- Submissions

Full Text

Advancements in Civil Engineering & Technology

Can Circular Economy-based Iridium Mining Become Profitable Due to the Rising Price of Critical Materials?

Victor Fabregat*

Department of Engineering and Innovation, Regenera Energy, Spain

*Corresponding author:Victor Fabregat, Department of Engineering and Innovation, Regenera Energy, C. Molina de Segura, nº 8, Murcia, Spain

Submission: April 15, 2024;Published: May 03, 2024

ISSN: 2639-0574 Volume6 Issue2

Abstract

The transition to low-carbon technologies increases the demand for critical materials. This shift has heightened mineral consumption, leading to geopolitical tensions, price volatility, and supply disruptions. In this context, Iridium has become the world’s most expensive mineral due to its scarcity on Earth. With the energy sector becoming a major consumer of critical minerals, new business models have emerged on reducing or substituting critical materials and leveraging circular economy strategies to mitigate supply vulnerabilities. This perspective report explores the future outlook on new business models in Iridium mining, focusing on those framed in the sustainability of the circular economy and analyzing a brief study of a practical case to evaluate its feasibility.

Keywords:Iridium; Critical materials; Circular economy; SEM; Business models

Abbreviations: PGM: Platinum Group Metals; IEA: International Energy Agency; TRL: Technological Readiness Level; SEM: Scanning Electron Microscopy; CAPEX: Capital expenses; OPEX: Operating Expenses

Introduction and Current Trends

The turn towards an energy system based on low-carbon technologies leads to a significant mineral demand compared to the current system, centered on fossil fuels. For instance, electric vehicles require six times more minerals than ordinary vehicles, and wind plants need nine times more minerals than natural gas plants. This transition has led to a 50% increase in the average quantity of minerals necessary for each electrical generation capacity unit since 2010 [1]. Key mineral resources include lithium, nickel, cobalt, manganese and graphite for batteries, and elements from rare earths for wind turbines and electric vehicles engines. The demand for these minerals could multiply between four and six times by 2040 at a global scale, turning the energy sector into a significant booster of mineral markets. Lowcarbon technologies will represent a relevant part of the total demand of minerals in the next decades, with a remarkable increase foreseen for copper, elements from rare earths, nickel, cobalt, and lithium. Electric grids need great amounts of copper and aluminium. Hydrogen technology needs great amounts of nickel and zirconium for electrolyzers, as well as copper and small, but crucial amounts of PGM (Platinum Group Metals), such as Iridium and platinum [2].

In this way, as energy transition gets closer globally and green energies are deployed at a bigger scale, mineral consumption markets could be subject to price volatility, geopolitical influence and even supply interruptions [3]. As defined by IEA (International Energy Agency), a natural resource is considered critical when it comprises two conditions: the fact that it is scarce and essential for the economy [2]. However, the cruciality of a material is based on more criteria, such as a mix of environmental, geopolitical, social and economic matters. For example, they can be considered essential components within a wide range of matters, including advanced technologies, defense, aero spatial industry; besides green energies, which, as has already been previously mentioned, are currently growing, and their demand will continue to rapidly grow as the energy transition and the decarbonization of systems accelerate [3].

At a geopolitical level, mining and the processing of many critical materials is concentrated in a handful of countries. Not only this results in an expensive processing, but also, short-term and long-term, they create supply problems derived from water, energy and waste costs, as well as environmental, social and economic problem-related costs [4]. The first report containing the list of most critical material for the European Commission was published in 2010 and, out of the 41 elements analyzed, 14 were considered critical [5]. Four years later, in the year 2014, the list was extended up to a total of 20 elements [6]. In 2017, the list was revised, and 7 more elements were added [7]. The last report, published in 2020, includes a total of 30 critical elements [8].

The current market of raw materials and their supply capacity present numerous risk factors that result in a series of vulnerabilities that could lead to tensions within a market with a bullish demand and a greater price volatility. One of the main risk factors is the geographical concentration of the production of certain minerals. In some cases, a single country is responsible for more than half of the global production of a raw material, for instance, the Democratic Republic of the Congo exported 70% of the cobalt in 2019 and the People’s Republic of China exported the 60% of rare earths in the same year. The high levels of concentration, worsened by complex supply chains, increase the risks that could be derived from diplomatic crisis, commercial restrictions, or other events within the main producing countries.

Perspective

In order to mitigate these risks, new business models are currently being developed so as to address the scarcity of critical materials. The two most used strategies are the reduction of critical materials content [9] or their substitution for other more abundant materials, such as catalyzers based on novel nanomaterials [10,11]. Nevertheless, another approximation is becoming more and more relevant in the last years, such as the introduction of strategies based on circular economies that allow us to identify and explore secondary critical material resources [12-14]. A more futuristic approximation, which is however getting started, is space mining. Not in vain, private companies such as Space X are positioning themselves in the space race for the obtention of critical minerals from the remnants of meteor impacts (rich in this kind of materials) on the Moon, easily identifiable in the craters, especially on the dark side of the Moon. It seems that humans’ return to the Moon expected for the year 2025 with NASA’s mission Artemis indicates that investment could be bankable this time. Not in vain, other space agencies are currently studying our satellite’s soil thanks to unmanned missions. It is even being evaluated the capture of meteors for space mining, in which space agencies are taken the first preliminary steps in the subject matter by sending probes. In this sense, and due to the element, that we consider within this study, it is important to highlight that all of the Iridium present on the Earth is of extraterrestrial origin [15]. In fact, Iridium’s natural scarcity on Earth was pivotal for the Nobel Prize in Physics laureate Luis Álvarez and Walter Álvarez to locate and date the asteroid impact that led to the extinction of the dinosaurs. This was achieved through the study of Iridium concentrations in the clay layers at the Cretaceous-Paleogene boundary.

Obviously, the extraction of Iridium of extraterrestrial origin (the Moon or meteors) is still at a rather low TRL (Technological Readiness Level), it has only been named to highlight the magnitude of the technological effort that human beings are able to assume in order to obtain new ways to perform Iridium mining. Nevertheless, there are currently numerous ongoing research projects focused on its recovery from secondary resources using circular economy strategies such as alloy fragmentation, molten acid leaching, molten salt chlorination, pressurized chlorination, electrochemical dissolution, solvent extraction, and ion exchange [16]. However, can they become economically profitable?

At present, the state-of-the art on Iridium recovery from secondary resources is still at an intermediate TRL and no studies have been identified that could lead to the various physicochemical recovery and purification processes being economically profitable. However, the increasing prices of critical materials in the last years, besides the fact that the tendency indicates that their production increase will not be able to face the foreseen demand in the upcoming years, may suggest that the process may be bankable. Regarding the past few years, especially from November 2020, being the cost of Iridium 5000€/troy ounce at present, according to Johnson Matthey [17]. For the present study, an offer to purchase Hydrated Iridium Trichloride (51,37% Ir) will be utilized with a selling price of 119.89€/g of the Trichloride component, which is equivalent to 233.38€/g of pure Iridium (as of April 10, 2024).

A Brief Study of a Practical Case

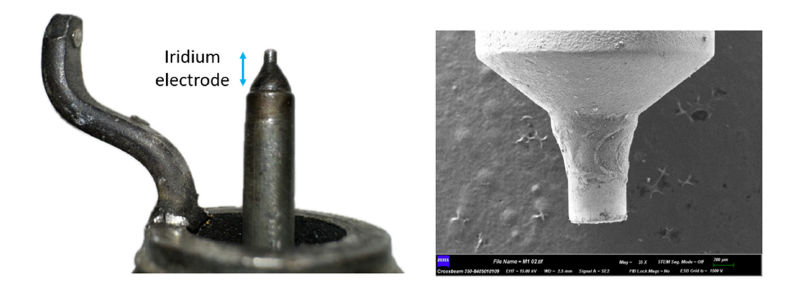

In order to answer the question that titles this study, a short case study on the recovery of Iridium present in discarded materials coming from the industry sector will be proposed, particularly, the automobile sector, such is the case of spark plugs and catalyzers, among others. For doing so, a simple experiment has been designed to evaluate the technical-economic viability of Iridium extraction from used automobile spark plugs (Figure 1).

Figure 1:Left: Image of an optical microscopy of the tip of a spark plug where the Iridium electrode is located. Right: SEM image of the Iridium tip.

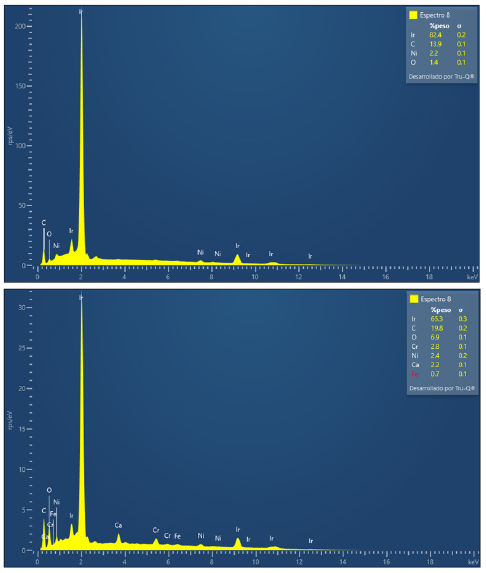

In the first place, a search of discarded spark plugs has taken place in auto repair shops that were characterized by optical microscopy and Scanning Electron Microscopy (SEM) with the aim of realizing an elemental chemical analysis. Subsequently, the tip of the spark plugs was cut, where Iridium is found and finally, an analysis that determined the percentage composition as well as the content of Iridium in those tips was realized through SEM (Figure 2).

Figure 2:Analysis of the chemical composition of the tip of the electrode of Iridium for two spark plugs, realized through SEM.

An analysis of 25 spark plugs was realized obtaining results of 4.8 ± 0.8 mg of Ir on average for each spark plugs. The variability is due to the different types of sparks plugs and the degree of impurities found due to its use in the engine’s combustion chamber

With the aim of analyzing a simple economic study, as a concept practical case, the average content of Iridium in each spark plug identified will be considered, the selling price of Iridium according to current quotation, as well as establishing a cost (CAPEX and OPEX of extraction and purity) for urban mining. In regards with this last aspect, it will be considered a process that is already being realized at present in economy of scale, such is the case of aluminium recovery and processing from metal waste, which is situated between 0.7 and 1.8 Euro cents per unit, according to sources consulted (recycling companies). Two scenarios were taken into account in order to proceed with the study: Scenario 1) production costs are equal to the average price of aluminium which is 0.013€/ unit. Scenario 2) production costs with a magnitude order higher than the average value of aluminium which is 0.13€/unit.

Conclusion

In Table 1, a comparative study according to treated units is presented in each column with an increase of one order of magnitude [18]. Following the conclusions of this study, it can be considered that the economy of scale of the extraction of Iridium from used spark plugs starts from the treatment of 100.000 units (105), which is when a considerable mineral weight can be obtained (nearly half a kilogram) and profits of the commercial line exceed 100,000€. Extraction costs are very low in both scenarios and it can be expected that they could be higher if complex process as hydrometallurgical or bio-hydrometallurgical are used. Moreover, it is true that there are other operative costs not included, such as the identification and moving of the spark plugs from the pick-up point to the treatment plant, later ultra purification processes of Iridium, quality tests of the Iridium’s quality, general costs, etc.

Table 1:Basic technical-economic comparative through Iridium mining.

Obviously, further research needs to be performed, both in terms of technical methodology and economic feasibility (once technical level reaches TRL 7-8), but according to this theoretical approximation, circular economy regarding Iridium recovery from discarded spark plugs from the automobile sector may be feasible as long as a volume higher than 100,000 units is processed in a technical-economically efficient way and of course, the price of the Iridium market follows current quotation.

References

- International Energy Agency (2022) The Role of Critical Minerals in Clean Energy Transitions.

- Valero A, Valero A, Calvo G (2021) Summary and critical review of the International Energy Agency’s special report: The role of critical minerals in clean energy transitions. Revista De Metalurgia 57(2): 197.

- International Energy Agency (2021) The role of critical minerals in clean energy transitions. World Energy Outlook Special Report.

- Valero A, Valero A, Calvo G (2021) Material limits of the energy transition. Zaragoza's University. Book ISBN: 978-84-1340-363-2.

- European Commission (2010) Critical raw materials for the EU. Report of the Ad-hoc.

- European Commission (2014) Report on critical raw materials for the EU. Report of the Ad-hoc working group on defining critical raw materials.

- European Commission (2017) Study on the Review of the list of Critical Raw Materials. Critical Raw Materials Factsheets.

- European Commission (2020) Study on the EU’s Critical Raw Materials. Final Report.

- Galyamin D, Torrero J, Rodríguez I, Kolb MJ, Ferrer P, et al. (2013) Active and durable R2MnRuO7 pyrochlores with low Ru content for acidic oxygen evolution. Nat Commun 14(1): 2010.

- Cobo S, Heidkamp J, Jacques PA, Fize J, Fourmond V, et al. (2012) A Janus Cobalt-based catalytic material for electro-splitting of water. Nature Materials 11(9): 802-807.

- Andreiadis ES, Jacques PA, Tran PD, Leyris A, Chavarot-Kerlidou M, et al. (2013) Molecular engineering of a cobalt-based electrocatalytic nanomaterial for H2 evolution under fully acqueous conditions. Nature Chemistry 5(1): 48-53.

- Zante G, Elgar CE, Hartley JM, Mukherjee R, Kettle J, et al. (2024) A toolbox for improved recycling of critical metals and materials in low-carbon technologies (Critical Review). RSC Sustain 2: 320-347.

- Varun R, Daobin L, Dong X, Yamuna J, Jean-Christophe PG (2021) Electrochemical approaches for the recovery of metals from electronic waste: A critical review. Recycling. 6 (3): 53.

- Biswas S, et al. (2024) A review on critical metals used in solid oxide cells for Power ↔ X applications and materials recyclability. ACS Sustainable Chem Eng 12(16): 6037-6058.

- Hunt LB (1987) A history of Iridium. Platinum Met Rev 31(1): 32-41.

- Chaoyang F, Kaidong Q, Zhimin H, Fei H, Zhi L, et al. (2023) Recovery and purification of iridium from secondary resources: A review. Journal of Sustainable Metallurgy 9: 909-926.

- Matthey J (2023) A guide to PGMs. Understanding the fundamentals of platinum group metals.

- Fabregat V, Pagán JM (2024) Technical-Economic feasibility of a new method of adsorbent materials and advanced oxidation techniques to remove emerging pollutants in treated wastewater. Water. 16(6): 814.

© 2024 Victor Fabregat. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)