- Submissions

Full Text

Novel Research in Sciences

Sustainable Bonds Issuance and Muti Stakeholders Governance

Hiroshige Tanaka*

Chuo University, Japan

*Corresponding author: Hiroshige Tanaka, Chuo University, Japan

Submission: February 07, 2022;Published: February 28, 2022

.jpg)

Volume10 Issue4February, 2022

Abstract

We have viewed that issuance of bonds is increasing in the periods of social crises such as climate change problems, financial crises and Covid 19 pandemic. However, the digital industrial revolution brings reconstruction of stakeholders. The structural changes of stakeholders brought by the new industrial revolution influence initiatives to achieve sustainable communities. The short-term remedies with issuing a large amount of government bonds require great cooperation with inside stakeholders including national banking system. To achieve sustainability in global communities we should make vital decentralized systems functionable. This paper argues in the long-term policies that outside and external stakeholders decline the amount of and raise the interest rates in issuing bonds to construct sustainable communities.

Keywords: Covid 19 pandemic; Decentralized systems; Digital industrial revolution; Global market and government failures; Inside; Outside; External stakeholders

Mini Review

Since the 1980s developing scale of global market economies has propelled remarkably

global economies in contrast with slow growth of governmental economies. Theories of the

new liberalism provoked deregulation of market rules. Multinational corporations have taken

the following wind of massive innovation of ICT and led enlarging global markets. However,

growing global communities have brought global market and governmental failures such as

climate change problems, financial crises and Covid 19 pandemic. As the global government

has not been stablished yet, we should make new approach to prevent global market and

government failures. The digital industrial revolution fucuses on structure of stakeholders

regarding evolution of the communication system in global and local communities. While

the corporation makes the stable relationship with many stakeholders in markets and

institutional relations, occasional connections with other stakeholders could improve its

productivity. The former stakeholders are defined by the inside stakeholders and the latter

are stated by the outside stakeholder. Although the external stakeholders in bonds issuance

are not directly concerned with market transaction, they could develop social relations by

enacting regulations and legislations. The theory of multi stakeholders implies that the

corporation is not only for-profit companies but also nonprofit organizations. The notation of

nonprofit organizations is applicable for exploring performance of public corporations. Global

communities have overcome Global financial crisis 2008-09 and Greek financial crisis 2015

by forming global cooperative mechanisms of private public partnerships [1]. To mitigate

Covid-19 pandemic major countries activate positive governmental supports for economic

damages as well as medical cares of the infectious disease. While governments are raising

funds for the pandemic by issuing governmental debts, they provide urgent and appropriate

supports for an individual resident. In a long perspective, we should proceed to construct

resilient economies and societies on health crises. It is assumed in this article that resilient

communities are constructed with public bonds finance. Achievement of resilient communities depends on fund raising from public bonds. Practical policies for this

pandemic show that development of effective methods to prevent

infectious diseases improve digitalization of industries. Tanaka

[2,3] demonstrates that the digital industrial revolution raises

the influence of the outside stakeholders. A principal and agency

model of game theories exhibits global sustainable mechanism that

consist of the corporation and the stakeholders. The corporation

is assumed to obtain net profit Π(x) such as by financing medical

projects with issuing bonds x. The social project is performed

with n stakeholders. The financing mechanism issuing bonds

could compensate the deficit of social projects. It is assumed that

bonds issuance presents declining marginal net profit. The bonds

are purchased by inside stakeholders who obtain benefit directly

from the social projects and with inside and outside stakeholders

who are concerned only with market matters. The social projects

are supposed to provide compensating payments for external

stakeholders. The corporation makes each stakeholder i payment

ti. The total payment t mathematically describes the summation  . The stakeholder i evaluates the benefit of bond issuance

by the function Vi (x, ti ) . To specify the structure of muti stakeholders

i and j are classified into positive stakeholders,

. The stakeholder i evaluates the benefit of bond issuance

by the function Vi (x, ti ) . To specify the structure of muti stakeholders

i and j are classified into positive stakeholders,  and negative

stakeholders,

and negative

stakeholders,  As inside stakeholders could bring great

internal network benefit, increasing valuation possibly happens.

As outside stakeholders must obey market rule, they are expected

to receive decreasing evaluation of products. External stakeholders

take negative marginal benefit from market transaction such as

environmental pollutions. To simplify the analysis, we take the

following assumption. While inside stakeholders (i=1,⋯,(n0)

are defined by positive stakeholders, outside and external

stakeholders (i=n0+1,⋯,n1; n1+1,… ,n) are featured as negative

stakeholders. Tanaka [2] demonstrates that the digitalization of

industries increases outside stakeholders than inside stakeholders.

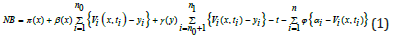

Tanaka [4] states the objective maximizing function (1) for the

corporation. Asymmetry information between the corporation and

stakeholders occurs in communication mechanism. β(x) and γ(y)

mean sensitive indexes or weights that the corporation obtains for

evaluation of inside and outside stakeholders. αi writes the target

that stakeholder i request for the corporation ϕ {αi − Vi (χ , ti )} exhibits

regulation and legislation to secure evaluation of stakeholder i.

As inside stakeholders could bring great

internal network benefit, increasing valuation possibly happens.

As outside stakeholders must obey market rule, they are expected

to receive decreasing evaluation of products. External stakeholders

take negative marginal benefit from market transaction such as

environmental pollutions. To simplify the analysis, we take the

following assumption. While inside stakeholders (i=1,⋯,(n0)

are defined by positive stakeholders, outside and external

stakeholders (i=n0+1,⋯,n1; n1+1,… ,n) are featured as negative

stakeholders. Tanaka [2] demonstrates that the digitalization of

industries increases outside stakeholders than inside stakeholders.

Tanaka [4] states the objective maximizing function (1) for the

corporation. Asymmetry information between the corporation and

stakeholders occurs in communication mechanism. β(x) and γ(y)

mean sensitive indexes or weights that the corporation obtains for

evaluation of inside and outside stakeholders. αi writes the target

that stakeholder i request for the corporation ϕ {αi − Vi (χ , ti )} exhibits

regulation and legislation to secure evaluation of stakeholder i.

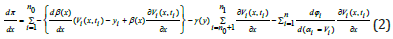

The first order differentiation condition of maximization derived from (1) is written by

The implication of the expression (2) is illustrated by producing Figure 1. In the above expression the right side social marginal evaluation curve of x depicted by 0G and 0F. Raising β(x) shifts the marginal curve toward rightward. Enhance of γ(y) turns the marginal curve toward leftward. Considering that the left side of the expression presents down sloping marginal benefit curve. The social crises such as corona virus pandemic raise the relative weight of evaluation by inside stakeholder and increase issuance of social bonds. The equilibrium is presented by the point D. After global communities overcome the critical situation, global communities will seek to achieve a new sustainable economies and societies. When innovation of digital technologies brings global communities to decline bonds issuance from x*to x**and to raise market interest rates (form p* to p**) of bonds. Tanaka [5] explores the green bonds issuance in multi stakeholders’ communities. Figure 1 exhibits new normal situation by the point B.

Figure 1: Issuarnce of social bonds and stakeholder dominance.

References

- Tanaka H (2021) Digital industrial revolution and an index of transaction cost. Novel Research in Sciences Crimson Publishers 8(1): 1-2.

- Tanaka H (2019) Innovation on the digital economies and sustainability of the global communities. Annals of Social Sciences & Management Studies Juniper 4(2): 1-10.

- Tanaka H (2020) Digital economic and social systems to be featured by stakeholders. Annals of Social Sciences & Management Studies 5(4): 86-94.

- Tanaka H (2022) Sustainable provision of medical services with radiation in digital industrial revolution. Annals of Radiology and Medical Imaging Scientific Eminence Group 1(1): 1-8.

- Tanaka H, Tanaka C (2022) Green bonds issuance and stakeholders governance. Annals of Social Sciences & Management Studies Juniper 6(4): 1-11.

© 2022 Hiroshige Tanaka. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)