- Submissions

Full Text

Trends in Textile Engineering & Fashion Technology

Corporate Image and Competitive Advantage for Apparel Companies

Gregory Clare* and Shahed Uddin

Associate Professor, Oklahoma State University, USA

*Corresponding author: Gregory Clare, Associate Professor, Oklahoma State University, USA

Submission: September 13, 2019; Published: September 27, 2019

ISSN 2578-0271 Volume5 Issue4

Abstract

Purpose: The purpose of the study was to offer new knowledge about how valences of communications about retailers’ corporate ability (CA) and corporate social responsibility (CSR) practices influence how consumers perceive the firm’s competitive advantage using empirical research methods.

Design: The study used an experimental design in which four groups of participants reviewed CA and CSR scenarios manipulated for valence strength for fictional retailers. The scenarios described managerial performance at the hypothetical retail firms.

Findings: The findings suggested that CA and CSR influence competitive advantage. The researchers found interaction effects between CA and CSR on competitive advantage when either dimension had positive scenario valence.

Practical Implications: If a retailer has expertise in either CA or CSR, it may be able to compensate for lower expertise in the other dimension to some extent when measuring competitive advantage.

Value: Methods for evaluating consumer perceptions of managerial corporate social responsibility strategy through framing corporate communications provides an opportunity for further research.

Keywords: Sustainability; Corporate Social Responsibility; Corporate Ability; Competitive.

Introduction

Corporate Image and its influence on consumer behavior have received much attention in the academic literature. However, the role of corporate image in achieving competitive advantage for retailers has received little attention. Corporate image may be described as an abstract concept of a person’s general evaluation of a company Huang [1], or the overall impression made on the mind of a person about a company [2]. As a strategic and valuable asset, corporate image allows a company to demonstrate its expertise in managerial capability to stakeholders [3]. Research has demonstrated that corporate image can also positively influence consumers’ purchase intentions [4]. Brown & Dacin [5] defined two dimensions of corporate image including corporate ability (CA) and corporate social responsibility (CSR) attributions from firm stakeholders. CA relates to the company’s expertise in producing and delivering its products or services [5]. CSR describes the firms approach to doing business in sustainable ways that balance economic, social and environmental issues of the firm and its stakeholders [6]; or more recently meeting the needs of people, the planet and profit [7]. This study explores the influence of CA and CSR perceptions, as strategic dimensions of a retailer’s corporate image and their role in influencing consumer perceived competitive advantage in varied message frame manipulations of positive or negative firm performance for four hypothetical retailers.

Literature Review

Brown & Dacin [5] described corporate image as the collective representation of attributions toward a company from various stakeholder perspectives such as consumers, employees, suppliers, investors, communities, or others. These attributions help stakeholders to evaluate tangible and intangible aspects of the company related to product, service offerings, and may contribute to consumption behaviours [2,5,8]. Over time, stakeholders’ attributions about a firm’s products and services may influence their perceived corporate image [5,9].

Corporate ability

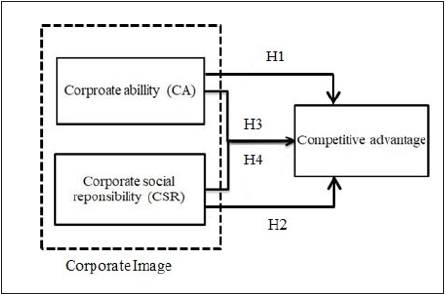

Corporate ability (CA) is the collection of strategic tangible and intangible assets through which a firm demonstrates competency to its stakeholders and contributes to a firm’s corporate image [5,10]. Examples include the relationship of managerial, environmental, and social capabilities to influence superior financial performance and greater market share [11]. Prior research has found that CA is comprised of several factors such as product quality and features, managerial expertise, service, innovation, pricing strategy, and financial performance [5,12-14]. CA plays a demonstrable role in influencing perceived competitive advantage as evidenced in prior studies [14,15]. The current study builds on Gupta’s (2003) study that explored corporate image role in influencing competitive advantage. To develop a better understanding of the relationships between CA and firm performance, the researchers suspected the valence strength of management statements describing a retailer’s performance would directly influence consumer opinions of the firm in predictable ways. Message framing with bi-polar valence statements offered the researchers an opportunity to measure consumer attributions about CA and CSR based on strong positive or negative message framing to discover if valence strength manipulation is reliable for measuring latent constructs of CA and CSR with observable variance. Predictable results based on consumer responses to strong positive or negative messages could offer insights about consumers’ retailer attributions and ways that positive and negative framing influence consumer behavior and help reinforce public relations goals. Findings from the current study will support more nuanced message framing designs including communications with neutral to moderate message strength within frames including strong positive and negative valences. The conceptual model including the latent constructs explored in the present study are presented in Figure 1. Based on these factors, the researchers hypothesize that:

H1a--2a: (1a CA); (2a CSR) influences a company’s managerial capability.

H1b-2b: (1b CA); (2b CSR) influences a company’s market position.

Figure 1:Theoretical framework adopted from Gupta’s (2003) study.

Corporate social responsibility (CSR)

Khojastehpour & Johns [16] defined CSR as the process through which a company goes beyond its economic performance and embraces its societal duties. Research has found that an organizations’ CSR communications to consumers creates positive word of mouth, purchasing intentions and attributions to an organization [17,18]. From the perspective of corporate image, Brown & Dacin [5] explained CSR as a company’s activities that address important socio-economic issues. Pérez [19] found a strong positive influence of corporate ability and corporate social responsibility. Consumers demonstrate strong attachment to retailers that demonstrate CA through effective service, availability of locations and effective communication of products and service offerings [19]. Consumers’ knowledge of a firm’s CSR strategy influences positive attributions toward a company [19]. Maintaining a competitive position in the market requires a company to balance consumer product and service needs and the consumer’s perceptions about the firm’s CA and CSR strategies [19,20] suggested that good CSR strategies support effective public relations and influence improved relationships with stakeholders. The researchers also determined that CSR strategy influenced perceived corporate capability and increased sales performance, long-term profitability and a better market position. Several other studies have found that perceived corporate ability of a company influences higher return on investment, increased market value and sales growth [21-23]. The researchers further hyothesise: H2a-b: CSR influences a company’s (a) managerial capability (b) market position. Environmental concerns and recycling practices of a company may favorably influence a consumers purchase decisions for sustainable apparel products, conducting business with minimal impact on the environment and integrating sustainable features in apparel products [24]. However, research has also found that environmentally related CSR does not influence a company’s market position [25]. Consumers may express less concern about an apparel companies’ philanthropic activities and prioritise price and quality as major determinant factors for purchase behavior [26]. The researchers propose that to influence consumers purchasing motivations, apparel companies need to communicate about sustainable products price or quality trade-offs while emphasizing their CSR strategy to consumers [27,24]. Competitive advantage can be achieved within different dimensions, including product quality, price, services, managerial capability or through differentiation strategies [28-30]. Porter introduced two major types of competitive advantage: cost advantage and differentiation.

The earlier competitive advantage research often focused on differentiation strategy [31-34]. Differentiation contributes to corporate ability through use management’s use of a firm’s tacit knowledge to offer exceptional products or services, which influence superior financial performance and competitive advantage [31]. Peters suggested that with appropriate differentiation strategies, the consumers’ value attributions increase and lead to increased purchase intentions and price premiums [35]. Research has found the corporate image and ability of a firm predict consumers’ willingness to pay price premiums for product and the corporate image is a greater predictor for acceptance of the price premiums [36]. Similar results were found for firms demonstrating a strong positive valence in corporate social responsibility communications as a predictor of consumer willingness to accept price premiums, with negative valence message content more severely reducing the willingness to pay the price premiums [37]. The resulting hypotheses are proposed: H1c-d: CA influences (c) a consumer’s willingness to purchase (d) a consumer’s willingness to pay a premium price.

H2c-d: CSR influences a consumer’s willingness (c) to purchase (d) to pay a premium price.

Interaction of CA and CSR as a source of competitive advantage

Researchers have found that to achieve greater market share and to establish greater perceptions of corporate ability, differentiation from competitors is necessary [32,38-41]. Several studies support the positive relationship between perceived corporate ability and competitive advantage of a company [42-48]. According to Gupta [45] a consumers’ evaluation of a company and their purchasing decisions depends on their perception of the company’s CA and CSR. In addition, research has found that corporate reputation and image, factors in perceived corporate ability, influence perception of product, service, patronage, satisfaction, and cost savings related to sustainable competitive advantage [49-54]. Wiese et al. [55] identified three factors that influence consumer attributions and subsequent purchase behavior from retailers including adopting sustainable products, processes, and services.

Berens et al. [56] highlighted the importance of CA associations as essential cues that influence consumers’ product evaluation and positively affect their product attitudes, whereas CSR had little to no effect on product evaluation. Ritch [57] found that consumers contextualize sustainable practices and form attributions about retailers. However, findings from Lin et al. study suggested that attributes of CA and CSR in communications might mitigate the effects negative publicity about the firm on consumers’ purchase intentions. The proposed interaction of CA and CSR leads to the following hypotheses: H3a-d: The influence of CA on a company’s (a) managerial capability, (b)market position, (c)purchase intentions, and (d) willingness to pay price premiums is greater when CSR messages are positively framed. H4a-d: The influence of CSR on a company’s (a) managerial capability, (b) market position, (c) purchase intentions, and (d) willingness to pay price premiums managerial capability is greater when CA messages are positively framed.

Research Methods

Scenario development

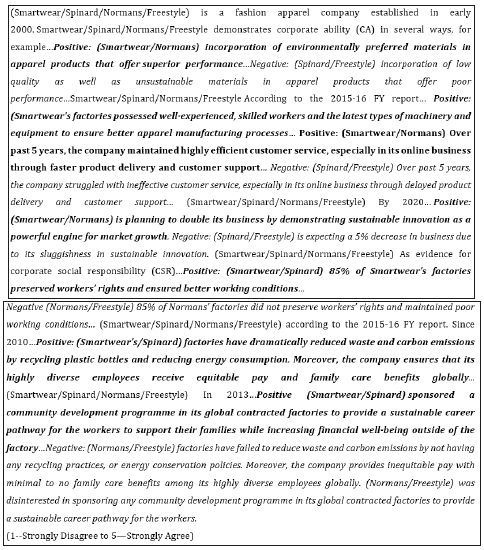

The researchers analyzed corporate social responsibility reports from the top 10 US based retail companies from 2016 and compared the firms CA and CSR strategies. Based on the analysis, among many factors presented in the reports, sustainable product features, organizational expertise in offering sustainable products, customer service innovations, expedited product delivery improved customer communications, and consistent efforts at introducing innovative new products or services described CA for retailers. For CSR, the top 10 retail companies consistently communicated their efforts to lessen environmental impact by integrating waste management and recycling in their facilities. As added evidence of CSR, the top 10 retail firms supported employees’ career development and participated in varied community support programs. Based on this information, the researchers then developed scenarios describing four hypothetical U.S. based retail firms that demonstrated CA and CSR performance. The fictional firms included Smart wear, Spinard, Normans, and Freestyle. Each scenario manipulated the valence of the fictional firm’s CA and CSR performance. The four scenarios valence manipulations included: positive CA and positive CSR; positive CA and negative CSR; negative CA and positive CSR; negative CA and negative CSR within each of the four scenarios. In alignment with the findings of [58], consumer evaluations of sustainable practices are suspected to be influenced by the consumer’s values and social identity which are attributed to their evaluation of narratives about the retailer’s good or bad sustainability practices.

Characteristics of the sample

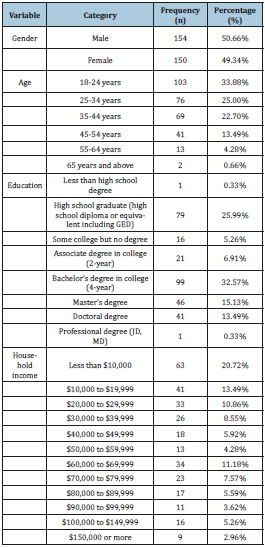

The study participants consisted of a convenience sample of students, faculty and staff of a large Midwestern university representing consumer stakeholders. The university aided in participant recruitment by emailing survey invitations to 5000 potential university participants with a one-week follow-up email reminder. 366 responses were received or a 7% response rate and from which, 304 completed responses were identified for a final response rate of 6.1% (Table 1). Participants completed university informed consent documentation approved by the university’s institutional review board before taking part in the study. Participants were then presented at random with a scenario describing one of four hypothetical retailers and included the varied valence message frame manipulations as follows: Smart wear +CA/+CSR, Spinard +CA/-CSR, Normans -CA/+CSR, Freestyle -CA/-CSR (Figure 2). Participants were asked to read the scenario and then provide their opinions about the information presented using a five-point Likert scale (5=Strongly Agree to 3=Neutral to 1=Strongly Disagree) on 12 statements that measured dimensions of CA/CSR (Figure 3). Participants then completed an overall evaluation of the company based on their opinions about the firm’s overall CA and CSR performance followed by demographic questions. The overall evaluations served as a manipulation check of the scenarios’ bi-polar valences for CA and CSR.

Figure 2: Valence scenario variations summary (italicized text outlines variations to participant scripts).

Figure 3: Survey scale items adapted from Gupta (2003).

Table 1: Summary of demographic information of the samples (N=304).

Summated scales and manipulation check for CA and CSR

Among the four retailer scenarios, Smart wear (CA+, CSR+) recorded the highest mean values in both CA (M = 4.13, SD = 0.93) and CSR (M = 4.27, SD = 0.86). Freestyle (CA-, CSR) recorded the lowest mean values for CA (M = 1.7, SD = 1.11) and CSR (M = 1.42, SD = 0.98). The Cronbach Alpha reliability tests for all the measurement items for CA and CSR across the four retailer scenarios resulted in acceptable levels of internal reliability (α > 0.7) for all survey items. The direct measures in the manipulation check for CA and CSR demonstrated that respondents perceived the hypothetical company favorably or unfavorable based on the message-framing valence within and between the four scenarios. For example, Smart wear company received the highest values in the manipulation check for both CA (M = 4.14) and CSR (M = 4.29). On the contrary, Freestyle received the lowest scores for CA (M = 1.84) and CSR (M = 1.72). The researchers found similar valence effects based on the positive negative message framing combinations.

Results

Hypotheses testing

One-way analysis of variance (ANOVA) tests using IBM SPSS Statistics 23 were conducted to test the hypotheses from H1a -d and H2a-d. Hypotheses H 1a-d were supported. CA had a significant influence on the retailer’s managerial capability with an average value of 2.47 for negative CA (SD = 1.29), and an average value of 3.39 for positive CA (SD = 1.43); F (1,302) = 34.40, p < 0.001. For CSR, the average value for positive CSR was 3.93 (SD = 1.10), with an average value of 1.94 for negative CSR (SD = 0.95); F (1,302) = 284.94, p < 0.001, for managerial capability. CA had a significant influence on a company’s position in the market, with an average value of 2.19 for negative CA (SD = 1.14), and an average value of 3.63 for positive CA (SD = 0.90); F (1,302) = 149.44, p < 0.001. Hypotheses H1 b-d were also supported. For CSR, the average value for positive CSR was 3.07 (SD = 1.19), with an average value of 2.76 for negative CSR (SD = 1.30); F (1,302) = 4.64, p < 0.05, for perceptions of the hypothetical firm’s market position in the market. CA had a significant influence on a consumer’s willingness to purchase from the scenario firm, F (1,302) = 26.92, p < 0.001, with an average value of 2.33 for negative CA (SD = 1.26), and an average value of 3.07 for positive CA (SD = 1.23). For CSR, the average value for positive CSR was 3.18 (SD = 1.25), with an average value of 2.23 for negative CSR (SD = 1.17); F (1,302) = 46.81, p < 0.001, for consumer’s willingness to purchase. CA had a significant influence on a consumer’s willingness to pay premium price, F (1,302) = 28.08, p < 0.001, with an average value of 1.88 for negative CA (SD = 1.29), and an average value of 2.67 for positive CA (SD = 1.31). For CSR, the average value for positive CSR was 2.56 (SD = 1.33), with an average value of 2.00 for negative CSR (SD = 1.32); F (1,302) = 13.32, p < 0.001, for consumer’s willingness to pay price premiums. Hypotheses 3a-d and 4a-d were tested using two-way univariate ANOVA tests. All the tests were performed at a p<.05 significance level. The estimated marginal means demonstrated that, for positive perceived CA, managerial capability means were greater when perceived CSR valence was positive (Smart wear: M = 4.51, SD = 0.67) compared with negative valence (Normans: M = 2.30, SD = 1.09). Similarly, for negative valence CA, managerial capability means were greater when CSR was positive (Spinard: M = 3.37, SD = 1.15) than when CSR had negative valence (Freestyle: M = 1.58, SD = 0.62). Hypotheses 3 a-d and 4 a-d were supported. For positive CSR, perceived managerial capability of the hypothetical firm demonstrated a higher mean when CA was positively framed (Smart wear: M = 4.51, SD = 0.67) compared with negative message framing; CA (Spinard: M = 3.37, SD = 1.15). Similarly, for negative CSR, managerial capability demonstrated higher mean values when CA was positive (Normans: M = 2.30, SD = 1.09) than when the message was negatively framed; CA (Freestyle: M = 1.58, SD = 0.62). A significant CA by CSR interaction effect was found on perceived managerial capability of the hypothetical firm between subjects, F (1,300) = 3.98, p = .047. For positive CSR, position in the market demonstrated higher mean values when CA was positively framed (Smart wear: M = 3.58, SD = 1.01) than when negatively framed; CA (Spinard: M = 2.47, SD = 1.15). Similarly, for negative CSR, position in the market demonstrated higher mean values when CA was positive framed (Normans: M = 3.48, SD = 0.91) than when negatively framed; CA (Freestyle: M = 1.91, SD = 1.06). A significant CA by CSR interaction effect was observed on perceived position in the market of the hypothetical firm F (1,300) = 3.89, p = .049. For positive CSR, perceived willingness to purchase from the hypothetical brand demonstrated higher mean values when CA was positively framed (Smart wear: M = 3.76, SD = 0.93) compared with negatively framed CA (Spinard: M = 2.63, SD = 1.26). Similarly, for negative CSR, perceived willingness to purchase from the scenario brand demonstrated higher mean values when CA was positive (Normans: M = 2.43, SD = 1.12) than when negatively framed (Freestyle: M = 2.03, SD = 1.20). A significant CA by CSR interaction effect on perceived willingness to purchase was observed, F (1,300) = 7.76, p = .006. For positive CSR, willingness to pay premium price demonstrated higher means when CA was positively framed (Smart wear: M = 3.12, SD = 1.14) compared with negative CA message framing (Spinard: M = 2.00, SD = 1.29). Similarly, for negative CSR, willingness to pay premium price demonstrated higher mean values when CA was positively framed (Normans: M = 2.23, SD = 1.33) compared with negatively framed CA messages (Freestyle: M = 1.76, SD = 1.28). A significant CA by CSR interaction effect on willingness to pay premium price, F (1,300) = 5.03, p = .026 was observed.

Discussion

The findings suggest that retailers who demonstrate varied degrees of corporate ability may experience different consumer perceived effects of the firm’s competitive advantage in the market. According to Berens et al. [56], CA attributes facilitated consumers’ involvement and evaluation of products. Prior research has highlighted the importance of product features and customer service as critical predictors of corporate ability [59,60]. A retailer’s ability for effectively communicating operating policies to consumers through effective message framing may influence the financial performance of the firm by reinforcing corporate ability and corporate image supporting. The findings of Graham & Bansal [61]. The communication of innovative management strategy such as innovations in product features, quality, service and manufacturing expertise may influence consumer perception of corporate reputation [62]. The current study demonstrated that CSR is a significant predictor of corporate image, which influences consumer perceived competitive advantage of retailers. Positively framed CSR communications significantly influenced perceived competitive advantage. For CA, a significant difference was observed between perceived managerial capabilities between positive and negative CSR. This finding suggests that CSR may play a role in influencing perceived managerial capability more than CA in corporate communications, supported the findings of Trudel and Cotte (2009). However, this favorable evidence requires further study involving message framing involving more nuanced messages than extreme valence positive or negative bipolar message frames. Based on the current study findings, consumers may report different perceived strengths of CSR dimensions when framed in a neutral manner for example, Lin et al. (2011) suggested that a firm’s communication about strategies to improve social and environmental concerns may play a role in strengthening their competitive advantage within the market.

Earlier research from Brown & Dacin [62] demonstrated that CSR had no significant effects on consumers’ purchase intentions, however emerging consumer groups such as the mainly millennial generation participants in the current study may place greater emphasis on CSR compared with participants a decade ago. The current study found evidence that consumers were likely to purchase products from retailers, even with premium-priced product alternatives, who demonstrated positive CSR activities, compared with companies with lower CSR activities. These results are consistent with the findings from Gupta and Mayard’s study about consumers’ willingness to adopt a price premium based on perceived corporate social responsibility of the firm. This current study provided new knowledge about the potential for CA and CSR as dimensions that work together to varying degrees to predict competitive advantage as demonstrated by consistent interaction effects. Gupta found no significant interaction between CA and CSR on competitive advantage. Gupta’s explanation of no observed interaction effect (2002) was contingent on the utility of the products measured where utilitarian products despite the retailer’s CSR strategy had no significant effects on purchase intentions. Research from two stakeholder perspectives including consumers and corporate leaders demonstrated that CA and CSR combined, produced greater effects on competitive advantage than CA and CSR individually. Mayard also found that CA had a higher influence on competitive advantage when CSR was positively framed compared to negative framing and conversely. No studies have suggested the combined influence of CA and CSR on the managerial capability and position the market might serve as predictors of competitive advantage within the retail sector. This gap in the literature highlights the need for further study. The interactions found between CA and CSR, and their combined influence on achieving competitive advantage demonstrate the need for research to better understand message framing effects on consumers. Effective message design could help retailers strengthen the impact of key strategies while reducing the impact on consumers from less favourable firm behaviours. The context and content of written descriptions of a retailer in which consumers are provided with multifaceted stories about CSR practices may be more persuasive [58]. Valence statements may further influence a consumer’s perceptions of the story communicated.

The findings from the two-way univariate ANOVA analysis suggested that CA and CSR combined effects had significant influence on a retailer’s perceived managerial capability and position in the market. Although both Smart wear and Normans companies had positive valence CA in the scenarios, Smart wear demonstrated greater managerial capability and a stronger market position from positive message framing for CSR, compared to Normans with negative CSR message framing. Similarly, both Spinard and Freestyle companies had negative CA; however, Spinard’s positive CSR may have influenced the retailer’s higher managerial capability and market position than participants’ attributions to Freestyle, which had negative CSR. Similar results were noted for retailers that had the same CSR message framing valences compared with hypothetical firms with different CA valences. Supporting Mayard the findings that managerial capability and position in the market are perceived greater with positive valence message framing. Smart wear and Normans had positive CA; however, consumers showed more willingness to purchase, even with price premiums, from Smart wear company as opposed to Normans. Smart wear’s observed competitive advantage over Normans could be attributed to the interaction of valence message framing for both CA and CSR. Similarly, Spinard Company achieved a competitive edge over Freestyle in terms of willingness to purchase and willingness to pay premium perhaps contingent on Spinard’s positive CSR compared to Freestyle’s negative CSR; both hypothetical companies had negative CA message framing. Further research should explore whether retailers demonstrating greater expertise in CSR than CA, how the greater perceived CSR influences consumer behavior. Moreover, a consumers’ preference for higher quality products and services implied by price premiums may influence greater consumer attributions to the retailer’s CA than CSR. For the retail industry, the researchers identified that factors contributing to the latent constructs of CA and CSR presumably play a role in consumer perceptions of a firm’s competitive advantage. Research has demonstrated that firms with greater perceived CA and CSR have a stronger consumer corporate image and may favorably influence purchase intentions. Huang et al. [1] defines the role of organizational involvement in CA and CSR as a means to increase positive consumer word of mouth and increase the corporate image. In addition, a strong corporate image may increase consumer trust and willingness to pay price premiums.

Although Gupta and Mayard examined the individual and interaction effect of CA and CSR on achieving competitive advantage, neither of the researchers explored message framing effects role in the interaction of CA and CSR to compensate for the negative attributes common to overall firm performance. Preliminary findings of the current study suggest that if a retailer has either positive CA or positive CSR; it may be able to compensate for a negative CSR, or CA. However, for consumer perception of the firm’s position in the market and willingness to pay premium prices, perceived CA appeared to produce greater effects than CSR. For businesses seeking price premiums for their products, increasing perceived CA through effective message design plays an important role in persuasive consumer communications. Therefore, if a retailer has low perceptions of CSR, increasing communications about CA through factors like quality, product features, customer service, and exemplary manufacturing expertise may reduce the negative perception effects. According to Berens et al. consumers were willing to purchase apparel products from a company with positive CSR and negative CA, and a clearer understanding of the role of each dimension requires further study. Research has demonstrated that competitive advantage strategies based on the combination of excellent CSR practices requires involvement of consumers of the firm who derive meaning from corporate communications [63].

Conclusion

A firm’s primary resources for producing profits is its organizational resources and capabilities and how they help to create the corporate image of the firm. To achieve and maintain competitive advantage within a market, a retailer should consistently review current strategies and strive for opportunities to innovate in ways that could lead to market superiority. Such superiority may further support product and service innovations while reducing costs. The current study offered two new insights. First, message framing can influence the perceived competitive advantage of retailers by varying the valence of message content. Secondly, high expertise in one dimension (CA or CSR) may contribute to discounting effects of negatively or positively framed CA and CSR information. The role of these discounting effects when valances of messages include neutral framing on CA and CSR factors provides an interesting future direction for researchers. Similarly, addition research using a parsimonious number of factors describing the latent variables of CA and CSR with confirmatory factor analysis and structural equation modeling provides a future direction. Research has suggested that a balanced combination of CA and CSR attributes allows firms to both attract new consumers by improving their value proposition and price competitiveness. This study provided some evidence of a consumer’s willingness to adopt price premiums based on well communicated CA and CSR strategies.

Limitations and further research

A limitation of the study is the generalizability of the research findings. The study utilized a convenience sampling from a population of students, staff, employees, and faculties of a large Midwestern university. The samples are not representative of U.S. retail consumers, which restricts the generalizability of the results. A comparative study of managers, demographically diverse consumers and other stakeholders’ perceptions of retailer CA and CSR would strengthen the understanding of perceived competitive advantage. The researchers plan to use additional measurement items from earlier studies (for example leadership strategy, differentiation strategy, growth of the company, strategic planning, time to market, etc.) to strengthen the understanding of CA, CSR and competitive advantage and will allow for confirmatory factor analysis and structural equation modeling to describe the structure of the proposed latent constructs. Expanding the scope of the current study through improved methods will provide a more thorough understanding of how retailers respond to market changes through their investment in CA and CSR. Future research should also consider integrating a global apparel stakeholder sample to discover if consumers perceive CA, CSR and competitive advantage differently for apparel firms in different countries.

References

- Huang CC, Yen SW, Liu CY, Huang PC (2014) The relationship among corporate social responsibility, service quality, corporate image and purchase intention. International Journal of Organizational Innovation 6(3): 68.

- Nguyen N, Leblanc G (2001) Corporate image and corporate reputation in customers’ retention decisions in services. Journal of Retailing and Consumer Services 8(4): 227-236.

- Pina JM, Martinez E, Chernatony L, Drury S (2006) The effect of service brand extensions on corporate image: an empirical model. European Journal of Marketing 40(1/2): 174-197.

- Gürhan CZ, Batra R (2004) When corporate image affects product evaluations: The moderating role of perceived risk. Journal of Marketing Research 41(2): 197-205.

- Brown TJ, Dacin PA (1997) The company and the product: Corporate associations and consumer product responses. Journal of marketing 61(1): 68-84.

- Elkington J (1998) Cannibals with forks: The triple bottom line of sustainability. Gabriola Island, New Society Publishers, Canada.

- Fisk P (2010) People planet profit: How to embrace sustainability for innovation and business growth.

- Weiwei T (2007) Impact of corporate image and corporate reputation on customer loyalty: A review. Management Science and Engineering 1(2): 57.

- Argenti PA, Druckenmiller B (2004) Reputation and the corporate brand. Corporate Reputation Review 6(4): 368-374.

- Berens G, Van Riel CB, Van Bruggen GH (2005) Corporate associations and consumer product responses: The moderating role of corporate brand dominance. Journal of Marketing 69(3): 35-48.

- Paulraj A (2011) Understanding the relationships between internal resources and capabilities, sustainable supply management and organizational sustainability. Journal of Supply Chain Management 47(1): 19-37.

- Boulstridge E, Carrigan M (2000) Do consumers really care about corporate responsibility? Highlighting the attitude-behavior gap. Journal of Communication Management 4(4): 355-368.

- Sirdeshmukh D, Singh J, Sabol B (2002) Consumer trust, value, and loyalty in relational exchanges. Journal of Marketing 66(1): 15-37.

- Gupta S (2003) Strategic dimensions of corporate image: Corporate ability and corporate social responsibility as sources of competitive advantage via differentiation. Master Thesis, University of Agder, Europe, pp. 2-117.

- Mayard YM (2007) Consumers and leaders’ perspectives: Corporate social responsibility as a source of a firm's competitive advantage. University of Phoenix, USA.

- Khojastehpour M, Johns R (2014) The effect of environmental CSR issues on corporate/brand reputation and corporate profitability. European Business Review 26(4): 330-339.

- Bhattacharya CB, Sen S (2004) Doing better at doing good: When, why, and how consumers respond to corporate social initiatives. California Management Review 47(1): 9-24.

- Marquina FP, Vasquez PAZ (2013) Consumer social responses to CSR initiatives versus corporate abilities. Journal of Consumer Marketing 30(2): 100-111.

- Pérez A, Mar García SM, Rodríguez BI (2013) The effect of corporate associations on consumer behaviour. European Journal of Marketing 47(1/2): 218-238.

- Aksak EO, Ferguson MA, Duman SA (2016) Corporate social responsibility and CSR fit as predictors of corporate reputation: a global perspective. Public Relations Review 42(1): 79-81.

- Gruca TS, Rego LL (2005) Customer satisfaction, cash flow, and shareholder value. Journal of Marketing 69(3): 115-130.

- Kotha S, Rajgopal S, Rindova V (2001) Reputation building and performance: An empirical analysis of the top-50 pure Internet firms. European Management Journal 19(6): 571-586.

- Roberts PW, Dowling GR (2002) Corporate reputation and sustained superior financial performance. Strategic Management Journal 23(12): 1077-1093.

- Rodrigues P, Borges AP (2015) Corporate social responsibility and its impact in consumer decision-making. Social Responsibility Journal 11(4): 690-701.

- Stoian C, Gilman M (2017) Corporate social responsibility that pay: A strategic approach to CSR for SMEs. Journal of Small Business Management 55(1): 5-31.

- Iwanow H, McEachern MG, Jeffrey A (2005) The influence of ethical trading policies on consumer apparel purchase decisions. International Journal of Retail and Distribution Management 33(5) :371-387.

- Mann M, Byun SE, Kim H, Hoggle K (2014) Assessment of leading apparel specialty retailers’ CSR practices as communicated on corporate websites: Problems and opportunities. Journal of Business Ethics 122(4): 599-622.

- Bataineh MT, Al Zoabi M (2011) The effect of intellectual capital on organizational competitive advantage: Jordanian Commercial Banks (Irbid district) an empirical study. International Bulletin of Business Administration 10(10): 15-24.

- Chang CH (2011) The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. Journal of Business Ethics 104(3): 361-370.

- Chen YS, Lai SB, Wen CT (2006) The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics 67(4): 331-339.

- Barney J (1991) Firm resources and sustained competitive advantage. Journal of Management 17(1): 99-120.

- Day GS, Wensley R (1988) Assessing advantage: a framework for diagnosing competitive superiority. Journal of Marketing 52(2): 1-20.

- Nakra P (2000) Corporate reputation management: CRM with a strategic twist? Public Relations Quarterly 45(2): 35-42.

- Berens G, Van Riel CB, Van Rekom J (2007) The CSR-quality trade-off: when can corporate social responsibility and corporate ability compensate each other? Journal of Business Ethics 74(3): 233-252.

- Cabral L (2012) Living up to expectations: Corporate reputation and sustainable competitive advantage.

- Graham ME, Bansal P (2007) Consumers' willingness to pay for corporate reputation: the context of airline companies. Corporate Reputation Review 10(3): 189-200.

- Trudel R, Cotte J (2009) Does it pay to be good? MIT Sloan Management Review 50(2): 61.

- Ghemawat P (1986) Sustainable advantage. Harvard Business Review 64(5): 53-58.

- Maignan I, Ferrell OC (2004) Corporate social responsibility and marketing: An integrative framework. Journal of the Academy of Marketing science 32(1): 3-19.

- Petrick JA, Scherer RF, Brodzinski JD, Quinn JF, Ainina MF (1999) Global leadership skills and reputational capital: Intangible resources for sustainable competitive advantage. Academy of Management Perspectives 13(1): 58-69.

- Zahra SA (1999) The changing rules of global competitiveness in the 21st Academy of Management Perspectives 13(1): 36-42.

- Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Academy of Management Review 4(4): 497-505.

- Carroll AB (1999) Corporate social responsibility: Evolution of a definitional construct. Business and society 38(3): 268-295.

- Dean DH (2004) Consumer reaction to negative publicity: Effects of corporate reputation, response, and responsibility for a crisis event. The Journal of Business Communication 41(2): 192-211.

- Grant RM (1991) The resource-based theory of competitive advantage: implications for strategy formulation. California Management Review 33(3): 114-135.

- Keh HT, Xie Y (2009) Corporate reputation and customer behavioural intentions: the roles of trust, identification and commitment. Industrial marketing management 38(7): 732-742.

- Gueterbock R (2004) Greenpeace campaign case study-Stop Esso. Journal of Consumer Behaviour 3(3): 265-271.

- Kinard J, Smith ME, Kinard BR (2003) Business executives’ attitudes toward social responsibility: Past and present. American Business Review 21(2): 87-91.

- Schuler M (2004) Management of the organizational image: a method for organizational image configuration. Corporate Reputation Review 7(1): 37-53.

- Carroll AB (2004) Managing ethically with global stakeholders: A present and future challenge. Academy of Management Perspectives 18(2): 114-120.

- Galbreath J (2002) Twenty-first century management rules: the management of relationships as intangible assets. Management Decision 40(2): 116-126.

- Matzler K, Hinterhuber HH (1998) How to make product development projects more successful by integrating Kano's model of customer satisfaction into quality function deployment. Technovation 18(1): 25-38.

- Walsh G, Dinnie K, Wiedmann KP (2006) How do corporate reputation and customer satisfaction impact customer defection? A study of private energy customers in Germany. Journal of Services Marketing 20(6): 412-420.

- Walsh G, Mitchell VW, Jackson PR, Beatty SE (2009) Examining the antecedents and consequences of corporate reputation: A customer perspective. British Journal of Management 20(2): 187-203.

- Wiese A, Zielke S, Toporowski W (2015) Sustainability in retailing-research streams and emerging trends. International Journal of Retail & Distribution Management 43(4/5): 312-316.

- Li Ragu Nathan B, Ragu Nathan TS, Rao SS (2006) The impact of supply chain management practises on competitive advantage and organisational performance. Omega 34(2): 107-124.

- Ritch EL (2015) Consumers interpreting sustainability: moving beyond food to fashion. International Journal of Retail & Distribution Management 43(12): 1162-1181.

- Elg U, Hultman J (2016) CSR: retailer activities vs consumer buying decisions. International Journal of Retail & Distribution Management 44(6): 640-657.

- Arrigo E (2013) Corporate responsibility management in fast fashion companies: The Gap Inc. case. Journal of Fashion Marketing and Management 17(2): 175-189.

- Wilson JP (2015) The triple bottom line. International Journal of Retail & Distribution Management 43(4/5): 432-447.

- Peters RC (2007) Corporate social responsibility and strategic performance: Realising a competitive advantage through corporate social reputation and a stakeholder network approach. Florida Atlantic University, USA.

- Saeidi SP, Sofian S, Saeidi P, Saeidi SP, Saaeidi SA (2015) How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research 68(2): 341-350.

- Wilkins S, Huisman J (2014) Corporate images' impact on consumers' product choices: The case of multinational foreign subsidiaries. Journal of Business Research 67(10): 2224-2230.

© 2019 Gregory Clare. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)