- Submissions

Full Text

Strategies in Accounting and Management

FRS105

Robin Jarvis, Suman Lodh, Akshay Shah and Monomita Nandy*

Reader in Accounting and Finance, UK

*Corresponding author:Monomita Nandy, Reader in Accounting and Finance, Brunel Business School, Kingston Lane, Uxbridge, UK

Submission: August 26, 2019; Published: September 11, 2019

ISSN:2770-6648Volume1 Issue1

Abstract

In 2015 The standard FRS 105 was introduced for micro entities eligible under company law in the UK. FRS 105 generally follows the principles applied to the main accounting standard in the UK and Republic of Ireland (FRS 102). It is further simplified in terms of recognition, measurement and disclosure. By asking four relevant questions we will empirically assess the extent that the new micro company regime has been taken up in the UK. In this report we used FAME database to empirically test the questions.

Introduction

Based on the legislation related to minimum disclosures and principles of FRS 102 (recognition and measurement principles) the FRC introduced FRS 105. The standard FRS 105 was introduced in 2015 for micro entities eligible under company law. There are 3 size classifications of private companies- small, medium or large. Within the small company classification there is a sub-set called a micro-entity, which is applicable to very small companies. Micro entity category was introduced for accounts falling after 30 September 2013. Companies are classified as micro entities if they meet at least two of the following criteria: sales ≤£632,000, total assets ≤£316,000, and number of employees ≤10 (DBIS, 2013, p. 5). Although, FRS 105 generally follows the principles applied to the main accounting standard in the UK and Republic of Ireland (FRS 102), it is further simplified in terms of recognition, measurement and disclosure. The main intention of this simplified accounting is to reduce the administrative burden for the micro entities. There is also an option under the micro-entity regime to file unaudited abbreviated balance sheet. But in the literature and in practice there exists a contradictory view about loss of information related to micro entities [1,2]. This report will empirically assess the extent that the new micro company regime has been taken up in the UK by an interrogation of the Bureau van Dijk FAME (Financial Analysis Made Easy) database.

Questions/objectives

1. Has the new micro/FRS105 regime been chosen by most eligible companies?

2. Are there any significant differences in take up between sizes of micro companies?

3. Are there any difference between sectors between those using FRS105 and those who do not?

4. Are those with greater liabilities more likely to provide fuller information in their financial reports?

A database of financial information of over 11 million UK and Irish companies, dating back up to 10 years, the information is updated daily.

Methodology

Fame search criteria

The data for micro entities was collected based on the criteria related to total asset and number of employees for these entities that reported after 30 September 2017. Although, the level of turnover is another of the criteria determining whether or not a company is categorized as a micro-entity this information is not available when a company elects to file abbreviated accounts. Companies with activities in all sectors were included with exception of those involving financial intermediation as these companies are subject to differing financial reporting requirements. These companies include investment undertakings, financial holding and insurance undertakings and credit institutions. In addition, other entities excluded from the micro entities regime are charities, qualifying partnerships, overseas companies, unregistered companies and companies authorized to register pursuant to 1040 of the Companies Act 2006. Following Collis (2012) investigation of the use of the voluntary audit and full accounts of micro and non- micro small companies in the UK only independent companies were included since subsidiaries may be part of larger exempt groups. FAME database was used to retrieve the abovementioned information. FAME contains information drawn from the annual reports and accounts registered at Companies House in the UK and the Companies Registration Office in Ireland. According to FAME (Source: Bureau van Dijk 2017), the database presents the accounts in a standard format and contains information on 11.5 million companies in the UK and Ireland and which includes:

A. Over 2 million companies in a detailed format,

B. 280,000 companies in a summary format,

C. Details of 1.3 million companies that are active but not required to file accounts or have yet to file accounts,

D. 6 million companies that are no longer active. These are included by FAME so that researchers can study patterns in default and confirm previous existence.

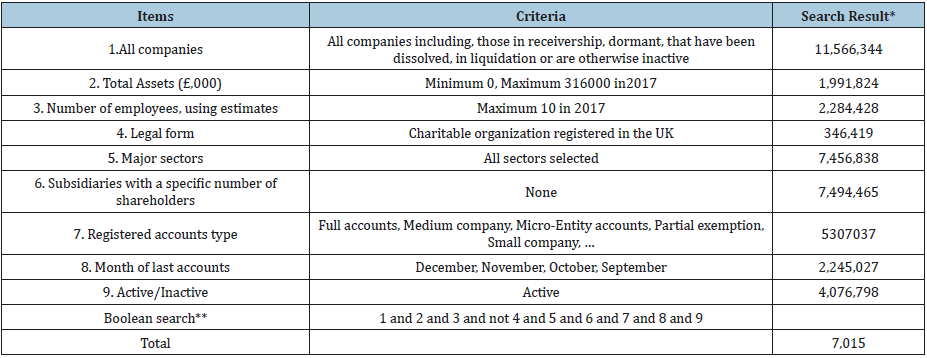

Non-availability of sufficient information in Company House has motivated us to contact them to identify if there is any other way, we determine the population of micro entity in the UK. In the following section we reported our communication with Company House. Appendix 1 outlines the selection criteria and search results used in this research project. Using our data search criteria FAME from their own database generate a list of 7015 active entities based on the definition of micro-entity defined by the Small Companies (Micro- Entities’ Accounts) Regulations 2013 out of which 2365 entities are registered as Micro Entity in the Company House. However, after consulting with the support service of FAME, we find that there may exist entities fulfilling the micro entity criteria but are not registered as micro entity correctly in the Company House. Thus, we consider other registered account type in our search criteria to capture entities with micro entity criteria but registered under other type of account. The other registered account types are full accounts, small company, medium company, total exemption full, total exemption small, partial exemption. For the definition of each of the registered account type in FAME refer to Appendix 2.

Appendix 1

A. All Companies in FAME search includes, those in receivership, dormant, that have been dissolved, in liquidation or are otherwise inactive. The number here is company year observation.

B. Number of employees, in FAME search can distinguish companies having maximum 10 employees which is one of the criterions to file under FRS 105.

C. Legal form is introduced in the search criteria in order to categorize charitable organization and omit them from the list, as one of the criteria for FRS 105 is charitable organizations cannot file under this account.

D. Major sectors in FAME allows to categorize the data by sectors, however we will be including all the sectors for our search option.

E. Subsidiaries with a specific number of shareholders - “none” as for a company to qualify as a micro entity should not have another subsidiary.

F. Registered account types - all accounts were chosen as the aim of the project is to quantify which account types are following FRS 105.

G. As explained before the Month of last accounts indicate that we considered accounts after 31 August 2017.

H. Active/Inactive accounts in FAME search categories companies which are trading and not trading. For the purpose of the study we chose active companies.

Appendix 2

Definition of all registered account type- Source: FAME database

A. Full accounts - Accounts that cover a full accounting period but omit detailed financial information.

B. Small company - According to the UK’s Companies Act 2006, a small company is defined as one that does not have a turnover of more than £6.5million, a balance sheet total of more than £3.26 million and does not have more than 50 employees.

C. Medium company - a medium-sized company is determined by its turnover, balance sheet total (meaning the total of the assets) and average number of employees. A medium-sized company can prepare accounts according to special provisions applicable to medium-sized companies. To be a medium-sized company, you must meet at least two of the following conditions: annual turnover must be no more than £36 million, the balance sheet total must be no more than £18 million the average number of employees must be no more than 250.

D. Group - group qualifies as a small group or would qualify if all the bodies corporate (which includes non-UK incorporated bodies) in the group were companies the turnover for the whole group is not more than £6.5 million net (or £7.8 million gross) the group’s combined balance sheet total is not more than £3.26 million net (or £3.9 million gross)

E. Dormant - a company is dormant if it has had no ‘significant accounting transactions’ during the accounting period. A significant accounting transaction is one, which the company should enter, in its accounting records. Dormant companies may claim exemption from audit in accordance with section 480 of the Companies Act 2006.

F. Total exemption full - small or medium sized companies filing full accounts.

G. Total exemption small - small or medium sized companies who have chosen to abbreviated accounts.

H. Partial exemption - A VAT-registered business falls within the scope of partial exemption when it has both supplies of a taxable and an exempt nature. Output VAT cannot be charged on an exempt supply, and any input VAT incurred in making the exempt supply is usually unable to be recovered.

Company house database and micro entity companies

Companies house and FRS 105: The first major objective of the study is to identify the proportion of active micro-entities that have adopted FRS 105. It was widely thought Companies House would be able to provide this information by differentiating those adopting FRS 105 as compared to adopting FRS 102 or some other standard. On request for information from Companies House the following response was received: With regards to your query the number/proportion of micro-entities that have adopted FRS 105 in preparing their accounts. Under the current legislation, we are not required to capture this information and do not perform this type of analysis. Therefore, we are unable to offer information in relation to this part of the enquiry.

The population of companies that are micro entities: In considering implementing an alternative strategy to identify FRS 105 adoption by companies who are micro entities a starting point would be identification of the total population of active micro entity companies. After searching through Company House data bases this was found to be problematic. Company House were then contacted, and a request made for sources of this data. The following response was received by Companies House: ‘Our latest annual publication for 2016/17 provides volumes of accounts with a break down using our accounts category types. Please use the link below and refer to Table 1 for volumes and percentage of accounts by accounts type for each year from 2012/13 to 2016/17, by location (England/Wales; Scotland & Northern Ireland)’ Definition of each of the Accounts Type mentioned in Table 1 is explained in Appendix 3. The total population of active micro-entities companies are included in the categories ‘Audit Exempt’ (which also includes small companies) and ‘Micro Entity’. There is no further published information which can differentiate micro entities from small companies in the category ‘Audit Exempt’. Therefore, it is impossible to determine the population of micro entities from the Companies House data base.

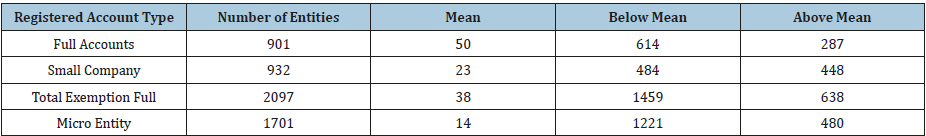

Table 1:Net tangible assets summary.

Appendix 3

Definition of all registered account type- source: Company house

A. Full accounts - Any companies that do not meet the criteria for micro-entities, small or medium are large companies and will have to prepare and submit full accounts. There were 123,649 companies who submitted full accounts in 2017 representing 4.3% of the submitted accounts.

B. Small company - Company that have a turnover of £6.5million and less, a balance sheet total of more than £3.26 million and does not have more than 50 employees file under the abbreviated small companies’ section. Only 1.1% of the companies in the UK file under this section.

C. Medium company - Companies must meet at least two of the following conditions: annual turnover must be no more than £36 million, the balance sheet total must be no more than £18 million the average number of employees must be no more than 250. In the UK there were only 3086 companies that registered their account types in this section.

D. Group - 21,133 companies registered as group whose turnover was not more than £6.5 million net (or £7.8 million gross) the group’s combined balance sheet total was more than £3.26 million net (or £3.9 million gross).

E. Dormant - 17.6% / 508, 868 companies where dormant in 2017 according to company house, they had no ‘significant accounting transactions’ during the accounting period.

F. Interim/Initial-222 companies filed interim accounts as there financial statements covered a period of less than one year.G. Audit Exempt - Companies that are exempt from the statutory requirement due to their size or (in a few cases) their nature.1,964,318 of the companies in 2017 were exempt, representing 68% of all the registered accounts in the UK.

H. Micro Entity - 8.2% of the companies registered in 2016/2017 filed micro entity accounts having either a turnover of £632,000 or less. £316,000 or less on its balance sheet as asset and less than 10 employees.

I. Audited Abridged-Accounts that cover a full accounting period but omit detailed financial information is known as Abridged account. Only 940 companies omitted detailed financial information and filed abridged accounts in 2017 [8-10].

A. For policy makers and other interested parties this deficiency is clearly significant. If regulators, policy makers and other stakeholders are to be able to monitor the impact of decisions this information needs to be available.

B. It therefore seems that the FAME data base cannot identify the total population of active micro entity companies as its source of data is from Companies House.

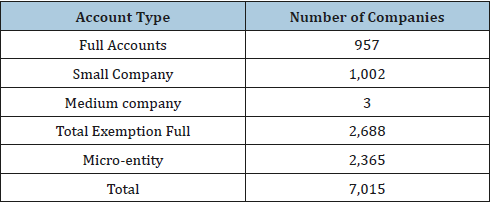

Table 2:Distribution of entities in terms of registered account types.

FAME database and micro entity companies: Appendix 1 shows that up to the end of 2017, FAME reports a total of 11.5 million companies. Once we start incorporating the criteria to identify only the active micro entities, we end up with 7,015 micro entities from the database. So, our study focuses on these 7,015 companies compromised of 5 types of registered account as described below in Table 2. Table 2 below shows us all eligible account types found by using our search criteria in Appendix 1. FAME’s publisher points out that it does not include companies with a turnover under £0.5 million but does not provide a rationale for this underrepresentation. This underrepresentation is highlighted in research articles [3], which seems to be a common concern with researchers using FAME data. Hence there are differences between Companies House data and FAME. There could be several reasons behind the differences in FAME and Company House information. For example,

1. Private companies are allowed to register their accounts up to 9 months at the end of their accounting reference period, but it could be the case that some new companies failed to survive long enough to file accounts.

2. Companies House have no record of any entity registering in wrong account type.

3. In our sample we excluded dormant which Companies House might have considered.

4. FAME is not considering audited abridged account.

5. Fame is not capturing entities with a turnover below £0.5 million.

The under representation of micro entities in this study is a limitation which is impossible to address due to problems with the collection of data by Companies House this must be borne in mind when interpreting the results.

Effective date: FRS 105 is effective for periods beginning on or after 1 January 2016 (www.frc.org.uk; Accessed on 25 March 2018). So, these entities report for the year ended on 31 December 2016 (assuming their year-end is 31 December). These companies have 9 months to publish their financial reports i.e. until 30 September 2017. Only financial reports that are published after 31 August 2017 were selected to capture those filing under FRS 105.

Excluding turnover criteria: Micro entities might not report turnover because under Abridged Accounts, the Profit and Loss account is not required that normally would show turnover (Refer Appendix 4 for Abridged Account).

Appendix 4

Abridged accounts

1. Can be provided to the shareholders as well as to Companies House.

2. Requires 100% shareholder consent; directors are required to confirm this consent with Companies House when accounts are filed.

3. Certain line items in the Profit and Loss account need not be presented.

4. Profit and loss account should start with gross profit.

5. Turnover, cost of sales and other income therefore combined.

6. FRC is clear that accounts should still give a true and fair view and recommend turnover number be disclosed in notes to the accounts.

7. Split of debtors and creditors need not be provided.

Robust sample selection: Above we explained that it is impossible to find the population of micro entity, so we work on a sample of micro entities. The next challenge is to identify a robust sample. This study is based on 7015 micro entity companies. A sample of 613 active micro entity companies was taken from this population. The sample selection was guided by [4]. There were three options categorized for the sample selection, however we chose the higher sample value in order to get a better representative sample.

Beside our sample of 613 micro entities randomly selected from micro entity criteria we randomly examined 153 eligible micro entities registered under other type of accounts (See Appendix 2 for the definition of other type of accounts). These other types of accounts are Full account, Small company, Medium Company and Total exempt full. We took a random sample of 50 from each account type. The purpose of this additional sample examination was to check if any company by mistake reported in another account type but actually as an eligible micro entity, they are following FRS 105 or not. We applied the same technique for the first randomly selected sample of 613 and the second random sample of 153 eligible micro entities. First, we check if any of the entities mention 102 or 105 in their financial reports. Where we could not find any specific mention in the reported account, we used the 102 and 105 formats to identify which standard they were following. We identified that all the 613 micro entities were following FRS 105 but the 153 entities were using FRS 102.

Result and Discussion

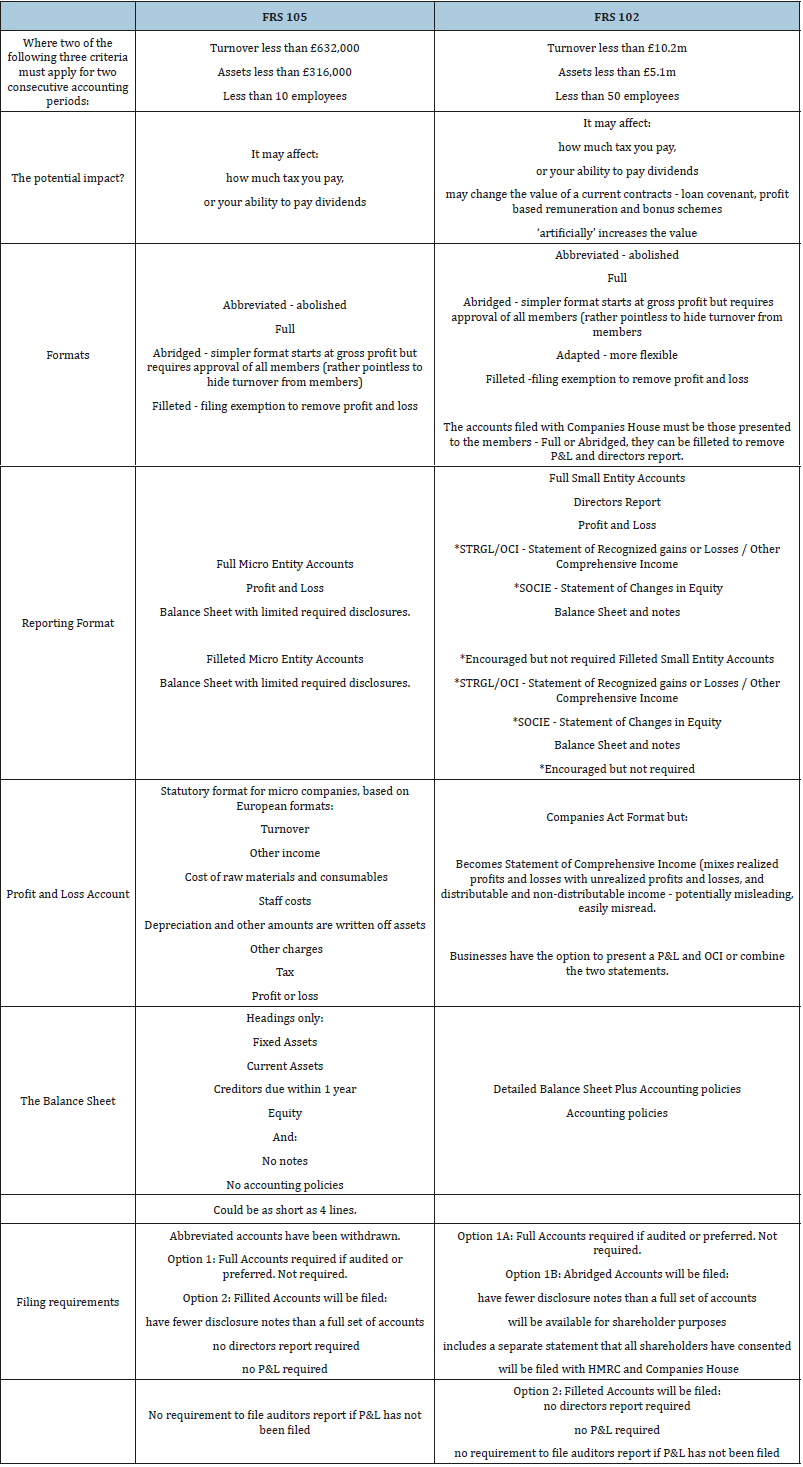

Eligible entities adopting FRS 105

The following commentary describes how micro entities adopting FRS105 were identified: A list of 7,015 entities were generated following the search criteria explained in Appendix 1. Second, from the registered account types variables 2,365 micro entities were identified that are registered as micro entities in Company House register (www.gov.uk/government/organisations/ companies-house). Third, following the robust sample selection criteria mentioned above, 613 micro entities (including 100 more micro entities that are incorporated before 1990-denoted as matured micro entities) were randomly selected. In studying the mature micro entities, the intention was to examine if there were any differences in preferences between the young micro entities (500 micro entities) in adopting FRS105. Fourthly, a manual searched was carried out from the sample of micro entities in the Company House to check if these eligible micro-entities are following FRS 102 or FRS 105. Based on the information collected from the Company House and following Caseron UK (//caseron.co.uk/. Last accessed 18th September 2018) we add the following Table 3 which mention the differences between FRS 105 and FRS102. These differences identify the FRS 105 and FRS 102 formats.

Table 3:The difference in reporting formats.

By analyzing the final sample of 613 micro entities we conclude that all the micro entity in the sample are following FRS 105. In addition, to examine further and confirm our conclusion above we went back two years in the Companies House data to examine how the micro-entities in our sample were registered before. In other words, which of these micro entities belong to the varying type of registered account (refer Appendix 3 for definition of registered account type). We found in 2015 and 2016 the registered account type for almost all of these micro entities were Total Exemption Small Accounts. Thus, we draw a conclusion that majority of the eligible micro entities used abbreviated accounts As all micro entities in our sample are following FRS 105 the other three objectives mentioned in the beginning of the report are irrelevant. But to get a better understanding of the sample of micro entities considered in this study we examined the sample in respect of variations in terms of size, industry and liabilities. The findings are reported in the following section (Figure 1).

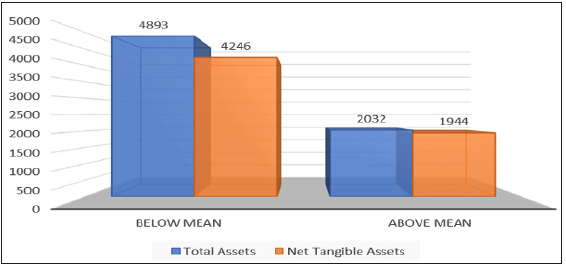

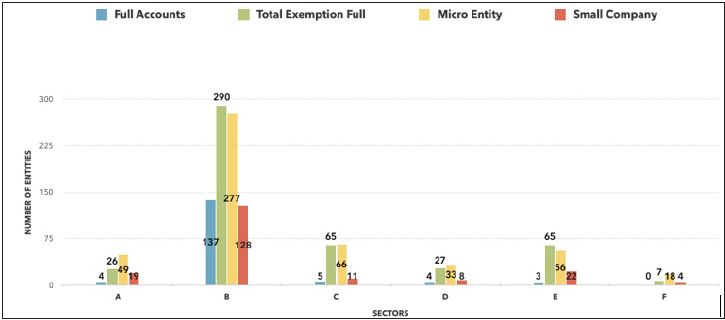

Figure 1:Impact of size.

Impact of size

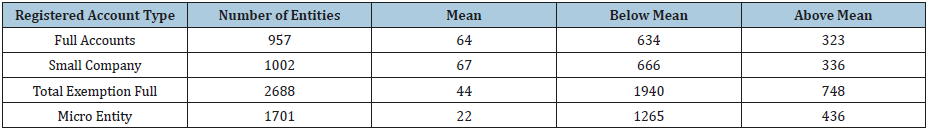

Following Brown [5], in our study we take the mean of total assets and net tangible assets and categorize the sample into large and small micro entities. All entities whose total assets are below the mean value are classified as smaller entities and vice versa. We find that out of 7,015 eligible micro entities, there are 4,893 below mean and 2,032 above mean (based on total assets), and 4,246 are smaller entities compared to 1,944 eligible micro entities (based on net tangible assets) [6-8].

Impact of sector

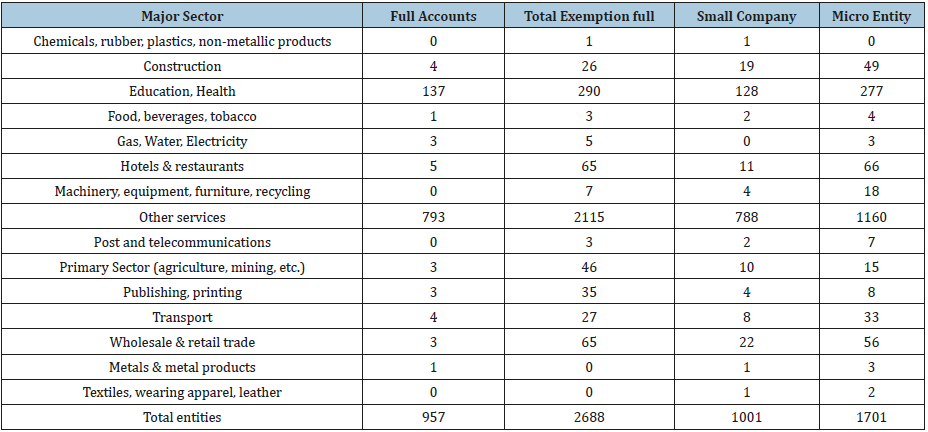

This analysis examines if there are any patterns between sector and the nature of the type of those micro entities filing accounts at Companies House. Table 2 shows five different types of accounts - namely full account, small company, medium company, total exemption full and micro entities. As the medium company account filling type, we have only 3 companies, in Figure 2 we excluded medium companies. The Figure 2 reports the sectors and the registered account types (only 6 sectors are shown). As can be seen from Figure 2 and Table 4 below that there are 6 sectors- namely Construction (A), Health and Education (B), Hotel and Restaurants (C), Transport (D), Wholesale and Retail Trades (E) and Machinery, Equipment, Furniture and Recycling (F)- where micro entities have significant contribution to the UK economy. These micro entities occupy 50% in construction, 33% in Health and Education, and 24% in other services (Table 4). Notes: A- Construction, B- Health and Education, C- Hotel and Restaurants, D- Transport, E- Wholesale and Retail Trades and F- Machinery, Equipment, Furniture and Recycling Figure 2 further shows that the micro entities dominate in Transport, Machinery, Equipment, Furniture and Recycling sectors. Table 4 shows that, apart from ‘Other Services’ (defined by FAME database), the Health and Education sector has significant number of companies in our sample. A large number of small UK private companies in this sector meet specific size criteria and need to file only unaudited abbreviated balance sheet containing less financial information.

Figure 2:Registered accounts by sectors.

Table 4:Comparing registered account types across the major sectors.

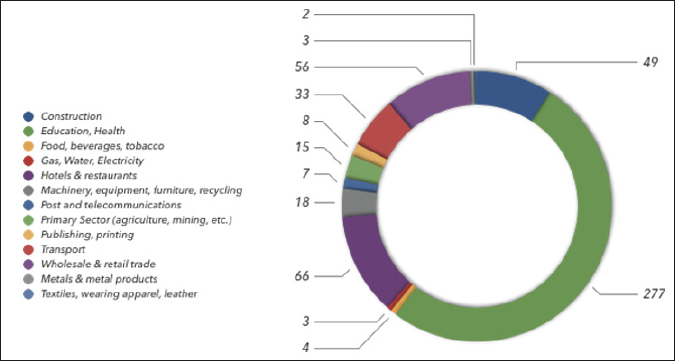

Distribution of entities in terms of sectors

There are 1701 entities Table 4 that are filling under micro company accounts at Company House. Figure 3 below shows that in our randomly selected sample, 541 entities Table 4 that are filling under micro company accounts and they belong to a variety of different sectors. Among all these companies, about 16% of entities are in Health and Education Sectors, nearly 4% in Hotels and Restaurants sectors, and 3% in Wholesale and Retail trade business. Thus, Health and Education sector occupies a large proportion of the micro-entity account type which are following FRS 102.

Impact of Liabilities

Table 5-7 document a summary statistic of Total Assets and Net Tangible Assets in 4 types of accounts filling Appendix 5.

Figure 3:Micro entities account by sectors.

Appendix 5

Abbreviated accounts

A small limited company may be entitled to file abbreviated accounts to Companies House. The advantage is that they require much less information than full accounts, Abbreviated accounts contain a basic balance sheet, which show the assets and liabilities of the company. Assets include things such as bank balances, equipment, vehicles, trade debtors (money customers owe you). Liabilities may include loans, overdrafts, trade creditors (money you owe suppliers).

Table 5:Total assets summary.

Table 6:Annual accounts registered at companies house by accounts type 2016/17 for the UK (referred as table 6 by company house in the reported communication).

Table 7:FAME search criteria and results (number of companies).

*Number of companies.

**Boolean search is a search allowing to combine keywords with operators

References

- Kitching J, Kašperová E, Collis J (2015) The contradictory consequences of regulation: The influence of filing abbreviated accounts on UK small company performance. International Small Business Journal 33(7): 671-688.

- Clatworthy M, Peel M (2016) The timeliness of UK private company financial reporting: Regulatory and economic influences. British Accounting Review 48(3): 297-315.

- Collis J (2012) Determinants of voluntary audit and voluntary full accounts in micro and non-micro small companies in the UK. Accounting and Business Research 42(4): 441-468.

- Bartlett J, Kotrlik J, Higgins C (2001) Organizational research: Determining appropriate sample size in survey research. Information Technology, Learning and Performance Journal 19(1).

- Brown S (1985) Using daily stock returns: The case of event studies. Journal of Financial Economics 14(1): 3-31.

- Bartlett J, Kotrlik J, Higgins C, Williams H (2001) Exploring factors associated with research productivity of business faculty at national association of business teacher education member institutions.

- Caseron (2017) New UK GAAP: FRS 102 and FRS 105 reporting changes. New York, UK.

- DBIS (2013) Simpler financial reporting for micro-entities: The UK’s proposal to implement the micros directive. Department for Business, Innovation and Skills, London, UK.

- Jarvis R (2017) Performance measurement in small and medium size entities. The Routledge companion to performance management and control. Routledge, London, UK.

- Jarvis R, Daskaladis N, Schizas M (2013) Finance practices and preferences for micro and small firms. Journal of Small Business and Enterprise Development.

© 2019 Monomita Nandy. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)