet rearing mode and the related technology cannot meet the needs of domestic large-scale breeding. Due to the unique biological characteristics of donkeys, the relevant mature technologies in livestock and poultry at home and abroad cannot be directly used for reference. From the point of view of the industrial chain, the upstream industry of the donkey industry mainly includes feed, breeding, veterinary medicine and other industries, and the downstream industry mainly includes slaughtering and processing industry, donkey-hide gelatin and other industries. With the continuous enhancement of people’s awareness of health preservation, the downstream demand for donkey-hide gelatin will grow rapidly and promote the rapid development of China’s donkey industry. In recent years, people are increasingly pursuing high-quality life, health awareness has been further enhanced, and the consumption structure has changed from satiation and warming to nutrition. Both donkey meat products and donkey-ejiao products as health food are more and more popular with consumers, and the donkey industry is gradually developing better (Table 2).

Table 2:Chemical Composition of donkey meat.

Development of the donkey meat industry

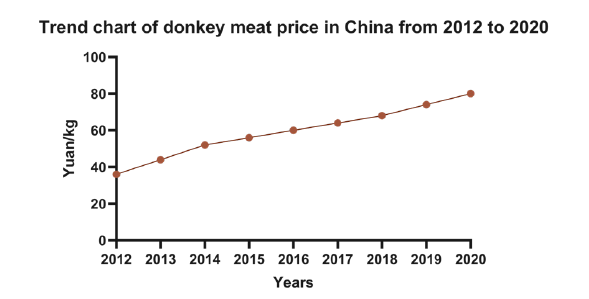

In donkey breeding production, more than 80% of the economic benefits come from donkey meat and high-quality donkey meat has huge market demand and benefits. Donkey meat is characterized by high levels of protein, essential amino acids and unsaturated fatty acids and low levels of fat, cholesterol and calories. Therefore, it is considered a quality meat source. The Liaocheng University systematically reviewed the basic information, classification and physiological functions of donkey lipids. The team studied the metabolite and lipid composition of raw and cooked donkey meat through metabolomics and lipidomic, and found that malt triose, L-glutamic acid and L-proline may be the main sources of the unique umami and sweet taste of donkey meat. Triglyceride and glycerophosphatidic acid may be the main lipids that combine and generate aromatic compounds, respectively, providing a theoretical basis for understanding the unique taste of donkey meat [17]. The price of donkey meat in China shows a continuous upward trend, indicating that there is still a lot of room for development in the donkey meat market affected by the amount of breeding (Figure 4).

Fgure 4:Changes of donkey meat price in China from 2012 to 20202.2 Development of the donkey skin industry.

Development of the donkey skin industry

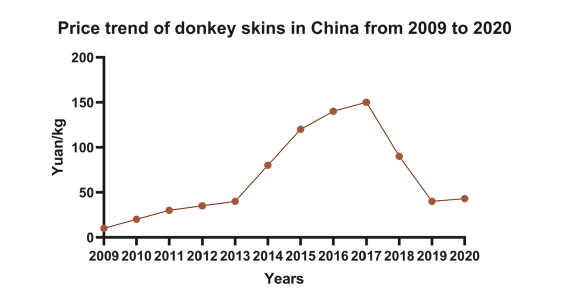

Ejiao is the skin of the horse donkey, which is boiled after bleaching and foaming. It is rich in protein and a variety of amino acids and is widely used in the field of traditional Chinese medicine for the treatment of anemia, qi and blood insufficiency, insomnia and other diseases. In recent years, the market scale of China’s donkeyhide industry has grown steadily. Since 2012, the price of donkey skin in China has shown a trend of first rising and then falling [18]. The price of donkey skin has continued to rise, but the number of donkey stocks has decreased year by year, so the domestic breeding volume is not enough to support the donkey skin and donkey meat industries. As the raw material of donkey-hide production, the price of donkey-hide fluctuates with the price of donkey-hide. In 2017, the price of donkey-hide fell, leading to the downturn of the whole donkey industry. After that, practitioners realized that it was difficult to drive the development of the whole donkey industry by only relying on donkey-hide and began to develop in parallel with donkey-hide and donkey-meat. At present, domestic fresh donkey meat and donkey skin can only meet a small part of the domestic demand and imports have become a key factor affecting the development of the industry. The donkey industry is small, and a little more import will cause price fluctuations. As the local advantages and characteristics of the animal husbandry industry in China, it is necessary to actively develop new live products such as donkey milk and pregnant donkey serum to further expand the market [19] (Figure 5).

Fgure 5:The price change of donkey skins in China from 2009 to 2020.

In summary, there has been a significant increase in the price of donkeys and donkey skins in China from 2010 to 2021, accompanied by this increase, as well as the shortage of the number of pens and stocks. This indicates the growing demand for donkey meat and donkey skin products in China’s domestic consumer market. However, the self-sufficiency rate of donkey meat in China continues to decline, indicating that the production capacity of donkey meat in China cannot keep up with the consumption ability and the production level of the donkey industry in China needs to be further improved. Stable returns can ensure the development of industry and future market demand determines the breeding goals of breeding personnel. After 10-12 years of decline, the price index of live donkey production continues to increase, which proves that China’s donkey industry has full development potential [20].

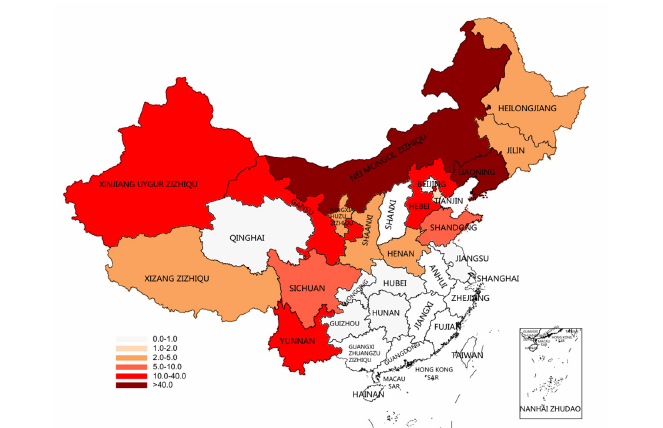

Distribution of donkey industry in China

Donkey breeding in China is mainly concentrated in eastern Inner Mongolia, western Liaoning Province, Gansu Province and parts of Xinjiang Autonomous Region. Eastern Mongolia and western Liaoning, Gansu Province and Xinjiang Autonomous Region have a long history of animal husbandry, obvious characteristics of animal husbandry industry, outstanding advantages of land and ecological environment and rich feed resources, which are the key development areas of donkey breeding [21] (Figure 6).

Fgure 6:Distribution of donkey stock in China by province and city in 2019. Unit: Ten thousand heads.

Study on Driving Factors and Mechanisms of Successful Transformation in China’s Donkey Breeding Industry

Since the reform and opening-up, China’s donkey breeding industry has undergone a profound transformation from traditional draught use to a modern economic composite industry. This transition has not only reshaped the industrial value chain but also established a unique industrial paradigm in global animal husbandry. This paper systematically analyzes the core driving mechanisms of its successful transformation through three dimensions: policy orientation, market demand, and technological innovation [22].

Economic value reconstruction: From single draught use to multidimensional composite resources

The core driving force of the transformation lies in the systemic

reconstruction of economic value. The decline of traditional

draught functions compelled industry to explore new growth

points, manifested in two breakthroughs:

Upgraded meat consumption market: Donkey meat, with

its high protein and low-fat biological characteristics, aligns with

health-conscious dietary trends. From 2012 to 2020, donkey meat

prices rose by an annual average of 8%, with further price surges

post-2019 due to supply-demand imbalances caused by African

swine fever [23]. Breakthroughs in deep-processing technologies

(e.g., vacuum-packed ready-to-eat products) enhanced added value,

extending the industry into food manufacturing.

Vertical integration of medicinal supply chains: The demand

for donkey hides in the ejiao (donkey-hide gelatin) industry (yielding

2-3kg of ejiao per hide) has created the world’s only complete

industrial chain. Enterprises like Dong’e Ejiao Group adopted an

integrated “breeding-processing-sales” model, dominating 80% of

global ejiao production. Additionally, R&D on biological agents such

as donkey serum estrogen and immunoglobulin-rich donkey milk

expanded the industry into pharmaceuticals [24].

This value reconstruction represents a market-demand-driven industrial leap, liberating donkey breeding from low-value-added traditional agriculture.

Policy-technology synergy: Institutional guarantees for industrial transformation

Government-led institutional support and technological innovation provided structural reinforcement. Policy initiatives like the Shandong Donkey Industry High-Quality Development Plan (2024-2035) implemented endangered breed conservation (e.g., Dezhou donkey gene banks) and large-scale farming subsidies. Enterprises such as Shandong Hong sheng Donkey Breeding Co. reduced breeding costs by 20% and increased stock by 270% within three years. Technological advancements in breeding (e.g., artificial insemination), standardized feed systems, and disease control broke the “technology lock-in” effect of traditional farming.

Industrial chain upgrading

Innovations in industrial organization catalyzed transformation. Leading enterprises adopted a “cooperative farmer” model, covering over 50% of national breeders, enabling unified epidemic prevention and centralized sales. Cultural tourism projects like Dezhou Donkey Theme Farms boosted end-profit margins by 25%, creating a tertiary-industry-integrated ecosystem. China reduced import dependency by controlling global quality standards for donkey hides. IoT technologies have expanded the capacity for percapita farm management capacity, while blockchain traceability systems lowered product loss rates. This restructuring enhanced risk resilience and secured pricing dominance in global trade.

Conclusion

Compared with pig and cattle breeding, donkey breeding in China has the characteristics of high regional aggregation and weak breeding system. Large-scale production of donkeys by farmers as well as small farms does not require the use of sophisticated breeding techniques, making it an ideal industry in regions with relatively weak economic endowments. At present, with some policy support, local farmers have received training and technical support to improve their skills in raising donkey meat and can be selected for special industries, such as the black donkey skin from Shandong province in China used in Shanghao Ejiao. The transition path of donkey breeding in China provides valuable experience for the development of animal husbandry economy in developing countries. The successful transformation of China’s donkey breeding industry reflects an industrial leap driven by market demand, institutional innovation and technological revolution. Modernizing traditional agriculture requires value reconstruction to break path dependence. Policy-technology-capital synergy enables optimal resource allocation. Future priorities involve genetic resource conservation (e.g., Guangling donkey living gene banks) and digital management (e.g., AI-based disease diagnosis). This model offers replicable insights for upgrading niche livestock industries globally.

As the only country in the world used in donkey industry chain, China shows its uniqueness in the field of livestock and poultry resources and it also provides reference for many countries in Africa with high stock of donkeys. In the process of global trade, many germplasm resources are not fully utilized or efficiently developed, leading to their possible extinction due to their inability to generate substantial economic benefits compared with more dominant varieties and the industry’s increasing preference for mono specificity. However, the donkey is a livestock resource with a long history in China, and its edible and medicinal development shows the universality of the development of livestock and poultry resources, which provides the development template for the donkey industry in other areas.

References

- Zixin D, Ru HD (2023) Research progress on the excavation of characteristic varieties of donkey meat. Food Research and Development 12.

- Seyiti S, Kelimu A (2021) Donkey industry in China: Current aspects, suggestions and future challenges. Journal of Equine Veterinary Science 102: 103642.

- Nan Z (2014) Studies on histological characteristics and physical and chemical properties of muscle of male donkey in Bohai Sea.

- Nan Z (2014) Study on histological characteristics and physicochemical characteristics of muscle of fattening male donkey in the Bohai Sea. Agricultural University of Hebei, China.

- Polidori P, Santini G, Klimanova Y, Zhang JJ, Vincenzetti S (2022) Effects of ageing on donkey meat chemical composition, fatty acid profile and volatile compounds. Foods 11(6): 821.

- Chen Jianxing, Hong Jun, Li Jing, Zhi YM, Qin LG, et al. (2019) Research progress on nutritional value and influencing factors of quality of donkey meat. Animal Husbandry and Feed Science 40(7): 60-64.

- Chen Jianxing, Hong Jun, LI Jing, Ma Zhi Yan, Qin LG, et al. (2019) Research progress on influencing factors of nutritional value and quality of donkey meat. Animal Husbandry and Feed Science 40(7): 60-64.

- Li J, Yubin W (2019) Current situation, problem and countermeasure of trade of China donkey. Chinese Journal of Animal Husbandry 55(5).

- Qun L, Shibin L (1986) An overview of the development history of donkeys and mules in China. Agricultural History of China 4: 60- 67.

- Zai Y, Songwu F (1991) Some historical materials of raising donkeys in China. Journal of West Henan Agricultural College 11(1): 10-13.

- (2011) National commission on livestock and poultry genetic resources. Journal of Genetic Resources of Livestock and Poultry in China: Annals of Horse, Donkey and Camel, China Agriculture Press, Beijing, China.

- Rossel S, Marshall F, Peters J (2008) Domestication of the donkey: Timing processes and indicators. Proceedings of the National Academy of Sciences of the United States of America 105(10): 3715-3720.

- Beja-Pereira A, England PR, Ferrand N, Jordan S, Bakhiet AO, et al. (2004) African origins of the domestic donkey. Science 304(5678): 1781.

- Xia X, Yu J, Zhao X, Yao Y, Zeng L, et al. (2019) Genetic diversity and maternal origin of Northeast African and South American donkey populations. Animal Genetics 56(3): 266-270.

- Jingfang L, Yan W, Donglin L (2018) Donkey meat performance and nutritional value of donkey meat. Animal Husbandry in Xinjiang 33(12): 11-16,19.

- Jingfang L, Yan W, Donglin L (2018) Meat performance of donkey and nutritional value of donkey meat. Xinjiang Xumuye 33(12): 11-16,19.

- Song Y (2022) A Comprehensive review of lipidomic and its application to assess food obtained from farm animals. Food Sci Anim Resour 42(1): 1-17.

- Polidori P, Vincenzetti S, Cavallucci C, Beghelli D (2008) Quality of donkey meat and carcass characteristics. Meat Science 80(4): 1222-1224.

- Polidori P, Vincenzetti S, Pucciarelli S, Polzonetti V (2020) Comparison of carcass and meat quality obtained from mule and donkey. Animals 10(9): 1620.

- Panpan X, Haifeng Z, Xu L (2021) Determination and analysis of meat quality of different parts of Sanfen male donkey. J Food Science 42(22): 276-282.

- Xue Panpan, Zhang Haifeng, Li Xu, Qiuyu W, Jiamin S (2021) Evaluation of meat quality in different carcass cuts of male Sanfen donkeys. Food Science 42(22): 276-282.

- Yujiang S, Deqiang A, Rong G (2021) Nutritional analysis of the muscle of Qinghai donkey. Proceedings of the Seventh (2021) China Donkey Industry Development Conference and the Second Texas Donkey Germplasm Resource Conservation and Development Utilization Summit Forum, Dezhou, China, pp. 243-248.

- Wentong H (2016) Analysis to meat nutrition composition of donkey fattened in different ages. Grass-Feeding Livestock 2016(4): 1-9.

- Nan Z, Guocai H, Xiaofeng C, Zhong SB, Peng LH, et al. (2015) A comparative study of donkey meat production, physicochemical indicators and processing properties. Chinese Journal of Animal and Veterinary Sciences 46(12): 2314-2321.

© 2025 Yue Wanfu. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)