- Submissions

Full Text

Strategies in Accounting and Management

Financial, Environmental and Social Sustainability Reporting: The Case for Integrated Accounting

Farid Bensebaa1* and Jose Etcheverry2

1Team Leader, Energy, Mining and Environment (EME), National Research Council of Canada, 1200 Montreal Road, Ottawa, Ontario, K1A 0R6, Canada

2Director, International Renewable Energy Academy, York University, 169 Enterprise Boulevard, Markham, Ontario L6G 0E7, Canada

*Corresponding author:Farid Bensebaa, Team Leader, Energy, Mining and Environment (EME), National Research Council of Canada, 1200 Montreal Road, Ottawa, Ontario, K1A 0R6, Canada

Submission:January 18, 2024;Published: January 29, 2024

ISSN:2770-6648Volume4 Issue3

Abstract

Today, there are numerous inconsistencies in how enterprises assess, interpret, and report sustainability on their products, services and organizational practices. Both financial and environmental sustainability are critical to any organization. Although more challenging to quantify, social indicators are crucial for accurate sustainability reporting. Aligning corporate activities to achieve short and long-term sustainability is difficult as the three sustainability pillars (financial, environmental and social) are currently assessed independently from each other using different expertise, tools, standards, and multiple verification bodies. The lack of universally accepted sustainability measurement and reporting approaches create challenges to developing reliable standards, robust data management solutions, and reliable decision-making processes. In this manuscript, we summarize a new open framework designed to address identified deficiencies in sustainability reporting, which often result in poor decision-making, and prompt greenwashing criticisms. We show that Life Cycle Thinking (LCT) approaches and rationale that are currently used in environmental impact assessment can be expanded to include financial and social indicators. A roadmap is provided to address shortcomings, controversies and challenges widely encountered when using ESG (Environment, Social and Governance) and SDG (Sustainable Development Goals) sustainability frameworks. A new transparent bottom-up sustainability reporting approach is presented which reinforces “buy-in” and increases workforce engagement by linking operational activities with sustainability performance. Furthermore, our proposed approach can support increased stakeholders and shareholders engagement and enhance overall understanding of required sustainability-related trade-offs. Overall, the proposed framework can enable more informed and timely decision-making to improve overall organizational performance, public perception and internal/external collaboration. The integration of advanced digital tools in the proposed framework can improve accuracy, efficiency, agility and accelerate decision-making.

Context

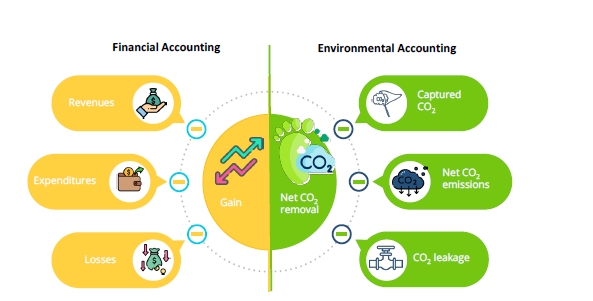

Corporate financial reporting is a well-established discipline with its own accounting standards, guidelines and tools. Prescriptive environmental impact assessment of business activities is still under development and attempts at refinement are often riddled with controversy. For example, environmental and financial accounting disciplines could benefit from each other through knowledge sharing and harmonization. As shown in Figure 1, there are numerous analogies between the key elements of these two sustainability parameters. Net financial profit (or loss), obtained by subtracting expenditures from revenues, is the main indicator in financial reporting. Other related indicators commonly used include income statements, capital costs, cash flows and gross margins. Key indicators for environmental impact include Global Warming Potential (GWP), ecotoxicity and land use. Net CO2 emission, a proxy for GWP, is obtaining by subtracting CO2 reduction solutions from the total CO2 emissions. Not discussed in detail in this paper, social indicators cover areas such as: zero hunger, poverty, health, education and equality.

Figure 1:High level representation of Financial (top) and environmental (bottom) accountings. For simplification, we have considered financial gain (loss) and net CO2 as proxies for financial and environmental impacts.

As energy is a significant contributor to carbon footprints

and operational costs, there is a clear relationship between green

finance, clean energy and environmentally friendly investments

[1]. Thus, integrating environmental cost into current accounting

tools [2] could be critical to both government and privately

funded organizations. However, harmonization between the two

approaches is still required. As both financial and environmental

indicators are directly impacted by organizational activities, there

are no fundamental challenges preventing practitioners from

quantifying these two groups of indicators and using an approach

that combines each group. In the context of development of

climate change solutions, the authors have developed a bottom-up

framework to assess cost and GWP [3]. This framework provides

a specific example of how to assess financial and environmental

performances using a single integrated framework. Expanding

this approach to all other sustainability indicators (including

social indicators) is possible but remains challenging, due mainly

to data gaps. As mentioned above, the possibility of developing an

integrated framework arises from the fundamental similarities

between environmental and economic assessments. When

assessing environmental impacts there are two key contributions:

1. Resources (materials and Energy) uses required to build capital

goods (e.g. equipment)

2. Resources (mostly energy) required to use capital goods.

Often these two contributions are addressed by Scope 3 (capital goods) and Scope 1 and 2 (energy use). Differentiation between these three accounting scopes is critical as they can impact both cost and environmental parameters. For example, Scope 3, which is mostly related to supply chains, impacts both financial bottom lines, while creating detrimental environmental impacts, Additionally, supply chain issues can be a key inflationary contributor. An important take-home message is that Scope 3 emissions can represent up to 90% of total company carbon footprint [4].

Organizations report GHG emissions in three categories: Scope 1 (direct emission from resources owned/controlled by the organization), Scope 2 (indirect emission from imported energy sources) and Scope 3 (indirect emission not included in Scope 2). Thus, Capex (Scope 3) and Opex (Scope 1 and 2) corresponding to equipment and energy expenses respectively, are the key inputs to cost estimation. The similarity between financial and environmental accounting is not limited to just calculation methodology. In both cases, a verification step is used through third parties, that often may have different accreditations. Also, in both cases, the third party (e.g. auditor) inspects relevant evidence and then performs a validation of the calculations.

Of course, at first glance, this approach may seem as an oversimplification. However, it is important to highlight the main goals of integrated reporting before diving into details. In short, detailed frameworks and transparent methodologies should be developed to achieve economic, social and environmental goals. Instead, too often, indicators are selected to satisfy the limitations of current reporting without, for example, consulting with shareholders and stakeholders. To illustrate, trade-offs are made at an early planning stage based on selected shareholder and/or stakeholder lobbying. As a next step, assessment tools and data limitations adversely affect the choice of sustainability indicators. Detrimental compounding of these factors then occurs with the large list of heterogenous activities within each enterprise, making sustainability report a challenging and inaccurate task. All the above challenges are more related to epistemology and limited public data availability rather than faulty accounting approaches. However, a high-level integrated framework can help address the aforementioned challenges and the current lack of harmonization reporting that exists across jurisdictions [5].

Financial Accounting Tools

Although financial accounting is a well-established discipline, this is not the case for environmental accounting and it is even less so for social sustainability indicators. This reality has been factored in the decision to integrate environmental and social accounting into current financial reporting. Accounting methodologies developed using Life Cycle Assessment (LCA), are backed by significant scientific research ranging almost a half-century and are more appropriate for sustainability reporting. However, the development of integrated sustainability reporting should take advantage of the advanced tools, software, guidelines and standards developed in the financial and accounting sectors. As summarized elsewhere [6], there are several advantages in integrating financial, environmental and social accounting systems. Besides streamlining diverse data, it can help business achieve compliance with various regulatory bodies and improve sustainability performance. Furthermore, bottom-up data collection, digital processing, and reporting automation will improve efficiency and enable more timely and accurate decision-making.

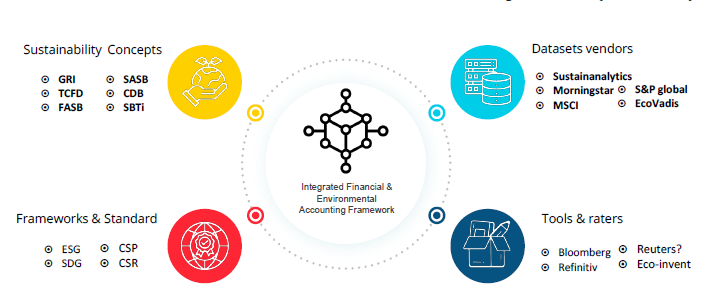

Multiplicity of sustainability accounting frameworks and tools

The overarching challenge preventing the development

and deployment of an integrated reporting framework is the

development of separate knowledge disciplines to address

effectively financial and environmental accounting. These two

disciplines, today use separate reporting methodologies and

standards. Harmonizing these reporting approaches is difficult

and slow. Both disciplines have developed over time very different

standards, guideline and ad hoc analytic tools. ESG, for example, has

been developed by the financial sector to integrate environmental,

social and governance performances. As summarized in Figure

2 there is a complex web of sustainability concepts, framework,

databases, tools and indexes. Limited harmonization, consistency

and fairness are key challenges hampering industry’s performance

and the achievement of better decision-making. To illustrate,

the Sustainable Accounting Standards Board (SASB) provides

guidelines for ESG performance reporting based on selected

sustainability metrics. There is abundant literature showing the

limitation of the current ESG rating tools. When comparing Apple,

Microsoft, Amazon, Facebook, JP Morgan and Berkshire Hathaway,

four ESG rating showed significant discrepancies for E, S, G indicators,

and overall ESG performances [7]. Implementation approaches of

ESG and other sustainability concepts can also be very confusing

due to the multiplication of competing frameworks, indexes,

standards, guidelines, tools and databases. Figure 2 is a first attempt

to clarify different aspects of sustainability in the corporate world

(albeit please note that, due to inherent complexities, key players

within each group represented in Figure 2 are probably missing).

Currently these three main sustainability disclosure frameworks are

used by major organizations:

1. International Sustainability Standards Board (ISSB),

2. European Financial Reporting Advisory Group (EFRAG)

3. Securities and Exchange Commission (SEC in the USA)

Figure 2:Four key steps in development of sustainability index. Corporate Social Responsibility (CSR) Corporate Social Performance (CSP); Science Based Target initiative (SBTi); Carbon Disclosure Project (CDP); Climate Disclosure Standards Board (CDSB); Taskforce on Climate Related Disclosures (TCFD); International Integrated Council (IIRC).

Ongoing efforts from the financial industry to integrate the different frameworks and existing standards are under way through the Sustainability Accounting Standards Board (SASB) led by the International Financial Reporting Standards (IFRS). This effort integrates standards from 77 industries, including the International Integrated Reporting Council (IIRC) and Task Force on Climate-Related Financial Disclosures (TCFD). Other reporting frameworks such as GRI are still used separately although they could be integrated into SASB in the future. Once the framework is selected, appropriate analytical tools should be used or even developed as needed. This approach includes databases, indicator quantification tools, and index cards. Standards are sometimes used to refer to some frameworks (e.g. GRI) even if there is still a blurred line between sustainability frameworks and standards.

Proposed Framework

Accountants could benefit from engaging directly with LCA experts to integrate financial and environmental indicators under a single harmonized framework. Granularity of sustainability accounting is critical to enable transparency. Once aggregated data are used as input, it is difficult to assess the quality of the accounting. Furthermore, environmental accounting should be undertaken with the same rigour as financial accounting under the same framework. This is different, from current practice, when some environmental indicators are selected for integration in financial reporting. We have published an integrated framework to assess economic and environmental sustainability of a novel carbon capture and conversion technology [3]. This framework could be generalized to assess economic and environmental sustainability of other technologies and even whole organizations. Figure 3 summarizes the proposed approach. This 7-step methodology is based on the possibility for generating detailed mass (including intermediary products) and energy balances of each process (activities) units within an organization. We are proposing the use of a digital twin tool to combine physical and non-physical modeling to generate the necessary data to perform replicable and more accurate sustainability assessments. Figure 3 provides also a reliable and holistic pathway towards integrating environmental, financial and social data from different sources for use in sustainability accounting. The bottom-up approach summarized in Figure 3 improves visibility, improves communications with shareholders and the public, and could help enhance collaboration between the different units within the organization and with collaborators outside the organization (stakeholders). The flow of data and information across divisions within and outside the organization is more transparent and everyone can understand more transparently how decisions affect sustainability bottom lines. Finally, everyone will understand where to get additional information and expertise as needed.

Figure 3:The seven steps approach leading to Integrated Sustainability Reporting.

One critical requirement for the quality of integrated sustainability reporting is the importance of internal, shareholder and stakeholder engagement at different steps of the framework. As large organizations are hiring sustainability officers, it is critical to engage with all collaborators and partners within and outside the organization through consultation and open dialogue. The use of digital twins (Step #3) could be critical in addressing data gaps including improvement of the quality of current data. Instead of having different data management solutions for each sustainability pillar, the proposed approach will enhance data compatibility. As noted above, the numerous frameworks, standards and analytical tools that have been developed and used and implemented to assess and report sustainability of products and services require revisions and upgrades. The proposed data management system could benefit from recent advancements in machine learning, cloud computing and block chain. Private and public organizations are making important policy and investment decisions to improve the sustainability of their products and services. Consultants are often hired to assess and rate sustainability performance based using ESG.

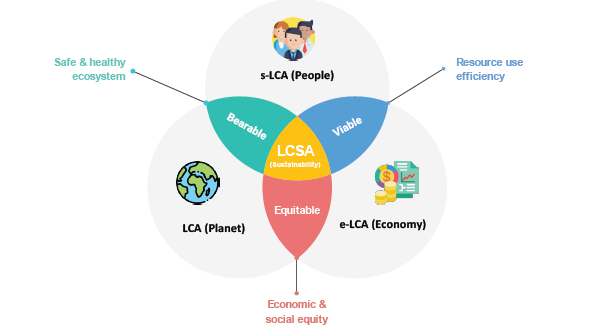

The selection of these indicators and their relative weights, data sources, and quantification approaches often lack transparency and strong consistency. Thus, these assessments are, at best, qualitative with limited capability for choosing and developing optimal social and environmental solutions. Considering the imperative need of using sustainability reporting to improve current ESG practices [8], it is crucial to improve the quality of current sustainability assessments. Disclosure materials are not prepared with consistency [9]. There are also other limitations related to indexes, standards, guidelines, tools and databases. Beside global warming potential, other indicators should be considered to assess environmental sustainability. In addition to environmental impact factors, socio-economic performance indicators should assess to provide a full sustainability picture (Figure 4). In addition, the linking of Sustainable Development Goals (SDG) indicators to the different LCSA tools has not been effectively addressed. The three LCSA pillars are often carried out separately using different system boundaries, functional units and tools. Environmental, economic and social LCA tools are not all developed at the same level of sophistication. This current reality makes a complete comparison between alternative climate change solutions very difficult.

Figure 4:High-level description of the three key component of life cycle sustainability assessment.

LCA is a well established and transparent scientific methodology and tool arsenal to assess environmental indicators through the quantification of gas, liquid, and solid harmful products. This method is currently adapted to assess economic(e- LCA) and social (s-LCA) indicators. Today, assessment tools for measuring social indicators are the least developed within the proposed LCSA framework. Furthermore, there is no consistency in methodology and data management. Borrowing concepts from LCA, a social-LCA (s-LCA) is currently under development through case studies (although with limited scope). Widely reported as a techno-economic assessment (TEA), there is no generally accepted approach for economic (e-LCA) methodology beyond life cycle costing.

Conclusion and Next Steps

Conducting financial and environmental assessments and reporting using separate methodologies and tools leads to challenges and shortcomings for both decision-makers, auditors and society as a whole. That reality often leads to non-transparent trade-offs. That conundrum also could lead to sustainability underperformance. Instead, conducting integrated reporting using a harmonized framework can help organisations achieve better sustainability results. However, to achieve those laudable goals, life cycle thinking (developed using LCA tools) should be expanded to achieve better economic impact assessment, and subsequently more accurate social impact assessments. With 17 sustainability goals and over 200 indicators, the Sustainable Development Goals (SDGs) remain as the most accepted and comprehensive sustainability theoretical framework with pragmatic guidelines for action. To the best of our knowledge there is no verifiable implementation of SDGs as a sustainability reporting framework. The proposed LCSA will enable to assess each of the SDG indicators under a harmonized framework. Depending on the type of indicators, the currently developed LCA, e-LCA or s-LCA tools could be used to assess progress towards each target and ultimately help organizations and society to achieve better decision-making, cleaner ecosystems, and socially responsible resource allocations. This framework clearly helps provide cost-benefit assessment of trade-offs and thus address potential greenwashing suspicions from stakeholders and the general public. It can also help identify and quantify opportunities for sustainable practices throughout their value chains. Another important advantage when using the proposed framework is embedding a sustainability culture across an organization with a bottom-up support through direct linkage between operations changes and sustainability strategies.

References

- Bei J, Wang C (2023) Resources Policy 80: 103194.

- Integration of environmental costs into accounting information system.

- Kannangara M, Shadbahr J, Vasudev M (2022) A standardized methodology for economic and carbon footprint assessment of CO2 to transport fuels: Comparison of novel bicarbonate electrolysis with competing pathways. Applied Energy 325(1): 119897.

- CDP-technical-note-scope-3-relevance-by-sector.pdf.

- Technical Line: How the climate-related disclosures under the SEC proposal, the ESRS and the ISSB standards compare.

- Integration of financial reporting software with other accounting systems.

- LaBella MJ (2019) The devil is in the details: The divergence in ESG data and implications for sustainable investing.

- Jebe R (2019) The convergence of financial and ESG materiality: Taking sustainability mainstream. American Business Law Journal 56(3): 645-702.

- List of key ESG reporting frameworks and standards. Greenstone.

© 2024 Farid Bensebaa. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)