- Submissions

Full Text

Academic Journal of Engineering Studies

Residential Market Assessment During the Pandemic Period for Detroit, MI

Radwan Al Shaer, Kasim Korkmaz*

Eastern Michigan University, Construction Management Program, Ypsilanti, USA

*Corresponding author: Kasim Korkmaz, Eastern Michigan University, Construction Management Program, Ypsilanti, USA

Submission: December 07, 2022; Published: December 19, 2022

.jpg)

ISSN:2694-4421 Volume3 Issue2

Abstract

The residential market for the city of Detroit has had a storied history full of dramatic changes. The first of those came during the 2008 global recession when the prices dropped to new lows and then steadily recovered, only to be halted just as the changes were beginning to truly show. The newest change affecting the market is the recent pandemic due to Covid-19. Among the topics discussed, the impact of the virus on both buying and selling is important. By analyzing the effects on the sale of homes, information about the future of the market can be obtained as there are patterns that often happen as the economy goes through its repeated up-and-down cycles. By analyzing the virus’s effect on buying homes, projections for future behavior and buying patterns may be observed. Furthermore, the impact on the supply of homes and how this affects the price of the homes is important as shifting in the supply of a market has economic implications for the price and for the future. Interpreting the demand changes is equally important as demand does drive a market. Regardless of the supply, demand is an important factor by itself as it indicated an interest in a market. Considering Detroit’s history as thousands of residents fled, bringing back interest in the market has been a vital part of the revitalization efforts. By evaluating what factors have contributed to such a shift in supply and determining how those factors are bound to change, a better understanding of both the present and future residential economies. Contributions to the supply of the markets have been mainly due to personal decisions such as the decision to hold off listing properties until the pandemic is over or not having anywhere to go once their house is sold. Contributions to the shift in the demand for houses are due to a range of factors that affect the ability to actually purchase a home such as stimulus checks or interest rates. Aspects that influence the increasing prices without direct regard to supply or demand include the increased costs of building houses as builders have had to deal with increased shipping costs and increased overhead of material as well as the problem of delays due to workers getting the coronavirus. Additionally, an analysis was carried out of where the market continues to go in the future, based upon current projections, as well as what the current boost means for the city and those already owning or buying properties in Detroit, MI

Keywords:Detroit; Residential market; Covid-19; Supply; Demand; Prices; Building materials; Constructions delays

Introduction

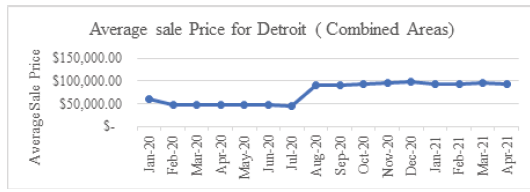

Figure 1:A Graph showing the average home value in Detroit.

2020-21 was not the first time that city of Detroit has dealt with an economic disturbance; however, unlike the 2008-10 economic recession, this disturbance has had a good effect on the market- aside from the first couple of months in which the country was completely shut down. In Figure 1, average sales prices are given. Such a disturbance can be attributed to a multitude of factors; however, the main factors are a sharp decrease in supply, a large increase in demand, and an overall increased cost in the total price of construction due to an increase in the price of important materials such as lumber or metal. By analyzing the effect of such factors on the health of the market, future predictions can be made in, allowing us to determine the trajectory of the market, an any implications of this trajectory.

Methodology

The first crisis of the twenty-first century Detroit experienced was the 2008 recession in which the entire city felt the staggering effects. The residents in the city had been steadily fleeing, which became a problem as it caused the eroding tax base for the city, meaning the city received less in income taxes and less in property taxes as the values were declining. This made the city unable to bail out the residents, or at least contribute something to combat the effects of the recession. Additionally, housing prices began to decline and reached their lowest point in 2009, where the average price of a home ranged around $15,000. This was an evident decrease from the early 2000s. One can clearly see how this decrease in values could be problematic to an already drowning city. Another problem arose when the vacant lots began to show up in the city and populate already struggling neighborhoods. After the recession, people could not afford to maintain their properties, and by 2009, 13% of all lots were vacant [1]. Vacant lots attract squatters and trash to be dumped on the property, which only further hurts the lower housing prices. Such large numbers of vacancies contributed significantly to the place where the city is at today, partly because the city had to pay to demo them, but this was mostly due to the amount of money needed to address the issue, money the city did not have. This, coupled with the significant decrease in the value of home prices, caused the entire market to fall into a deep recession, one from which it was just beginning to recover when the pandemic began.

At the beginning of the pandemic, the entire country was essentially frozen: People did not go to work, students weren’t at school, and many people lost their jobs. In fact, the unemployment rate during the pandemic was roughly 20% higher than it currently is (Dept of Numbers 2021. This caused people to economize and try to make whatever money they had in their saving work because they were no longer receiving a weekly income. A third of Americans had not set up any type of savings, which was highly influential in the intensity of the struggle that many Detroiters (CBS 2021). Many workers that had lower-paying jobs were laid off from their jobs and those who were fortunate enough to keep their jobs were forced to work at home. Unemployment stimulus checks helped to cushion those that had run out of money, but that money was spent on household items, such as groceries or gasoline for cars. Due to these high levels of unemployment and the halting of in-person events, the residential market was significantly halted. This meant that people could no longer host open houses, take people on home tours, or meet up to see homes like they traditionally would.

Due to this shift in the system, the prices of homes began to decrease because buying in the midst of the pandemic was unpopular. This also means that many people decided to put off listing their homes because they wanted to wait until the market began to recover and return to normalcy to increase their chances of selling at or near the list price. Moreover, adults who had been previously laid off or were fired due to the pandemic needed to use whatever money they had to get themselves through the unforeseeable future, meaning that they were making fewer major purchases, such as a house. When looking at the state of the beginning of the pandemic from an economical perspective, one can see how lower demand would make prices drop. Real estate agents and homeowners were struggling to move their properties. Because of this unfortunate mix of low investments, high unemployment, and more time at home, the market suffered in a unique way. Since the beginning of the pandemic, Detroit has been hit hard with cases because it is a crowded city, with a number of lower-income residents. The number of cases in Michigan has been steadily increasing since May 2020, despite the growing number of vaccinated people in the state (Michigan.gov, 2021). One of the places in the Detroit economy that particularly illustrates the effect that the pandemic has had on the citizens is the residential sector of the economy. Detroit is no stranger to residential struggles as it was in the middle of fighting a blight problem that affected a substantial portion of the city and lower housing prices, as briefly described above [1]; however, the pandemic has affected many of the main factors in deciding how much a house can be sold for and if Detroiters can afford it. Such factors include interest rates, loan affordability and accessibility, and the overall market supply against demand.

By looking at the supply of homes and comparing it to the market demand, an individual can predict what will happen to the prices of Detroit homes in the future, as well as understand their current state. The supply of homes in a market plays a great driving force in how prices are going to shift as does demand [2]. He illustrates that if there is little demand and little supply, then prices wouldn’t go up in the way you would expect with a declining number of available homes. By illustrating the effect of the supply on the market, one can understand how the prices of homes in the Detroit residential market are increasing. Moreover, the lack of supply is illustrated, while the number of home listings was declining, the number of home showings was increasing (Bridge Michigan, 2021). It is evident that prices should have gone up because the demand had not decreased but the supply dramatically increased, leaving more buyers to compete to secure the limited number of homes from the diminishing number of sellers, causing them to have to outbid each other. Bidding wars, like the ones described above, often result in a significant increase in the price of a house, often well over listing in the case of Detroit. Additionally, there was also an impact on the demand for homes, which aided to the soaring prices.

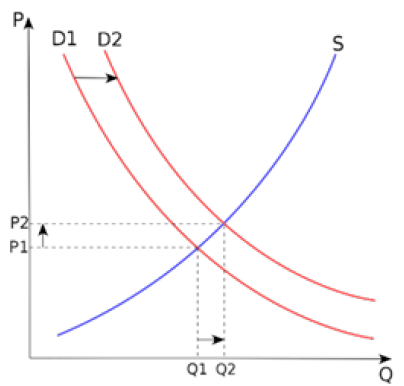

Figure 2: An illustration of supply and demand.

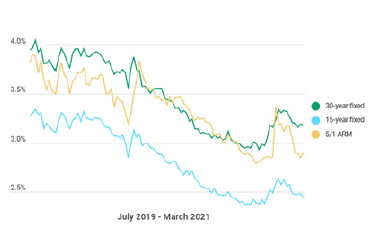

Figure 3: A graph showing the rates over the past two years [18].

When the pandemic caused the country to stop completely from March to May 2020, people were confined to their homes, where they had previously spent much less time. Spending so much time in their own homes motivated people to want to change and move into bigger and better homes, motivating them to enter the market as buyers, if they were financially able to afford a loan [3]. Furthermore, due to the pandemic, people could no longer spend as much money on expenditures, such as restaurants or social outings. This caused people to save more money overall, which is another strong factor in many people deciding to enter the market as buyers. This also aided in increasing prices as well because more people were demanding homes, and with such a short supply, they were all looking at and bidding on the same homes that were listed in the Detroit area. This relationship can be demonstrated by looking at the supply and demand curve, which shows that if supply decreases, prices will increase. It also states that consequently, if demand increases, the price will increase. This relationship is demonstrated above in Figure 2. Either one of these shifts in market conditions would have been enough to raise prices in the area; however, with both of these actions around nearly the same time, the end result is reflected in the current state of the housing prices: higher. Another major consideration is that despite the addition of new construction to the area, many projects had to be postponed due to the corona shutdowns that many states nationally experienced, especially in Detroit. The staggered supply could not keep up the demand, nor could it offset the effect that the increasing demand had on the prices. While the higher prices are good news for the sellers in the market, buyers now must have more money (or mortgages with a higher amount) available if they are going to be able to compete in such a competitive market. This is where the ability to get a loan comes in for those willing to buy during the pandemic, especially as homes are being sold for well over the asking price. A resident’s ability to buy a house rest mostly on a few factors, including income and interest rates. If these two factors are working in the favor of the buyer, it makes getting a home loan much easier, making house hunting easier. The first factor to look at would have to be interest rates as they correlate to the monthly amount paid on a loan. When comparing interest rates over the course of the past year, one can see that since the beginning of the pandemic, interest rates have been steadily declining for a 5/1 ARM, a 30-year fixed, and a 15-year fixed mortgage [4]. This is demonstrated in Figure 3, which shows a graph of the interest rates over the past 2 years, and their steady decline, especially following the beginning of the global pandemic. This significantly contributes to the ability of someone to be able to afford a home; therefore, when interest rates are lower, this will promote more people to enter the market as buyers, further propelling the prices in the market. Rates have been lowered to offset some of the financial hardships that families may have experienced since the beginning of the pandemic. Consequently, the current rates are expected to aid the socioeconomic status of those living in the city just as federal aid has been attempting to..

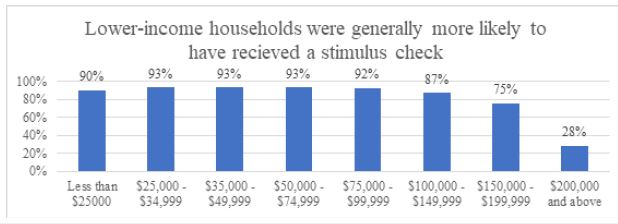

Since the beginning of the pandemic, the question of whether the government should be supplying aid has been a long-debated topic and in spite of this, Americans have received multiple rounds of stimulus checks dependent upon how many people they care for and their socioeconomic status. These checks came in at thousands of dollars for the families of Detroit and achieved their goal of providing aid to those in the corona-struck city (Peter G. Peterson Foundation 2021). This influx of cash into the economy affected the residential market in multiple different ways. The stimulus money allowed those buying properties in Detroit to have enough for a down payment for example or allowed them to bid higher on a house, which only stood to drive prices up as demand increased. Figure 4 presents the stimulus check distribution probability. Furthermore, when more money is put into the economy, the overall neighborhood and residents begin to do better, which in turn, only helps housing prices and causes them to increase.

Figure 4: A diagram showing the likelihood of receiving a stimulus check (Peter, 2021).

While it is important to look at how human behaviors drove the market to behave the way it did over the course of the pandemicfirst in the slow phase and in the second phase where activity suddenly increased. It is equally important to note that the price to build homes has gone up significantly due to a number of factors. This is important to notice due to a large number of empty lots in the city. Prior to the pandemic, Detroit’s mayor Mike Duggan began his project to remove blight from the city by demolishing abandoned homes and trying to open land for it to be developed (Detroit.gov, 2020). Currently, many dangerous, blighted homes have already been demolished and those newly cleaned lots are being sold.

This opened land for future developers to build new homes or residential complexes. Some of such developments are outlined such as the Sugar Hill Development, which will provide 68 apartment units to the city and would have been completed this year. Another new development that is in the works is the Packard Automotive Redevelopment, which will bring 38 new lofts to the city (Mondray and Runyan, 2020). The majority of new developments were expected to wrap up in 2020 or 2021; however, because of the pandemic, essentially halted all work for a couple of months. When assessing the residential market in Detroit through the pandemic, the rising costs of materials, as well as the severe delays experienced during building, are essential to note with the rising prices of the listings in the residential market.

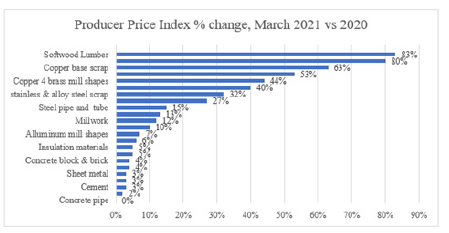

While one of the reasons that the prices in the Detroit residential market have been increasing is, in fact, due to the reduced supply and increased demand for houses. Another factor has been the increased ease in the factors going into getting a loan, such as lower interest rates and stimulus checks. However, another important factor is the increased cost of the material required to build a house. This includes the soaring costs of lumber [5]. The rising cost of lumber has added at least 24,000 dollars to the cost of a home, which adds at least 24,000 to the list price of the new homes. Furthermore, it is not just lumber that is experiencing such a rapid increase in the cost of homes, the prices are bound to go up. Just as with the homes in the city of Detroit, this is due to a decrease in supply. This is mainly because of the shutdowns that occurred worldwide during the beginning stages of the pandemic, causing less material to be produced. Furthermore, when the plants finally opened back up, demand was so high due to the absence, that the factories could not keep up. This combined supply decrease and demand increase caused an almost 200% jump in the price of lumber. Further adding to the shortage was the expected decrease in demand following the pandemic, which caused less to be produced prior to the shutdown [5]. Adding to the increased cost of building is the rise in the cost of subcontractor labor, which is also another direct factor that is factor into the cost of a house [6]. This, in turn, increased the prices of new homes that might be newly listed in the market.

Figure 5:Percent Change in the Prices of Building Materials (Bureau of Labor Statistics, 2021).

The second main factor had to do with an increase in the cost of the houses, where the materials that were supposed to be delivered took longer. Figure 5 depicts the change in material costs. Since the pandemic was worse in other countries such as China at the beginning, the United States placed strict limits on the imports coming from China to the United States. This caused a delay in the arrival of new materials as well as contributed to the increased cost of the imported construction material, which was described above [7]. Furthermore, the delays in materials also set projects back and can cause increased costs associated with the timeline or having to reschedule. Additionally, the rates in order to ship have become more expensive due to the increase in rules and regulations making materials in the country more expensive or somebody outsourcing more expensive.

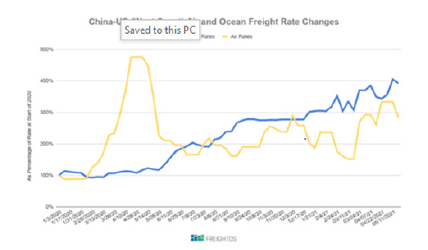

As given in Figure 6, the rates have been much higher than usual and are increasing due to the growing US-China tensions and the safety concern over the coronavirus. The rates have been different between other countries and the United States, but because many of our materials come from China, looking at the Chinese-American rates is the most indicative of how a change in the rates can truly have an effect on the prices, which will, in turn, have an effect on the prices of the houses. Furthermore, this rate change could cause an increase in the price levels of the listed homes in large cities with new developments, like Detroit.

Figure 6:The rate changes from China to the US [5].

As illustrated countless times above, the current stage of the residential market is much higher due to the coronavirus than it was prior to the pandemic. However, in order to have achieved a holistic evaluation of the city’s residential economy, we must also discuss potential future projections for the city of Detroit. All economic indicators point to the market sustaining this increased value due to the vaccine rollout. This means a large number of things including the opening up of the country and a faster return to normalcy, meaning a return to some of the traditional real estate practices such as open houses or in-person walkthroughs rather than online videos. Despite the increase in demand for houses, there is still a large number of people that have yet to reenter the market as buyers. This potential post-pandemic surge of buyers is only going to help the market in the future. As explained above when discussing the current supply and demand impacts, an increase in buyers results in an increase in demand, which will then increase the prices in a similar fashion to how they increased during the pandemic. Another vital aspect is that as the pandemic begins to end and the return to normalcy becomes more apparent, people will be able to spend more money on businesses, which will only help those living in the city as the number of jobs can further increase, as well as the income of the residents. This adjustment in spending will come as more people will begin to go back to work as they will no longer have stimulus checks they need to rely upon. This newly restored income is essential to consider as having a job makes them more likely to afford a loan, especially considering the extremely low-interest rates that have emerged since the pandemic. Also, with the new projects that will enter the city within the foreseeable future, the demand will be able to be met, leading to increased sales [8]. As the end of the pandemic comes, the city of Detroit will be met with a sustained pattern of economic growth.

If prices continue to increase in the future or the current prices are at least sustained, then how this will affect both buyers and sellers will differ as they are on opposite sides of the market. An increase in the price levels of the homes will generally benefit sellers as they are able to get more money for the houses that they were planning on selling, to begin with. Using the stock market as an analogy for the residential market is an effective way to explain the concept. If a stock is going up and you sell your shares too early, you still make money, but you could have realized a bigger profit had you waited a little longer. Therefore, when looking at the selling of houses, it is important to note that some sellers who already sold their homes could have benefitted from the projected further growth had they waited. Buyers, however, have a dilemma that is the opposite of the situation of the sellers [9-15]. Although the current prices are much higher than they were prior to the coronavirus pandemic, they are projected to increase. If a buyer buys a house now or earlier, then they may potentially save themselves money as they are not buying in a higher-priced market and are not going to be competing with the surge of post-pandemic buyers. Just like with the stock market analogy, if a buyer buys a stock after it has already begun to increase, they run the risk of paying too much for something they could have gotten for a cheaper price. Both dilemmas will be important for both buyers and sellers to consider as they will attempt to navigate the new residential market [16-21].

Conclusion

Considering a variety of factors associated with both the supply and demand of the residential market and how each of them affects the price of the houses in the area, it can be accurately assessed the state of the residential market in Detroit. The factors that would cause such a shift in supply, include the low inventory, as well as the slow pace in which new construction is being achieved due to the various setbacks provided by the coronavirus pandemic. Of the various causes of a shift in demand, some of them include the increased ease in affording a home provided by the stimulus checks as well very low-interest rates within the mortgages. Furthermore, the increased time spent at home during the lockdown has heavily affected the ideas that people have of what they want in a home, causing them to be more likely to move. The momentum of the market began after a virtual stop in all of the market activities for a couple of months, beginning in March of 2020; however, this momentum has been continuing for a year and is projected to continue as the market keeps opening and the prospect of returning to normal becomes more apparent. This is especially good for sellers if they can capitalize on this; however, this means a more difficult time for buyers as they face increased competition as well as higher prices, meaning they may not be able to afford this new market.

References

- Dewar M, Seymour E, Druță O (2014) Disinvesting in the city: The role of tax foreclosure in detroit. Sage Journal 51(5).

- Gyourko J (2009) The supply side of housing markets. National Bureau of Economic Research, No. 2.

- CBS Detroit (2021) Why are there no houses to buy? CBS Detroit, CBS Detroit.

- Stauffer J (2021) Historical mortgage rates | next advisor with time. Time.

- Sheffey A (2021) Surging lumber costs have increased the average cost of a new house by $24,000. Business Insider.

- Zevin A (2021) Material prices rise in all categories in January. Engineering News Record RSS.

- Coronavirus & Shipping: Air & Ocean Freight Delays 2021. Freightos.

- Mastroeni T (2021) Detroit real estate market investing forecast. Million Acres.

- Amanda L (2020) How stay-at-home orders are affecting the real estate market. Forbes, Forbes Magazine.

- Bereitschaft B, Daniel S (2020) How might the COVID-19 pandemic affect 21st century urban design, planning, and Development? Multidisciplinary Digital Publishing Institute 4(4): 56.

- Chetty R, Friedman JN, Hendren N, Stepner M (2020) The Economic impacts of COVID-19: Evidence from a new public database built using private sector data. National Bureau of Economic Research, Cambridge, USA.

- Cox E (2020) How the U.S. housing market was rocked by COVID-19 and where we go from here.

- Fickenscher L (2021) Businesses are struggling to hire workers-and say uncle Sam is to blame. New York Post, New York, USA.

- Glaeser, E, Joseph G (2017) The economic implications of housing supply. Journal of Economic Perspectives 32(1): 3-30.

- Grandy N (2021) House of the rising costs: Construction materials surge amid higher demand, supply constraints. The Real Economy Blog.

- Herbik R (2020) How will temporary unemployment impact my ability to buy a home? OVM Financial.

- Horsley S (2020) Pandemic thins out savings of unemployed Americans. NPR-National Public Radio, USA.

- Dowle J (2021) House moves should be delayed, say the government. House Beautiful.

- Quora (2020 ) How is COVID affecting mortgages? Forbes, Forbes Magazine.

- Whitacre R, Orisan AO, Gaber N, Martinez C, Buchbinder L, et al. (2021) COVID-19 and the political geography of racialisation: Ethnographic cases in san Francisco, Los Angeles and Detroit. Global Public Health 16(8-9): 1-15.

- Yoruk B (2020) Early effects of the COVID-19 pandemic on housing market in the United States. SSRN Electronic Journal, p. 28.

© 2022 Kasim Korkmaz. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)