- Submissions

Full Text

Strategies in Accounting and Management

COVID-19 Boosts the Need for New Competencies for Accountancy Knowledge Workers

Hussin J Hejase1*, Hassan I Rkein2 and Hasan F Fayyad-Kazan2

1Senior Researcher, Professor of Business Administration, Beirut, Lebanon

2Faculty of Business Administration, Al Maaref University, Beirut, Lebanon

*Corresponding author: Hussin J Hejase, Senior Researcher, Professor of Business Administration, Beirut, Lebanon

Submission: December 04, 2020Published: January 28, 2021

ISSN:2770-6648Volume2 Issue2

Abstract

Information and Communication Technology (ICT) resources are considered a major booster to all business functions during the COVID-19 pandemic. In fact, the grand majority of the institutions, in all economic sectors, including education have moved to online work [work from home] and consequently the need for technology literacy as well as information literacy became a much needed competence. These aforementioned literacy competences became salient in Higher Education Institutions (HEIs), more specifically, in their endeavor to train students amid the pandemic harsh health conditions and strict requirements for health conservation being at home or while at move. This paper aims to shed light on Accounting major students who are more than other are required to cope with the wave of automation which started even before the COVID-19 emergence. Descriptive analysis is performed shedding light on the status quo conditions of students’ preparation and the acquisition of competences much needed in the years to come beyond the pandemic. Secondary data is considered the source of the evidence needed to discuss the issue herein. Findings of this descriptive essay will serve as an eye opener to policy makers in the concerned HEIs and government officers as well.

Keywords: ICT;Automation;Knowledge workers; Accountancy;Future employees

Introduction

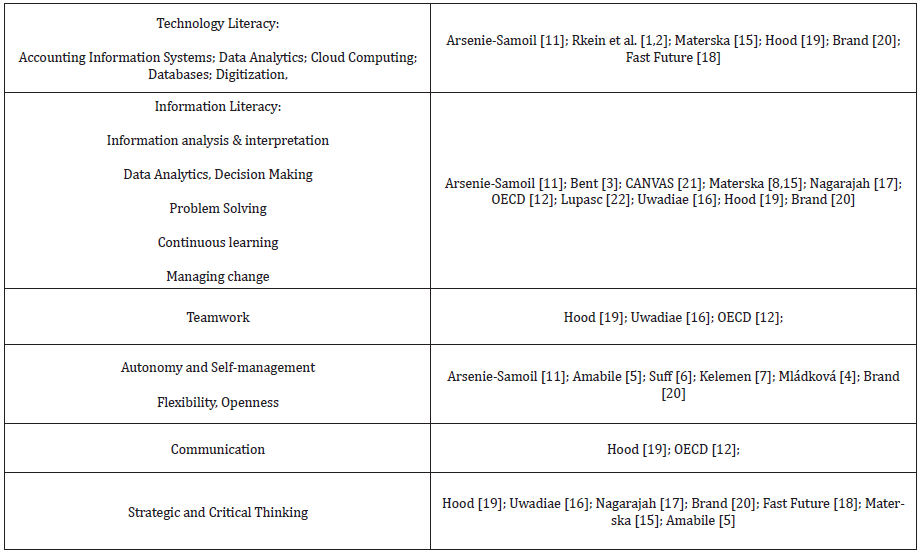

CANVAS (2020) recognized four recent trends shaping higher education that provide actionable insights to aid HEIs’ strategy to reimagine learning during and after the pandemic, including: the explosion of online and remote learning options, the need for engaging student experiences and personalized learning, shaping learning with immersive technologies, and data-driven educational transformation. The aforementioned show the major role of ICT technologies and resources in shaping the present and next generation of students who will form the knowledge-workers of the years to come. Indeed, Rkein et al. [1] identified in their research that the major subjects addressed by their interviewees consisting of Accountancy stakeholders including employers, educators, professionals and students are those depicted in Table 1 herein [2]. Table 1 shows that technology literacy and information literacy have become of concern in an era governed by ICT-rich knowledge economy that is boosted by artificial intelligence. The immediate outcomes govern a continuous learning breed of workers who require non-classical management practices which have been demanded highly especially during the COVID-19 pandemic. Accounting workers as well as students in HEIs are no different than others in such requirements.

Table 1: Major subjects affecting the accounting profession.

Source: Rkein et al. [1,2].

According to Bent [3], “Information literate people will demonstrate an awareness of how they gather, use, manage, synthesize and create information and data in an ethical manner and will have the information skills to do so effectively” (p. 3). On the other hand, knowledge workers are individuals characterized by being creative and innovative. Knowledge workers are able and willing to decide, manage, organize and control themselves. The first results of the research on knowledge workers and their management since 2010, show that knowledge workers really value less directive styles of management [4]. Indeed, Amabile [5] enforce employee engagement by recommending the removal of obstacles to progress, including meaningless tasks and toxic relationships. They also assert the activation of forces that enable progress including clear goals and autonomy as well as encouragement, demonstrations of respect and collegiality. Knowledge work leads to less directive styles of management and require higher autonomy of knowledge workers [6,7].

Knowledge Workers and Competencies

Materska [8] stresses that the understanding of information literacy (IL) has changed over time. In fact, many authors confirm that the definition of IL is not constant-each decade a new scope of IL is specified. Webber [9] states that “Information literacy differs” and indicates “progression in information literacy each year!” while Bent [3], the SCONUL Working Group, emphasizes in its publications that every year “we live in a very different information world”. Since 2001, OECD asserts that there are additional “workplace competencies” needed in the knowledge economy. Communication skills, problem-solving skills, the ability to work in teams and ICT skills, among others, are important and complementary to basic core or foundation skills. Even more than other workers, knowledge workers rely on workplace competencies. The number and importance of knowledge workers has grown in the recent decades. They are claimed to represent more than half of all employees in advanced economies Mládková [10] and appear to be one of most important information user communities, usually identified as those performing knowledge-rich jobs or, in other words, professionals whose position relies on their ability to find, synthesize, communicate and apply knowledge [11,12]. On the other hand, O’Neill [13] clarifies that the new competencies demanded by automation have opened new fields of application, one potential competency is “predictive analytic” which “allows for the automation of evidence gathering and the production of complex data reports, saving time and improving client services” (Para 18). Deloitte [14] stressed on such an issue in their report emphasizing that “Artificial intelligence has arrived at a point where machines can scale human expertise by extracting information from complex documents” (Para 34). The above-mentioned facts directly touch the profession of accountancy in such a way that not only the pandemic accelerated the need for technology and information literacy, but actually boosted the beginning of a new era of the accountancy and audit professions which govern the integrity of financial accounting and the use of the newly introduced world IFRS standards. That is, future generation of accounting students must be prepared to “scale their competencies in AI” and therefore proactively join the next generation of the job market workforce. The combination of cognitive skills enabled by the power of ICT leads to a cohort of Accounting graduates and practitioners who foment a powerful mixture of skills, knowledge, abilities and attitudes which must be nurtured in HEIS and nourished with continuous training and development stages. Table 2 shows a brief summary of the above.

Table 2: Fomenting a continuous build-up of competencies.

Source: Materska [15].

Knowledge-related work requires thinking; being creative, always questioning, interpreting, understanding situations, and adapting to changes Materska [15]. Such requirements fit the automation impact on Accountancy in general, and IFRS changes, in particular. Uwadiae [16] contends in this respect, “The reporting process is definitely a challenging one under IFRS regime. For a start, entities still battle with transition adjustments or recurring IFRS adjustments which must be continuously repassed for the purpose of reporting.” (Para 4). Furthermore, according to Uwadiae, “automation of financial reporting helps to improve audit readiness, promote reliable consolidation of financial statements across different countries, team sharing and optimized collaborations, electronic review and monitoring while ensuring transparency and credibility of financial data” (Para 7). The aforementioned clearly leads to the increasing need of new competencies related to technology and information analysis and interpretation. In fact, Rkein et al. [1], quoting Tom Osborne Regional Director of Hays Malaysia, contend that with the continuous automation of accountancy-with the advancement of technology and automated processes will require professionals “to give more time to be strategic and become true business partners”. Furthermore, against the fear of machines taking over the profession, Salika Suksuwan, Human Capital Leader of PwC Malaysia, asserts that, “-Automation brings greater opportunities for the profession as it helps reduce transactional and routine tasks such as data entry, bookkeeping and compliance work, and allows accounting and finance professionals to focus more on value-added services” [17].

The Institute of Management Accountants (IMA) strongly believes that “The diverse range of demands and impacts on the profession is forcing a rethink of everything from training and development through to the type of people being recruited. Characteristics such as entrepreneurial spirit, curiosity, creativity and strategic thinking skills could assume far more significance in the selection of tomorrow’s accountants” [18]. The aforementioned summarizes to some extent the rigorous planning for the future of the Accountancy profession, however Table 3 shows a more detailed view of the amount of competencies needed to prepare and guard proactively against change that the covid-19 pandemic has accelerated beside the evolutionary trend of globalization and automation [19-22].

Table 3: New competences needed for future accounting profession beside technical knowledge.

Source: Collected by the authors.

Conclusion and Recommendations

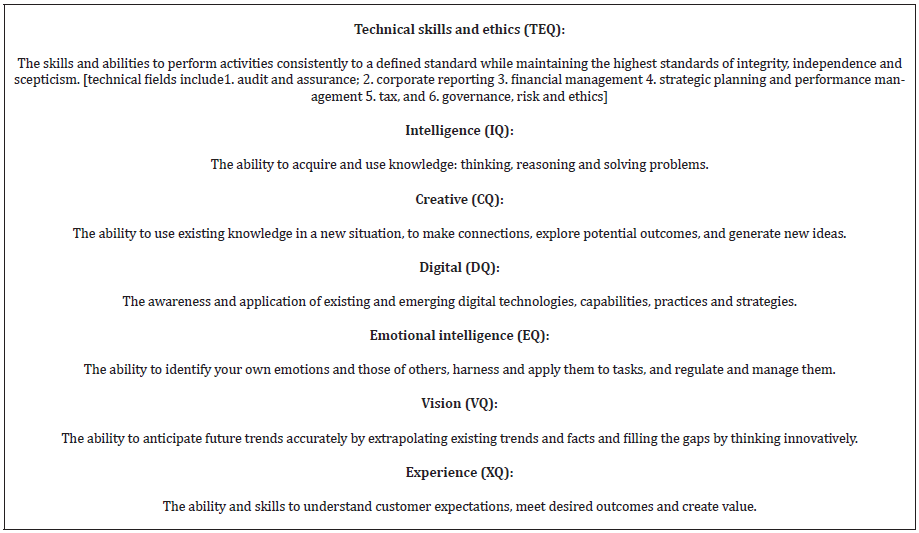

Arsenie-Samoil [11] stresses the fact that within a global information environment, for an organization modernizing process to be efficient, such businesses should have the following characteristics: “flexibility, openness, receptivity to integration and globalization, standardization, digitalization, and artificial intelligence. Integrating and computerizing the activities in an organization and carrying out the operations within a digital economy and a virtual organization, highly interconnected, calls for the expansion and acceptance of the computer-assisted accounting method, real-time work, accepting new ways of working and new activities” (p. 1695). Such characteristics embody the necessary competencies expected for the profession for the next decade (at least) and to which Helen Brand, CEO ACCA, agree to and recommend as the report “Drivers of change and future skills” shows. She contends that, “Whatever the shape of the future business environment, it will require flexibility and relevance. Professional accountants must both maintain their technical excellence and supplement this with highly developed personal skills and professional qualities” [20]. To credit the issue of change, Brand presents in her report a meticulous scheme of competencies reflecting the proactive spirit of the exercise whereby an integrated combination of professional competencies is presented and labelled “Professional Quotients” as depicted in Table 4.

Fast Future Research [18] asserts that for accountants there is a twofold challenge: “firstly, understanding how the key forces shaping the future could affect the organizations they serve. Secondly, they need to assess the implications for accounting standards and processes and the accountancy profession as a whole. The impacts encompass everything from the CFO’s role and reporting standards through to the training and development of tomorrow’s accountant” (p. 5). Therefore, as Table 4 shows, the “Professional Quotients” analysis suggests that to add value for their employers and clients, professional accountants of the future will need an optimal and changing combination of professional competencies; a collection of technical knowledge, skills and abilities, combined with interpersonal behaviors and qualities [23].

Table 4: Professional quotients.

Source: Brand [20].

Implications to students

Actually, according to Rkein et al. [1], accounting students were initially concerned of adopting the automation but as soon as they experienced it they were the first to recommend it. Besides, students agreed on that automation will not replace 100% the accountants, worrying for unemployment, so no need for graduates to fear it, still they can find jobs if they equipped themselves for the outside market. Therefore, accounting major students need to adopt an open mind set for readiness to continuous education so as to prepare themselves technically either by pursuing post-higher education or professional development seeking certifications like CPA, CMA, CISA, etc. nevertheless, they have to gain experience by joining the job market.

Implications for HEIs

The value of the accounting profession is inherent in the professionals’ skills and ethics and not in computers. Nevertheless, HEIs need to review their programs of study to enrich their students’ learning outcomes with the professionally recommended competencies, presented herein, and accounting professors need to co-work with students to keep the value. On the other hand, universities need to supplement their programs of study with more professional workshops and internships (virtually as well as oncampus) to sustain the impetus toward active preparation of the students to fit the dynamics of the workplace.

Implications to employers

Törnqvist [23] emphasize that the wave of “digitalization, autonomous processes, and digital archives heavily reduce the environmental impacts and is an important perspective for both stakeholders and the society in general” (p. 66). In fact, this view supports Hejase et al. [24] findings showing that corporate social responsibility (CSR) integrates corporate activities abiding by the legal regulations and going beyond compliance, and investing more in human capital, the environment and the relations with stakeholders; as the business pursuit of sustainable development and focus on economic, social and environmental aspects. Furthermore, Hejase et al. [25] state that CSR has become a norm that safeguards organizational compliance with legislation and regulations, and capitalizes on commitments and activities pertaining to: corporate governance and ethics, health and safety, environmental stewardship, human rights (including core labor rights), human resource management, community involvement, development and investment, corporate philanthropy and employee volunteering, customer satisfaction and adherence to principles of fair competition, anti-bribery and anti-corruption measures, accountability, transparency and performance reporting, supplier relations, for both domestic and international supply chains.” Therefore, organizations which manifest having a strategic outlook towards its sustainability are actually adopting proactive moves toward the continuous commitment to upgrade its technology and human capital within the framework of CSR, a fact that boosts its competitive advantage. Consequently, the accounting firms’ norms have to also educate and direct its employees’ and clients’ willingness going digital instead of being manual, where such a shift could have an enormous positive impact on the environment. The challenge of climate pollution and awareness of social responsibility in business should be more emphasized and an increased dialogue with the stakeholders may result in a more positive attitude towards automated accounting and its impacts [23].

Finally, according to the Association of Chartered Certified Accountants [ACCA], based on the last five years observations pertaining to employers’ needs and the impact of artificial intelligence on the profession of Accountancy, five exciting career zones are emerging. Lyon [26] asserts that these “zones represent broad areas of opportunity which individuals may develop their careers in, or indeed navigate across. Career paths in the profession will become more diverse and working lives will evolve as technology blurs the work divide between humans and machines” (Para 3). Figure 1 depicts a schema about the 2020s careers, namely [27]:

Figure 1:

1. The assurance advocate needed for the future in areas such as auditing, risk management, and compliance. They bring new levels of trust and integrity to organizational operations.

2. The business transformer needed to drive change, strategy and supporting sustainable businesses for the future.

3. The data navigator is a true business partner. Uses emerging analytical tools to drive insights that deliver business outcomes.

4. The digital playmaker who champions technology adoption and data governance within the organization.

The sustainability trailblazer plays a key role in establishing frameworks that capture, evaluate and report on the activities that truly drive value and in ways that are much more transparent and meaningful to the outside world.

References

- Rkein HI, Issa ZA, Awada FJ, Hejase HJ (2019) Impact of automation on accounting profession and employability: A qualitative assessment from Lebanon. Saudi Journal of Business and Management Studies 4(4): 372-385.

- Rkein H, Issa ZA, Awada, FJ, Hejase HJ (2020) Does automation of the accounting profession affect employability? an exploratory research from Lebanon. Open Journal of Business and Management 8(1): 175-193.

- Bent M, Stubbings R (2011) The seven pillars of information literacy: The core model. Society of college, National and University Libraries-Sconul, Turkey.

- Mládková L (2012) Management of knowledge workers. Bratislava, IURA Edition, Serbia.

- Amabile TM, Kramer SJ (2011) The progress principle: Using small wins to ignite joy, engagement, and creativity at work. Harvard Business Review Press, Brighton, Massachusetts.

- Suff P, Reilly P (2005) In the know: Reward and performance management of knowledge workers. Institute of Employment Studies, Brighton, UK.

- Kelemen J (2010) On knowledge in context. IEEE 8th international symposium on intelligent systems and informatics, Subotica, Serbia, pp. 17-21.

- Materska K (2013a) Is information literacy enough for a knowledge worker? worldwide commonalities and challenges in information literacy research and practice. Communications in Computer and Information Science.

- Webber S (2008) What does information literacy mean? Some examples from different disciplines presentation.

- Mládková L (2011) Management of knowledge workers. Economics and Management 16: 826-831.

- Arsenie-Samoil M (2010) The Impact of using new information technologies on accounting organizations. Ovidius University Annals, Economic Sciences Series, Ovidius University of Constantza, Faculty of Economic Sciences 0(1): 1695-1699.

- OECD (2001) Competences for the knowledge economy, Chapter 4.

- O’Neill E (2016) How is the accountancy and finance world using artificial intelligence?

- Deloitte (2016) Transformers: How machines are changing every sector of the UK economy. Deloitte, UK.

- Materska K (2013b) Is information literacy enough for a knowledge worker? power point. European Conference on Information Literacy (ECIL), Istanbul, Turkey.

- Uwadiae O (2015) Financial reporting automation. Deloitte, UK.

- Nagarajah E (2016) Hi robot. What does automation mean for the accounting profession?

- Fast Future (2012) Accountancy futures academy: 100 drivers of change for the global accountancy profession. Collaborative report by ACCA the Association of Chartered Certified Accountants and IMA Institute of Management Accountants.

- Hood T (2020) 7 Skills every accountant needs in the age of automation blog.

- Brand H (2016) Professional accountants-the future: Drivers of change and future skills. The Association of Chartered Certified Accountants [ACCA].

- CANVAS (2020) Student Success today and into the future: Four trends shaping higher education and insights on how to tackle them. Instructure Corp.

- Lupasc A, Lupasc I, Zamfir CG (2012) Impact of intelligent modern technologies in business. Ovidius University Annals Economic Sciences Series 12(1): 580-585.

- Törnqvist E, Forss L (2018) Automated accounting in accounting firms-A qualitative study on impacts and attitudes. Master's Thesis, department of business administration accounting, Umeå University, Sweden.

- Hejase H, Farha C, Haddad Z, Hamdar B (2012) Exploring the multiple benefits of CSR on organizational performance: Case of Lebanon. Journal of Social Sciences 1(1): 1-23.

- Hejase HJ, Hashem F, Al Dirani A, Haddad Z, Atwi K (2017) Corporate social responsibility impact on consumer decision. The Journal of Middle East and North Africa Sciences 3(2): 3-20.

- Lyon J (2020) Future ready: Accountancy careers in the 2020s. The Association of Chartered Certified Accountants [ACCA].

- Mládková L (2015) Knowledge workers and the principle of 3S (self-management, self-organization, self-control). 3rd International conference on leadership, technology and innovation management. Procedia-Social and Behavioral Sciences 18: 178-184.

© 2021 Hussin J Hejase. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)