- Submissions

Full Text

Strategies in Accounting and Management

An Alternate Interpretation of VIX Evidence: Will the Real VIX Please Stand-Up?

Hancock GD*

Associate Research Professor of Finance, USA

*Corresponding author: Hancock GD, Associate Research Professor of Finance in the Anheuser-Busch College of Business, University of Missouri-St. Louis, USA

Submission: February 21, 2020; Published: March 05, 2020

ISSN:2770-6648Volume1 Issue4

Abstract

In spite of efforts to securitize the VIX, it cannot be done. The theoretical benefits of VIX have provided invaluable insight into the behavior of volatility but the attempts to create a tradable alternative have failed. This paper rejects the notion that VIX-products are related to the VIX, rejects the misnomer index, in favor of statistic, rejects the idea of the VIX-statistic as a separate asset class and rejects the VIX as a measure of fear. Instead, VIX-products are by design between 6-16 times different from the VIX-statistic. Using daily data from inception, the VIX is first tested as a predictor for the actual 30-day forward volatility of the S&P 500 Stock Index. Subsequent tests are based on hypotheses of equality between movements in VIX and selected VIX-products to changes in the S&P 500 Stock Index. The specific products studied are: VIX Futures 1-month roll, VIXM, VIXY, VIIX, VXX and VXZ. The VIXM and VIXY funds comprise the ETF group, while VIIX, VXX and VXZ notes represent the ETN group. The findings show that VIX is a poor predictor of SPFV and VIX-products exhibit large, significant differences from the VIX-statistic. The basic idea behind tradable volatility is to offer the benefits of VIX by mimicking its behavior. But the very creation of a security provides a tangible contract that, by definition, is no longer just a statistic.

Keywords: VIX; VIX futures; VIX ETFs/ETNs; Investor fear

Introduction

The allure of VIX began with the discovery that a reliable estimate of the 30-day forward Standard & Poor’s 500 volatility was mathematically possible by solving for the variance while the option is alive using BSOP, for a given strike price and maturity. The value of market volatility lies in the fact that it is negatively correlated with the returns of the underlying market index and can produce win-win solutions, compounding both gains and losses. The negative correlation of volatility to stock market returns is well documented and suggests, to some, a unique diversification benefit if securitized and traded, thereby, creating a new asset class. The most popular measure of market volatility, the VIX, was first introduced by the Chicago Board Options Exchange (CBOE) in 1993 based on S&P 100 at-the-money option premiums (OEX). The calculations were revised in 2003 based on the S&P 500 out-of-the-money options (SPX). The new procedure requires averaging the weighted prices of the SPX puts and calls over a wide range of out-of-the-money strike prices. The resulting CBOE calculation is a statistic, that provides a solution for the volatility of the S&P 500 stock index 30-days from now. [1]A VIX solution of 20 means the expected standard deviation of the S&P 500 stock market index is expected to be 20%, 30 days from now. In 2004, the CBOE introduced VIX futures (VX) and two years later in 2006 options on VIX were offered. In 2009, VIX products were expanded to include Exchange Traded Notes (ETNs) and in 2011 Exchange Traded Funds (ETFs). This paper argues that the Standard & Poor’s 500 VIX futures (SPVF), VIX ETFs and VIX ETNs are so far removed from the VIX-statistic that they are unlikely to exhibit the characteristics of volatility at a reasonable price. The existing literature provides ample evidence for rejecting VIX-products as equal to the VIX-statistic. The very creation of a security provides a tangible contract that, by definition, is no longer just a statistic. For example, the creation of VIX futures, requires compliance with a written contract specifying the rules for: trading times, trading platforms, settlement procedures, block trades, marking-to-market, margin requirements, trading costs, etc. The tangible futures security is subject to many rules, expenses and cash flow patterns that are unrelated to a VIX-statistic. Each time a futures contract is rolled into another futures, roll costs are incurred, increasing the total expenses. Market practices and contract specifications result in an asset that is guaranteed, by design, not to equal the VIX-statistic plus the cost-of-carry. More importantly, the lack of a tangible underlier creates an inability for traders to arbitrage, thereby severing any tangible link between the VIX futures and the cash VIX-statistic.

Table 1:

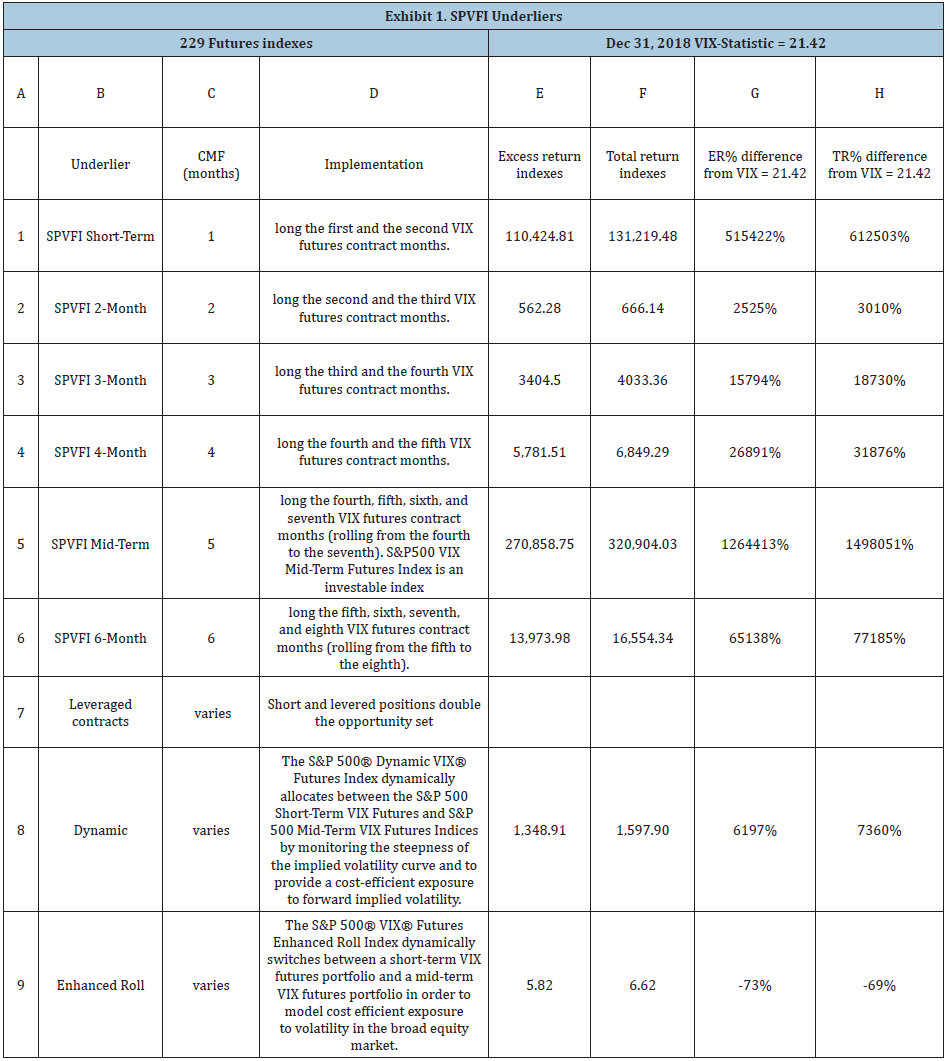

Unlike VIX futures, volatility ETFs and ETNs are not based on the VIX-statistic. Instead, the tradable funds are based on one of the 229 investable S&P 500 Volatility Futures Indexes (SPVFI) series, such as those listed in Exhibit 1. Each index is defined as either an excess return or total return value. The total return indexes include accrued interest on the notional value of the index, based on the 3-month US Treasury rate, which is reinvested into the index. The exact pricing differences between the VIX-statistic and related ETFs and ETNs depends on the specific underlying index. Not surprisingly, the index denominations bear no resemblance to the actual VIX-statistic because the underlier is a weighted index of VIX CMF contracts. Comparisons between the values of volatility ETFs, ETNs and the VIX-statistic are nonsensical because none of the values for the excess or total return indexes are remotely related to the value of the standard deviation of the S&P 500, i.e. 21.42%. Column E shows the value of the excess return indexes on 12/31/2018 and column F shows the total return differences. Clearly, none of the values in columns E or F bear any resemblance to the VIX-statistic. Column G calculates the percentage difference between the excess return indexes and the VIX-statistic while column H is the same for the total return indexes (Table 1). The value differences are a clear indication of the separation between the VIX-statistic and the underliers for ETFs and ETNs. Even so, the introduction of volatility ETFs and ETNs, expanded access to the volatility market to smaller investors.

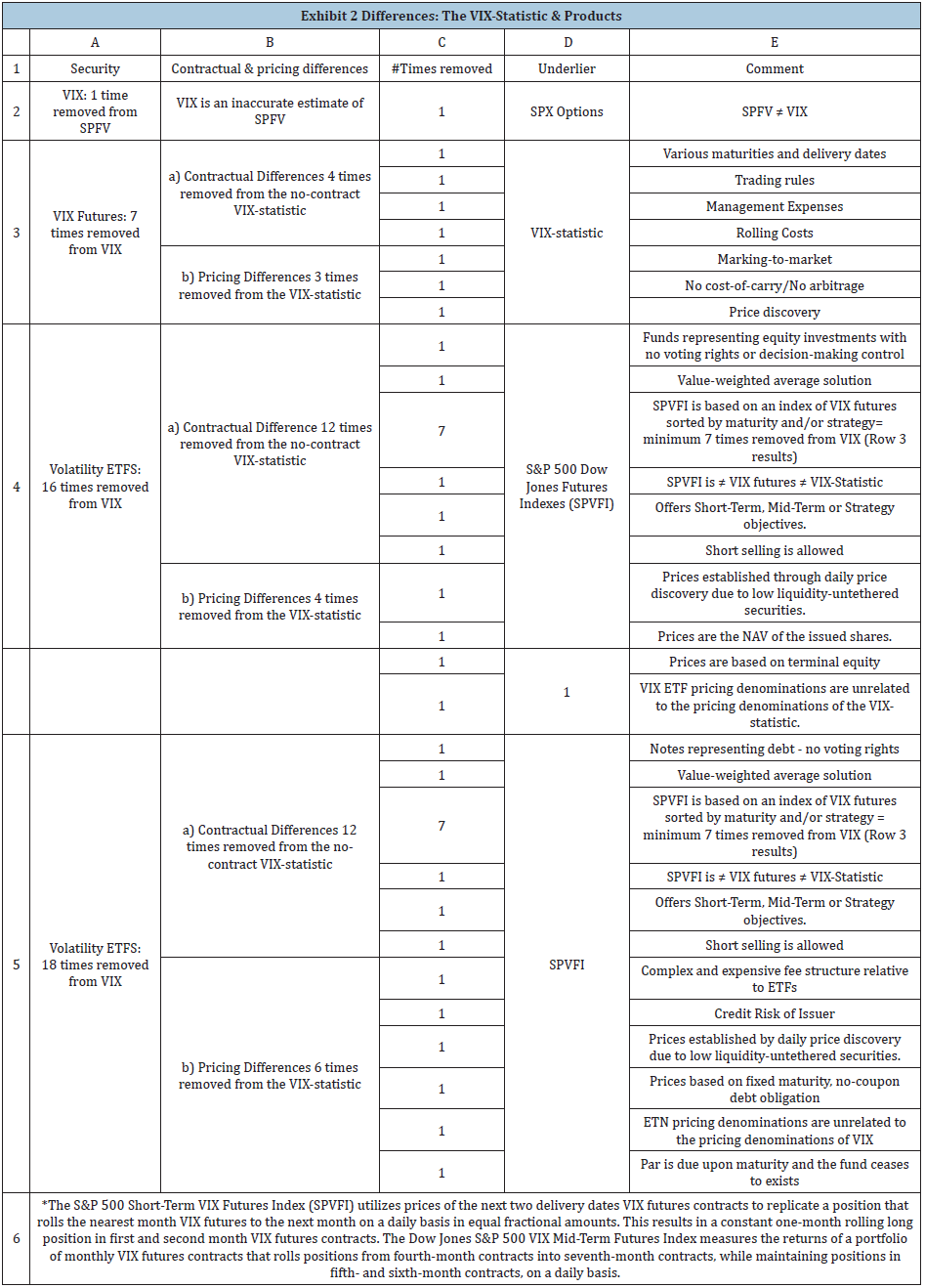

Exhibit 2, row 1 identifies the five columns presented as:

- Security: Column A provides the name of the volatility instrument, i.e. VIX, VIX futures, VIX ETFs and VIX ETNs, and the total differences from the underlying VIX-statistic.

- Contractual and pricing differences: Column B separates each volatility security into 2 parts:

- Contractual Differences from the VIX-statistic, and

- Pricing Differences from the VIX-statistic.

- #Times removed: Column C provides the number of times each contract and pricing characteristic results in a difference from the VIX-statistic. Specifically, each characteristic of a VIX security that differs from the VIX-statistic is counted as 1 time removed, but it is not weighted by impact. Therefore, some differences may have a minor impact while others may have a major impact, but each is still counted as 1 time removed (Table 2).

Table 2:

- Underlier: Column D indicates the underlier for each contract type. Note that the VIX-statistic is the underlier only for VIX futures. The underliers for VIX ETFs and ETNs are tied to a given VIX futures index that is categorized as: short-term, mid-term or leveraged. The most interesting point is that ETFs and ETNs are not directly tied to the VIX-statistic or even to the VIX futures but to an index of VIX futures that have preferred or common maturity characteristics.

- Comments: Column E provides a brief explanation for counting a difference from VIX.

Row 2 provides a baseline for the VIX-statistic, which cannot be different from itself, but is different from the actual 30-day S&P500 Future Volatility. The volatility literature compares VIX to the actual 30-day forward S&P 500 variance and concludes the current calculation used for VIX, may be incorrect. Academics have developed alternate models for VIX that are arguably better than the current calculation of VIX. For example, Wang and Daigler [2011], Grunbichler and Longstaff [1996], Carr and Lee [2007] and Lin and Chang [2009] provide theoretically sound models but all have pricing errors when measured over the entire range of strike prices and times to expiration. In particular, out‐of‐the‐money VIX options are difficult to model and price due to the mean‐reverting characteristic of the VIX-statistic [see Grunbichler and Longstaff, 1996]. Whaley's [1993] Black‐like option model produces the best results for in‐the‐money VIX options but overprices out‐of‐the‐money call and put options. Note that this behavior is the opposite result obtained for stock index option pricing models. Vodenska and Chambers [2013] also find the VIX-statistic is a poor predictor of the actual 30-day forward volatility of the S&P 500. The authors examine the daily VIX and S&P 500 Index volatility data for the 20-year period between 1990 and 2009 and find that VIX lags the S&P 500 one-month volatility. The authors then study time periods of high volatility versus low volatility and find that VIX overestimates the S&P 500 Index volatility during the stable financial market regimes and underestimates the S&P 500 Index volatility throughout high volatility periods. Zhu and Zhang (2007) posit a stochastic variance model of VIX time evolution and develop an alternate expression for VIX futures. It is found that the model with parameters estimated from the whole period from 1990 to 2005, overprices the futures contracts by 2–12% when the parameters are estimated from the most recent one‐year period. Bardgett, Gourier & Leippold (2019) estimate a flexible affine model using an unbalanced panel containing the S&P 500 and VIX index returns and option prices and analyze the contribution of VIX options to the model’s in- and out-of-sample performance. The authors find that the affine model contains valuable information on the risk-neutral conditional distributions of volatility at different time horizons, not spanned by the S&P 500 market. Row 3 identifies VIX Futures contracts as 6 times removed from the VIX-statistic based on 3 contractual and 3 pricing differences. VIX futures are accompanied by a contract providing various maturities and delivery dates. In addition, futures involve contractual rules that include maturity and delivery dates, trading cost, rolling expenses and available hours. The mere existence of a contract differentiates VIX futures from the VIX-statistic. Other features of VIX futures create pricing differences between the VIX-statistic. The practice of marking-to-market introduces interim cashflows into the pricing models. More serious price divergences can occur because the futures price is not tethered to the underlying VIX-statistic, eliminating investor ability to arbitrage. In addition, the volume of trade for VIX has declined dramatically since the introduction of other volatility instruments. Low volume can lead to lags in price discovery for volatility futures (Table 3)

Table 3:

Row 4 identifies VIX ETFs as 14 times removed from the VIX-statistic based on 10 contractual and 4 pricing differences. The underlier for volatility ETFs can be one of several different SPVFIs, none of the indexes are equal to the VIX Futures. SPVFIs are constructed as value-weighted indexes based on short-term futures contracts, mid-term or strategy objectives. Prices are established based on the Net Asset Value (NAV) and the denominations are unrelated to the denominations of VIX. In addition, there are management expenses that average 1.16% plus rolling costs. Finally, Row 5 identifies VIX ETNs as 16 times removed from the VIX-statistic based on 10 contractual and 6 pricing differences. Many of the ETF differential factors are the same for ETN with the exception of the unique features of debt that accompany notes.

In so far as the goal is to obtain an accurate measure of the 30-day future volatility of the S&P 500, the literature offers several models, with no consensus on the best approach. It is generally accepted that the CBOE VIX calculation is not an accurate measure of SPFV and is not the only measure of SPFV. Pricing differences between VIX ETFs and VIX futures are not limited to the CMF or the measure of total or excess returns. Contracts are also rebalanced daily by rolling futures positions, increasing the transactions fees. Additionally, index weighting methodologies are a function of the total dollar obtained on day t divided by the total dollars invested on day t-1. The prospectuses for both ETFs and ETNs contain the following disclosure:

While the Funds seek to meet their investment objectives, there is no guarantee they will do so. Factors that may affect a Fund’s ability to meet its investment objective include:

- The Sponsor’s ability to purchase and sell Financial Instruments in a manner that correlates to a Fund’s objective.

- An imperfect correlation between the performance of the Financial Instruments held by a Fund and the performance of the Index.

- Bid-ask spreads on such Financial Instruments.

- Fees, expenses, transaction costs, financing costs and margin requirements associated with the use of Financial Instruments and commission costs.

- Holding or trading Financial Instruments in a market that has become illiquid or disrupted.

- A Fund’s Share prices being rounded to the nearest cent and/or valuation methodologies.

- Changes to the Index that are not disseminated in advance.

- The need to conform a Fund’s portfolio holdings to comply with investment restrictions or policies or regulatory or tax law requirements.

- Early and unanticipated closings of the markets on which the holdings of a Fund trade, resulting in the inability of the Fund to execute intended portfolio transactions.

- Accounting standards and

- Differences caused by a Fund obtaining exposure to only a representative sample of the components of the Index, overweighting or underweighting certain components of the Index or obtaining exposure to assets that are not included in the Index.

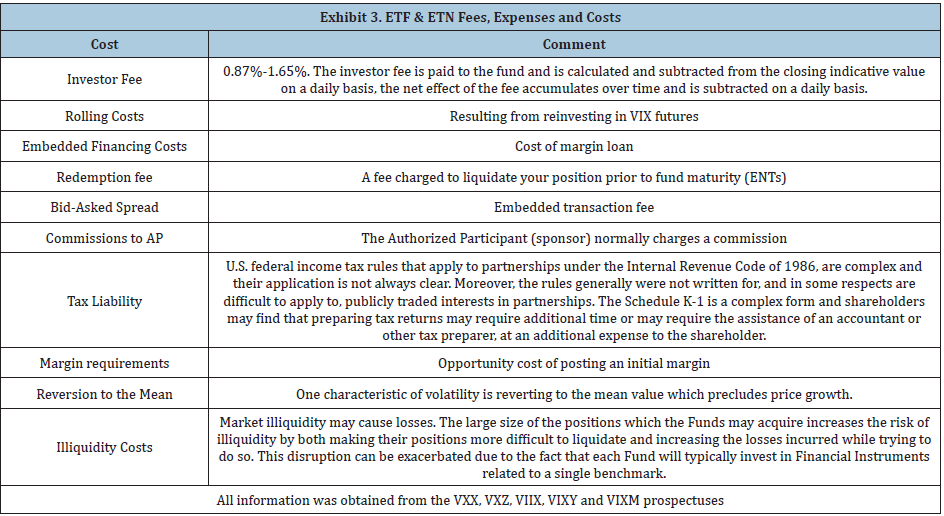

Investors in volatility funds should be aware of the fees, expenses and costs shown in Exhibit 3 that apply to ETFs and ETNs. Expenses fall into two categories: explicit and implicit costs. The explicit costs include the investor fee, redemption fee, bid-asked spread and commission to the authorize participant (AP). Implicit costs include tax liability, margin requirements, embedded financing costs, reversion to the mean and illiquidity costs.

VIX IS not equal to the future S&P 500 volatility

Table 4:

One of the main, documented benefits of trading VIX- type contracts is its negative correlation with movements in the market. The inverse relationship between market volatility and stock market returns is well documented and suggests a diversification benefit which implies that including volatility as a diversification asset can significantly reduce portfolio risk. VIX futures and options are designed to deliver pure volatility exposure in a single, efficient package. The volatility of the VIX is about four times as great as the underlying cash index and is referred to as the volatility of volatility. The average value of the VIX in 2010 was 21.6070 and is 24.66, to date, in 2011 on all available S&P 500 option contracts. Higher VIX levels indicate that the market’s anticipation of 30-day forward volatility is increased. Some argue that this also indicates greater fear in the market. However, there is no research showing a direct relationship between increased standard deviation of stock returns and market fear (Table 4).

The idea behind the construction of the VIX dates back to the implied volatility present in the Black-Scholes [1973] model. The Black-Scholes Option Pricing (BSOP) model demonstrates that call option premiums can be completely described from four deterministic values as well as the variance of the underlying stock. The relevant variance required to accurately price calls is the variance of the underlying stock while the option is alive. This future variance requirement limited the usefulness of the BSOP model until it became clear that the model could be used in reverse to discover the forward variance for the underlying equity. That is, given the current market call premium, the risk-free rate, the strike price, the stock price and time until expiration, an iterative process was used to solve for the implied forward variance of the underlying stock.

The idea behind the current VIX was introduced by Professor Robert Whaley of Duke University [1993]. Professor Whaley’s calculations are slightly different than those now employed by the CBOE but the substance remains much the same. Madan, Carr and Chang [1998] and Demeterfi, Derman, Kamal and Zou [1999] developed the original idea behind the currently used VIX methodology but it was not put in to practice until 2003 when Sandy Rattray and Devesh Shah of Goldman Sachs along with the CBOE updated the VIX methodology using the S&P 500 (SPX) index options. [2]The new procedure requires averaging the weighted prices of the SPX puts and calls over a wide range of out-of-the-money strike prices. This made it possible to transform the VIX from an abstract concept into a realistic standard but it could not be traded until 2004 when VIX futures were first offered.

Higher VIX levels indicate that the market’s anticipation of 30-day forward volatility is increased. Some argue that this also indicates greater fear in the market. However, there is no research showing a relationship between a higher standard deviation of stock returns and market fear. Given the bell shape of the normal distribution, one could just as easily argue that a high VIX indicates market exuberance, but it is more accurate to term high VIX as high uncertainty. The implied volatility of the market can be calculated iteratively using the Newton-Raphson technique (Kim, et al, [2008]) based on the Black-Scholes model or the CBOE approach. There is no general model or approach which is theoretically accepted. Even so, the CBOE approach to the VIX calculation has become the accepted market norm. The concept for the construction of the VIX is rooted in the implied volatility present in the Black- Scholes (1973) model. The Black-Scholes Option Pricing (BSOP) model demonstrates that call option premiums can be completely described from four deterministic values plus the variance of the underlying stock. The relevant variance required to accurately price calls is the variance of the underlying stock while the option is alive. This future variance requirement limited the usefulness of the BSOP model until researchers realized that the model could be used in reverse to derive the forward variance for the underlying equity. An iterative process can be used to solve for the implied forward variance of the underlying stock when given the current market call premium, risk-free rate, strike price, stock price and time until expiration.

This may be due to the rapid release of multiple, unique volatility products during the 2006-2011 time period combined with the identification of some very interesting price behaviors. Academics have identified a plethora of issues with the behavior of volatility over time, including mean-reverting values, distributional skewness, jump-diffusion processes and non-constant volatility (volatility smiles). These characteristics should not occur based on standard Black-Scholes [1973] option theory, which normally requires a completely flat volatility curve. Many authors have studied the mean reversion characteristic of VIX and confirmed its existence, see for example Dash and Moran [2005] and Lin [2013]. Similarly, the distributional skewness of VIX and VIX futures contract is carefully documented in the Black [2006] research and the Lalancette and Simonato [2017] paper. Eraker, Johannes and Polson [2003] provide detailed evidence of the impact of the jump-diffusion process, including jump times, jump sizes and spot volatility. Later, Mencia and Sentana [2013] provide additional insight into the VIX jump-diffusion process. Buraschi and Jackwerth [1999] confirm the existence of a volatility smile in their work. In an updated model Bardgett, Gourier and Leippold [2019] shed new light on the volatility dynamics and the volatility smile. Aside from the pricing behavior of VIX, Bekaert and Hoerova [2014] find that the variance premium predicts stock returns while the conditional stock market variance predicts economic activity and has a relatively higher predictive power for financial instability than does the variance premium. Gantenbein and Rehrauer [2013] show that VIX is a truly negatively correlated asset with the S&P 500. As such, they argue that volatility deserves a place in the investment opportunity set. However, the authors go on to show large differences in performance between spot volatility and derived futures-based volatility products. This can lead to investor misunderstandings because volatility is promoted using the spot VIX, in spite of the fact that the prospectuses clearly state the volatility product is not related to VIX.

VIX futures are not VIX

Generally, futures prices are a function of the underlying cash price plus a cost-of-carry, Øjt,n. In the context of volatility this implies that: VXjt,n =VIXt,n +Øjt,n. When futures prices are misaligned with a cost-of-carry model, arbitrage will occur between spot and futures prices until a bounded range of possible values, defined by the size of trading cost, is established. This cost-of-carry model does not work for VXjt,n because VIXt,n is not tradable. Therefore, arbitraging is not possible which places volatility futures in a class of, interesting, but untethered values. Still, researchers have gained invaluable insight into the behavior of volatility due to the existence of the VIX-statistic and other volatility indexes (also a misnomer). Contrary to the academic benefit of VIX and VIX-type statistics for other stock indexes, the practical application of VIX has been unsuccessful, so far.

The most closely related volatility product to VIX is the VIX futures contract. Although the VX contracts are the most closely related to the VIX-statistic, they still represent significant differences from the underlier. The securitization of an actual asset into a futures contract, results in contract requirements that offer various maturities, numerous trading rules and roll-expenses that are three times different from the no-contract, no-expense VIX-statistic. In addition, due to clearing house practices, the VXjt,n contract price cannot ever equal VIXt,n because the jth contract requires interim cashflows that influence the value of VXjt,n contracts but are unrelated to the VIX-statistic. For example, VXjt,n contracts require gains and losses to be realized in cash each day through the marking-to-market process. Similarly, roll expenses associated with maintaining a CMF position, are incurred when trading VXjt,n contracts. Anytime a cashflow pattern is changed, the value of the financial security will also change, resulting in a value for VXjt,n that need not ever equal VIXt,n. In addition, the lack of a closed-form futures basis, results in the absence of a natural market equilibrator for the range of possible prices around VIXt,n. VXjt,n contract prices are an additional 3x different from the pricing of VIXt,n.

Volatility futures are the securitization of an educated guess on the 30-day forward volatility of the underlying S&P 500 Stock Market Index. Volatility futures contracts obligate the long to pay the futures contract price, VXo, in exchange for the Special Opening Quotation (SOQd) on the day of delivery. Specifically, the final settlement value for VIX futures is a SOQd of the VIX-statistic calculated from the sequence of opening premiums for the SPX options used to calculate the single value of the statistic. In the event that there is no opening traded price for an option, the opening price used in the SOQd calculation is the average of the first bid and offer immediately after the series is opened but prior to the cancellation of any remaining open orders. If the first bid disseminated in a particular series is zero, the limit price of the best unexecuted buy order(s) with quantity remaining, if any, is used as the opening bid. Upon delivery: (Fo - SOQd) *1000/contract is paid by the long to the short if Fo >SOQd. However, if Fo <SOQd, then the short pays the long the times removed. There is no underlier, resulting in a contract that must be cash-settled. Clearly, this entire process is unrelated to the value of a VIX-statistic on any given day and removes the possibility of equality.

Nossman and Wilhelmsson [2009] formally test the relationship between VIX and VIX futures contract values and find that when the VXjt,n price is adjusted by a negative risk premium, the futures will accurately forecast the direction of the VIX-statistic 73% of the time. However, when the VXjt,n prices are not adjusted, the forecasts of the direction of the VIX-statistic are very poor, causing the rejection of the Expectations Hypothesis. Eraker and Wu [2017] study the returns to investing in VIX futures and find that investors who purchase VXjt,n contracts pay more than the value of the spot VIX at expiration of the futures contract, on average. This is not surprising given the findings of Psychosis, Dotsis and Markellos [2010] who demonstrate that VX prices are often higher (lower) than the VIX-statistic at times when the statistic is at relatively low (high) levels.

Other research suggests that holding VXjt,n over a long time-period is a counter-productive strategy because the mean-reverting values result in negative returns. Bollen, O’Neill and Whaley [2017] and Whaley [2009], find some very interesting results regarding whether trading in a volatility instrument, impact the value of the underlying volatility. The authors show that because the relation between the VIX cash index and the VIX futures is not arbitraged, the changes in VXjt,n now lead changes in VIXt,n, whereas previously Vixen changes led VXjt,n price changes.

VIX ETFs are not VIX

A volatility exchange traded fund offers investors buying opportunities that are as easy to initiate as buying a stock. An investment in a volatility fund is a limited liability investment; investors cannot lose more than the amount invested plus fund expenses. However, shareholders of the fund could be required, as a matter of bankruptcy law, to return to the estate any distribution received at a time when the fund was insolvent. Each volatility fund issues shares, which represent units of fractional, undivided beneficial interest in and ownership of the funds. Volatility ETFs are held by a sponsoring institution that has exclusive management and control of all aspects of the business. Shareholders do not vote on any aspect of the sponsor’s business.

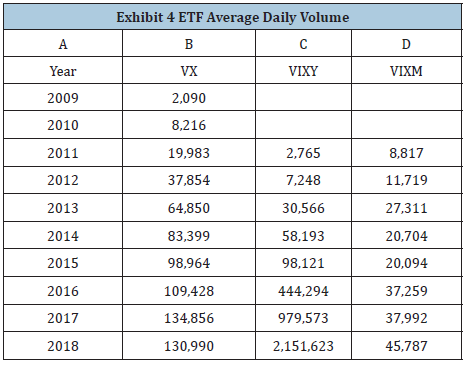

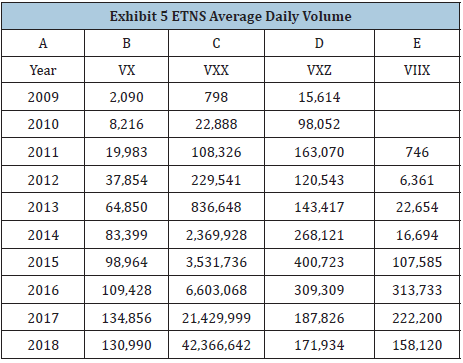

The underlier for VIX ETFs is one of the 12 SPVFIs previously listed. There are also funds that use SPVFIs to create strategy funds, inverse volatility funds and those that offer 2-3 times magnification of leverage. Shares may be purchased from the fund or redeemed on a continuous basis by Authorized Participants[3] (AP), but not by individual shareholders. APs may offer shares to the public at a per share market price that varies depending on factors such as: the trade price/share, the NAV/share and the supply of and demand for the shares at the time of the offer. The shares are not are not guaranteed by the Sponsor nor are they insured by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Exhibit 5 provides some insight into the growth in volume for VX, VIXY and VIXM. Higher volumes of trade are associated with higher liquidity and more accuracy in price discovery. When VIXY and VIXM were first introduced in 2011, the volume for both is much less than for VX. In 2015, VIXY’s average daily volume came close to the volume of VX contracts and then surpassed both VIXM and VX in 2016-2018 as it gained in popularity. The main times removed between VIXY and VIXM, is that VIXY is based on the short-term SPVFI and VIXM is based on the mid-term SPVFI. The final year studied, 2018, indicates that the volume for VIXY is 16.5 times greater than VX and 47 times higher than VIXM. Not surprisingly, the volume of trade for volatility products relative to stocks products is miniscule. For example, in 2011 volatility products have an average daily volume of only 0.0071% relative to the 500 stocks representing the S&P index. By 2018, the volume of volatility products increased to 1.18% of the underlying equity. In spite of the relatively low volume, research has provided more insight into the price discovery function of SPVFI-based ETFs.

Bordonado, Molnár and Samdal [2017] examine price discovery, hedging and trading strategies using VIX ETFs and ETNs. They find that the funds and notes are exposed to the same mean-reversion tendencies as the underling SPVFI. The authors conclude that this makes volatility ETFs and ETNs unsuitable for buy‐and‐hold investments because expected returns are negative. Despite being negatively correlated with the S&P 500, the authors conclude that ETFs and ETNs perform poorly as a hedging tool and their inclusion in a portfolio based on the S&P 500 will decrease the risk‐adjusted performance of the portfolio. Work by Deng, McCann and Wang [2012] also shows that volatility ETFs and ETNs are not effective as stock hedges due to the mean reverting behavior of volatility and the negative roll-yield on volatility futures. Taking a completely different approach, Chen and Huang [2014] fail to reject the weak-form market efficiency for volatility ETFs, due to the presence of long-term memory which results in reversion to the mean.

In addition to pricing issues, volatility ETFs are also expensive relative to equity index ETFs. Fees associated with the sponsor include management fees, licensing fees and administrative fees, ranging from 0.89% to 1.98%. In addition, brokerage fees and marketing fees are charged and vary widely, depending on the selected AP. Participants are generally required to pay variable redemption fees of up to 0.10% of the value of each order placed. Expenses and fees are accrued daily and are accounted for in determining the NAV. NAV is determined once each trading day at 4:15p.m. ET. Volatility ETFs are not managed by investment companies nor are they regulated under the Investment Company Act of 1940. Whaley [2013] argues that even in the absence of all the fees and expenses, volatility ETFs and ETNs are destined to lose money from a contango trap, in which VX prices are systematically drawn downward. Similarly, Clowers and Jones [2016] demonstrate that the risk and return features of volatility ETFs and ETNs are unrelated to the risk-return features of the VIX-statistic. The authors go on to accurately note that VIX ETFs and ETNs do not correlate well to the VIX-statistic, most likely because it is not the underlier. This results in some problems with individual investors often mistaking the volatility funds and notes for and an investment in the VIX-statistic itself. Clowers and Jones [2016] and Whaley [2013] separately study this problem and find that individual investors often make this mistake which leads to costly hedging errors.

VIX ETNs are not VIX

Volatility exchange traded notes are similar to exchange traded funds in that they trade on a stock exchange and track a benchmark index. Juxtaposing volatility ETFs, ETNs are senior, unsecured debt securities issued by an investment company. Returns for volatility ETNs are based on one of the SPVFI, which offers various maturities and strategies. ETNs promise to pay at maturity, the full value of the index/share minus the management fee. Volatility ETNs have a unique fee structure. The investor fees are calculated cumulatively based on the yearly fee and the performance of the underlying index and increases each day based on the level of the index on that day. Naturally, the investor fee reduces the amount of return at maturity and if the value of the underlier decreases, or does not increase enough, the investor will receive less than the principal amount of investment at maturity or upon redemption. Redemption value may be zero, resulting in a 100% loss of invested funds, upon maturity. Like any other debt security, the investor is subject to the credit risk of the bank issuer. Traditional ETNs can be liquidated before maturity by trading them on the exchange or by redeeming a large block of securities directly to the issuing bank. However, volatility ETNs generally do not allow early redemptions; those that do, charge a penalty. ETNs are less liquid than ETFs and their performance differs significantly from the performance of the underlying index. For volatility ETNs, the times removed between the performance of the futures underlier and the ETN is large and sustainable.

Goltz, Felix and Stoyanov [2013] used the failure of the TVIX, a volatility ETN, to show that tracking a CMF SPVFI, rather than the VIX-statistic itself, results in a negative impact on returns. Further, ETNs are not governed by the same standards of disclosure as investment funds or commodity pools, resulting in a higher likelihood that investors are less informed. According to Liu, Berlinda and Dash [2012], the advent of volatility ETNs linked to the SPVFIs has broadened access to volatility trading but has also significantly increased the misconceptions about the relationship of these products with spot VIX and the volatility term structure. Bašta and Molnár [2018] finds that ETNs impound information at different speeds based on the trading volume. For example, the author finds that VXX (ETN) impounds information faster than VIXY (ETF) due to the higher trading volume. Comparing Exhibit 4, column C, with Exhibit 5, column C, highlights that the volume of VXX trading ranges from a high of 41 times greater (2014) to a low of 15 times greater (2016), than VIXY. Fernandez‐Perez, et al [2018] also find that trading costs and market liquidity are significant determinants of price discovery (Table 5). Markets with high trading costs and low liquidity, such as the volatility ETN market, distort the price discovery function. Alexander and Korovilas [2013] and Alexander, Kapraun and Korovilas [2015] find that, contrary to classical commodities, VIX and VIX futures exhibit large volatility and skewness, consistent with the absence of cash-and-carry arbitrage. Most interesting, the authors find a feedback problem whereby trading volatility ETNs, influences the price of the underlying SPVFI. As mentioned previously, Bollen, O’Neill and Whaley [2017] find this same result with regard to VIX futures in their aptly named paper Tail Wags Dog: Intraday Price Discovery in VIX Markets. The securities listed in Exhibit 6 show that VXXn has the greater liquidity in every year, except 2009, than VXjn. However, VXXn also has less liquidity in every year than VXZn and less than VIIX in the past 4 years. ETNs are not deposit liabilities and are not insured or guaranteed by the FDIC or any other governmental agency of the United States, Switzerland or any other jurisdiction. The value of ETNs is heavily impacted by the credit rating of the issuer. The value can decline due to a downgrade in the issuer's credit rating, even though there is no change in the underlying index. The price denominations of the volatility ETNs make no sense in the context of VIX. For example, VXX opened on 1/30/2009 with a price of 102,512.64, VXZ opened on 2/20/2009 at 432.68 and VIIX opened on 11/30/10 at 5,177.50. On those same dates, VIX is equal to 44.84, 49.30 and 21.36, respectively. More recently, ETNs are issued at a par values of $50 per share, resulting in a level value that will always remain disparate from VIX. Gantenbein and Rehrauer [2013] argue that the current common conception of ETNs as being convenient investment instruments is misleading, since they are highly complex financial products that are more difficult to make use of than the financial industry would like retail investors to believe.

Table 5:

VX IS still not VIX

To test the equality of VIX futures contract prices to the value of the VIX-statistic, daily data from inception on 3/26/2004 through 12/31/2018 is collected and a roll-period of one-month established. The roll with the best fit is a one-month futures contract, rolled into another one-month futures one day prior to the expiration of the previous contract. The VX contract data is obtained from the CBOE and used to create a 1-month futures rolling time series. Specifically, on the first VX trading day, 3/26/2004, a position is established in the nearest available contract, the May 04. One day prior to the May 04 delivery, 5/19/04, the position is rolled into the Jun 04 contract. On 6/16/04, one day prior to the Jun 04 delivery, the contract is rolled into the Jul 04, and so on. All results displayed for 2004 are missing the first 3 months of the year. The resulting VX series created for this study has a CMF of two weeks

- The S&P 500 Stock Index data series shows evidence of URs in every year tested for the drift component, but the slope test rejects evidence of URs in every year.

- The VIX-statistic daily data series shows evidence, in both the drift and slope coefficients, of URs in 7 years: 2010, 2012-2015 and 2017-2018. The remaining 8 years indicate that UR are not present.

- The VX 1-month rolling futures data series shows evidence, in both the drift and slope coefficients, of URs in 6 years 2012-2015 and 2017-2018. The remaining 9 years indicate that UR are not present.

To stabilize the S&P 500 and VIX data, a natural logarithmic adjustment is made to all the variables for consistent interpretations, as follows:

VIX ETFs are still not VIX

The objective of this section is to determine whether the performance of two VIX ETFs: VIXY and VIXM, mimic the performance of the VIX-statistic by exhibiting the same return pattern with respect to changes in the lnSPt,n. Data Set #3 is specified in Exhibit 8 and contains Data Set #2 plus daily data for the two ETFs: VIXY and VIXM, both introduced in 2011. The ETF data is obtained from finance. Yahoo, covering the period from inception through 12/31/2018. Column A shows the Data Period and column B identifies the Security. Each security’s Benchmark and Sponsor are listed in columns C and D, respectively.

VIX ETNs are still not VIX

The objective is to determine whether the performance of the 3 ETNs: VXX, VXZ and VIIX, mimic the performance of VIX by exhibiting the same return pattern with respect to movements in the S&P 500.

VIX cannot measure investor fear

To argue that VIX is a measure of fear, has no more meaning than VIX as a measure of exuberance. While those two extreme emotions could be involved in the distribution of possible feelings, there are no academic studies, in the finance or psychology literature, to support VIXt,n as a successful measure of the distribution of feelings. In fact, there is no such thing as an accurate distribution of feelings. VIX does not, cannot and will not ever measure feelings because it estimates the 30-day forward volatility of the S&P 500 stock index. Even so, without evidence, much of the early literature assumes investors are fearful when VIX rises, rather than excited or driven by some other emotion. Some interesting article on this topic include Arak and Mijid [2006], Smales [2014] and Durand, Lim and Zumwalt [2011]. Beginning in 2015, popular news outlets discussed investor puzzlement at the low levels of VIX, during a period of high public stress, high political stress and social division. Some investors have argued that VIX no longer has the same meaning as it once did; but it does. VIX cannot be judged for being a poor predictor of investor feelings, since it is designed to estimates the 30-day forward volatility of the S&P 500 stock index.

In 2007 the CBOE recognized that investors may be reacting to, not only the level of VIX, but its own volatility, the VVIX. The VVIX measures the volatility of the VIX-statistic and is frequently summarized as a ratio, VVIX/VIX. Exhibit 12 highlights the need for a more careful interpretation of the level of VIX relative to some hypothetical distribution of investor feelings. Suggesting that VIXn measures the level of investor fear, suggests that VIXn is equal to a distribution of investor feelings, but it is not. The way VIXn is presented, not only eliminates investor feelings about the upper half of the distribution but assumes that investors are singularly impacted by only the level value of VIXn and VVIXn does not matter.

The level of the VIX-statistic cannot distinguish between exuberance and fear and is not a distribution of investor feelings. Instead, VIXn levels provide a point estimate on a distribution that has a width defined by VVIXn. The distribution of VIXn does not equal some hypothetical distribution of investor feelings, nor is there any theoretical basis to assume otherwise. The size of the VIXn distribution, defined by VVIXn, provides a set of possible point outcomes for VIX. Higher risk is rewarded in the stock market with higher expected returns, however, when the ‘asset’ is defined as a measure of risk (i.e. VIX), then higher levels of VVIXn do not correspond with higher returns on investment. This is normally attributed to the mean reverting behavior of VIXn, but it is also due to the fact that VIXn is not an asset. The return on an investment in the risk of the S&P 500 stock index implies that increased risk will result in increased returns on VIXn but not necessarily increases in VVIXn.[1]The VIX-statistic is calculated twice a day:

- at the end of session G: between 2:15 a.m. CT-8:15 a.m. CT and

- at the end of session H: between 8:30 a.m. CT - 3:15 p.m. CT.

[2]See Carr and Wu [2006] for a complete explanation of the differences between the old and new VIX calculations.

[3]The prospectuses refer to investment companies, brokerage firms, banks, etc., as Authorized Participants.

Conclusion

Contrary to popular belief, the VIX has not, and cannot, be securitized and traded. The theoretical benefits of VIX have provided invaluable insight into the behavior of volatility but the attempts to create a tradable alternative have failed. As a practical tool, VIX does not exist because the very act of securitizing the statistic for trade, results in contract requirements that remove the product at least 3-10 times from the no-contract VIX-statistic. Additionally, there are unique principles that apply to each product-type, that results in distinctive pricing times removes that remove VIX instruments an additional 3-6 times from the VIX-statistic. This work provides theoretically based arguments for the rejection of VIX as an index, the rejection of the VIX-statistic as a separate asset class and the rejection of VIX as a measure of fear, or any other distribution of investor feelings. The first test results demonstrate that VIXt,n is a poor predictor of SPFVt,n, such that VIXt,n is at least 1 time different from the actual 30-day forward volatility of the S&P 500. This means the VIX-statistic, VIX futures, VIX ETNs and VIX ETFs are based on an inaccurate measure of the future 30-day volatility of the S&P 500. The regression test results indicate that VIX-products are significantly different than the VIX-statistic.

Volatility securities that are far removed from the VIX-statistic, produce results that are less likely to exhibit the beneficial characteristics of volatility. If investors need negative correlations and win-lose contracts, this can be more easily and accurately accomplished, with lower risk and lower expenses, through equity derivatives. For example, a short position in the S&P 500 futures, S&P 500 ETFs or S&P 500 ETNs, will create negatively correlated positions with the returns on the S&P 500. In addition, long S&P 500 put positions or short call positions will also create negative correlations with movements in the S&P 500. A position in the S&P 500 stocks, combined with an offsetting position in one of several S&P 500 derivative products, guarantees losses in one position and offsetting gains in the other position. VIX Futures, VIX ETFs and VIX ETNs are 6, 14 and 16 times removed, respectively, from the actual VIX-statistic as specified in column C. The CMF are also measured in weeks for many of the futures indexes, expanding the opportunity set for investors. When long, short and levered positions are considered, the opportunity set is doubled and then tripled. When volatility securities are far removed from the VIX-statistic, they will not exhibit the beneficial characteristics of inverse at a reasonable price.

© 2020 Hancock GD. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)