- Submissions

Full Text

Novel Research in Sciences

Approaches to Integrating Geopolitical Risks into Company-Wide Risk Management Systems - Consideration in VaR - Concepts and Future-Oriented Options for Risk Measurement

Thomas Wolke*

Berlin School of Economics and Law, Germany

*Corresponding author: Thomas Wolke, Berlin School of Economics and Law, Germany

Submission: December 12, 2021;Published: February 7, 2022

.jpg)

Volume10 Issue3February, 2022

Introduction

Enterprise-wide risk management systems primarily reflect market price risks, default risks, operational risks and sales/procurement risks in quantitative terms. In literature and practice, geopolitical risks in a company have so far mainly been depicted descriptively, qualitatively Hood [1], Howell [2] or in the form of country risk [3,4]. However, the influence of geopolitical risks (e.g. in the USA (Trump), Turkey (Erdogan), Great Britain (Brexit), Ukraine (Crimea - annexation, EU - sanctions against Russia), Egypt (Arabian Spring), etc.) has strongly increased in recent years Feldstein [5] and currently forms a central research area in Supply Chain Risk Management (SCRM, see Bendul [6]). In the following, approaches will therefore be developed to not only qualitatively integrate geopolitical risks into enterprisewide risk management systems but also to map them in currency units. The aim is to integrate future geopolitical risks into the Value at Risk concept as objectively and comprehensibly as possible.

Significance, definition and distinction of geopolitical risks

The current significance of geopolitical risks is highlighted by numerous publications of company surveys [7-11]. Most multinational companies consider geopolitical risks to be one of the most important risks of the future (along with cyber risks, recruitment risks, climate change risks, see [7,12,13]. However, the consideration of geopolitical risks is also important for small and medium-sized nationally active companies through

A. The increasing effects of globalization (cf. Dicken [14],

B. Digitization and

C. The increased complexity due to dwindling (natural) resources due to a simultaneously

increasing population size

is becoming increasingly important in risk management. The significance of geopolitical risks is also currently reflected in various economic indicators (e.g. due to declining growth in investments in equipment, cf. Statistisches Bundesamt 2019, decrease in the number of foreign correspondent banks, cf. Bundesverband deutscher Banken 2019). However, it is often not possible to derive company-specific business decisions from these general economic indicators. Risk identification, risk measurement, risk analysis and finally risk control are necessary for consideration in risk management [15,16]. The first step in risk identification is to define geopolitical risks. The definition of geopolitical risks is not clear in science and practice. While there are numerous definitions of risk in the business sense (Vanini [15]), in theory and practice the term risk in the sense of a future potential asset loss / damage without comparison of possible profits / returns (so-called shortfall risk measures) is widespread and should also be used as a basis in the following explanations (Wolke [16]). The definition of geopolitics is more difficult (for an introduction see Werber [17]). The vagueness of the term geopolitics is one of the basic problems of geopolitical research. One possible definition is “the investigation of the influence of factors such as geography, economy and population size on policy, especially on the foreign policy of a state” (Brill [18]). For the treatment of geopolitical risks from a business point of view, this definition could be more targeted and comprehensive from a business point of view:

Geopolitics is the influence of geographical, economic, demographic, cultural, religious, and historical factors on the politics and decisions of communities, especially states and alliances of states (e.g., EU), nationally and internationally.

From a business perspective, this definition takes greater account of current global developments for example covering terrorist attacks by religious groups (e.g. the so-called Islamic state, Boko Haram, Al Qaida, etc.) through this definition (e.g. the terrorist attack on the Norwegian oil company Statoil and BP in January 2013; see Chipman [19]). But the effects of individual states on alliances of states would also be recorded (e.g. the Brexit). Further possibilities for the definition of geopolitical risks can be found in so-called risk maps [20-22].

Such a broader definition not only takes into account the increasing destabilization in the world, in which multinational companies can no longer rely on the promise of protection and the associated stability of superpowers [19]. It is also better suited for risk identification through a systematisation of risk types in risk management [16,23]. Nevertheless, this definition makes no claim to completeness of the factors and illustration of possible future geopolitical risks. A further problem with this definition is the problem of a clear distinction from other types of risk (for further details see Rice [24]). The problem of differentiation also exists for other risk types (e.g. the procurement of crude oil for a European industrial company includes a procurement risk and at the same time an exchange rate risk of US-$ - €). Various principles (e.g. the causation principle) are available for assigning risk types [16,23].

For the risk measurement of geopolitical risks, the problem of demarcation should be considered in more detail. This is necessary in order to identify geopolitical risks using appropriate measuring instruments. Country ratings and corresponding probabilities of default are available for mapping country risks [25]. This enables financial receivables from foreign states and companies to be valued [4]. The country risk is measured using corresponding leftaligned distribution functions of the default risk. The mapping of geopolitical risks in country risk would therefore have to be applied to this special form of distribution. Geopolitical risks undoubtedly also have an influence on the country rating (e.g. Brexit on the rating of Great Britain). However, the question arises as to the effects from a business point of view and the possibilities of adequately taking these into account. Country risks in the sense of country default risks primarily affect a company’s financial receivables from the respective country. These country default risks can be managed via credit default insurance and other (capital market-based) instruments of default risk [16]. If a company exports goods or has production sites abroad, it cannot be affected by the country default risk of the respective country if, for example, it has no financial receivables from this country. Country risks in the sense of country default risks with regard to financial receivables are therefore not considered in the following. A further distinction is necessary between geographical risks, in particular natural catastrophes, and geopolitical risks. Geographical factors have a significant influence on the geopolitics of states [14,26]. Geographical conditions also have an impact on natural catastrophes (e.g. hurricanes in the Gulf of Mexico). Insurances play a central role as a risk management instrument in business risks arising from natural catastrophes. Natural catastrophes often threaten the existence of companies. Companies despite an unfavourable return - risk - ratio therefore take out insurances against the consequences of natural catastrophes from the company’s point of view. A prerequisite for taking out insurance is the possibility of a precise definition of a loss event at the insured location. In the case of natural catastrophes, this is usually possible, whereas it is in the nature of geopolitical risks that this definition of loss cannot be determined (for the difficulties of insuring political risks, [27,28].

The measurement of geopolitical risks on the basis of insurance premiums is also inappropriate for two other reasons. Firstly, premium calculation is not always transparent and unambiguous, at least methodologically, as there are different (actuarial) calculation approaches [29-31]. On the other hand, similar to the lending rate of banks, the insurance premium to be paid by the policyholder is composed of various components, e.g. the operating costs and profit surcharge [31]. If companies were to use the insurance premium as a measure of geopolitical risk, the profit and operating cost surcharge, which varies from insurance company to insurance company, would result in a less favourable profit-risk ratio than with an isolated measurement of the net risk premium of the geopolitical risk. However, isolating the net risk premium (which represents the equality of expected premium payments and expected insurance benefits) does not appear to be expedient for the reasons of methodological opacity and failure to meet a loss definition. Even if possible geopolitical risks are also covered within the scope of a possible defined total loss for a company, these would have to be methodically separated from other risks (e.g. risks from natural catastrophes) in a very complex manner (for an insurance- and stock market-based approach [32]. The measurement of geopolitical risks on the basis of insurance premiums is therefore not pursued further here. In connection with geopolitical risks there are numerous studies on the development of the oil price. Among other things, these investigations are concerned with identifying risk premiums for various risk factors, including geopolitical risks, for example. This is used to investigate the influence of geopolitical risks on oil prices [33]. However, the oil price is only one (more or less significant depending on the industry) risk factor of the procurement risk of many. Companies for which the oil price is an important risk factor (e.g. airlines) have a comprehensive range of capital market-based risk management instruments at their disposal, e.g. in the form of derivatives [34,35]. On the basis of over-the-counter contracts, oil price hedging can also be carried out for any terms and volumes against payment of corresponding premiums. This approach to taking geopolitical risks into account will therefore not be further developed here either. In the following, the geopolitical risks within the meaning of the above definition, which relate to operating risk (e.g. in the form of production sites abroad) and sales risk (in the form of exports), are to be examined, taking into account the differentiations made above from country risk, insurance and the oil price. This could allow for sales slumps, e.g. through sanctions against Russia, Iran or punitive tariffs imposed by the USA and BREXIT. However, risks could also be identified as a result of the impairment of production facilities by the Arab spring (e.g. at LEONI, Huber [36]), the Ukraine conflict, the BREXIT, etc.

Past oriented vs. future oriented risk measurement

Risk measurement in theory and practice has so far been carried out predominantly with risk measures based on historical data (ex post). One example is the Value at Risk concept developed from investment banking. Originally developed for market price risks, the VaR concept has also been further developed for other types of business risk, e.g. the operational Value at Risk for operating risks (cf. Hull [35]) and the cash flow at risk for performance risks (in particular sales risks [37]). Influencing factors of the Value at Risk are the risk setting (probability of security), the volatility (risk) of the influencing factor, the liquidation period (period of liquidation of the risk position) and the amount of the risk position [38]. The most important advantages of this concept are:

1) a risk figure determined in currency units that can be directly

compared with equity,

2) a central component in corporate management for a profitrisk-

based comparison (e.g. return on risk-adjusted capital) of

various products, business areas, organizational units or parts

of companies,

3) a calculation variable that can be objectively comprehended

and is not subject to the subjective assessments of the risk

carrier, decision-maker and other institutions, and

4) a comparable risk variable that can be used for various

comparison purposes when specifying the influencing

variables (e.g. for company comparisons, for regulatory

authorities, etc.).

5) However, this also has disadvantages:

6) A fundamental and decisive disadvantage is the ex post

property. It is based on historical data and assumes that the

structures of the past that led to the data can also be found in

the future. For clarification purposes, the “rear-view mirror in

the car” is often cited in this context, according to which driving

a car inevitably leads to an accident by constantly looking into

the rear-view mirror instead through the windscreen.

7) For the calculation from historical data, statistical (idealised)

assumptions must be made (e.g. the assumption of normal

distribution), which are usually only approximately fulfilled.

8) For the VaR concept to be able to forecast future risks,

further statistical assumptions must be made (e.g. statistical

independence when taking the liquidation period into

account), which in reality are only partially fulfilled or can only

be approximately fulfilled by statistical correction calculations.

This must be contrasted with qualitative risk measures based on a future risk assessment and not on a quantitative analysis of historical data. These primarily include future risk assessments (forecasts) by experts and decision-makers or institutions (e.g. OPEC regarding the assessment of future oil price developments; for economic forecasts in general see Vogel 2015, for the forecast of political risks [39,40]. Here the methods of brainstorming, survey, Delphi method etc. are applied [41]. The advantages of qualitative risk measures essentially correspond to the disadvantages of quantitative risk measures and vice versa. The advantages are:

1) A fundamental and decisive advantage is the possible

consideration of future changes in structures. In the case of

geopolitical risks, these are naturally the rule and a typical

feature of geopolitical risks.

2) No statistical assumptions need to be made about historical

data (e.g. assumption of normal distribution).

3) However, this is offset by the following serious disadvantages:

4) It is often not possible to objectively comprehend qualitative

risk measurement. This concerns the transferability of

subjective risk assessment to other risk factors and companies.

5) The comprehensibility of the argumentation is only possible if

it is scientifically documented in detail and, in particular, if it is

as “ideology-free” as possible from an economic point of view.

A requirement that is frequently not observed in practice (e.g.

in the stress test - scenarios of the ECB for real estate credit

risks, [42]).

6) In the case of future risk assessments by experts, precise

information in currency units is the exception. The forecast

results of experts are often in the form of trends, e.g. the

exchange rate will rise or fall or bandwidths (e.g. the oil

price will be in the range of US$ 70 - 90 in the future). Such

information can only be used to a limited extent for profit/risk

ratios or for comparisons with the equity of companies.

7) In the next step it is obvious to develop or apply a concept/

approach which tries to eliminate the respective disadvantages

as far as possible. Such a concept should ideally have the

following characteristics:

8) A risk measurement, which is objectively comprehensible

regarding the procedure and the transferability to different

enterprises and/or risk influencing variables.

9) Estimated future structural changes should be mapped or

incorporated in as objective a manner as possible.

10) Risk is measured in currency units that are as accurate as

possible, or at least in relatively small ranges with interval

sizes in currency units.

11) As few statistical assumptions as possible must be made. This

applies in particular to future risk assessment when necessary

but unrealistic statistical assumptions have to be made. In this

case, statistical correction calculations should be available

that approximately heal these assumptions (as is the case

with the VaR concept with regard to the assumption of normal

distribution and possible correction calculations for fat tails,

skewness, kurtosis, etc.).

In the following we try to develop concepts and approaches for the measurement of geopolitical risks that correspond to the above mentioned characteristics as far as possible.

Approaches for consideration geopolitical risks in risk measurement

First, appropriate types of business risks should be identified to which companies are exposed in a particular way to geopolitical risks. This is necessary because different measurement concepts are used for different risk types and their measurement. Rating classes are required for default risks, historical share prices for share price risks and loss databases for operational risks. The calculation of risk (e.g. in the form of Value at Risk) is then also carried out using different methods (e.g. for share prices by simple calculation of historical share price volatility, for operational risks by full enumeration). The consideration of geopolitical risks must then be based on the particularities of the data basis and the (distribution) parameters of the measurement method. For German internationally active companies, risks naturally arise from the export of products to other countries. A further central risk exists if multinational companies produce abroad, in particular if they operate their own production facilities abroad. There are also other risks due to the integration of German companies with foreign countries (e.g. financial receivables from foreign countries and companies), which are not discussed here for two reasons:

I. For example, in the case of financial receivables from foreign countries (e.g. in the form of foreign bonds), geopolitical risks can be captured by the country ratings of the major rating agencies (e.g. Moody’s, Standard & Poor’s). Methodically, the default risk of the foreign borrower associated with the rating is then taken into account and linked to the credit risk recorded by the Credit Value at Risk [16,35]. The discussion on the correct assessment and procedure of rating agencies, particularly in connection with the 2008 financial crisis (Bavli [43]), is only referred to here. It will not be discussed further here.

II. Other risks arise from the derivation or combination of the above-mentioned activities (sales, production) abroad. On the one hand, these risks are company-specific and, on the other hand, they can only be derived indirectly from cause - effect - connections with regard to the geopolitical risk. However, it is a question here of a fundamental consideration of geopolitical risk and not of a company-specific consideration or a risk consideration that could be indirectly derived from geopolitical risks. In the case of such indirect risk recording, it would also be difficult to record the influence of other potential risk influencing variables or to take their correlations into account.

In the next step, three types of risk can be identified from these remarks in which geopolitical risks have a direct and general impact on companies:

a) For German companies that sell products abroad (in noneuro zones) and acquire foreign currency positions for this purpose, there is a direct exchange rate risk. If geopolitical risks threaten the foreign currency country, a devaluation of the foreign currency (= appreciation of the euro against the foreign currency) can be observed, e.g. the British pound through the Brexit or the Turkish lira through Erdogan’s policy. A devaluation of the foreign currency corresponds to a decrease in the value of the euro. This exchange rate risk does not only exist due to increased geopolitical risks but is also a well-known and always current risk for multinational companies. For the management of exchange rate risks, numerous instruments (e.g. currency options, currency swaps, forward exchange transactions, etc.) that have been tried and tested in theory and practice are available for risk management [44]. However, it is not a question here of examining the control instruments with regard to geopolitical risks, but of taking geopolitical risks into account in risk measurement. Following complete risk measurement (possibly taking geopolitical risk into account), an assessment is then made of the use of control instruments and their benefits. The assessment of control instruments is not the subject of these statements.

Taking geopolitical risks into account through a higher exchange rate risk approach is methodologically difficult: the exchange rate, like many other financial market variables, is also dependent on other factors (e.g. inflation rate differential, interest rate differential, government debt, GDP growth, current account balance, etc.). Although in some cases the link between geopolitical risk and the depreciation of the foreign currency may appear obvious (e.g. Turkish lira, pound sterling, see Chart 1), possible compensatory effects of other factors (e.g. higher interest rates) should not be neglected in the analysis. If the impact of geopolitical risk on the exchange rate is not obvious, a comprehensive economic analysis would be necessary to quantify the share of geopolitical risk in currency devaluation. The measurement of exchange rate risk can be made by the Value at Risk, which is composed multiplicatively of the components risk position, volatility of the risk factor, liquidation period and probability of confidence. The geopolitical risk must be taken into account in the volatility, since the other variables of the Value at Risk are used for other purposes. For example, the risk position is based on the amount of the foreign currency position at the time the risk is measured. The liquidation period reflects the nature of the asset position or the market in which it is traded and the organisational structures of the decision maker. Finally, the probability of confidence reflects the general risk setting of the decision-maker or the targeted credit rating [16,23]. This leaves only volatility or a surcharge on volatility to reflect the influence of geopolitical risk.

b) Sales risk is the generic term for a type of risk that is usually further subdivided. Other subtypes of sales risk are settlement risk, storage risk, transport risk and purchase risk. For these subtypes of the sales risk, a connection or influence of the geopolitical risk cannot be derived at least more directly. The main component of sales risk is selling risk, which is subdivided into sales default risk, sales price risk and sales volume risk [16]. Geopolitical risks have a direct influence on the sales price risk (e.g. through punitive tariffs) and the sales volume risk (e.g. through trade barriers due to additional controls or increased sales prices). For the sales default risk, i.e. that no buyers can be found at all, other or further influencing factors must be analysed in risk management. In the following, the possible sales default risk is represented by a sales quantity of zero. By multiplying the price per unit (=sales price risk) by the sales volume (=sales volume risk), the risk parameters relevant to geopolitical risks can be combined to form the central risk factor sales revenues. Here, too, geopolitical risks can be taken into account by adding a premium (however calculated) to the volatility of sales revenues. The factors influencing the volatility of sales revenues are the expected sales volume and the expected sales price and the associated volatilities [16]. Depending on how the geopolitical risk is reflected, a discount on the expected sales volume or an increase in the volatility of the sales price, for example, can occur here, which in turn leads to an increase in the volatility of sales revenues.

c) The operating risk arises from production facilities abroad. The operating risk is also subdivided into various subtypes. Geopolitical risks can primarily affect the personal risks (internal operating risk) of the production facility, e.g. the workers at the production facility do not appear at the plant due to political circumstances (e.g. production facility in Tunisia and the Arab spring). Disruptions to the production process are also conceivable (process risks, internal operating risk). Political risks can also manifest themselves as external operating risks if, for example, laws are changed for political reasons (legal risks) and, for example, production facilities are expropriated. Destruction for political reasons by violent demonstrations (external operating risk) would also have to be included under geopolitical risk. Operating risk is measured on the basis of the loss database and a full enumeration [23,35]. Geopolitical risks can be taken into account by simulating possible additional loss events in the loss database. The resulting full enumeration would then result in the increased volatility of the operating risk due to geopolitical risks. On the other hand, geopolitical risks could be taken into account by adding a direct surcharge to the volatility of the operating risk, i.e. without influencing the loss database or adding loss events.

Measurement of geopolitical risk

Different approaches to measuring geopolitical risk are conceivable. On the one hand, experts can be asked how high they estimate the impact of geopolitical risk on the corresponding volatility (or the impact on the loss database, volatility and expected value of sales volumes and sales prices). According to the experts’ assessment, a certain surcharge would then be applied to the volatility. This approach is contrary to the objectivity required above (see 2.). An approach that goes in a similar direction would be the stress test. Again, experts or institutions (e.g. the ECB) assume various worst-case scenarios (e.g. the introduction of punitive duties in the USA on German cars) and from these scenarios a surcharge on volatility is estimated or derived. Stress tests can also be used to determine safety cushions or capital requirements for future geopolitical crises. In addition to the bankspecific criticism of the stress test by the ECB [42,45], there are two other general central disadvantages of expert estimates and stress tests: a) The (pronounced) subjectivity and the resulting lack of comprehensibility of the expert estimates and the worst-case scenarios. This contradicts the requirement of objectivity described above (see 2.). b) The high degree of error in forecasts by experts [46]. Another way of measuring geopolitical risks would be to increase the number of standard deviations in the concept of Value at Risk [47]. However, this approach has the following methodological shortcomings: The confidence level serves as a parameter for the investor’s risk setting and the desired rating (or the associated probability of default) and therefore cannot be used as a measure of risk at the same time. The level of volatility is the parameter for the actual risk measurement of the influencing factor. In addition, when using the number of standard deviations approach, it is difficult to derive the number of standard deviations from the geopolitical risk or to map the cause - effect - relationship. A further approach would be the lower partial moments [48], which, however, are based exclusively on historical data and, with a given distribution of loss data, determine the possible loss heights above the VaR (between the confidence level and 100%). Methodologically, the lower partials moments are therefore unsuitable for mapping future geopolitical risks. An approach that would be methodologically more appropriate and at the same time ensure a certain objectivity would be to identify possible geopolitical risks in the future through appropriate geopolitical indicators (e.g. political indicators), developments (e.g. Brexit, Ukraine - Russia) or announcements (threat of e.g. punitive tariffs, USA). If certain geopolitical risks are identified in this way in the future, the next step is to assign them to the types of business risk. In the development towards a hard Brexit, there is an exchange rate risk for a German carmaker, for example, due to a devaluation of the British pound. The announcement of possible punitive tariffs involves a sales risk, e.g. in the form of a sales volume risk for the exporter. In the event of possible military instabilities (e.g. Eastern Ukraine), existing production facilities are threatened with production stoppages and thus with an external operating risk.After identification and allocation to the business risk types, past comparable geopolitical risks and the associated business risks would have to be identified. The increased volatility of the corresponding business risk factor could then be measured from comparable situations in the past. The question that arises is whether comparable events can be found in the past. Shackle speaks of “critical” decisions, especially in the case of the big things (e.g. crises), which are unique and did not take place in the past [49]. The comparable geopolitical risks of the past provide a higher degree of objectivity and comprehensibility than would be the case with expert estimates or stress tests. The risk assessment on the basis, for example, of past exchange rates or generally of secondary market prices of financial securities includes the collection and processing of information by numerous investors or financial market participants, which presumably reflects a better and more objective risk assessment than the risk assessment of individual experts or expert groups [4]. In the final step, the probabilities of occurrence for the respective geopolitical risk still have to be assessed (e.g. before the referendum on Brexit, a vote for Brexit was generally estimated at 50%). The difference between increased volatility (due to geopolitical risk) and normal volatility (without geopolitical risk) is multiplied by the probability of occurrence and then added to the current volatility of the business risk factor to consider the respective future geopolitical risk. This approach is a combination of measuring the past to ensure a certain objectivity (determining the level of volatility from comparable past risk developments) and estimating future risk by identifying future parameters and probabilities of occurrence (e.g. announcing the Brexit referendum and determining the probability of occurrence of 50%). A further methodological key point for measuring geopolitical risks is the consideration of correlations between the various influencing variables. A lower sales volume or a lower sales price due to a geopolitical risk is correlated with the respective exchange rate risk. The sales price is also correlated with the sales volume, etc. Statistically, correlations can be recorded and taken into account by the variance - covariance - matrix. The prerequisite is that comparable time series of the influencing variables are available. In the case of monthly time series from a loss database or monthly sales figures, this is methodologically worth discussing when compared, for example, with daily exchange rate data. The addition of different distributions (the so-called folding) of different influencing variables is also statistically not entirely unproblematic. Finally, in connection with correlations, the question arises as to how these increase in (geopolitical) times of crisis Hull. Due to the need to take these aspects into account when calculating correlations, we will not go into more detail here. For the assessment of geopolitical risks, numerous questions / problems (see above) still have to be answered at the individual level of the influencing variables, so that the calculation and problem treatment of correlations of the influencing variables will not be dealt with further at this point. Finally, additional considerations can be included for the duration of the impact of the geopolitical risk. Thus, it can be taken into account that with an estimated duration of a geopolitical crisis of two years, only the average increase in volatility is assumed for this period and not the highest and lowest volatilities are reflected in the risk measurement. When interpreting the Value at Risk as risk capital and thus also as a necessary equity requirement, a uniform capital requirement makes more sense from an business point of view than the presentation of maximum and minimum values and the associated fluctuation in risk capital or equity. This will be illustrated in the following section using Brexit as an example.

The measurement and consideration of geopolitical risks using Brexit as an example

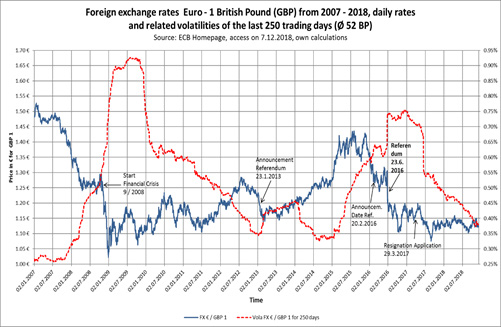

A current geopolitical risk that is very much present in the media is Britain’s withdrawal from the EU (Brexit). German companies are affected by Brexit if they sell products in Great Britain or operate production facilities in Great Britain. Since the export of German companies to Great Britain predominates in comparison to production sites, the sales revenue of German companies in British pounds should be considered here as an example. The sales proceeds in British pounds are subject to an exchange rate risk. In 2017, for example, BMW had a currency exposure in British pounds of the equivalent of €4.4 billion with an associated Value at Risk of €154 million (with total Group equity of €55 billion; cf. BMW 2017). BMW’s sales in the United Kingdom amounted to €6.113 billion in 2017 (see Statista 2019). The total value of all goods exported from Germany to Great Britain in 2018 was €82 billion, of which €22 billion were motor vehicles (cf. Außenwirtschaftsportal Bayern 2018). Figure 1 illustrates the development of the pound sterling (GBP) in relation to the euro from 2007 to the end of 2018. For a more appropriate presentation, the time series was presented in price quotation (€ per 1 GBP) and not in the current usual volume quotation. In the price quotation, a devaluation of the Pound is accompanied by a falling exchange rate. It is also easier to convert risk positions in GBP and basis points into euros. The risk position of GBP10 billion at an exchange rate of €1.10 / GBP1 is exactly €11 billion (1.10 times GBP10 billion). In addition to exchange rates, Figure 1 also shows the volatilities of exchange rates over the last 250 trading days. Volatility is the central risk measure for determining exchange rate risk. Figure 1 is completed by some comments on important events (e.g. announcement of referendum, start of financial crisis, etc.).

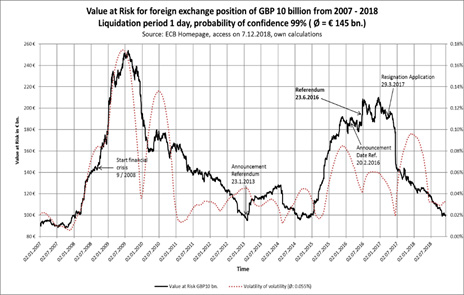

Figure 1 illustrates two significant events for the selected period from 2007 to 2018: The financial crisis in 2008 and the vote for the Brexit 2016. Both events are characterized by a (strong) increase in volatility and a simultaneous depreciation of the British pound. The increase in volatility (from 50 BP to 90 BP) and the amount of the devaluation (€1.30 to €1.03) are significantly higher during the financial crisis than for Brexit (60 BP to 75 BP, €1.30 to €1.10). The length of the crisis, i.e. until volatility returns to its long-term average of 52 bp, is also higher during the financial crisis (financial crisis from 9/2008 to 9/2011, Brexit from 6/2016 to 10/2017). For the analysis of the Brexit it is still remarkable that since the announcement of a referendum on 23.1.2013 the British pound has appreciated strongly from €1.15 to €1.40 and in the same period the volatility has increased from 40 BP to 65 BP. In crises, on the other hand, it can be observed that a depreciation is accompanied by an increase in volatility. The next step is to derive possible forecasts for the Brexit and thus an increase of volatility. Since the announcement of the referendum on 23 January 2013, no significant signs of a higher risk (volatility) can be derived at least from the exchange rate and volatility. The volatility increased and decreased in the period 23.1.2013 - 23.6.2016. However, it always remained within a range between 35 BP and 50 BP. The pound also appreciated and showed a clear downward trend only shortly before the date for the referendum was announced. To derive risk premiums from the development of the exchange rate or its volatility from the developments before the referendum seems speculative and not well-founded. It remains possible to measure the increase in volatility during the crisis itself and to use it as a risk premium on the volatility. For the Brexit, this results in a maximum increase in volatility of 20 BP for a period of approx. 1.5 years and an average increase of approx. 10 BP. For a German export company this means a calculation of a risk premium on the volatility of 5 BP with an assumed probability of occurrence of 50% for the Brexit (leave). This calculation would be necessary from the announcement of the referendum on the pricing of the geopolitical risk of a Brexit. For a foreign exchange position of GBP10 billion, this means a premium of GBP5 million or the corresponding euro amount at the current exchange rate. A similar approach could be applied to the financial crisis. Here the average increase in volatility was 20 BP over a period of three years. However, there were no clear signs or indicators of the financial crisis (as opposed to Brexit). To apply this approach to financial crises, for example, it would be necessary to identify indicators that provide indications of possible future financial crises. This would be the future-oriented component of the crisis forecast. This part of the risk assessment could then be combined with the volatility surcharges measured in past crises. The volatility surcharges measured in the past serve for (ex post) objectivity and the indicators for possible future crises represent the future (exante) component of the forecast. Possible indicators for a future forecast of financial crises would be, for example, the development of the price index of assets in relation to the disposable income of potential buyers of these assets. Other indicators for identifying asset bubbles could also be identified. A more differentiated picture emerges when looking at the Value at Risk for a currency position of GBP10 billion in Figure 2. The Value at Risk for a currency position of GBP10 billion results from currency exposure x current exchange rate (=risk position) x volatility x number of standard deviations (=99%) x root from the liquidation period (=1) (cf. Wolke 2017, p. 157). For the exchange rates and volatilities shown in Figure 1, this results in the corresponding Value at Risk values shown in Figure 2. The confidence level (99%) and the liquidation period (1 day) are constant values and are therefore only relevant for the absolute Value at Risk. In contrast to Figure 1, the interplay of exchange rate and volatility shows a more differentiated picture with certain effects [50-55].

Figure 1: Euro exchange rates - 1 British pound (GBP) from 2007 - 2018 and related volatilities.

A devaluation of the British pound is accompanied by a reduction in the risk position in euros. If volatility rises at the same time, both effects can compensate each other or intensify if the appreciation and volatility increase at the same time. The strengthening effects of appreciation and increased volatility can be seen in the run-up to Brexit from early 2015 (€100 million) to the referendum (€195 million). Immediately after the referendum, the peak value at risk rose to around € 210 million in the short term, but just one year after the referendum, the Value at Risk fell back to its long-term average of €145 million. For a possible surcharge on the Value at Risk analogous to the above estimate for the volatility surcharge, a maximum increase of €50 million (€195 million - €145 million long-term average) would have to be assumed. This would result in an average increase in VaR of €25 million for a period of 2 years (from mid-2015 to mid-2017). For a 50% probability of occurrence of the brexit, this results in a surcharge on the VaR for the geopolitical risk of €12.5 million for a period of 2 years. This is a significantly higher amount than an estimate based solely on volatility (GBP5 million over 1.5 years). The reinforcing effect of an appreciation of the foreign currency is therefore significant (in this case) and should not be neglected. However, it must still be taken into account that in the Value at Risk concept, the probability of security and the liquidation period still affect the absolute Value at Risk. Similarly, the financial crisis would result in an average premium of €50 million over a period of three years. Figure 2 also shows the associated volatility of volatility as an indicator of the stability of the risk estimator volatility. The trend confirms the instability of volatility in times of crisis (financial crisis, Brexit).

Figure 2: Value at Risk for a GBP10 billion foreign exchange position from 2007-2018.

Conclusion and Outlook

The consideration of geopolitical risks makes business sense and is even necessary in certain (company-dependent) cases. A possible approach is a combination of future forecasting and past risk measurement. However, difficulties and open questions arise with the possible approach described above. The first step is the identification of geopolitical risks and their possible business effects. On the one hand, this requires a political analysis of the situation in the respective foreign country. This is all the more difficult because there is no clear definition of geopolitical risks and the effects at the business and economic level also depend on subjective factors that are difficult to calculate (e.g. the introduction of punitive tariffs by Trump in the USA). The subsequent problem concerns the identification of macroeconomic variables influencing geopolitical risks and their quantitative measurement. For example, the question arises whether certain exchange rate developments were (are) actually triggered by geopolitical factors or whether other factors (e.g. inflation rate differential, interest rate differential, government debt, GDP growth, current account balance, etc.) influence or overlap exchange rate developments in a certain way. This requires appropriate macroeconomic multifactorial models and further econometric studies on the significance of influencing factors. Whether there are suitable multifactorial models to explain the exchange rate is, however, disputed or denied in economics.

A further problem lies in the allocation to the business risk factors. The allocation of a premium to, for example, the volatility of a certain exchange rate for the risk measurement of a foreign currency position is methodologically unproblematic (see Brexit example). When assigning geopolitical risk, e.g. to the business (company-specific) risk factor sales volume (sales risk) or personal risk (internal business risk), methodological difficulties arise if no historical data with comparable geopolitical risks is available. In this case, subjective estimates or simulations would have to be carried out, which in turn may not sufficiently meet the objectivity requirements required under 2. Finally, a discussion from a risk management and statistical point of view is necessary with regard to the calculation of the Value at Risk and its influencing variables and the determination of the periods for the volatility surcharge. The methodologically comprehensible consideration of geopolitical risks thus requires an interdisciplinary use of scientific resources and methods, which is considerable in view of the problems described above. In particular, this includes observing and identifying geopolitical risks and their effects on the company from a statistical, business (sales, procurement, production, SCM, finance, risk management), economic and political point of view. Due to cost-benefit considerations, complexity and the need for indepth technical and interdisciplinary knowledge, taking geopolitical risks into account does not make sense or is not suitable for all companies. SMEs in particular are faced with the task of weighing up the effort required to manage geopolitical risks and the resulting potential added value. If small and medium-sized enterprises are not in a position to manage geopolitical risks themselves (e.g. because data, specific knowledge are not available or their effort for procurement is too high), it may be possible to fall back on management consultants or auditing companies (which possess the necessary expertise and data material). Large multinational companies need (considering the above points) a “foreign policy” and internal “know-how” for the management of geopolitical risks and / or the support of management consultants or large auditing companies (e.g. Deloitte, KPMG, EY, PWC).

References

- Hood J, Nawaz MS (2004) Political risk exposure and management in multi-national companies: Is there a role for the corporate risk manager?. Risk management: An International Journey 6(1): 7-18.

- Howell Llewellyn D, Chaddick B (1994) Models of political risk for foreign investment and trade. The Columbia Journal of World Business 29(3): 70-91.

- Meyer Margit (1987) Die beurteilung von länderrisiken der internationale unternehmung. Duncker&Humblot, Berlin, Germany.

- Maltritz D (2006) Quantifizierung von souveränrisiken, Metropolis-Verlag, Marburg, Germany.

- Feldstein M (2016) Why geopolitical risks are becoming more and more important economically. In Wirtschafts Woche 5, p. 39.

- Bendul J, Brüning M Cooperative supply chain risk management-new ways to deal with existence-threatening supply Chain disruptions. Jacobs University Bremen, Funk Stiftung, Germany.

- Allianz (2017) Allianz risk barometer-The 10 most important business risks.

- Bank of England (2018) Systemic risk survey-survey results 2018 H1.

- Deloitte (2017) Deloitte CFO survey spring 2017-political risk challenge. The CFO Program.

- (2018) ECB Banking Supervision. The supervisory priorities of the SSM in 2019.

- (2019) World economic forum. The global risks report (14th edn).

- Solyp (2016) How to deal with geopolitical risks?.

- Hirschmann S (2015) Ten theses on risk management of the future. die bank 2: 25-30.

- Dicken P (2015) Global shift-mapping the changing of the world economy.

- Vanini U (2012) Risk management-fundamentals, instruments, business practice. Schäffer Poeschel, Stuttgart, Germany.

- Wolke T (2017) Risk management, deGruyter Oldenbourg, Berlin/Boston, USA.

- Werber N (2014) Geopolitik zur Einfü Junius, Hamburg, Germany.

- Brill H (1994) Geopolitik heute. Deutschlands Chance? Frankfurt am Main / Berlin, Germany.

- Chipman J (2017) Why your company needs its own foreign policy. Swiss Month, pp. 66-73.

- Bocquel-news (2017) Global risks at a glance: The Risk Map.

- Jedynak P, Bak S (2018) The global risk landscape-its shape, tendencies, and consequences for management. Journal of Economics and Management 32(2): 48-59.

- 2IOD (2014) Responding to global risks-practical advice for business leaders.

- Jorion P (2011) Financial risk manager handbook. Wiley, Hoboken, New Jersey, USA.

- Rice Condoleezza, Zegart Amy (2018) Managing 21st- century political risk. In Harvard Business Review, pp. 130-138.

- (2018) Moody’s investor service. Sovereign and supranational Research, Berlin, Germany.

- Marshall Tim (2017) The power of geography. dtv Verlagsgesellschaft, (7th edn), Munich, Germany.

- Iftinchi V, Hurduzeu G (2016) The place of political risk insurance in the political risk management strategy of multinational corporations. The Romanian Economic Journal 19(60): 201-212.

- Braun A, Fischer M (2018) Handbook of political risk insurance. University of St. Gallen, Institute of Insurance Economics. I.VW-HSG Schriftenreihe, Band, p. 64.

- Wagner F (2017) Gabler versicherungslexikon. Springer Gabler, (2nd edn), Wiesbaden, Germany.

- Führer C, Grimmer A (2009) Versicherungsbetriebslehre. Kiehl, Ludwigshafen (Rhein).

- Karten W, Nell M, Richter A, Schiller J (2018) Risiko und versicherungstechnik. Springer gabler, Wiesbaden, Germany, pp. 151-181.

- Liebenberg Andre P, Liebenberg Yvonne A, Ruhland, Joseph S (2008) Market pricing of political risk: Evidence from the property-liability insurance industry. Journal of Insurance Issues 31(2): 98-118.

- Zhang HL (2018) Economics, fundamentals, technology, finance, speculation and geopolitics of crude oil prices: An econometric analysis and forecast based on data from 1990 to 2017. Petroleum Science 15(2): 432-450.

- Hull John C (2011) Fundamentals of futures and options markets. Pearson, UK.

- Hull John C (2018) Risk management and financial institutions. Wiley, Hoboken, (5th edn), New Jersey, USA, pp. 479-496.

- Huber R (2017) Forschungsfragestellungen aus der Praxis. 1st Hamburg risk management forum, Funk Stiftung, Hamburg, Germany.

- Damodaran A (2008) Strategic risk taking-a framework for risk management. Pearson Education, New Jersey, USA, pp. 224-225.

- Jorion P (2002) Value at risk: The new benchmark for managing financial risks. McGraw-Hill, New York, USA.

- Simon Jeffrey D (1985) Political risk forecasting. Futures, pp. 132-148.

- Torre Jose de la, Neckar David H (1988) Forecasting political risks for international operations. In International Journal of Forecasting, pp. 221-241.

- Knauer T, Brück C, Nikiforow N (2019) Plausibilisierung von Unternehmensplanungen im rahmen der bewertung. In Controlling-Zeitschrift für erfolgsorientierte Unternehmenssteuerung, pp. 4-11.

- Frühauf, M (2016) Growing doubts about banks-stress tests. In Frankfurter Allgemeine.

- Bavli C (2012) The power of rating agencies and their role in the financial crisis 2008, Hamburg, Diplomica Verlag GmbH.

- Shapiro alan c (2010) Multinational financial management.

- Kröner A, Deters J (2018) ECB-bank supervisor calls for a reform of stress tests for financial institutions.

- Neuhaus Carla (2019) Why economists are always wrong.

- Bookstaber R (1997) Global risk management: Are we missing the point? Journal of Portfolio Management 23: 102-107.

- Angermüller Niels O, Eichhorn M, Ramke T (2006) Lower partial moments: Alternative oder Ergänzung zum Value at Risk. Finanz Betrieb, Heft 3, pp. 149-153.

- Shackle GLS (1972) Epistemic & economics: A critique of economic doctrines. Cambridge University Press, UK.

- Foreign Trade Portal Bavaria (2018) export to and import from great Britain.

- (2017) BMW Group, Annual report.

- (2019) Federal Association of German Banks (BdB) spring forecast: German economy slowed down. Lecture and panel discussion.

- (2018) Statista.

- (2019) Federal statistical office.

- Vogel J (2015) Prognose von zeitreihen-eine einführung für wirtschaftswissenschaftler. Springer Fachmedien Wiesbaden, Germany.

© 2022 Thomas Wolke. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)