- Submissions

Full Text

Strategies in Accounting and Management

The Role of Costs in Pricing

Donald E Sexton*

Professor Emeritus of Business, Columbia University, USA

*Corresponding author: Donald E Sexton, Professor Emeritus of Business, Columbia University, USA

Submission: August 13, 2019; Published: September 18, 2020

ISSN:2770-6648Volume1 Issue5

Introduction

Costs certainly play a role in pricing. However, typically cost-plus pricing assigns the wrong role for costs in the pricing process and that can lead to serious pricing mistakes. The role of costs should be to evaluate the feasibility of a price, not to set the price.

Cost-plus pricing

Consider the typical steps in the full cost-plus pricing approach:

- Estimate unit sales.

- Calculate the average full cost per unit.

- Set the price by adding a mark-up to the average full cost per unit.

Note that, in cost-plus pricing, cost is used to set price not to evaluate price. In another article Sexton [1], some of the dangers of the cost-plus pricing approach are explained. In brief, key erroneous assumptions underlying the full cost-plus pricing approach include:

- In order to determine a cost-plus price, sales must be estimated before price is determined. In any open market situation, that is backwards thinking as price determines sales not sales determine price. The sole exception are situations, such as certain government contracts, where demand is known beforehand and a cost-plus calculation is made based on profit that is allowed by the purchaser.

- The mark-up is often cited to indicate relative profitability among products. The mark-up percentage reflects actual profit only at the level of sales assumed to determine the cost-plus price. Since in most cases, the price has an impact on sales and the actual sales will not be the same as the sales assumed to determine the cost-plus price, the mark-up percentage will probably not represent the actual profit percentage.

- Overhead allocation potentially has a great impact on price. Perhaps the most significant objection to cost-plus pricing is the role of overhead allocation in the process. Because average full costs per unit are often used to determine a cost-plus price, how much overhead is allocated to a product or service will affect the average cost per unit which in turn can substantially affect the cost-plus price.

The role costs should play in setting a price

Dependence on costs alone can lead to pricing mistakes in the usual cost-plus pricing approach because costs are brought into the price-setting process far too early. Costs have a role to play in pricing, but it is a diagnostic role-the role of evaluating a price by asking the question: Will the price under consideration allow us to meet our financial objectives? Cost-related pricing problems can be avoided by employing Value-Cost Pricing.

Steps in value-cost pricing

Prices that are set to achieve financial objectives such as margin, profit, and cash flow, should be determined by considering both the value of the product or service as perceived by the customer relative to competitors’ products and services and the costs that must be covered for the business to flourish. The main steps in value-cost pricing consist of:

- Estimate the perceived value (or willingness to pay) for the customer. (How to make these estimates is discussed in another article Sexton [2])

- Estimate fixed costs and variable costs per unit.

- Assess competitors’ pricing.

- Develop tentative strategy, including target markets, positioning, and business objectives such as margin, profitability, or cash flow.

- Set a tentative price.

- Estimate sales for the tentative price.

- Predict and evaluate the financial results for the tentative price.

- Assess the tentative price - redo all or parts of the steps in the process if necessary.

Step 7 in the above process is the step when costs should be considered. Notice that costs are examined in the value-cost pricing process. Costs must be considered to ascertain whether a specific price is realistic. However, in the value-cost pricing process, costs are considered much later than they are in the cost-plus process. Rather than using costs to determine price, in value-cost pricing costs are used to evaluate whether a given price is financially feasible.

Financial criteria for an effective price

There are four questions that must be examined to determine whether a price is feasible. These questions follow a logical sequence. If the answer to any question is “no,” then the price under consideration should be discarded and another price should be examined. The four questions should be considered in the following order:

Does price cover variable cost per unit?: Price less variable cost per unit is the incremental profit on each unit sold - known as variable margin per unit. If the answer to this question is “no,” then one is losing money on every sale. A famous on-line pet food company found out too late that the shipping costs for canned dog and cat food caused their variable cost per unit to exceed their price per unit. The more cans of pet food they sold, the more money they lost! The company went out of business. There may be situations where one might price below variable cost per unit for strategic reasons. However, if one is considering that strategy, it would be advisable to seek advice from an attorney to be sure that such an approach is legal. If it is legal, then time limits should be set for how long prices will be kept below variable cost per unit. Variable margin (also known as contribution) plays a major role in the next three questions.

Variable Margin= (Price-Variable Cost Per Unit) X Unit Sales

Conceptually, variable margin is the total incremental contribution due to a product or service. For a product or service to achieve target profits, then the variable margin must cover all fixed costs, and anything left over must equal or exceed the target profit for that product or service.

Does variable margin cover direct fixed costs?: Direct fixed costs are any fixed costs that disappear if the product or service disappears. For example, suppose that there is a team of product experts who provide technical advice for use of a particular line of electronic business products. If their expertise concerns only that line of products, if and when that product is no longer produced, then they are no longer needed and their costs (salaries, support) disappear. That service team would represent a direct fixed cost for the product. This criterion is known as the shut-down level. If, at a given price, a product or service does not cover its direct fixed costs, then it should be shut down. Shut-down level is different than breakeven level which is the focus of the next question.

Does variable margin cover all fixed costs-direct plus indirect fixed costs?: While direct fixed costs are necessary to produce the product or service, indirect costs - also known as overhead - are costs related to company capabilities shared by many products or services. Examples of indirect costs include the salary of the Chief Executive Officer, corporate advertising, and costs associated with the headquarters building. If variable margin does not cover both direct and assigned indirect fixed costs, the company will eventually go out of business. Note that there is a very important discussion of how to allocate indirect costs to be to ensure that financially sound decisions are made for a company. That discussion, while very important, is out of the scope of this article. Here, the assumption made is that the allocation of indirect costs to the product or service is appropriate, whatever it happens to be. If the variable margin exactly covers all fixed costs, then that sales level is known as the breakeven level. Sales above the breakeven level result in profits. However, note that even if a product or service is not at the breakeven level, it still may be useful to keep that product or service if it is contributing to coverage of overhead and that is the most efficient use the company can make of its resources. Sometimes contribution to overhead is not considered when evaluating the financial impact of a product or service. As one example, a well-known manufacturer of large motorcycles had a line of four large motorcycles. A finance manager found that one of the motorcycles was not making a profit because it was not covering all its fixed costs. The decision was made to remove that model from the line. However, that meant that the remaining three models had to cover the overhead that had been covered by the model that was dropped. The result was that one of the three remaining motorcycles did not cover all fixed costs and so therefore was not making a profit. Same manager. Same decision. Same result. Eventually one model was left to cover the entire overhead (also known as burden) of the firm. The model was not sufficiently profitable to do so and the company went out of business.

Does variable margin cover all fixed costs and the target financial objective?: If the answer is no, then one must evaluate whether it delivers enough financial results to keep the product or service in the line. Options at this stage include revising the target financial objectives or not proceeding with the product or service. If any of these four questions are answered in the negative, then it may be necessary to set another price and perform the same evaluation again on that price. This value-cost pricing process takes longer than the typical cost-plus pricing approach but it has the chance of identifying the price with the highest possibility of achieving financial objectives. If one achieves specific financial objectives with cost-plus pricing, it is probably due to good luck, not to good pricing strategy.

Example: Evaluating a price with the financial criteria

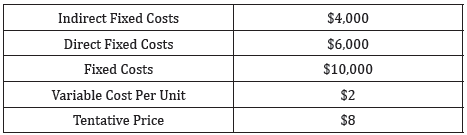

As an example, suppose a book publisher wants to set a price for a book. This example uses most of the same numbers in a related article on pricing Sexton [2]. Relevant costs are shown in Table 1. Suppose unit sales are estimated to be 2000 books if the price is $8 per book and that the target profit is $5,000.

Table 1: Cost example.

Steps:

Price≥Variable Cost Per Unit?

$8≥$2? Yes. So there is incremental margin on every unit sold.

For questions 2, 3, and 4:

Variable Margin= (Price-Variable Cost Per Unit) X (Unit Sales)

= ($8 - $2) X 2000=$12,000

Variable Margin≥Direct Fixed Costs?

$12,000≥$6,000 Yes. So sales are above the shutdown level.

Variable Margin≥Direct Fixed Costs + Indirect Fixed Costs = Fixed Costs?

$12,000≥$6,000+$4,000=$10,000 Yes. So sales are above the breakeven level.

Variable Margin≥Fixed Costs + Target Profit?

$12,000≥$6,000+$4,000+$5,000=$15,000 No. So this price is unacceptable if one needs to achieve the stated target profit. Either another price needs to be evaluated or the target profit needs to be reduced.

Even if the tentative price of $8 met all the criteria, it would still be worthwhile to evaluate other prices with the four questions. There may be another price that would achieve higher financial results.

Final Comments

Costs, of course, have a significant role in any determination of price. However, that role is a birth-control role - determining whether or not it is financially feasible to place a product or service on the market at a given price. That means the evaluation of a price must take place after determination of the marketing strategy, including setting of financial objectives and evaluation of the customers and the competitors-as well as relevant regulations. Value-cost pricing requires time and thought but increases the chances that the go-to-market price is strategically correct with respect to achieving financial objectives.

Donald Sexton, Professor Emeritus of Business, Columbia University. Professor Sexton teaches in the areas of marketing, branding, international business, and statistics and is a recipient of the Business School’s Distinguished Teaching Award. His numerous articles have appeared in journals such as the Harvard Business Review, Management Science, and Journal of Marketing and he is often quoted in media such as the New York Times, Business Week, Ad Age, WCBS, and Beijing’s China Economic Daily. He received the 2011 Marketing Trends Award for his work in branding and marketing. His best-selling Marketing 101 has been translated into several languages including Chinese, Turkish, Polish, and Indonesian and his Branding 101 has been translated into Russian and Vietnamese. Don’s most recent book, Value Above Cost, explains how marketing determines financial performance and is available in Chinese. He received his MBA and PhD degrees from the University of Chicago and has taught at the University of California-Berkeley, INSEAD, China Europe International Business School, Australian School of Business, Moscow School of Management, Indian School of Business, University of Tehran, U.S. Business School in Prague, and the Hong Kong University of Science and Technology. Don is the founder of The Arrow Group, Ltd.®, a company that has provided consulting and training services to many organizations including IBM, Pfizer, GE, Unilever, MetLife, Tencent, Citibank, Pepsi, Yili, Vivo, Vollkswagen, Boeing, ABInBev, Verizon, JD.com, Baidu, and DuPont. Email: des5@columbia.edu Web: donsexton.com.

References

- Sexton DE (2019) The dangers of cost-plus pricing. Strategies in Accounting and Management.

- Sexton DE (2006) Pricing, perceived value, and communications. The Advertiser, pp. 56-58.

© 2020 Donald E Sexton. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)