- Submissions

Full Text

Strategies in Accounting and Management

Greenhouse Gas (GHG) Emissions Accounting Systems: Testing the Rationale Behind Corporate Verification Practices

Mel Gabriel* and Jatin Nathwani

Department of Management Sciences (MSCI), University of Waterloo, 200 University Avenue West Waterloo, Ontario, Canada N2L 3G1, Canada

*Corresponding author: Mel Gabriel, Department of Management Sciences (MSCI), University of Waterloo, 200 University Avenue West Waterloo, Ontario, Canada N2L 3G1, Canada

Submission:May 31, 2021Published: June 17, 2021

ISSN:2770-6648Volume2 Issue4

Abstract

The total quantity of GHG emissions produced within or beyond the boundaries of a firm’s business activities, owned or non-owned, is of a great concern with respect to verification. A carbon accounting system enables an organization to audit its GHG emissions inventory, and it is becoming a standard requirement for most businesses to shape future decision-making. Currently, corporations use GHG emissions inventory data for regulatory compliance, raising capital in the market and reputational assurance. The scholarly and non-academic body of knowledge that deals with the critical aspects of verifying GHG emissions inventories involves using a protocol or a standard to verify an entity’s reported inventory. Currently recognized GHG reporting protocols and standards specify acceptable verification methods and emphasize GHG emissions inventory assurance. The goal of this paper is to understand the rationale and relative importance of corporate verification of GHG emissions. We identify the potential drivers underlying corporate GHG emissions verification practices and highlight the governing principles to classify them based on the extant scholarly literature. We studied a sample of the S&P 500 companies that were recognized by the Carbon Disclosure Project (CDP) as best-in-industry for disclosure of GHG emissions information based on the Climate Disclosure Leadership Index (CDLI). A logit model was built to estimate the probability that a company would verify its GHG emissions given the values of the explanatory variables. GHG emissions verification practices data as well as its drivers were collected from the publicly available sustainability or corporate social responsibility reports. The analysis showed that the main drivers for corporate GHG emissions verification include meeting mandatory regulatory requirements and/or complying with voluntary GHG emissions reporting standards as well as responding to emerging requirements for GHG emissions trading programs and stakeholders demand for full disclosure of GHG emissions to demonstrate environmental stewardship and social responsibility.

Keywords: Greenhouse gas emissions; GHG; Verification; Carbon accounting system; Emissions inventory; Regulatory compliance; Corporate verification; Reporting protocols; Content analysis; Sustainability; Corporate social reasonability; Business ethics; Climate change; Corporate disclosure

Introduction

It has been established that burning fossil fuels contributes to global warming, and there

is growing concern that climate change has the potential to create havoc [1]. Corporations are

becoming well aware of the serious long-term impact of GHG emissions on the environment

[2]. Organizations around the world are striving to reduce and eliminate their operations’

detrimental environmental effect and emphasizing green initiatives that might help to improve

the Earth’s climate [3]. Corporate leaders are increasingly beginning to accept the views that

they must balance the rate of their GHG emissions generation with mitigation or adaptation

strategies that may also involve sequestration to reduce further impacts on climate change

[4]. GHG emissions reduction has become of increasing interest to almost all stakeholders [5].

Knowledgeable consumers are paying premiums for “green product” to help combat climate

change and limit mean global surface warming to 2 °C [6]. Industry leaders are looking for

unconventional solutions to lessen the severity of the climate change problem [7]. As they get more involved in climate change issues, they are demonstrating

greater interest in the verification of GHG emissions inventories [8].

According to Young [9], carbon accounting systems are critical

to any corporate climate governance scheme and have become the

standard for most businesses that want to go green [10]. These

systems entail tracking, accounting and reporting GHG emissions,

and they need stakeholders to buy in before being implemented

[11]. As more organizations are being encouraged to openly report

their environmental footprint, GHG emissions reduction initiatives

have become highly publicized [12]. However, scholarly studies

on corporate GHG emission assurance that was communicated

recently in sustainability reports and related documents have

raised serious questions regarding credibility, especially due to

the absence of established verification procedures [13]. Corporate

disclosure of GHG emissions quantities without adequate

validation cannot satisfy stakeholders’ requirements [14]. Power

[15] argued that audit philosophies emphasize the importance of

verifiability. The verification process normally involves assessing a

firm’s reported inventory according to data relevancy, consistency,

and dependability, and includes reporting accuracy, credibility,

and reliability [16]. Currently, recognized GHG reporting protocols

and standards (e.g., The GHG Protocol, ISO 14064 standard)

place little emphasis on GHG verification [17]. However, some

governments have established standards for validating GHG

emissions for specific programs, while more general approaches

for verifying GHG emissions have evolved over time [18]. The

absence of a generally accepted GHG emissions verification and

validation protocol has generated an immediate need for one.

Given the current situation, companies are diligently working

to confirm the accuracy and consistency of their GHG emissions

estimates, which minimizes the risk of human error and reduces

the likelihood that decision-makers will be led astray by misleading

information [19]. Verification method depends on the firm’s goals

and objectives. Self-verification involves using trained auditors

within the organization to independently check documentation

and calculations for errors or omissions. Self- verification should

be sufficient for use of results to drive internal business practices

but may not be adequate for broader societal acceptance. However,

public disclosure of a corporation’s carbon footprint may require

independent verification. Third- party verification organizations,

such as Bureau Veritas and Cventure, use official certified auditors

to provide the highest level of GHG emissions validation [19].

External validation services are typically offered through thirdparty

providers. Independent verification deals also with publicly

published corporate sustainability reports to review the relevance

of reported information on GHG emissions, boundaries assessed,

applied methodology and assessment period.

The target audience and goal of the carbon footprint determine

the report’s level of detail and scope. However, public sustainability

reports usually include the best available data at the time of

publication and should clarify the limitations of the data [17]. When

the carbon footprint is determined on a periodic basis, reports

normally include GHG emissions level trends [20]. To examine

the motivations behind corporate GHG emissions inventories

verification, the paper classifies current GHG emissions verification

principles and identifies different drivers. The framework developed

was later tested using a sample of truly sustainable firms identified

by CDP using content analysis. According to Ahn [21], companies

have different motivations for verifying their GHG emissions.

According to our analysis, some firms might be required to assure

external stakeholders that they are accurately reporting their GHG

emissions and meeting their targets. Other firms might be required

to publish verified GHG emissions in an environmental indicator

report, or demonstrate specific results as part of implemented

reduction projects. The possibility of meeting requirements for

trading GHG emissions reductions could encourage certain firms to

pursue GHG emissions verification. In general, firms that consider

GHG emissions verification clearly understand their goals and

pursue a verification approach to reach those goals [22].

Literature Review

According to the BSI (British Standards Institution), verification

is a validation process that confirms that a firm’s reported GHG

emissions data meet transparency, dependability and creditability

standards. The GHG Protocol defines verification as the process of

ensuring users that a company’s reported GHG information and

associated statements are faithful, accurate and representative.

Companies may use different verification approaches, and

common patterns often require third-party verification. However,

companies may employ self-verification methods such as US EPA

self-certification approach. Global standards for corporate GHG

verification are still in their infancy. This includes EU ETS protocols,

which are considered the most advanced emissions control

schemes, and ISO 14064-3 standard (which will be complemented

by ISO 14065) that specifies GHG emissions principles and provides

guidance for companies that conduct or manage validation of

GHG emissions data. According to Sundin [23], the absence of an

internationally accepted GHG emissions verification protocol or

standard has led to variations in assertion methodologies. As a

result, this limits the comparability of verification procedures

disclosed in environmental governance reports. It also raises doubts

about the reliability and credibility of reported GHG emissions data.

While it is not mandatory, more companies are verifying their GHG

emissions [24]. According to CDP [25], 55 percent of companies

publicly disclosing their environmental performance had verified

their GHG emissions data using external verifiers compared to

39 percent in 2011. A survey on corporate governance showed

that 70 percent of US and UK corporate respondents believe that

independent parties should verify GHG emissions reported [26].

According to Kolk [14], corporations are becoming increasingly

aware that they should verify and validate their GHG emissions

reported. By using external or internal verification approaches,

they demonstrate the importance of adding another element of

credibility to their extant efforts for more trustworthy environmental

governance. Therefore, it is becoming vital to understand the drivers

behind corporate GHG emissions verification. According to Kolk

[27], corporations verify their GHG emissions to meet an urgent

need of complying with laws and regulations, as well as adapt to the changing GHG emissions reporting standards. Governmental

regulations and policy instruments that address eschewing GHG

emissions are rapidly developing [28]. According to the report

published by the GRI, UNEP, University of Stellenbosch and KPMG,

voluntary and mandatory GHG emissions reporting standards are

evolving [29]. The report showed that as regulations grow more

stringent and standards become more complicated, the number of

firms verifying their GHG emissions also increases.

A key motivator for corporate GHG emissions verification is the

establishment of worldwide GHG emissions trading schemes [30].

National and sub-national carbon markets are being developed

across the US, Europe, Japan, New Zealand and Australia. Their

integration process is becoming vital and among the urgent

topics of discussion are the reduction of carbon leakage and the

potential solution of competitiveness issues. China, India and

South Africa have established regulations that directly require

emission accounting and reductions; their GHG emissions trading

mechanisms are becoming more complex and carbon market

efficiency is capturing more attention [31]. Another driver of

corporate GHG emissions verification is the increasing demand

from stakeholders for the disclosure of accurate and reliable

GHG emissions. With increasing awareness of climate change

challenges and opportunities, consumers are now calling for

greater transparency and third-party assessment of corporate

published data on GHG emissions and reduction efforts [32]. For

example, product certification (e.g., green electricity, carbonneutral

products) requires third-party GHG emissions verification

[33]. Corporations are also establishing their own review panels

to verify GHG emissions, reductions, and offsets. Corporate GHG

emissions verification is carefully associated with Corporate Social

Responsibility (CSR) as per many authors’ notes. Many experts find

that corporate GHG emissions verification and CSR are associated

[34]. Steurer et al. [35] argued that they have converged to very

similar concepts in recent years. Cheung [36] demonstrated that

CSR adopted by major Asian firms, involved implementing explicit

policies that emphasized strict ethical behaviour and implementing

explicit policies on environmental responsibility such as verifying

GHG emissions. Non accurate and unverified GHG emissions data

can cause negative media exposure, and damaged reputations for

companies. Firms undertake voluntary initiatives to preserve and

restore the habitat and reduce their GHG emissions, as opposed

to proactive initiatives that involve only controlling emissions, are

using independent parties to verify their GHG emissions reported

and partnering with stakeholders for environmental preservation

and social prosperity.

Conceptual Framework and Hypotheses

Conceptual framework

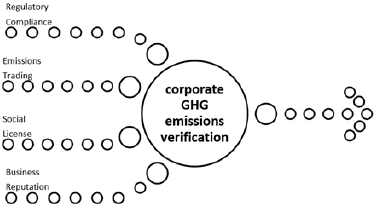

Companies have different motivations to verify GHG emissions. Figure 1 shows the conceptual framework developed to demonstrate the different motivations underlying corporate GHG emissions verification. Based on the literature reviewed, companies are driven to verify their GHG emissions to meet regulatory requirements, trade GHG emissions, react to climate-related challenges and opportunities, respond to stakeholders’ demands for disclosure of GHG emissions information, and conduct a responsible business.

Figure 1: Corporate GHG emissions verification conceptual framework.

Hypotheses

Corporate GHG verification practices are driven by the firm’s desire to comply with current and future voluntary and mandatory GHG emissions reporting standards and regulatory schemes

Based on recent EPA figures, GHG emissions verification is becoming mandatory for US facilities emitting 25 thousand metric tonnes or more. Also, Canadian establishments that produce 50 thousand metric tonnes or more must submit a verified GHG emissions report to Environment Canada. The new guidelines published by the UK government require firms to validate reported GHG emissions [37]. Australian firms emitting 125 thousand metric tonnes or more must report and verify their GHG emissions, while Japanese facilities that produce three thousand metric tonnes or more are obligated to verify their GHG emissions. Based on these regulatory schemes, the GHG emissions verification process is becoming mandatory. However, GHG emissions verification protocols and standards are evolving. Based on current protocols and standards, it is the company’s responsibility to report true GHG emissions data to avoid being held liable for fraud or deception. As a result, companies will have to verify their GHG emissions to comply with regulatory schemes and demonstrate adherence to different standards. This will help them to avoid fines and penalties. Even though regulations and standards might not yet be in place, engaging in GHG verification will ultimately prepare companies for future compliance and adequate reporting [38].

Corporate GHG verification practices are typically driven by developing requirements for the emerging GHG emission reductions trading regimes

Woerdman [39] argued that trading GHG emissions helps in meeting regulatory requirements. Regulatory programs that include trading of GHG emissions closely monitor and verify emissions to ensure accurate reporting of excess emissions reductions. In any bilateral GHG emissions trading contract, verification is an integral part of the negotiations phase. Third-party verification is mandatory and external verification certifications are required for tractability purposes [40]. As there is no established verification standard or protocol, verifying emissions reductions vary according to reduction type and verification firm [41]. Zapfel [42] argued that the EU has a long history in GHG emissions trading. The EU ETS is taking the lead to develop guidance for GHG emissions calculations and verification reductions [43]. The state of New Jersey addressed GHG emissions verification in its Open Market Emission Trading (OMET) program, while market mechanisms in California, Tokyo and Australia are following the same path. These GHG emissions trading markets depend on the reliability, credibility and consistency of verified GHG emissions data. Carbon credits are an effective way for corporations to reduce current and future GHG emissions Lovell, Bulkeley, and Liverman, 2009, p. 2357. Besides cost effectiveness in accomplishing the firm’s annual GHG emissions targets Galatowitsch [44], it can serve as a best practices model to stay ahead of the regulatory curve [45]. As volumes of carbon offsets do not have to be purchased in the same location, compensation for generated emissions could be achieved through carbon reduction in several locations. Therefore, verification of GHG emissions will help companies to register and submit accurate GHG emissions data and trade surpluses within any regime.

Corporate GHG verification practices are usually driven by increasing demand from stakeholders for the disclosure of accurate and reliable GHG emissions information

Srivastava [46] argued that sharing accurate and reliable GHG emissions data is becoming a must to establish a supply chain that could be labelled green. However, industry leaders’ extensive efforts to assimilate climate change concerns into the supply chain are increasing the demand for comprehensible and comparable GHG emissions data. Chaabane [47] argued that corporations could access novel markets by verifying GHG emissions. Supply chain business partners want verification of corporate GHG emissions performance claims. Independent verification enables companies to manage the potential risk involved in investment and procurement. It is obvious that companies are showing signs of concern regarding climate change-related issues. As a result, management boards continue to pay greater attention to GHG emissions verification practices. Executive boards are pushing for robust, complete and comparable GHG emissions data. Whether they employ self-verification or third-party auditing, management boards are looking for methods that help them to meet their objectives; ultimately, GHG emissions verification is not questionable. Levy [48] argued that institutional entrepreneurship can create or transform an existing institution’s arrangement by leveraging resources differently. Institutional context plays a critical role in environmental disclosure, especially in corporate GHG emissions verification practices [49].

It is becoming a common practice that GHG emissions reduction initiatives and related key performance indicators are used in the valuation of corporate assets [14]. Now a day, firms understand their financial performance and carbon footprint are working hand-in- hand to determine the future of its operations [50]. Consequently, investor plays a critical role in pushing firms to verify disclosed GHG emissions information. In a carbon-restricted economy, employees are demanding that their companies publish accurate, trustworthy and reliable GHG emissions information. Verification of corporate GHG emissions is a must to understand their corporate future carbon strategy. It also helps in defining associated risks and related opportunities based on the current and future levels of GHG emissions. Miscalculating or misjudging GHG emissions can seriously impact the organization’s long-term viability, perception of multiple stakeholders, as well as it social license of operation, which indicates the level of acceptance by the community [51]. Climate change challenges and opportunities have forced NGOs and other stakeholders to ask for third-party verification for publicly published corporate GHG emissions data [19]. For example, CDP’s ‘shaming’ pressure of Boeing forced the company to answer its environmental performance questionnaire and to verify its GHG emissions using a third-party auditor with GHG emission certification as proof. US investment bank Morgan Stanley was on CDP’s ‘wall of shame’ for two consecutive years, which shaped its future GHG emissions disclosure and verification. To conclude, social license of operation is granted by all the stakeholders that are going to be impacted by firms’ activities.

Corporate GHG verification practices are partially driven by the evolving requisite for responsible business conduct

Corporate Social Responsibility (CSR) can be viewed as either explicit or implicit [52]. Explicit CSR is tied to business ethics. It takes into consideration corporate guidelines that are voluntary in nature. Also, it includes green strategies that dictate the company’s stance toward societal interests. Business ethics begin where the law ends [53]. Corporate citizenship is calling for the incorporation of climate change issues into a firm’s day-to-day activities. Prado- Lorenz et al. [54] expressed the need for accurate, true and reliable GHG emissions data, and the growing demand for trustworthy data will continue to stem from the evolving requisite for responsible business conduct.

Research Method

In our opinion, content analysis is the most appropriate research methodology for these types of studies. Weber [55] stated that content analysis is used to examine organizational communications published in different media forms. This research technique can make inferences using an objective and systematic approach to analyze verbal or written communications [56]. Content analysis was developed to obtain inferences about a predefined problem using the communication’s content [57]. It is a conceptual analysis that attempts to answer an identified research question using an appropriately selected sample [58]. To examine our corporate GHG emissions verification conceptual framework, we conducted a content analysis using the communicated text published on selected firms’ environmental websites and sustainability annual reports [59]. The coding process was done in Excel using a selective reduction technique with a series of key words and its synonymous (e.g., audit, third-party, assurance, emissions, offsets, responsible...etc.). We selected a sample of firms based on the 2012 CDP classification for Global 500 companies. The CDP survey was administered on all 500 companies based on publicly reported GHG emissions. The ranking of companies was performed using a leadership index, which was calculated based on disclosed GHG emissions information.

Sample

Our sample comprises 52 companies that made it into the CDP ranking, which is the most widely used methodology and highly appreciated by scholars. Using the 2012 list has given more width to the research as ISO 14064-3 for GHG emissions verification was introduced along with a couple of influential verification approaches. These verification approaches specifically place more emphasis on the use of third- party assurance firms. Using the recently published information from the 52 companies’ environmental websites and sustainability reports text, we performed our content analysis on the written text using the selective reduction technique to infer reasonable possibilities about the motivation that drove those firms to verify their GHG emissions. The probing technique involved an in-depth examination of the language, references and specific detail used in the reports along with the attestations that provided insights into the reasons underlying the construction of GHG emissions verification communication. We used a consistency approach to establish standardized analytics, and analysis involved verification trends identification where applicable. Intuitively, the expected variations within the sample were assumed to be minor based on the degree of capture. However, there were notable variations between firms published data. As the paper analyzed the best of what is available, we are confident in the results.

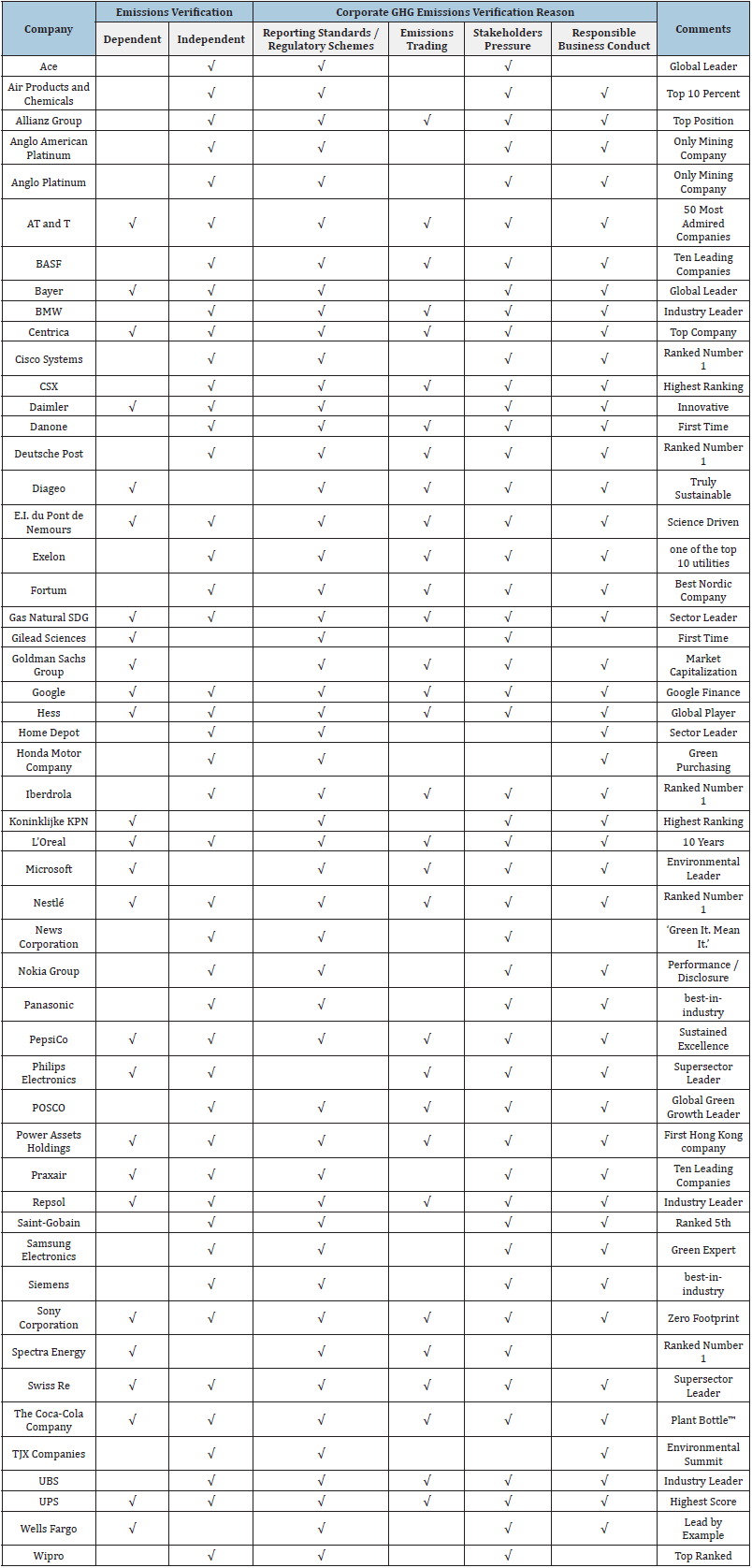

Result

The results show that verification is a growing activity within the sample of companies’ studied. Most companies that have publicly reported GHG emissions either on their environmental websites or sustainability annual reports have pursued external verification for publicly published data. Of the 52 entities sampled in our study, 45 have independent verification of their GHG emissions, which represents approximately 86% of the sample. However, some companies preferred to verify on a voluntary bases before independent verification. Table 1 shows both activities (i.e., dependent and independent verification) performed by firms as of 2012. Some firms tracked their GHG emissions and acted internally upon this information solely, while others used both approaches. Although most of the corporations are not obligated to independently verify their GHG emissions, many are doing so voluntarily using either approach (i.e., self-verification or third-party verification) or both. Companies that have verified GHG emissions inventories have various reasons for doing so, including pressures from external or internal parties, the need to verify reduced emissions due to engagement in an emissions trading regime, or ethical conduct. Table 1 presents a summary for the content analysis coding worksheet. The results showed that 100 percent of the companies we studied verified their GHG emissions to meet mandatory and voluntary GHG emissions reporting standards and regulatory schemes. Only 60 percent of the firms validated their reported GHG emissions to react to developing requirements for GHG emissions reduction trading programs. Almost 95 percent of the firms were able to respond to demand from stakeholders for proper disclosure of GHG emissions information through different verification methodologies. For 90 percent of the firms to demonstrate proper business conduct, they verified GHG emissions using either approach (i.e., self-verification or third-party verification) or both. Based on the data collected in Table 1, although corporate GHG emissions verification is not mandatory, companies are perceiving verification as an essential step for future compatibility [60-62].

Table 1: Content analysis coding worksheet.

Discussion

This investigative study tries to draw on the extant research within the field of GHG emissions disclosure to answer the question, “Why do corporations have to verify their GHG emissions reported?” by testing the developed corporate GHG emissions verification conceptual framework. The research showed that verification practices can be driven by the firm’s need to comply with mandatory and voluntary GHG emissions reporting standards and regulatory schemes. Another driver is the requirement for GHG emissions reduction trading regimes. The increasing demand from various stakeholders for the disclosure of accurate and reliable GHG emissions information has the potential to highlight corporate weaknesses in its business practices and expose it to corporate reputational risk. Corporate GHG verification practices can be further re-enforced by being recognized for its leadership CSR. Some companies use environmental websites, sustainability annual reports and/or similar documents to report their GHG emissions to public, while others post GHG emissions profiles on public disclosure portals (e.g., CDP and TCR). Many companies have reached a critical decision point with respect to GHG emissions verification, which involves assessing their reported GHG emission inventory using a third-party to establish applicability, comprehensibility, reliability, comparability and dependability of the data presented. Employing an external GHG emissions data verification expert can assure the company that its numbers are correct.

Implications

Proper auditing of GHG emissions data is essential for ensuring stakeholder confidence. However, audit results can vary widely due to the lack of a regulated standard for voluntary GHG reporting. Audits can range from interviews with personnel who compile the inventory to more thorough data analysis. There is a move toward full public disclosure of GHG data, and conceivably very few companies will have failed to disclose emissions data. Eventually, independent verification of all companies’ GHG data will become the standard, and stakeholders will label corporations that have not done so as laggards. In our opinion, corporations can use verification to improve their image, reinforce their presence, and establish good rapport with stakeholders. With more corporations publicly reporting their GHG emissions, a growing array of interests is converging to use this data. Companies engage in emission verification for four reasons: (a) to meet mandatory and voluntary GHG emissions reporting standards and regulatory schemes; (b) respond to developing requirements for GHG emissions reduction trading programs; (c) act to demand from stakeholders for proper disclosure of GHG emissions information to obtain the social license for operation; and (d) demonstrate leadership in corporate social responsibility.

References

- Ash C, Culotta E, Fahrenkamp-Uppenbrink J, Malakoff D, Smith J, et al. (2103) Once and future climate change. Science 341(6145): 472-473.

- Wilkinson A, Hill M, Gollan P (2001) The sustainability debate. International Journal of Operations & Production Management 21(12): 1492-1502.

- Griffiths A, Petrick JA (2001) Corporate architectures for sustainability. International Journal of Operations & Production Management 21(12): 1573-1585.

- Meinshausen M, Smith SJ, Calvin KV, Daniel JS, Kainuma M, et al. (2011) The RCP greenhouse gas concentrations and their extension. Climatic Change (Special Issue), pp. 1765-2300

- Simnett R, Vanstraelen A, Wai FC (2009) Assurance on sustainability reports: An international comparison. Accounting Review 84(3): 937-367.

- Piecyk M (2010) Carbon auditing of companies, supply chains and products. In: McKinnon, et al. (Eds.), p. 49.

- Lodhia S, Martin N (2012) Stakeholder responses to the national greenhouse and energy reporting act. Accounting, Auditing & Accountability Journal 25(1): 126-145.

- Deegan C, Blomquist C (2006) Stakeholder influence on corporate reporting: An exploration of the interaction between WWF-Australia and the Australian minerals industry. Accounting, Organizations and Society 31(4-5): 343-372.

- Young SB, Abbott C (2013) Developing integrated carbon accounting systems. In: Craik N, Studer I, Van Nijnatten D (Eds.), designing integration: Regional cooperation on climate change law and policy in North America. University of Toronto Press, Toronto, Canada.

- Otte G, Prasad S (2008) GHG emissions accounting. Accounting, Organizations and Society 27(2): 687-708.

- Van Amstel AR, Janssen LHJM, Olivier JGJ (2000) Greenhouse gas emission accounting. In: Editor EE (Ed.), non-CO2 greenhouse gases: Scientific understanding, control and implementation, Springer, Netherlands, pp. 461-468.

- Jose A, Lee S (2007) Environmental reporting of global corporations: A content analysis based on website disclosures. Journal of Business Ethics 72(4): 307-321.

- Ball A, Owen DL, Gray R (2000) External transparency or internal capture? The role of third-party statements in adding value to corporate environmental reports1. Business Strategy and the Environment 9(1): 1-23.

- Kolk A, Levy D, Pinkse J (2008) Corporate responses in an emerging climate regime: The institutionalization and commensuration of carbon disclosure. European Accounting Review 17(4): 719-745.

- Power M (1996) Making things auditable. Accounting, Organizations and Society 21(2-3): 289-315.

- Rypdal K, Winiwarter W (2001) Uncertainties in greenhouse gas emission inventories-evaluation, comparability and implications. Environmental Science and Policy 4(2-3): 107-116.

- WBCSD/WRI (2004) The greenhouse gas protocol: A corporate accounting and reporting standard. (2nd edn), World Resources Institute and World Business Council for Sustainable Development, Washington, DC, USA.

- ISO 14064-3. (2006) Greenhouse gases-Part 3: Specification with guidance for the validation and verification of greenhouse gas assertions. International Organisation for Standardization.

- Wintergreen JT, Sandler LM (2004) Preparing for GHG inventory verification. Chemical Engineering Progress 100(4): 35-38.

- Chatterjee A, Alagiah R (2012) Reporting and verification of corporate greenhouse-gas disclosures. GSTF Business Review 2(1): 164-169.

- Ahn C, Lee S, Pena-Mora F (2011) Carbon emissions quantification and verification strategies for large-scale construction projects, In Proceedings of International Conference on Sustainable Design and Construction (ICSDC).

- Sullivan R (2009) The management of greenhouse gas emissions in large European companies. Corporate Social Responsibility and Environmental Management 16(6): 301-309.

- Sundin H, Ranganathan J (2002) Managing business greenhouse gas emissions: The greenhouse gas protocol-a strategic and operational tool. Corporate Environmental Strategy 9(2): 137-144.

- Dragomir VD (2012) The disclosure of industrial greenhouse gas emissions: A critical assessment of corporate sustainability reports. Journal of Cleaner Production 29(30): 222-237.

- CDP, Carbon Disclosure Project (2012) Climate disclosure scores, Climate Disclosure Leadership Index (CDLI).

- CERES (2008) Corporate governance and climate change. Consumer and technology companies.

- Kolk A (2010) Trajectories of sustainability reporting by MNCs. Journal of World Business 45(4): 367-374.

- Matten D (2007) Regulation. In: Visser W, Matten D, Pohl M, Tolhurst N (eds.), The A-Z of corporate social responsibility-the complete reference of concepts, codes and organizations. Wiley, London, UK, pp. 385-388.

- GRI, UNEP, University of Stellenbosch and KPMG (2010) Carrots and sticks-promoting transparency and sustainability.

- Levin I, Hammer S, Eichelmann E, Vogel FR (2011) Verification of greenhouse gas emission reductions: The prospect of atmospheric monitoring in polluted areas. Philos Trans A Math Phys Eng Sci 369(1943): 1906-1924.

- OECD (2009) The economics of climate change mitigation: Policies and options for global action beyond 2012.

- Albino V, Balice A, Dangelico RM (2009) Environmental strategies and green product development: an overview on sustainability-driven companies. Business Strategy and the Environment 18(2): 83-96.

- Hamilton SF, Zilberman D (2006) Green markets, eco-certification, and equilibrium fraud. Journal of Environmental Economics and Management 52(3): 627-644.

- Van Marrewijk M (2003) Concepts and definitions of CSR and corporate sustainability: Between agency and communion. Journal of Business Ethics 44(3): 95-105.

- Steurer R, Langer ME, Konrad A, Martinuzzi A (2005) Corporations, stakeholders and sustainable development I: A theoretical exploration of business-society relations. Journal of Business Ethics 61(3): 263-281.

- Cheung Y, Tan W, Ahn H, Zhang Z (2010) Does corporate social responsibility matter in Asian emerging markets? Journal of Business Ethics 92(3): 401-413.

- DEFRA, Department for Environment, Food and Rural Affairs (2013) Environmental reporting guidelines: Including mandatory greenhouse gas emissions reporting guidance.

- Smith M, Yahya K, Amiruddin AM (2007) Environmental disclosure and performance reporting in Malaysia. Asian Review of Accounting 15(2): 185-199.

- Woerdman E (2001) Emissions trading and transaction costs: Analyzing the flaws in the discussion. Ecological Economics 38(2): 293-304.

- Cason TN, Gangadharan L (2003) Transactions costs in tradable permit markets: An experimental study of pollution market designs. Journal of Regulatory Economics 23(2): 145-165.

- Wintergreen J, Delaney T (2007) ISO 14064, International standard for GHG emissions inventories and verification. In 16th Annual International Emissions Inventory Conference, Raleigh, NC, USA.

- Zapfel P, Vainio M (2002) Pathways to European greenhouse gas emissions trading history and misconceptions. Fondazione Eni Enrico Mattei, p. 36.

- Convery FJ, Redmond L (2007) Market and price developments in the European Union emissions trading scheme. Review of Environmental Economics and Policy 1(1): 88-111.

- Galatowitsch SM (2009) Carbon offsets as ecological restorations. Restoration Ecology 17(5): 563-570.

- Bumpus AG, and Liverman DM (2008) Accumulation by decarbonization and the governance of carbon offsets. Economic Geography 84(2): 127-155.

- Srivastava SK (2007) Green supply-chain management: A state-of-the-art literature review. International Journal of Management Reviews 9(1): 53-80.

- Chaabane A, Ramudhin A, Paquet M (2012) Design of sustainable supply chains under the emission trading scheme. International Journal of Production Economics 135(1): 37- 49.

- Levy D, Scully M (2007) The institutional entrepreneur as modern prince: The strategic face of power in contested fields. Organization Studies 28(7): 971-991.

- Cormier D, Magnan M, Van Velthoven B (2005) Environmental disclosure quality in large German companies: Economic incentives, public pressures or institutional conditions? European Accounting Review 14(1): 3-39.

- Hassel L, Nilsson H, Nyquist S (2005) The value relevance of environmental performance. European Accounting Review 14(1): 41-61.

- Simnett R, Nugent M, Huggins AL (2009) Developing an international assurance standard on greenhouse gas statements. Accounting Horizons 23(4): 347-363.

- Matten D, Moon J (2008) Implicit and explicit CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Academy of Management Review 33(2): 404-424.

- Eberlein B, Matten D (2009) Business responses to climate change regulation in Canada and Germany: Lessons for MNCs from emerging economies. Journal of Business Ethics 86(2): 241-255.

- Prado-Lorenzo J, Rodríguez-Domínguez L, Gallego-Álvarez I, García-Sánchez I (2009) Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Management Decision 47(7): 1133-1157.

- Weber RP (1990) Basic content analysis. (2nd edn), Newbury Park, Canada.

- Krippendorff K (1980) Content analysis: An introduction to its methodology. Sage Publications C1980, Beverly Hills, USA.

- Holsti OR (1969) Content analysis for the social sciences and humanities. Addison-Wesley, Don Mills, Neighbourhood in Toronto, Canada.

- Berelson B (1952) Content analysis in communication research. Free Press, New York, NY, USA.

- Riffe D, Lacy S, Fico FG (2005) Analyzing media messages: Using quantitative content analysis in research. Psychology Press, London UK.

- CDP, Carbon Disclosure Project (2009) Global 500 Report.

- ISO (2007) Greenhouse gases-requirements for greenhouse gas validation and verification bodies for use in accreditation or other forms of recognition.

- Meinshausen M, Meinshausen N, Hare W, Raper SCB, Frieler K, et al. (2009) Greenhouse-gas emission targets for limiting global warming to 2 °C. Nature 458(7242): 1158-1177.

© 2021 Mel Gabriel. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)