- Submissions

Full Text

Strategies in Accounting and Management

How did Spanish Cooperatives Fare in the Inter-Crisis Period (2008-2020)?

Mercè Sala-Ríos*

Department of Applied Economics, University of Lleida, Spain

*Corresponding author: Mercè Sala- Ríos, Department of Applied Economics, University of Lleida, Lleida, Spain

Submission:December 15, 2021Published: January 05, 2022

ISSN:2770-6648Volume3 Issue2

Abstract

We present some reflections about how Spanish cooperatives, the most important social economy entity in Spain, have fared in the period 2008-2020. We analyse their economic and financial profitability, because they are key indicators of the survival of a firm.

Introduction

The paradigm of a new form of organization, that has underlain the discourse of entities, organizations and states for many years now, makes more sense than ever in the post-COVID era. The values of the Social Economy focused on cooperative principles, solidarity, equity and democracy become fundamental. The empirical evidence indicates that those countries with higher levels of social movements and a greater boom in the social economy are more capable of managing crises [1]. Today this reality is intertwined with sustainable development goals: “Social Economy is a business model whose values and principles are fully consistent with the objectives of the sustainable development agenda”1 . In this model, people are at the core and business activity is not the goal but a way to guarantee better collective well-being under a participatory and democratic process committed to the planet. In the post-pandemic era, the social economy should be at the core of decisions-makers’ agenda. We present some reflections about how Spanish cooperatives, the most important social economy entity in Spain, have fared in the period 2008-2020. We analyse their economic and financial profitability, because they are key indicators of the survival of a firm. The analysis is carried out breaking down cooperatives into four categories, depending on their turnover: micro (turnover ≤ 2 million), small (2 < turnover ≤ 10 million), medium (10 < turnover ≤ 50 million), and large cooperatives (turnover > 50 million) [2].

Main Result

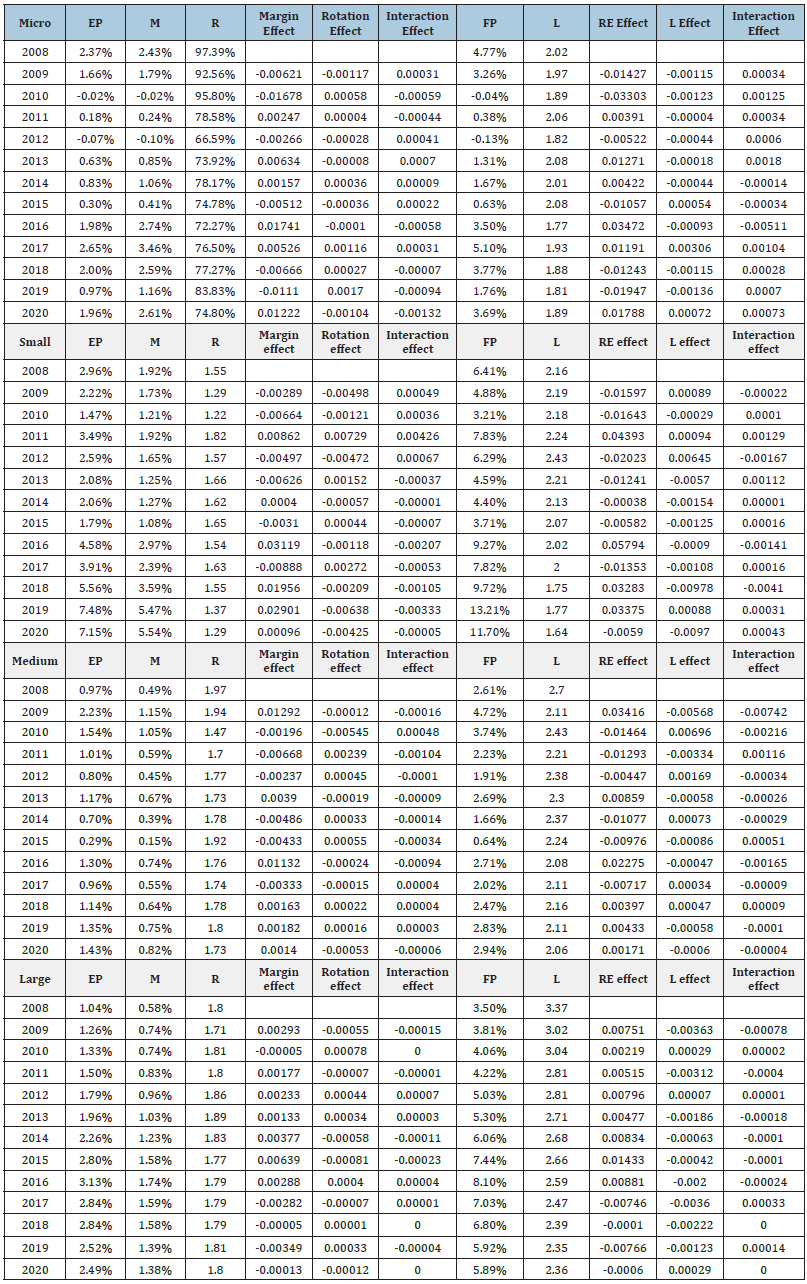

The results over the years are presented in Table 1. We highlight the main features:

1. The margin effect is the determinant of the behaviour of economic profitability (EP)

and, at the same time, EP is the key determinant of financial profitability (FP).

2. The 2008 crisis involved a significant percentage of

cooperatives that presented negative profitability. We can find

this in all sizes, although it is more important in micro and

especially small cooperatives.

3. Faced with the 2008 crisis, the recovery of medium and

large cooperatives was ahead of the recovery of micro and small

cooperatives.

4. The COVID-19 crisis increased the negative profitability

of micro, small and medium cooperatives. In contrast, large

cooperatives showed greater resilience.

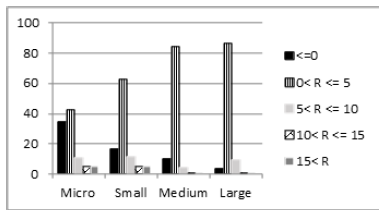

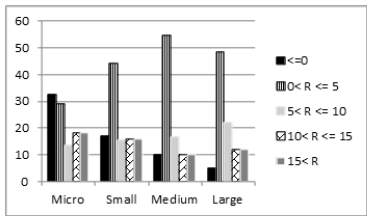

5. We break down EP and FP into five ranges (R): R ≤ 0; 0< R ≤

5; 5< R ≤10; 10< R ≤ 15, and 15< R [3]. The highest percentages

are those in the range (0

Conclusion

The literature tends to argue that there is a positive relationship between size and profitability [4-6]. Our results do not fit in with this result. There does not seem to be a positive relationship between size and profitability. However, it is true that greater resilience and earlier recovery are shown by large cooperatives.

Table 1: EP, FP and effects by cooperatives’ size.

Source: SABI and author’s compilation.

Figure 1: Economic profitability. Percentage by range

(Period average).

Source: SABI and author’s compilation.

Figure 2: Financial profitability. Percentage by range

(Period average).

Source: SABI and author’s compilation.

References

- Chaves R (2020) Covid-19 crisis: Impact and responses of the social economy. News from the Public, Social and Cooperative Economy 63: 28-43.

- European Commission (2016) User guide to the SME Definition.

- Menéndez Á, Mulino M (2021) Results of non-financial companies until the fourth quarter of 2020. A preview of the year-end. Economic Bulletin-Bank of Spain (2): 1-16.

- Alarussi AS, Alhaderi SM (2018) Factors affecting profitability in Malaysia. Journal of Economic Studies 45(3): 442-458.

- Gharaibeh OK, Bani Khaled MH (2020) Determinants of profitability in Jordanian services companies. Investment Management and Financial Innovations 17(1): 277-290.

- Nanda S, Panda AK (2018) The determinants of corporate profitability: An investigation of Indian manufacturing firms. International Journal of Emerging Markets 13(1): 66-86.

© 2022 Mercè Sala-Ríos. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)