- Submissions

Full Text

Strategies in Accounting and Management

The Dangers of Cost-Plus Pricing

Donald E Sexton*

Professor Emeritus of Business, USA

*Corresponding author:Donald E Sexton, Professor Emeritus of Business, USA

Submission: July 17, 2019; Published: August 01, 2019

ISSN:2770-6648Volume1 Issue1

Introduction

Numerous companies-probably the majority-use some form of cost-plus pricing. Costplus pricing can easily lead to pricing mistakes-prices that are too high or too low. Incorrect pricing can cause businesses and companies to fail. Nonetheless managers continue to use cost-plus pricing. Why? Because it is so easy to apply even though it usually produces the wrong prices. Consider the worst case of cost-plus pricing: full cost-plus pricing. Full cost-plus pricing can easily lead to serious pricing errors.

Steps in full cost-plus pricing

As an example, suppose a book publisher wants to set a price for a book and is using full cost-plus pricing. Typically, there would be three steps in full cost-plus pricing:

1. Estimate unit sales for the book.

2. Calculate the average full cost per unit for the book.

3. Set the price of the book by adding a mark-up to the average full cost per unit for the book.

Here is an example with some hypothetical numbers that make the arithmetic easy.

1. Sales Estimate = S = 1,000 books

2. Average Cost per Unit = AC = Variable Cost per Unit + Average Fixed Cost per Unit

Where: Variable Cost per Unit = VC = $2

Note: Variable Cost per Unit is the incremental cost of each book

such as paper and binding.

Fixed Costs = FC = $10,000

Fixed costs include equipment costs and overhead.

Average Fixed Costs per Unit = FC/S = $10,000/1,000 = $10

So:

AC = VC + AFC = $2 + $10 = $12

3. Full Cost-Plus Price = Average Cost per Unit X (1+% Markup)

Price = $12 (1.40) = $16.80

Where: Markup = 40%

Assumptions underlying full cost-plus pricing that may cause problems

Sales must be estimated before price is determined. In short, that assumption assumes that price has no impact on sales. In any open-market situation, that would likely not be the case. The author worked once with a large New York City bank that employed cost-plus pricing. When the manager was asked how she estimated sales without knowing the price, she said that the bank typically used the “6:6:8 rule.” They estimated sales growth for the first year at 6%, second year at 6%, and third year at 8%. In other words, they estimated sales without considering the price of the product. The mark-up is often cited to indicate relative profitability among products. For example, in the book example, someone might say that, with a $16.80 price, the publisher is making 40% above average cost per unit. However, that 40% occurs only when sales are exactly 1,000 books. If sales are fewer than one thousand books, profit per book is less than the 40% markup because average fixed cost per unit would be higher than $10. On the other hand, if sales are more than one thousand books, profit per book would be higher than 40% because average fixed cost per unit would be lower than $10.

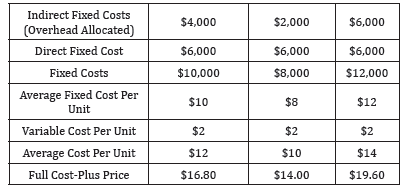

Overhead allocation potentially has a great impact on price. In the book example, suppose the $10,000 of fixed costs includes $6,000 of direct fixed costs and $4,000 of overhead (also known as indirect fixed costs). Direct fixed costs are costs directly involved in producing the product such as equipment. The test of whether a fixed cost is direct or indirect is: If the product disappears, does that fixed cost disappear? If so, it is a direct fixed cost - direct to that product. The table below shows the impact of overhead (indirect cost) allocation on a full cost-plus price based on a sales estimate of 1,000 units and a 40% markup. The table shows that the amount of overhead allocated to the product has a significant impact on the full cost-plus price. It may be that one of those prices is the optimal price but that would be due to chance. What is true is that whoever allocates overhead determines the full cost-plus price. That person, arguably, may be quite distant from the customers and the market and, in any case, usually is not directly responsible for pricing decisions. However, in a cost-plus system, whoever allocates overhead has a major Influence on price and, in effect, is responsible for pricing decisions.

Table 1:Allocation of overhead and cost-plus prices.

How should prices be set?

Costs have a role in pricing, but it is a diagnostic role - if a product does not cover costs in the long run, then it should probably not be continued. Costs should be at the end of the pricing process, not at the beginning as they are in cost-plus pricing. My recommendation to managers is to employ some form of value/cost pricing. Here are the steps in one approach to value/cost pricing that result in optimal pricing - prices that achieve strategic objectives:

1. Estimate the perceived value (or willingness to pay) for the customer. (This is the ceiling on price.)

2. Estimate fixed costs and variable costs.

3. Assess competitors’ pricing.

4. Develop tentative strategy, including target markets, positioning, and business objectives such as growth, profitability, or cash flow.

5. Set a tentative price.

6. Estimate sales for the tentative price.

7. Predict the financial results for the tentative price.

8. Evaluate the tentative price-redo all or parts of the steps in the process if necessary.

Value/cost pricing is more difficult than cost-plus pricing. Costplus pricing is relatively simple but has a high risk of leading to pricing mistakes. Value/cost pricing has a much higher chance of determining prices that are optimal for a company.

Final comments

Surveys indicate that many marketing managers consider the pricing decision their most difficult decision and they are probably right. However, if managers wish to make better pricing decisions, they need to move away from cost-plus pricing and incorporate customer perceived value in their process of determining prices - keeping in mind, of course, that costs must be covered if a company is to stay in business.

Donald Sexton, Professor Emeritus of Business, Columbia University. Professor Sexton teaches in the areas of marketing, branding, international business, and statistics and is a recipient of the Business School’s Distinguished Teaching Award. His numerous articles have appeared in journals such as the Harvard Business Review, Management Science, and Journal of Marketing and he is often quoted in media such as the New York Times, Business Week, Ad Age, WCBS, and Beijing’s China Economic Daily. He received the 2011 Marketing Trends Award for his work in branding and marketing. His best-selling Marketing 101 has been translated into several languages including Chinese, Turkish, Polish, and Indonesian and his Branding 101 has been translated into Russian and Vietnamese. Don’s most recent book, Value Above Cost, explains how marketing determines financial performance and is available in Chinese. He received his MBA and PhD degrees from the University of Chicago and has taught at the University of California- Berkeley, INSEAD, China Europe International Business School, Australian School of Business, Moscow School of Management, Indian School of Business, University of Tehran, U.S. Business School in Prague, and the Hong Kong University of Science and Technology. Don is the founder of The Arrow Group, Ltd.®, a company that has provided consulting and training services to many organizations including IBM, Pfizer, GE, Unilever, MetLife, Tencent, Citibank, Pepsi, Yili, Vivo, Vollkswagen, Boeing, ABInBev, Verizon, JD.com, Baidu, and DuPont. des5@columbia.edu

© 2019 Donald E Sexton . This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)