- Submissions

Full Text

Strategies in Accounting and Management

Things to Consider When Implementing Building Blocks Approach for Global Sustainability Reporting Standards

Jongsoo Han1* and SoHyeon Kang2

School of Business, Ewha Womans University, Republic of Korea

*Corresponding author: Jongsoo Han, Professor of Accounting, Ewha Womans University, Republic of Korea

Submission:September 17, 2021Published: November 29, 2021

ISSN:2770-6648Volume3 Issue1

Opinion

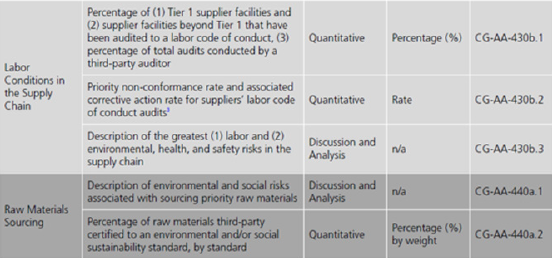

The Trustees of the IFRS Foundation has released three documents since September 2020 delving into the convergence in global sustainability reporting standards. SASB, GRI, TCFD, CDSB and CDP have agreed upon the collaboration to form the ‘building blocks’ approach for global non-financial reporting [1-3]. IFAC and IOSCO have also announced their support for this approach. As for the scope, the trustees announced a ‘climate-first’ approach that prioritizes Environmental issues among non-financial factors which compose of corporate sustainability. Inter alia, climate change and Greenhouse Gas (GHG) emissions will be the first focus. After that, it takes into consideration of wider environmental factors associated with financial risks. Then, the trustees plan to broaden its work overtime to focus on other criteria composing of non-financial reporting fields such as Social (S) and Corporate governance (G). Hear. We also see the ‘building blocks’ approach is great. Since many guidelines and measurement methodologies already exist when it comes to the Environment (E), they can provide substantial benchmark as a first step towards non-financial disclosures. However, there are things to note when adopting current principles by the trustees. We render three points to keep in mind before building the first block as per current approach. First, certain different properties exist on several points among E versus S, G in terms of their measurement methods, monetization potential, and the way how it is disclosed. With more than 20 years of global interest and joint effort represented by The Kyoto Protocol adopted in 1997 and Paris Alignment in 2015, methodologies for measurement and disclosure of E are substantially advanced. In most widely used international reporting tool, GHG emission including carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O) can be reported in units of tons emitted in a year. Then, reflecting it as monetized in the financial statements as illustrated in Figure 1 seems not so much problematic according to the fair value of emission since carbon markets have formed already. However, in terms of the S and G factors, the story can be different. GRI and SASB (refer to Figure 2) provide some guidelines regarding what to report as S and G metrics, but still, many more metrics need to be considered. Moreover, it is difficult to imagine at this point to monetize such values. Taking all things into consideration, a macroscopic blueprint is needed even in this ‘building block’ and ‘climate first’ approach, regarding whether non-financial information which is composed of E, S, and G that are whole different pillars in their nature regarding how all of these non-financial factors can be tied up under universal conceptual framework. Hence, the wholistic concept such as “conceptual framework of non-financial reporting” that can be compatible with S and G factors should be considered from the first step establishing standards for E factor in advance.

Figure 1: Climate-related risks, opportunities, and financial impact. (Source: TCFD [4]).

Figure 2: An excerpt of sustainability disclosure topics and accounting metrics by industries (Source: SASB [5]).

Second, when disclosing non-financial information represented

by ESG, tendency to disclose only positive information without

mentioning any negative matters is clearly observed. In IIRC

framework published in January 2021, it states “an integrated

report should include all material matters, both positive and

negative, in a balanced way and without material error” [4-6].

However, in reality, it is difficult to find a company that is reporting

non-financial information which contains negative impact toward

its firm value which can significantly mislead investors and other

market participants’ decision making. Volkswagen’s diesel scandal

in 2015 is a good example. In its 2014 Sustainability report that was

released right before the scandal, Volkswagen only highlighted how

much it contributes to renewable energy and made no mention of

risk factors hinting its cheating on emission test. In regard to this,

academic papers point out that current disclosure of corporate

sustainability is not so much different from corporate IR (Investor

Relations) or marketing tool [7,8], and concerns arises about the

potential risk of green washing or window dressing [9-11]. Despite

the GRI guideline and SASB standards that provide 77 industryspecific

standards and sophisticated metrics, selective releases

picking only positive content are occurring. Hence, paying close

attention is essential to whether new standards for corporate

sustainability reporting can be enacted in a way that can provide

investors balanced information according to the materiality,

regardless of whether it’s positive or negative.

Lastly, harmonization with existing accounting standards

should be considered even at this early stage embarking the

‘building blocks’ approach with E factor. Under the current

circumstances, it is expected the sustainability report and the

financial report to be published as separate ones. Nonetheless,

combining these two into a single report that implies holistic

information about the company that explains well on firm value

would be necessary at ultimate level. Such discussions have been

around for about a decade. According to recent research, 90% of

S&P 500 market value is explained by intangible assets and there is

only room for the rest 10% for tangible assets in 20201. In line with this, the FRC (Financial Reporting Council) published “business

reporting of intangibles: realistic proposals” in 2019 noting that

many intangibles cannot be recognized in financial statements

given the IASB’s Conceptual Framework’s current definition of

assets and recognition criteria so the compatibility with societal

change is urgent [12]. As such, existing debates over financial

standards related to intangible assets for intellectual capital or

expenses for R&D, etc. are still not ended. At this point, the more

radical ESG information is a preemptive question about how to be

integrated in accordance with the current conceptual framework

and standards for financial reporting.

Footnote

1Intangible asset market value study 2020 by Ocean Tomo, LLC

References

- IFRS Foundation (2020) Consultation paper on sustainability reporting.

- IFRS Foundation (2021) IFRS Foundation trustees’ feedback statement on the consultation paper on sustainability reporting.

- IFRS Foundation (2021) Proposed targeted amendments to the IFRS foundation constitution to accommodate an international sustainability standards board to set IFRS sustainability standards.

- TCFD (2017) Recommendations of the task force on climate-related financial disclosures.

- SASB (2018) SASB Guideline for Consumer Goods Sector.

- IIRC (2021) International <IR (Integrated Reporting)> framework.

- Baldassarre F, Campo R (2016) Sustainability as a marketing tool: To be or to appear to be?. Business Horizons 59(4): 421-429.

- Kumar V, Rahman Z, Kazmi AA, Goyal P (2012) Evolution of sustainability as marketing strategy: Beginning of new era. Procedia-Social and Behavioral Sciences 37: 482-489.

- Zharfpeykan R (2021) Representative account or greenwashing? voluntary sustainability reports in Australia's mining/metals and financial services industries. Business Strategy and the Environment 30(4): 2209-2223.

- Khan HZ, Bose S, Mollik AT, Harun H (2020) Green washing or authentic effort? An empirical investigation of the quality of sustainability reporting by banks. Accounting, Auditing & Accountability Journal 34(2).

- Lewis JK (2016) Corporate social responsibility/sustainability reporting among the fortune global 250: Greenwashing or green supply chain?. In Entrepreneurship, Business and Economics. Springer, Cham 1: 347-362.

- FRC (Financial Reporting Council) (2019) Discussion paper: Business reporting of intangibles: Realistic proposals.

© 2021 Jongsoo Han. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)