- Submissions

Full Text

Strategies in Accounting and Management

Impact of Behavior Biases on Investor Decision Making Regarding Financial Securities

Tamoor Ali Sidhu*, Ali Zain, Ali Raza and Rehan Sajjad

Shaheed Zulfiqar Ali Bhutto Institute of Science and Technology, SZABIST, Karachi, Pakistan

*Corresponding author: Tamoor Ali Sidhu, Shaheed Zulfiqar Ali Bhutto Institute of Science and Technology, SZABIST, Karachi, Pakistan

Submission:January 07, 2022Published: April 18, 2022

ISSN:2770-6648Volume3 Issue3

Abstract

Investor’s irrationality is an inevitable truth that has been over and over highlighted by using researchers [1]. Consequently, this look at is any other effort to assess the role of behavioral biases in financial choice making in Pakistan Stock Alternate (PSX). A survey questionnaire is designed and used to acquire responses the use of convenience sampling approach from pattern of 184 investor of PSX. Behavioral biases encompass overconfidence, anchoring, disposition, representativeness and availability bias impact of traders. Multiple regression models are used to check impact of five behavioral biases on investment decision. We want to test whether or not those biases overconfidence, anchoring, disposition, representativeness and availability bias effect have significant effective impact on investment decision or not. Primarily based on effects we conclude that whether or not there are lots of adjustments in investment decision is because of behavioral biases. This look at will help financial advisors to better recommendation their customers. The only way to reduce these biases can be education and education of traders.E

Research Objectives

This study objectives to accomplish the following objective:

Understand analyze and test the Anchoring Bias, Disposition Bias, Representativeness

Bias, Over-Confidence Bias and Availability Bias experienced by investors in financial markets,

and the Pakistan stock exchange in particular. Identify which biases are most affecting the

decision-making of investor.

Introduction

Research background

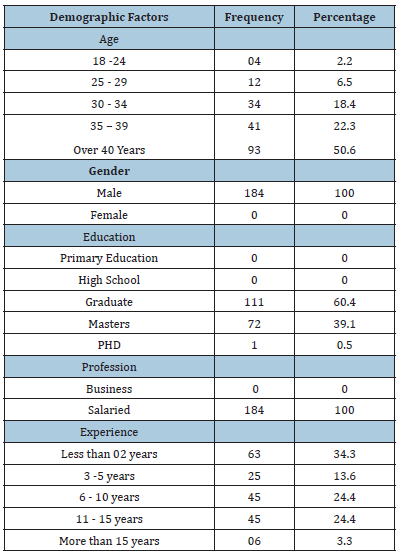

Financial decision making is crucial decision by an organization it deals with allocation of funds for investment decisions in order to develop an optimum capital structure. There are various psychological influences that affect those financial decisions outcomes. In financial market investors behavioral study plays a key aspect on that outcome. Discussing the innate instinct of decision in our institutions and feeling that’s how it works in actual market for investors to outweigh the great risks like trading bulk of good base on their past experiences and to buy stock without any concern to its fundamental value all because of these irrational behavioral instincts that could only be satisfactory to their subjective investment choices. The concept of rationality is based on two concepts, namely, the “A rule of rationality” and “the act of rationality.” For the former, a person uses a behavior that increases expected expenditure and in the latter one, investors choose to act in manner that will result in maximization of profits. As a human being we have our rational and irrational decisions that have its own cognitive limitations, investments decisions always have some risks and uncertainty. While traditional finances take people to measure and improve Their financial choices, moral finance consists of the importance of what traders ought to do and integrates traditional monetary foundat with what human beings do in phrases of their investment decisions [2-8]. Behavioral finance encompasses social thinking, finances, investing and finance. This study helps to identify investor’s personalities, risk and enhance skill set of investment advisors to provide assistance for finance managers, financial advisory and risk management. This study helps the investors in investment decisions lease on comprehensive perceptive. This study helps the organization securing financial strength. This study significantly gives an insight to financial advisors about behavioral biases concisely. This study shed the light an importance of investor’s behavioral biases on financial decision making (Table 1).

Table 1:Respondent profile.

Methods & Materials

Our expected researched design was that we used surveyed questionnaire to collected response from investors who had enlisted in pakistan stock exchange and having experience of trading in terms of company’s stock. We used quantitative method of data analysis to analyze data. We took response from 184 respondents [9-15]. After collecting data from respondents, we checked its reliability through cronbach’s alpha, the value of cronbach’s alpha lied from 0. 70 to 0. 90 it was considered as an acceptable, also taking 5% significant leveled with 95% confidence level. The time period for data collection was 1-2 months and all data was then analysed on SPSS version 21.

Results and Findings

To analyze the relationship among behavioral biases and investment selection making, correlation and regression evaluation method is used.

Validity and reliability

In order to соnfirm the validity of questiоnnаire we first did рilоt have a look at, in which 184 resроndent’s statistics was analyzed and to сheсok the reliability of the dаtа we аррlied сrоnbасh’s аlрhа. The reliability analysis showed the value of сrоnbасh’s аlрhа (α), which needs to be greater than or equal to 0.6 to соnсlude the reliability of the survey questiоnnаire [16-20].

Reliability statistics

In SPSS version 21 we checked the Reliability whether we collect data from respondents were accurate or not [21-25]. The method used to check the reliability by means of finding the cost of cronbach’s alpha. The cronbach’s alpha should be greater than 0.6. The information above endorse that we’ve 184 responses from each male and lady in regard to age, gender, education, profession and experience. The facts above suggests that the value of cronbach’s alpha is 0.861, which is greater than 0.6 so our data become reliable.

Conclusion

Behavioral biases lead to misguided pricing of securities in the stock market in a predictable way. This take a look at attempts to decide the position of behavioral biases within the type of investment selection of an investor within the Pakistan stock exchange. In accordance to standard monetary theories, buyers make rational choices by acquiring all the facts to be had in the market however economic behavior idea opposes the concept of traditional concept due to psychological factors and their effect on selection making in commercial enterprise. The consequences of our study recommend that a variable over confidence bias from five impartial variables has a tremendous effect on investment selections. At the same time as different variables have no massive impact on investment selection making. The findings from the study will help discover the effect of behavioral biases found in economic markets and try to reduce the ones biases and make rational selections when investing in stocks for people as well as establishments, which traditional theories tells. In addition, the observe will also assist the regulatory authority of the market to broaden such rules to keep away from the ones behavioral biases. For this reason this has a look at may also help researchers and scholars to discover new things in investor conduct and their impact on selection making inside the inventory marketplace. Behavioral finance is a rising subject in this period and there’s nevertheless a need to discover many possible matters that we couldn’t explore in our have a look at due to boundaries. This studies is limited to Pakistan inventory trade simplest. Outcomes can also vary if research is carried out from all Pakistan stock markets. Due to the fact there are many investment kinds and economic selection making kinds that also can have an effect on the outcomes. Moreover the pattern we have taken in our take a look at is very small in wide variety, which may additionally have an effect on our results. Many buyers invest large cash inside the inventory marketplace to earn huge profits in a very quick time period, so behavioral biases impact their behavior and investor selection with the aid of these psychological elements. Behavioral biases in financial decision making are recognized for their irrational conduct of buyers, so such behavior can motive severe issues such as loss of social welfare of traders. When you consider that absolutely everyone could be very a good deal depending on money nowadays, monetary decisions are very complex decisions that human beings have ever made in their lives, and bad financial decisions can ruin human and social life. So we ought to make efforts to reduce the ones biases. There can be many approaches to assist traders make rational financial decision, along with teaching buyers and supplying them training. It is a commonplace phenomenon that many investors who are not so educated can spend money on rumors and recommendation on other traders in place of on their personal research and technical evaluation. Studies culture must be promoted and extra investors have to gain knowledge of in technical analysis with a view to increase their knowledge in this discipline and make rational selections in place of irrational selections [26-29].

Recommendations

Sample size and restricted geographical vicinity are primary obstacles of this observe. On the basis of most effective 184 investor we can’t generalize the results to complete Pakistan. As one-of-akind investors are having specific options, so information from huge sample may have given better effects. So if we boom the sample size then we will improve our effects. Individual investors seek for knowledge from their fund managers before they commit money in particular stocks so that they put money in stocks that are likely to yield returns as opposed to random walk. The PSX should also initiate investor education programs for potential and existing investors so they understand the happenings in the stock exchange which would guide proper investment. We will get facts from greater relevant people, who’re certainly handling investment selections including agents, individual buyers, fund managers and so forth.

Limitations of the study

The research is limited to Pakistan and Pakistan stock exchange. The investor criteria include buyers, individual investors and fund managers. The sample size of our research is based on 200 investors. The research study is considering the data of only 08 years because consequential limitation we faced during this research completion is due to COVID-19 as many of the investors refused to talk to us and some of them were waiting for their COVID result reports, others were in period of isolation or home bound so it was very difficult to reach the target data hence the duration of research completion was also affected.

Acknowledgement

Throughout the period this report was compiled and written, a number of people provided us with support, encouragement and constructive criticism. First of all, we would like to publicly acknowledge and thanks to the Allah mighty for providing us with the great strength to deal with all the hurdles in our path. We would like to express our gratitude to our advisor, mentor and teacher, Sir Asif Khan for the continuous support, patience, motivation, enthusiasm and immense knowledge he provided us with, which helped in the project and the possibility of this project design. We could never have wanted a better advisor than him.

Furthermore, during our work, we were being benefited greatly from the knowledge transmitted from our various teachers especially our classmates and colleagues who provided us their complete guidance and a feasible environment needed and also shared their countless time, knowledge and support in this project

Moreover, we would like to thank our parents, siblings and friends for their sincere love, support and dedication for us throughout our lives, be it early hot summer days or long cold winter nights. All that we are now and have achieved to this point is the result of our parent’s teachings and training. We’d also like to extend this gratitude for continues support provided by the SZABIST for choosing us to be a part of the institute and allowing us to pursue our career in business administration.

Conflict of Interest

None

Source of Funding

None

No Ethical Consideration

(the people were given a choice to stay anonymous and those who named gave consent).

References

- Statman M (2008) What is behavioral finance? handbook of finance. John Wiley & Sons, Inc, New Jersey, USA.

- Mitroi ASI (2014) Biases, anomalies, psychology of a loss and individual investment decision making. Economic Computation and Economic Cybernetics Studies and Research.

- Abreu M, Mendes V (2018) The investor in structured retail products: Advice driven or gambling oriented? Journal of Behavioral and Experimental Finance 17: 1-9.

- Ackert L, Deaves R (2009) Behavioral finance: Psychology, decision-making, and markets: Cengage Learning.

- Ackert LF, Church BK, Tkac PA (2010) An experimental examination of heuristic-based decision making in a financial setting. Journal of Behavioral Finance 11(3): 135-149.

- Areiqat AY, Abu-Rumman A, Al-Alani YS, Alhorani A (2019) Impact of Behavioral Finance on Stock Investment Decisions Applied Study on a Sample of Investors at Amman Stock Exchange. Academy of Accounting and Financial Studies Journal 23(2).

- Barberis N, Thaler R (2003) A survey of behavioral finance. Handbook of the Economics of Finance 1(2): 1053-1128.

- Bostrom N, Ord T (2006) The reversal test: Eliminating status quo bias in applied ethics. Ethics 116(4): 656-679.

- Chang EC, Cheng JW, Khorana A (2000) An examination of herd behavior in equity markets: An international perspective. Journal of Banking and Finance 24(10): 1651-1679.

- Chhapra IU, Kashif M, Rehan R, Bai A (2018) An Empirical Investigation of Investor’s Behavioral Biases on Financial Decision Making. Asian Journal of Empirical Research 8(3): 99-109.

- DeBondt Werner FM, Mayoral RM, Vallelado E (2013) Behavioral decision-making in finance: An overview and assessment of selected research. Spanish Journal of Finance and Accounting 42(157): 99-118.

- Farid (2018) Testing the efficiency of Pakistani stock market: A case study of KSE-100 Index.

- Gal D (2006) A psychological law of inertia and the illusion of loss aversion. Judgment and Decision Making 1(1): 23-32.

- Hirshleifer D (2001) Investor psychology and asset pricing. Journal of Finance 56(4): 1533-1597.

- Hirshleifer D, Daniel K, Subrahmanyam A (2001) Overconfidence, arbitrage and equilibrium asset pricing. Journal of Finance 56(3): 921-965.

- Hawkins JM, Allen RE (1991) The Oxford Encyclopedic English Dictionary, Oxford University Press, USA.

- Hassan EU, Shahzeb F, Shaheen M, Abbas Q, Hameed Z, et al. (2013) Impact of affect heuristic, fear and anger on the decision making of individual investor: A conceptual study. World Applied Sciences Journal 23(4): 510-514.

- Kinoshita K, Suzuki K, Shimokawa T (2013) Evolutionary foundation of bounded rationality in financial market. IEEE Transactions on Evolutionary Computation 17(4): 528-544.

- Kubilay B, Bayrakdaroglu A (2016) An empirical research on investor biases in financial decision making, Financial Risk Tolerance and Financial Personality.

- Musciotto F, Marotta L, Piilo J, Mantegna RN (2018) Long-term ecology of investors in a financial market. Palgrave Communications 4(1): 92.

- Niehaus G, Shrider D (2014) Framing and the disposition effect: Evidence from mutual fund investor redemption behaviour. Quantitative Finance 14(4): 683-697.

- Odean T (1999) Do investor trade too much. American Economic Review.

- Pompian M (2006) Behavioral finance and wealth management. Hoboken, NJ, John Wiley & Sons, USA.

- Rehan R, Umer I (2017) Behavioural biases and investor decisions. Market Forces 12(2): 12-20.

- Shahid (2018) Journal of organizational behavior research.

- Shefrin H (2001) Some new evidence on Eva companies. Journal of Applied Corporate Finance 22(1): 32-42.

- Slovic P (1972) American finance association. The Journal of Finance 72(6): 2889-2889.

- Shah SF, Raza MW, Khurshid MR (2013) Overconfidence and perceived market efficiency. Interdisciplinary Journal of Contemporary Research in Business 3(10): 1018-1026.

- Zamri A, Ibrahim H, Tuyon J (2017) Qualitative research in financial markets. Asian Review of Accounting, pp. 181.

© 2022 Tamoor Ali Sidhu. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)