- Submissions

Full Text

Strategies in Accounting and Management

Toward a Framework for Examining the Implementation of IFRS 9 in Banking Industry: An Assessment from Lebanon

Hassan I Rkein1*, Hussin J Hejase1, Ibrahim Hadid1 and Ali Rkein2

1Faculty of Business Administration, Al Maaref University, Beirut, Lebanon

2Asia Pacific College of Business & Law, Charles Darwin University, Australia

*Corresponding author: Hassan I Rkein, Faculty of Business Administration, Al Maaref University, Beirut, Lebanon

Submission: September 09, 2020 Published: October 07, 2020

ISSN:2770-6648Volume2 Issue1

Abstract

The ill-timed recognition of Credit Losses had proven to have a remarkable negative impact not only on the financial position of the banks, but also it affected the banks’ going concern and sustainability. This has been evidenced by the most recent Global Financial Crisis (GFC) in 2007, whereby banks and other financial institutions have been obliged to implement the IFRS 9 accounting standard (International Financial Reporting Standard 9). The financial instrument IFRS 9 requires firms to model future events in the macroeconomic environment and calculate Expected Credit Loss (ECL) for their financial instruments over either a 12 month or lifetime period. The implementation of this newly developed and implemented accounting principle will help in reducing the likelihood of a repetition of another financial crisis based on similar causes since it allows investors to know detailed information about any projected credit losses. Financials need to know if this shifting in accounting principles will lead to eliminating or reducing financial crisis.

This paper puts forward as assessment of the impact on Lebanese banks linked to the transition from IAS 39 to IFRS 9, aiming to figure out if this new instrument helped avoiding financial crisis in the banking sector. This is an exploratory, qualitative research using inductive approach. Data will be collected using a simple questionnaire distributed to a sample of Lebanese banks. The paper offers a review of the International Financial Reporting Standards including history, the goals behind the implementation of common standards, defining IFRS principles that are applied in banks, and assessing the top concerns in applying IFRS 9 in banks with emphasis on Lebanon. The research`s outcome will propose a framework of recommendations to adopt the new accounting principle IFRS 9 in Banks in a way that will help in avoiding and eliminating the financial crisis.

Keywords: Financial crisis; Financial instruments; IAS 39, IFRS 9

Introduction

During the financial crisis, the delayed recognition of credit losses on loans and other financial instruments was acknowledged as a weakness in the previous accounting standards [1,2]. Particularly, the previous model in IAS 39 which was an ‘incurred loss’ model, delays the recognition of credit losses until there is evidence of trigger event [2]. This was designed to limit an entity’s ability to create reserves that can be used to help earnings during hard times. In consequence to this non- eglecting delay, financial authorities decided, in 2009, to develop a single financial reporting model for financial instruments that provides investors with the most useful, transparent, and relevant information about an entity’s exposure to financial instruments while reducing the complexity in accounting. Then, IFRS 9 as a principle emerged after the financial crisis of 2008 in order to solve the deficiencies in the previous principles that were applied such as IAS 39. In July 2014, the IASB published the final version of the new standard; IFRS 9 “Financial Instruments” with a mandatory effective date for implementation of January 1st, 2018.

IFRS 9 replaces IAS 39, Financial Instruments-Recognition and Measurement. It is “meant to respond to criticisms that IAS 39 is too complex, inconsistent with the way entities manage their businesses and risks, and defers the recognition of credit losses on loans and receivables until too late in the credit cycle. The IASB had always intended to reconsider IAS 39, but the financial crisis made this a priority” [3]. According to [4], “IFRS 9 retains the same measurement bases for financial assets as IAS 39-amortized cost, fair value through profit or loss, and fair value through other comprehensive income” (Para 4-5). Further changes are depicted in Table 1. The question of how an entity is affected by IFRS 9 is that it depends [5] contends that “some entities may find that classification and measurement of their financial assets will be substantially the same as when they were under IAS 39, and that their impairment allowances may not be materially affected. Others will change substantially” (Para 13). Regardless, every entity will have to go through the process of re-evaluating their accounting policies, financial statement note disclosures and other areas affected by the new requirements, and making appropriate changes to their accounting systems and internal controls.

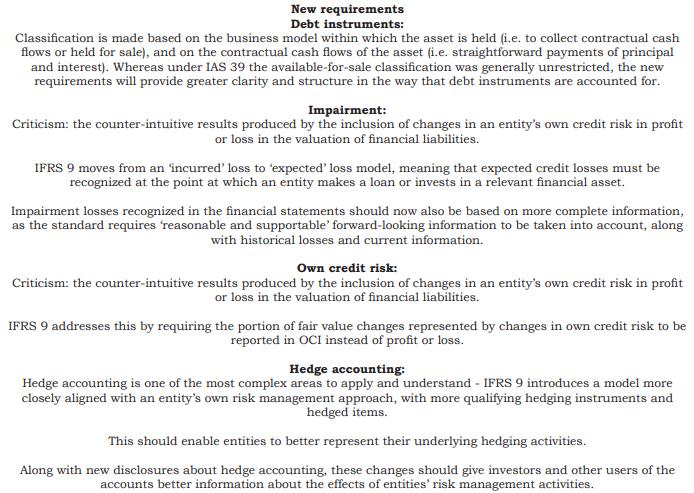

Table 1: IFRS 9 advantages.

On the other hand, as International Financial Reporting Standard 9 (IFRS 9) will soon replace International Accounting Standard 39 (IAS 39), according to [6], the change will materially influence banks’ financial statements, with impairment calculations affected most. IFRS 9 will cover financial institutions across Europe, the Middle East, Asia, Africa, and Oceania” (Para 1). Furthermore, [6] asserts that “IFRS 9 will align measurement of financial assets with the bank’s business model, contractual cash flow of instruments, and future economic scenarios. In addition, the IFRS 9 provision framework will make banks evaluate how economic and credit changes will alter their business models, portfolios, capital, and the provision levels under various scenarios” (Para 2). Consequently, given the IFRS 9 requirements in terms of classification, measurement, and impairment calculation and reporting, as depicted in Table 1, banks are expected to be required to make some changes to the way they do business, allocate capital, and manage the quality of loans and provisions at origination. Banks will face modeling, data, reporting, and infrastructure challenges.

Problem Statement

As a result of IFRS 9 implementation, the net earnings of banks will decrease, mainly due to increase in impairment credit loss charges. This has resulted in reduction in Banks’ retained earnings and capital resources. Both of Net profit and retained earnings as well as the capital resources would have been higher for the same periods having all other cases equal under IAS 39. Banks are now required to hold higher level of equity capital, to maintain their capital ratios under IFRS 9 [7]. When any new principle is adopted it should be tested in order to figure out if it helped in solving the problem that caused its adoption. IFRS 9 is a principle that was adopted by banks and financial institutions in order to avoid financial crisis, so it should be tested carefully and professionally to figure out if it is a useful tool in facing the crisis. However, IFRS 9 is much more than an upgrade from IAS 39. In fact, the new accounting standard for financial instruments represents a major shift in international accounting practices, adopting a principles-based approach to classification of financial assets and liabilities based on business models and cash flow. The standard also provides for a single impairment model to facilitate the recognition of expected credit loss (ECL). Under this new model, banks are required to estimate ECLs on financial assets on an ongoing basis and provision for these. This is vastly different from IAS 39.

Investors are always afraid from witnessing losses because of what happened in 2007 (GFC), so implementing IFRS 9 helps the investors to know about any expected credit losses that a bank might face. If the implementation of IFRS9 is not tested, how can investors and financials stakeholders be sure that they wouldn`t face another crisis as that of 2007? This paper aims to assess the impact on Lebanese banks linked to the transition from IAS 39 to IFRS 9. It is the right time to study the impact of IFRS 9 on Lebanese Banks as financial institutions are undergoing implementation and changes, though different actors may have proprietary perspectives and clarity on how IFRS 9 has been implemented by or in their respective organizations. Best practices may result from this assessment as different banks are surveyed besides the fact that it is possible to reach a framework for implementing the new accounting principle IFRS 9 successfully by banks.

Research Questions

The main research question addressed in this paper is:

Two years have elapsed since the implementation of IFRS 9 in the Lebanese banking sector: what are the impediments and advantages?

Other sub questions are:

1. Did the banks implement IFRS 9 following a well-set approach (professionally)?

2. Was it costly?

3. Was the implementation process complicated?

4. Concerning the investors; to what level was the new Expected Credit Loss model helpful for them in the past two years of implementation?

Significance of the Study

This study will benefit financial analysts, bankers, and investors because it will help them figure out if the new standard will contribute in avoiding financial crisis. Effectively implementing IFRS 9 will enable bank boards and senior management to make better-informed decisions, proactively manage provisions and effects on capital plans, make forward-looking strategic decisions for risk reduction in the event of actual stressed conditions, and help in understanding the evolving nature of risk in the banking business. A thoughtful, repeatable, consistent capital planning and impairment analysis should lead to a more sound, lower-risk banking system with more efficient banks and better allocation of capital [8]. Further, IFRS 9 completes stakeholders’ main response to the global financial crisis and brings together “all aspects of the accounting for financial instruments-classification and measurement, impairment and hedge accounting. Together with these changes, information about financial instruments is enhanced by an accompanying package of improved disclosures” [9].

Methodology

This paper is an exploratory, qualitative research using inductive approach. Qualitative research is often said to employ inductive thinking or induction reasoning since it moves from specific observations about individual occurrences to broader generalizations and theories [10]. In making use of the inductive approach to research, the researcher begins with specific observations and measures, and then moves to detecting themes and patterns in the data. This allows the researcher to form an early tentative hypothesis that can be explored. The results of the exploration may later lead to general conclusions or theories [11].

Exploratory research intends merely to explore the research questions and does not intend to offer final and conclusive solutions to existing problems. This type of research is usually conducted to study a problem that has not been clearly defined yet, and is not intended to provide conclusive evidence, but helps to have a better understanding of the problem. Exploratory research tends to tackle unstructured [10] new problems on which little or no previous research has been done. To answer the proposed research questions, a structured interview questionnaire will be used with a sample of internal auditors of Lebanese banks. Questions are open-ended whereby respondents can express themselves freely and provide the answers in their own words; these questions are useful for exploratory evaluations. The collected information will be analyzed in a way comparing before and after the adoption of IFRS 9. Also, samples of financial statements of banks will be analyzed in order to figure out what are the affected accounts after the implementation of IFRS 9. Furthermore, content analysis will be performed to address the proposed questions analytically and comparatively.

Conclusion

Prior to the financial crisis, the two accounting authorities, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), had already planned to revise and improve their respective standards on accounting for financial instruments. Furthermore, once the financial crisis arose, it confirmed the needs for changes in the application of these standards. Indeed, the financial crisis truly revealed that accounting standards in general were not appropriate for the past economic environment and showed that they were not efficient enough to face this changing environment [3]. The expectations for IFRS 9 are to align measurement of financial assets with the bank’s business model, contractual cash flow of instruments, and future economic scenarios. In addition, the IFRS 9 provision framework will make banks evaluate how economic and credit changes will alter their business models, portfolios, capital, and the provision levels under various scenarios [6].

Given the IFRS 9 requirements in terms of classification, measurement, and impairment calculation and reporting, banks should expect to be required to make some changes to the way they do business, allocate capital, and manage the quality of loans and provisions at origination (ibid). The main purpose of this research is to investigate and analyze banks’ implementation of IFRS 9 in terms of their accuracy and revision behavior. Specifically, these factors are examined in relation to the change in impairment method for financial instruments coming alongside the accounting change from IAS 39 to IFRS 9, with conclusions about the role this change plays in their current forecasts.

References

- Michael C (2014) IASB releases its own financial instruments standard.

- Halilbegovic S, Šaković Emir, Arapovic Adisa, Celebic N (2019) Implementation effects of IFRS 9 impairment modelling for financial instruments on regulatory capital banks in federation of Bosnia and Herzegovina. European Journal of Economic Studies 8(2): 120-130.

- PWC (2017) IFRS 9, Financial instruments: Understanding the basics.

- Institute of Chartered Accountants of Scotland-ICAS (2018) How will IFRS 9 change accounting for financial instruments?

- PWC Canada (2020) IFRS 9: Financial instruments: Contrary to widespread belief, IFRS 9 affects more than just financial institutions.

- Gea Cayetano (2015) IFRS 9 Will significantly impact banks provisions and financial statements. Risk Data Management V(5).

- Deloitte (2016) A Drain on resources? the impact of IFRS 9 on banking sector regulatory capital, pp. 13.

- Moodys’ Analytics (2015) IFRS 9 will significantly impact banks’ provisions and financial statements.

- Lloyd Sue (2014) IFRS 9: A complete package for investors. Investor perspectives.

- Hejase A, Hejase H (2013) Research methods: A practical approach for business students (2nd edn), Philadelphia, USA.

- Creswell W (2009) Research design: Qualitative, quantitative and mixed methods approaches (3rd edn), Thousand Oaks, CA, Sage Publications, USA.

© 2020 Hassan I Rkein. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)