- Submissions

Full Text

Strategies in Accounting and Management

Understanding Professor Ross Watts by Applying Kuhnian Interpretation of Science Progress

Khalid Al-Adeem*

Professor of Accounting and Director of Research Center, College of Business Administration, King Saud University, Saudi Arabia

*Corresponding author:Khalid Al- Adeem, Professor of Accounting and Director of Research Center, College of Business Administration, King Saud University, Saudi Arabia

Submission:August 15, 2023Published: September 06, 2023

ISSN:2770-6648Volume4 Issue1

Abstract

Professor Ross Watts identified an issue with corporate reporting. He wrote extensively alone and with others on the issue and proposed an accounting research methodology. The influence of economics from where he attended school is present in his views and writing. He playing the role of a knight in shifting accounting research. While bridging the gap between accounting practice and research was one of the arguments was used to propagate Rochester School of Accountancy’s positive accounting methodology, he (1983) testified that accounting research “has become more removed from the practitioner.” We should learn from his passion and eagerness as we should learn that basing accounting research on a single foundation does not yield the outcomes that the accounting practice expects from research of accounting academics.

Keywords:Professor ross watts; Positive accounting research; Science; Paradigm

Introduction

Professors Ross Watts and Jerold Zimmerman have assembled an establishment for the accountancy academe. They introduce a new paradigm through basing their research on a theory from financial economics (1978), justifying their newly introduced usage of positive research in accounting (1979) and to some extent comprehensively tie nexus contracts of divergent parties that collectively create corporation as a model and how such relationship can be explained (1986). Whether the wide use of their research methodology was due to imposition or acceptance of accounting researchers is an empirical question. Though some have made a case for a paradigm imposition [1-3], it may need further empirical exploration.

Before joining Zimmerman to coauthor several papers on the positive research methodology, Watts [4,5] expressed awareness and an interest in solving the issue that corporate accounting and reporting has never yet overcome. Early in his writings, Watts focused on a prime issue in corporate reporting that was the result of segregating management and ownership of corporation. The divorce between the two emerged with the advent of corporation as a contemporary model for conducting business [6]. The corporation has been a daunting mission that has come upon accountants [1,3,7-12]. This essay is not a comprehensive review of Watts’ contributions and of his views on accounting and auditing. That is, neither does it provide an evaluation of his position nor is it a critique of the research methodology he and Zimmerman introduced. This short essay is for researchers and emerging scholars to manifest to them that a graduate of Chicago School of Thought shifted the academic accounting research and never gives up on his belief. In doing so, this essay relies upon Kuhnian interpretation of scientific progression. Without evaluating the validity and the suitableness of such a paradigm to accounting practice, this essay’s main aim is to present a case for accounting researchers to propose solutions to accounting issues based upon what they believe. It is to make them aware of understand to what they are calling.

Perceiving Scientific Status Grounded in a Discipline in Which Watts Was Trained

Watts concluded his doctorate at the University of Chicago in 1971. While he started in accounting major earning a bachelor degree in commerce, he in his graduate studies mixed his knowledge with other field, namely finance and economics which are closely related to accounting. After earning his MBA from the University of Chicago, he earned his doctorate from the same university in finance, economics and accounting1. He is listed at the Solon School of Business at MIT in the accounting group and his academic area is economics, finance and accounting2. In his SAXE Lecture in Accounting of 1983, he compared between two of the University of Chicago Conferences on Empirical Research in 1967 and in 1982 by stating:

“The first conference included the Managing Director of the AICPA among those presenting papers and among the discussants, three accounting practitioners, two finance practitioners, one economist and one behavioral scientist. The most recent conference included a well-known economist and a well-known behavioral scientist among those giving papers and three top financial economists and a behavioral scientist as discussants. Further, several well-known economists even paid their own expenses to attend the Conference… No practitioners (finance or accounting) appeared on the program in 1982. [footnote omitted]3”.

He further commented that, “accounting research has attained a degree of academic respectability among economists far greater than I [Watts] would have thought possible in 1967. But, at the same time it has become more removed from the practitioner4”. In his attempts to explain the transition that led to such an outcome, he speculated two possible causes:

“First, accounting research has become much more scientific, more rigorous and sophisticated in its analysis and empirical work. This has gained the respect of economists, but at the same time it has made it much more difficult for practitioners to read and understand the literature. …. [footnote omitted]. Second, the topics addressed by accounting researchers are very important to the economists’ newfound interest in the theory of the firm. This has attracted the interest of the economist, but the result of this recent shift in topics has not yet begun to be translated for professional consumption. Practitioners are still confronted with the view that the EMH implies that if accounting procedures do not affect taxes they do not affect stock prices…. [footnote omitted]. The application of scientific methodology to interesting accounting topics has not only gained the respect of economists, it has produced some robust empirical results which were previously unknown (to me at least) …Such results, together with the insights produced by the analysis, suggest that the current thrust of economics-based accounting research will provide a better explanation for accounting practice. If it does, I [Watts] expect practitioners to be more actively involved in the accounting research process5”.

Extending the Orthodoxy of Chicago School of Thought and Spreading its Ideology

“Rochester School of Accounting” (Christenson [13] as cited in Williams [14]) “may not be a new school in terms of the history of ideas as much as a branch office of rather old schools” [14]. “The Rochester School was heavily influenced by the Chicago school of economic thought” Chabrak [15] which deem it a branch for the Chicago School of Thought [16]. Watts [17] is actually a believer in the mechanism of the invisible hand. He believes that the market on financial reporting recognizing that financial accounting and reporting are a segment of a broad-spectrum reporting, financing and governance equilibrium. He also perceives theory acceptance from a market perspective. In his defense of successful theories, Professor Watts [18] declared that “in the long term the researchers do not have the choice, the users will determine which theories are successful.” In fact in their evaluation of positive accounting methodologies ten years (1990) after they had proposed it, they declared themselves winners [19]. Such declaration of their winning was in the despite of serious and legitimate criticisms directed to their research methodology since it was first introduced. They deemed themselves front runners on a market base [16]. They (1990) justified the claimed success of their proposed research methodology by the wide spread of its usability. An alternative explanation, however, for such a widespread is through imposing it [1-3,16,20]. Despite all criticism toward positive accounting methodology throughout time, Watts and Zimmerman were firm that the market has chosen their methodology which makes them correct. There is a distinction between voluntary acceptance due to the validity and usability of an idea on one hand and imposing it on the other hand. To Watts and Zimmerman, its use should be interpreted as a validation for their research methodology despite the legitimacy of concerns raised by other authors that Watts and Zimmerman acknowledged [21]. It is a market choice in the sense that the market choices or is forced to choose as long as it is not the regulator who exercised such a force. Put differently, if it is not the regulator, then it must be the market who has decided its choice even such an option has been imposed.

Viewing the Development of Accounting Research Paradigmatically

Kuhn’s view has served as a base to understand how science progresses including accounting. Development of the accounting discipline in general and shift in accounting research can be viewed progressively [1-3, 16,22-30]6. The shift in the academic accounting research [1-3,26,31-41] is categorized in two distinct paradigms [36]. The former inquires about internal logic of accounting labeled as conventional [40]. The latter is labeled the financial empirical paradigm [1,2].

Editors of main accounting journals in the US e.g. Dopuch [26] ceased the prescriptive type of accounting research in favor of the descriptive type of accounting research. Accounting research experienced a tradeoff between the two types (Al-Adeem [3]) creating a demand for a theoretical ground. Such a demand has been moved because to date, accounting has not developed its own theory [1-3,9,10,22,23,29,37,42-57]. Virtually, a paradigm shift indicates a development in a science (Kuhn 1996). In the case of accounting it might not. “Interest in…contribution to the accounting discipline was giving way to capital market research, led by (among others) the Universities of Rochester and Chicago” is an unsuccessful shift in the development of accounting thought [58]. Such a shift can be viewed from the perspective of school domination. “The current structure of the U.S. academy is one constructed primarily for serving the purpose of generating politically correct academic reputations” [59]. Apparently, shifting accounting research from the prescriptive type of research to the descriptive accounting research ultimately calls for a need for a theoretical footing upon which a stream of empirical research.is founded. Researchers subscribing to the financial empirical paradigm utilize the agency theory in explaining observed behavior in the corporate reporting.

Rebuilding the Accounting Discipline

The Committee on Concepts and Standards for Externals Financial Reports (SATTA [29] emphasis added) acknowledged that “In this state of dissatisfaction with existing paradigms we can note that each theorist attempts to provide his own foundation for the field. In regard to Newton’s theory of optics, Kuhn writes: Being able to take no common body of belief for granted, each writer on physical optics felt forced to build his field anew from its foundations. In doing so, his choice of supporting observation and experiment was relatively free, for there was no standard set of methods or of phenomena that every optical writer felt forced to employ and explain. Under these circumstances, the dialogue of the resulting books was often directed as much to the members of other schools as it was to nature. That pattern is not unfamiliar in a number of creative fields today, nor is it incompatible with significant discovery and invention, (p.13). This seems to be an apt description of what is happening in accounting at the present time. Many theorists seem to feel the need to start from some basic foundations to build the field of accounting anew.”

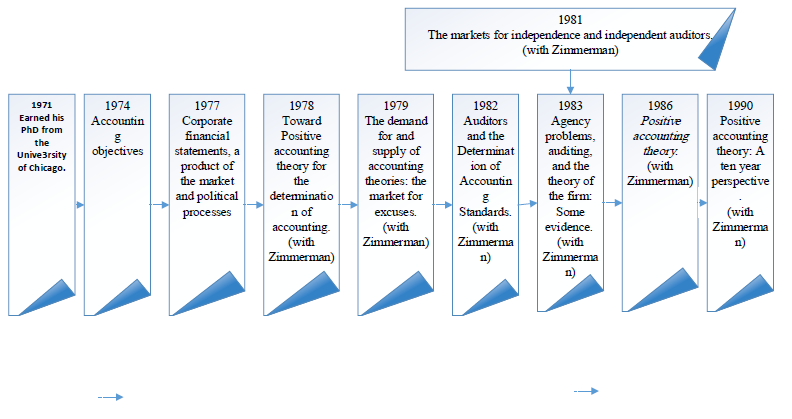

Figure 1:A list of works authored and coauthored by professor ross watts to build a new paradigm for accounting research.

Watts [4] initially enquired the objectives of accounting (Figure 1 for illustration)7. He 1977 then revisited the corporate model to view corporate financial statements as a product of the market and political processes. Watts and his co-author, Professor Jerold Zimmerman worked on fundamental topics such as auditor independence in market contexts (1981) and the determination of financial accounting standards (1982). In their manuscript on auditor independence (1982), they cite professional reports and in the other manuscript (1983) which was also on auditor independence they cite historical financial statements of early corporations. In 1983, they provide evidence of the importance of audit to the firm. In fact, the economic role of the audit in free and regulated markets is legitimate (Wallace [61]) among other proposed views of the audit function [8,62-68]. Watts [69,70] continued publishing on the topic of accounting theory in addition to others he coauthored (e.g., Balakrishnan [71]; LaFond [72]. Watts further joins Professor Jerold Zimmerman in three manuscripts [21,73,74] and a book (1986) dedicated to the positive accounting methodology. They argued that they proposed a metrology to rescue accounting research from what they labeled apologists oriented research. They (1990) defended their methodological choice arguing that even though they might be wrong the widespread of the researchers’ utilization and dependence make them correct.

Playing the rolf of a knight in shifting accounting research

Professor Watts is a firsthand reader of philosophers of science namely Karal Popper. This is evident when referring to Popper in his SAXE Lecture in Accounting (1983). He even interpreted Popper’s count for validating claims of knowledge. Watts [75] argued that “The successful theory is the one which is most useful to users. As Popper (1959, p. 108) writes: “We choose the theory which best holds its own in competition with other theories; the one which, by natural selection, proves itself the fittest to survive.” This suggests that there is no natural significance level for hypothesis testing such as the commonly used five or 10 percent. If there are no better theories available 20 percent could be acceptable. The choice is always between imperfect theories or between an imperfect theory and no theory at all.”

This interpretation was to defend positive accounting methodology. With the absence of alternative what one has might be, according to Watts, the best although failing to meet the standards of rigorous knowledge. While the minimum level of statistical significance accepted in the scientific community is 90%, 80% with the absence of competing explanation is suitable and should help the practice, according to Watts [18]. Discovery starts with the awareness of anomaly, with the recognition that nature has somehow violated paradigm-induced expectations that govern normal science Kuhn [76]. Until late sixties, the predominant stream of accounting research was normative. It started with the publication of Paton’s dissertation (Zeff, 1999) that he kept working on for two more years after awarded his doctorate in 1920. Normative theorization dominated the US accounting research until the publication of Ball [77] and Beaver [78] appeared when academic accounting research shifted to the empirical type of research. However, a theoretical base was absent is such a line of research Al-Adeem [3] which made empirical research mechanistic Wolk [40]. Novelty ordinarily surfaces only for the person who know with accuracy what to expect because of his ability in recognizing what has gone wrong [76]. Introducing agency theory, positive accounting methodology has served accounting research.

While normative research is needed and is a way to address the issue facing the accounting profession for more than a century, such a line of research might not explain why accounting is practiced a certain way. For example, when steel companies shifted from one method of depreciation to another, normative theory cannot explain the reason [79]. The new paradigm needs knights to support and propagate it. Kuhn [76] describes them as “somebody appears with a new candidate for paradigm-usually a young man or one new to the field…” While Professor Watts was not new to accounting in comparison to Professor Chambers whose accounting education is limited to a single course he took in his undergraduate studies Al- Hogail [80], Professor Watts acquired non-accounting knowledge in his graduate studies that have enabled him to view possibilities to issues confronting corporate reporting. Such knowledge was the base for his research methodologies he co-proposed with Professor Zimmerman. Professor Watts was also young when started developing and promoting his solutions to the issue accounting facing for approximately a century or even more. His first published work appeared four years after earning his doctorate followed by a series of publications addressing the standardization of financial accounting, the external audit function for corporations.

Launching a journal

A group of academics who proposed a new, or different, paradigm from the predominant one, seeks controlling journals of their discipline to stimulate their dogma [1,2,16,76,81]. Watts & Zimmerman however launched a new journal and named it the Journal of Accounting and Economics (JAE). Later the journal became one of the top accounting journals in corporation reporting that employs empirical archival research method and depends on agency theory in explaining observed behavior and predicting such behavior. In addition, the Rochester School of Accountancy maintained holding conferences on variance accounting topics that fit within the umbrella of positive accounting methodology. They are published as special issues in the journal8.

Discussion: A Learned Lesson

The critique of his accounting research methodology does not by any mean discredit Professor Watts from being a concerned accounting academic attempting to foot-putting accounting discipline on a scientific status in a way that academic accounting research best serves accounting practice by solving accounting issues in the context of corporate setting. A limitation of the proposed paradigm of Rochester School of Accounting for developing academic accounting research is the singularity in viewing the corporate model namely the issue of the divorce between management and ownership. Accounting is not only nor mainly an economic enterprise. Probably, this is a potential cause for its failure. Several accounting writers worldwide condemned it [1,3,13,15,16,19,20,22,28,44,45,58-60,82-107]. Accounting is much more than that. Accounting can been seen a social institution Hopwood [108]; Hopwood [61]; Potter [109]; Chapman [110] in addition to an economic organization Waymire [111]. Accounting might be viewed from a multi-paradigmatic perspective Riahi- Belkaoui 1999. One should learn from Professor Watts’s voyage in proposing a competing research methodology and defending it. He studied and inquired the root of the issue in corporate reporting. He displayed the research methodology in a book to ease teaching it. He saved the time of attempting to control one of the elite accounting journals by launching his own journal until it becomes an elite accounting journal that he used to disseminate the ideology in which he believed that should best benefit practiced accounting. He defended his belief on base of a dogma that is known disregarding to whether all agree upon or not. He made his name and fame while working in a university that might not be elite at that time in comparison to the top universities in the US9 whose accounting departments are deemed elites in the US. Professor Watts’ co-author and co-editor, Professor Zimmerman published advice of how to write a manuscript and to increases the likelihood of getting acceptance (1989). Fogarty [112] deemed Zimmerman’s advice provided to young scholars as one means whereby the social hierarchy is maintained. One of the main lessons can be learned from shifting the accounting research paradigm is the cost upon the accounting. Watts [18] testified that “accounting research has attained a degree of academic respectability among economists far greater than I [Watts] would have thought possible in 1967. But, at the same time it has become more removed from the practitioner10. In addition, Professor Stuipta Basu, a Rochester graduate who published in top US accounting and economics journals including the Journal of Accounting and Economics and who won the AAA Distinguished Contribution to Accounting Literature Award in 2012, is dismayed that accounting research and education and regulation lack a scientific creed (2015) and “is shameful that we still cannot answer basic questions” (Basu [115]). This criticized line of research is the one that Watts and Zimmerman in their winning manuscript the AAA Distinguished Contribution to Accounting Literature Award (1979) criticized the schism between accounting research and practice. Apparently, over four decades, we are still on the same spot where accounting practitioner are prevented from utilizing accounting research. The three arms of accounting (practice, education and academic) do not work harmonically. A gap between research and education and practice existed Sterling [116]. Two decades later, the gap is still present Lee [117]. AAA aided such a gap (Lee, 2005). The power of elite universities on boards of top-tier accounting journal who define body of knowledge is responsible for the failure of accounting research to address critical issues concerning accounting practice facing practitioners Lee [113].

Concluding Remarks

I among others have criticized the research methodology of Rochester School of Accounting [1,2,16,20,106,112-114,118-125]. I wrote in English and in Arabic. Even so, holding such a position toward the positive research methodology that he and his coauthor acknowledged its flaw in their 1990 manuscript does not prevent me from expressing my admiration toward the person who proposed what he believes and continues prompting it to the extent that others accounting researchers believed in the view that corporate reporting is an agency issue [1]. Even outside the US, researchers who were educated in other parts of the world share such an ideology [22]. Editorial board of top accounting journals contribute to the domination of their research methodology Al- Adeem [2] as well as the training they got in their doctoral studies play a role in adopting such an ideology [1]. Professor Watts acknowledged an issue in the corporate reporting function and attempted to solve it. He never stopped. We should learn from his passion and eagerness as we should learn that basing accounting research on a single foundation does not yield the outcomes that the accounting practice expects from research of accounting academics [126-138].

References

- Al-Adeem KR (2017a) Role of doctoral education in shaping minds and thinking: Reflection on my doctoral education at Case Western Reserve University. International Journal of Critical Accounting 9(5-6): 494-513.

- Al-Adeem KR (2019a) Who decides what is publishable? Empirical study on the influence of a journal’s editorial board on the observed paradigm shift in US academic accounting research. The North American Accounting Studies 2(1): 1-21.

- Al-Adeem KR, Fogarty TJ (2010) Accounting theory: A neglected topic in academic accounting research. (1st edn), LAP Lambert Academic Publishing, Germany.

- Watts R (1974) Accounting objectives. Working paper series No. 7408, University of Rochester, USA.

- Watts RL (1977) Corporate financial statements, a product of the market and political processes. Australian Journal of Management 2(1): 53-75.

- Berle AA, Means GC (1932) The modern corporation and private property. New York, USA.

- Al-Adeem KR (2022a) Revisiting the role of accounting from ancient to contemporary times: An attempt to evaluate the role of corporate accounting. Strategies in Accounting and Management 3(4): 1-13.

- Al-Adeem KR (2022b) Reconceptualizing the management-auditor relationship by applying the general partnership contract to challenge independence. Journal of Accounting, Business and Management (JABM) 29(1): 155-193.

- Al-Hazzani MM, Al-Adeem K (2020) Do corporations’ annual reports address shareholders as proprietors? evidence from Saudi Arabia. International Journal of Auditing and Accounting Studies 2(2): 175-192.

- Alharbi AM, Al-Adeem KR (2022) A defense on accounting discretion: An empirical inquiry based on users’ Awareness. Financial Markets, Institutions and Risks 6(3): 26-39.

- Merino BD (1993) An analysis of the development of accounting knowledge: A pragmatic approach. Accounting, Organizations and Society 18 (2-3): 163-185.

- Previts GJ, Merino BD (1998) A history of accountancy in the United States. Ohio State University Press Ohio, USA.

- Christenson (1983) Methodology of positive accounting. The Accounting Review 58(1): 1-22.

- Williams PF (1985) A descriptive analysis of authorship in The Accounting Review. The Accounting Review 60(2): 300-313.

- Chabrak N, Burrowes A (2006) the language of the Rochester school: Positive accounting theory deconstructed. In 8th IPA Conference-The interdisciplinary perspectives on accounting conference.

- Al-Adeem KR (2021a) Properly identified imaginary needs, an inaccurately proposed methodology: The case of Rochester school of accountancy’s positive accounting methodology. Accounting and Management Information Systems 20: 607-645.

- Watts RL (2006) What has the invisible hand achieved?. Accounting and Business Research 36(sup1): 51-61.

- Watts R (1983) The evolution of economics-based empirical research in accounting. The SAXE Lecture in Accounting.

- Mouck T (1992) The rhetoric of science and the rhetoric of revolt in the “story” of positive accounting theory. Accounting, Auditing & Accountability Journal 5(4): 35-56.

- Tinker T, Puxty T (1995) Policing accounting knowledge: The market for excuses affair, Markus Weiner Publishers, Princeton, NY, USA.

- Watts RL, Zimmerman JL (1990) Positive accounting theory: A ten year perspective. The Accounting Review 65(1): 131-156.

- Al-Adeem K (2021b) Empirically investigating the presence of positive accounting research as the meta-theory for accounting academics: Further evidence from Saudi Arabia. The Journal of Accounting and Management 11(3): 26-49.

- Belkaoui AR (2004) Accounting theory (5th edn), Thomson Learning, London, UK.

- Beuren IM, de Souza JC (2011) Kuhn’s theory of scientific revolution in accounting article. Corporate Ownership and Control 8(2): 77-88.

- Cushing BE (1989) A Kuhnian interpretation of the historical evolution of accounting. Accounting Historians Journal 16(2): 1-41.

- Dopuch N (1979) Empirical vs non-empirical contributions to accounting theory development. In: Davis JJ (Ed.), Accounting Research Convocation on the Subject of Seeking Full Disclosure. University of Alabama, USA, pp. 67-83.

- Previts GJ (1984) Methods and meanings of historical interpretation for accountancy. Accounting Historians Notebook 7 (2): 13-19.

- Riahi-Belkaoui A (1996) Accounting, a multiparadigmatic science. Greenwood Publishing Group, Westport, Connecticut, USA.

- Statement on Accounting Theory and Theory Acceptance (SATTA) (1977) American accounting association committee on concepts and standards for externals financial reports, Sarasota, American Accounting Association, FL, USA.

- Wells MC (1976) A revolution in accounting thought? The Accounting Review 51(3): 471-482.

- Buckmaster D, Theang Kok-Foo (1991) An exploratory study of early empiricism in the U. S. accounting literature. The Accounting Historians Journal 18(2): 55-83.

- Dyckman TR, Zeff SA (1984) Two decades of the Journal of Accounting Research. Journal of Accounting Research. Spring. 22(1): 225-297.

- Gaffikin MJR (1988) Legacy of the golden age: Recent developments in the methodology of accounting. ABACUS 24(1): 16-36.

- Gaffikin MJR (2005) Accounting research and theory: The age of neo-empiricism. School of Accounting and Finance. Working Paper Series 05-07, University of Wollongong, Australia.

- Granof MH, Zeff SA (2008) Research on accounting should learn from the past. The Chronicle of Higher Education 54(28): A34.

- Hopwood AG (2007) Whither accounting research. The Accounting Review 82 (5):1365-1374.

- Lee TA (2009) Financial accounting theory. In: Edwards JR, Walker SP (Eds.), The Routledge Companion to Accounting Theory. Routledge Taylor & Francis Group, UK, pp. 139-161.

- The Association to Advance Collegiate Schools of Business (AACSB-International) (2008) Final report of the AACSB international: Impact of research: Task Force. Tampa, FL, USA.

- Tuttle B, Dillard J (2007) Beyond competition: Institutional isomorphism in the U.S. accounting research. Accounting Horizons 21(4): 387-409.

- Wolk HI, Dodd JL, Tearney MG (2004) Accounting theory: Conceptual issues in a political and economic environment. (6th edn), Thomson South-Western, Mason, OH, USA.

- Zeff SA (1989) Recent trends in accounting education and research in the USA: Some implication for UK academics. British Accounting Review 21(2): 159-176.

- Al-Adeem KR (2017b) A need for theorizing corporation: An accounting perspective. International Journal of Accounting Research 5(2): 166.

- Al-Adeem KR (2017c) Contributions of Gulf Cooperation Council for Accounting and Auditing Organization’s (GCCAAO) attempts unifying accounting practices and standards in enriching accounting thought: Analysis and evaluation. Accounting Thought Journal 21(2): 533-566.

- Al-Adeem KR (2019b) Book review of: Understanding mattessich and ijiri: A study of accounting thought. European Accounting Association, EAA Newsletter.

- Al-Adeem KR (2019c) Critique and an extension of nohora garcía’s understanding mattessich and ijiri: A study of accounting thought. International Journal of Accounting and Financial Reporting 9(4): 420-438.

- Al-Adeem KR (2023a) The dilemma: Push-down accounting and the conceptual framework of financial accounting: A case of contradictions between relevance and reliability. Universal Journal of Accounting and Finance 11(1): 1-8.

- Al-Adeem KR (2023b) Accounting as a sustainable crafted technology for human exchange activities with nature: A defense of accounting continuity. Fron Environ Sci 11: 1165247.

- Alhomaid I (2009) Accounting theory. Obeikan Library, Riyadh, Saudi Arabia.

- Alshiban RF, Al-Adeem KR (2022) Empirically investigating the disclosure of nonfinancial information: A content study on corporations listed in the Saudi capital market. Journal of Risk and Financial Management 15(6): 251.

- Beaver W (2002) Review of the book accounting theory: An information content perspective by John A. Christensen JA, Demski JS. European Accounting Review 11(3): 631-633.

- Brearey CH, Al-Adeem KR (2019) Thinking beyond the black box: Sterling shows accountants the way toward relevance. Journal of Finance and Accountancy 26: 1-20.

- Chatfield M (1977) A History of Accounting Thought (Revised ed.), RE Krieger Pub Co, Huntington, New York, USA.

- Coetsee D (2010) The role of accounting theory in the development of accounting principles. Meditari Accountancy Research 8(1): 1-16.

- Gaffikin MJR (1987) The methodology of early accounting theorists. Abacus 23(1): 17-29.

- García N (2017) Understanding Mattessich and Ijiri: A study of accounting thought. Emerald Publishing, UK.

- Ijiri Y (1967) The foundations of accounting measurement: A mathematical, economic, and behavioral. Prentic-Hall Inc, Englewood, NJ, USA.

- King TA (2006) More than a numbers game: A brief history of accounting, John Wiley & Sons, USA.

- Persson ME (2016) Foreword AC Littleton's final thoughts on accounting: A collection of unpublished essays. Emerald Group Publishing Limited, UK.

- Williams PF (2017) Jumping on the wrong bus: Reflections on a long, strange journey. Critical Perspectives on Accounting 49: 76-85.

- Kabir H (2010) Positive accounting theory and science. Journal of CENTRUM Cathedra 3(2): 136-149.

- Wallace WA (1980) The economic role of the audit in free and regulated markets (The Touche Ross and Co. aid to education program] Reprinted in Auditing Monographs, translation into Japanese by five auditing scholars was published by Dobunnkan Macmillan Publishing Co., 1985, New York, USA.

- DeZoort FT, Holt T, Taylor MH (2012) A test of the auditor reliability framework using lenders’ judgments. Accounting, Organizations and Society 37(8): 519-533.

- DeZoort FT, Taylor MH (2015) Commentary-public interest view of auditor independence: Moving toward auditor reliability when considering and promoting audit quality. Accounting and the Public Interest 15(1): 53-63.

- Ronen J (2006) A proposed corporate governance reform: Financial statements insurance. Journal of Engineering and Technology Management 23(1-2): 130-146.

- Ronen J (2010) Corporate audits and how to fix them. Journal of Economic Perspectives 24(2): 189-210.

- Ronen J, Sagat KA (2007) The public auditor as an explicit insurer of client restatements: A proposal to promote market efficiency. Journal of Accounting, Auditing & Finance 22(3): 511-526.

- Taylor MH, DeZoort FT, Munn E, Thomas MW (2003) A proposed framework emphasizing auditor reliability over auditor independence. Accounting Horizons 17(3): 257-266.

- Wallace WA (2004) The economic role of the audit in free and regulated markets: A look back and a look forward. Research in accounting regulation 17: 267-298.

- Watts RL (2003a) Conservatism in accounting part I: Explanations and implications. Accounting Horizons 17(3): 207-221.

- Watts RL (2003b) Conservatism in accounting part II: Evidence and research opportunities. Accounting Horizons 17(4): 287-301.

- Balakrishnan K, Watts R, Zuo L (2016) The effect of accounting conservatism on corporate investment during the global financial crisis. Journal of Business Finance & Accounting 43(5-6): 513-542.

- LaFond R, Watts RL (2008) The information role of conservatism. The accounting review 83(2): 447-478.

- Watts RL, Zimmerman JL (1978) Positive accounting theory for the determination of accounting. The Accounting Review 53(1): 112-134.

- Watts RL, Zimmerman JL (1979) The demand for and supply of accounting theories: The market for excuses. Accounting Review 54(2): 273-304.

- Watts RL, Zimmerman JL (1983) Agency problems, auditing, and the theory of the firm: Some evidence. The Journal of Law and Economics 26(3): 613-633.

- Kuhn TS (1996) The structure of science revolution (3rd edn), The University of Chicago Press, Chicago, IL, USA.

- Ball R, Brown P (1968) An empirical evaluation of accounting income numbers. Journal of Accounting Research 6(2): 159-178.

- Beaver WH (1968) The information content of annual earnings announcements. Journal of Accounting Research 6 (Empirical Research in Accounting: Selected Studies): 67-92.

- Hadi I (2002) Accounting Theory. University of Neilain, Sudan.

- Al-Hogail AA, Previts GJ (2001) Raymond J. Chambers’ contribution to the development of accounting thought. Accounting Historians Journal 28(2): 1-30.

- Whitley R (2000) The intellectual and social organization of the science, 2nd edn, Oxford University Press, New York, USA.

- Avelé D (2014) Positive accounting theory: theoretical and critical perspectives. International Journal of Critical Accounting 6(4): 396-415.

- Boland LA, Gordon IM (1992) Criticizing positive accounting theory. Contemporary Accounting Research 9(1): 142-170.

- Chabrak N (2005) The politics of transcendence: Hermeneutic phenomenology and accounting policy. Critical Perspectives on Accounting 16(6): 701-716.

- Chambers RJ (1993) Positive accounting theory and the PA cult. Abacus 29(1): 1-26.

- Collin SOY, Tagesson T, Andersson A, Cato J, Hansson K (2009) Explaining the choice of accounting standards in municipal corporations: Positive accounting theory and institutional theory as competitive or concurrent theories. Critical Perspectives on Accounting 20(2): 141-174.

- Demski JS (1988) Positive accounting theory: A review. Accounting, Organizations and Society 13(6): 623-629.

- Hines RD (1988) Popper's methodology of falsificationism and accounting research. The Accounting Review 63(4): 657-662.

- Kabalski P (2016) Why should accounting science be more normative? Theoretical Accounting Notebooks 88: 61-72.

- Kaplan SE, Ruland RG (1991) Positive theory, rationality and accounting regulation. Critical Perspectives on Accounting 2(4): 361-374.

- Lowe EA, Puxty AG, Laughlin RC (1983) Simple theories for complex processes: Accounting policy and the market for myopia. Journal of Accounting and Public Policy 2(1): 19-42.

- Major MJ (2017) Positivism and alternative accounting research. Accounting & Finance Magazine 28(74): 173-178.

- Milne MJ (2002) Positive accounting theory, political costs and social disclosure analyses: A critical look. Critical Perspectives on Accounting 13(3): 369-395.

- Mouck T (1989) Irony of the golden age of accounting methodology. Accounting Historians Journal 16(2): 3.

- Mouck T (1990) Positive accounting theory as a Lakatosian research programme. Accounting and Business Research 21(79): 231-239.

- Ndjetcheu L (2012) An African critical interpretation of the positive theory of accounting of Watts and Zimmerman (1978, 1980, 1986). African Journal of Accounting, Auditing and Finance 1(1): 25-39.

- Okcabol F, Tinker T (1990) The market for positive theory: Deconstructing the theory for excuses. Advances in Public Interest 3: 71-95.

- Sinha SK (2008) Positive accounting theory: A critique. The IUP Journal of Accounting Research and Audit Practices 7(4): 7-16.

- Srivastava J, Baag PK (2020) Positive accounting theory and agency costs: A critical perspective. AIMS International 14(2): 101-113.

- Sterling RS (1990) Positive accounting theory: An assessment. Abacus 26(2): 97-135.

- Sy A, Tinker T (2011) From Mellmott to Madoff: history in the (re) making. Accounting Historians Journal 38(1): 141-158.

- Tinker AM, Merino BD, Neimark MD (1982) The normative origins of positive theories: Ideology and accounting thought. Accounting, Organizations and Society 7(2): 167-200.

- West BP (2003) Professionalism and accounting rules. Routledge, New York, NY, USA.

- Whittington G (1987) Positive accounting: A review article. Accounting and Business Research 17(68): 327-336.

- Williams PF (1989) The logic of positive accounting theory. Accounting, Organizations and Society 14(5-6): 455-468.

- Williams PF (2003) Modern accounting scholarship: The imperative of positive economics science. Accounting Forum 27(3): 251-269

- Yousof AM (2006) Analyses and critique the foundation of positive theorization in accounting. Business Administration 112: 26-35.

- Hopwood AM (1994) Accounting as social and institutional practice. Australia, Melbourne: Cambridge University Press, UK.

- Potter BN (2005) Accounting as a social and institutional practice: Perspectives to enrich our understanding of accounting change. Abacus 41(3): 265-289.

- Chapman CS, Cooper DJ, Miller PB (2009) Accounting, organizations, and institutions: Essays in honour of anthony hopwood. Oxford: Oxford University Press, USA.

- Waymire GB, Basu S (2008) Accounting is an evolved economic institution. Foundations and Trends in Accounting 2(1-2): 1-174.

- Fogarty TJ (2011) The social construction of research advice: The American Accounting Association plays Miss Lonelyhearts. Accounting and the Public Interest 11(1): 32-51.

- Lee T (1997) The editorial gatekeepers of the accounting academy. Accounting, Auditing & Accountability Journal 10(1): 11-30.

- Lee TA (2001) Sustaining a habitus. In Advances in Accountability: Regulation, Research, Gender and Justice 8: 177-194.

- Basu S (2012) How can accounting researchers become more innovative? Accounting Horizons 26(4): 851-870.

- Sterling RR (1973) Accounting research, education and practice. Journal of Accountancy 136(3): 44.

- Lee T (1989) Education, practice and research in accounting: Gaps, closed loops, bridges and magic accounting. Accounting and Business Research 19(75): 237-253.

- Fogarty T, Jonas G (2010) The hand that rocks the cradle: Disciplinary socialization at the American accounting association’s doctoral consortium. Critical Perspectives on Accounting 21(4): 303-317.

- Fogarty TJ, Liao C (2009) Blessed are the gatekeepers: A longitudinal study of the editorial boards of The Accounting Review. Issues in Accounting Education 24(3): 299-318.

- Fogarty TJ, Zimmerman A (2019) Few are called, fewer are chosen: Elite reproduction in US academic accounting. Critical Perspectives on Accounting 60(C): 1-17.

- Lee T (1995) Shaping the US academic accounting research profession: The American Accounting Association and the social construction of a professional elite. Critical Perspectives on Accounting 6(3): 241-261.

- Lee T (1999) Anatomy of a professional elite: The executive committee of the American Accounting Association 1916-1996. Critical Perspectives on Accounting 10(2): 247-264.

- Lee P, Guthrie J, Gray R (1998) Accounting and management research: Passwords from the gatekeepers. Accounting, Auditing & Accountability Journal 11(4): 371-406.

- Lee T, Williams P (1999) Accounting from the inside: Legitimating the accounting academic elite. Critical Perspectives on Accounting 10(6): 867-895.

- Williams PF (2001) Who gets to speak and what must they say? A commentary on the Briloff affair. Critical Perspectives on Accounting 12(2): 213-219.

- Al-Adeem KR (2017d) Significance of announcing auditor switch by corroborations in Saudi Arabia: Analysis of professional and legal requirements. Accounting Thought Journal 21(2): 232-262.

- Basu S (2015) Is there a scientific basis for accounting? Implications for practice, research and education. Journal of International Accounting Research 14(2): 235-265.

- Fogarty TJ, Jonas GA (2013) Author characteristics for major accounting journals: Differences among similarities 1989-2009. Issues in Accounting Education 28(4): 731-757.

- Heck J, Jensen B (2007) An analysis of the evolution of research contributions by The Accounting Review, 1926-2005. Accounting Historians Journal 34(2): 109-142.

- Oehler C (1942) Theory and practice. The Accounting Review 17(3): 277-282.

- Previts GJ, Robinson TR (1996) A discourse on historical inquiry and method in accountancy. In: Coffman EN, Tondkar RH, Previts GJ (Eds.), Historical Perspectives of Selected Financial Accounting Topics (2nd edn), The McGraw-Hill Companies, Inc, New York, USA.

- Sy A, Tinker T (2005) Archival research and the lost worlds of accounting. Accounting History 10(1): 48 - 69.

- Wallace WA (1987) The economic role of the audit in free and regulated markets: A look back and a look forward. Research in Accounting Regulation 17: 267-298.

- Watts R, Zimmerman JL (1981) The markets for independence and independent auditors. Working Paper, University of Rochester, USA.

- Watts R, Zimmerman JL (1982) Auditors and the Determination of Accounting Standards. Working Paper, University of Rochester, USA.

- Watts RL, Zimmerman JL (1986) Positive accounting theory. prentice-Hall, New Jersey, USA.

- Watts RL, Zuo L (2016) Understanding practice and institutions: A historical perspective. Accounting Horizons 30(3): 409-423.

- Zimmerman J (1989) Improving a manuscript’s readability and likelihood of publication. Issues in Accounting Education 4 (2): 458-466.

© 2023 Khalid Al-Adeem. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)