- Submissions

Full Text

Novel Research in Sciences

Market Research Regarding Manioc Flour in Alagoas, Brazil

José Crisólogo De Sales Silva1, Andrei Atroshenko2, Conceição Maria Dias De Lima3, Ricardo Santos De Almeida4 and Jakes Halan De Queiroz Costa5

1Teacher at the State University of Alagoas, Brazil

2Economist at the University of London, United Kingdom

3Teacher at the State University of Alagoas, Brazil

4Department of Science and Technology of Alagoas, Brazil

5Teacher at Federal University of Alagoas, Brazil

*Corresponding author:José Crisólogo De Sales Silva, Teacher, State University of Alagoas, Brazil

Submission: October 29, 2019;Published: December 04, 2019

.jpg)

Volume2 Issue4December, 2019

Abstract

This study was conducted in order to gain knowledge of the market of the manioc flour in Alagoas, Brazil, and its potentials, based on the information from all links in the production and marketing chain. In Brazil, several products are derived from manioc. Due to that it has a great social and economic importance. The current research is structured in the framework of the five forces analysis of Michael EP [1]. A combination of the all factors suggests that the production industry of the manioc flour is attractive for producers since all five forces are benefiting. Thus, we can consider that an investment would lead to an adequate development in the scope of this study.

Keywords: Agriculture; Industry; Social; Marketing chain

Introduction

The manioc flour is an edible powder produced from the manioc root. It is of great importance to supply the Brazilian population with food. Traditionally, it is produced in socalled “houses of flour”, which are usually small specialized factories with basic equipment. Recently, this way of production has been threatened due to health and safety concerns, such as the improper disposal of flour, a toxic byproduct of the production process. Depending on the way of the processing, the flour can belong to one of the following three groups: dry flour, the flour with water and the mixed one. Each group can in turn be divided into sub-groups: the granulation of the flour, sub-groups depending on the coloring and types which vary in the quality during processing Folegatti & Matsuura [2].

The following comments of manioc flour consumers help to understand the importance of the product for the population: “Manioc flour is highly sought because already in the beginning it was a dietary supplement which could not miss in human nutrition” ; “Cassava flour is an indispensable ingredient for many regional dishes like ‘pirão de farofa’, ‘peixada’ etc.”; “The use of the manioc flour in food is cultural and is an important part of the daily life of the population.”; “The cassava flour is very popular, because it is part of the staple food of the local population, of the state and the Northeast region of Brazil”.

The closure of the “houses of flour” led to a growing gap between a constant demand and diminishing supply. This trend justifies new constructions of manioc flour firms. In order to achieve this, it is important to understand the market conditions, the opinions of the consumers and potential suppliers, and to prepare for different difficulties or probable changes. The research, of which results are presented below, was conducted on this desire.

Material and Method

The study was done in order to receive an overview of the market in Alagoas. Due to that the focus of the research was the local market. In addition to the work, which has already been carried out by several researches, including Instituto Natura gro, the current study was done in the framework of the analysis of the five forces by Michael EP [1]. These forces are the threat of new ventures, the power of suppliers, the power of consumers, the rivalry between existing competitors and the threat of substitutes. In order to understand market dynamics, industry changes have also been considered.

The following sources of information were used for the current study: Interviews with producers of manioc flour, interviews with manioc flour consumers, interviews with supermarket managers, Open Source Information (OSINT) and preliminary research of Instituto Natura gro.

Result and Discussion

The power of consumers

The importance: Having powerful consumers means that they have the ability to influence product prices and for that to determine the distribution of the income among the participants of the production chain, compromising the stability of the producer position-the factory. This can happen through two channelsresistance to higher prices and the searching for better quality. The power of negotiation, like the price sensibility, are only few characteristics of powerful buyers.

Evaluation of the influence: For consumers it is difficult to differentiate between various brands of manioc flour. Hence, the producers who invest in differentiated product may have disadvantages since the higher production costs are not going to attract more consumers. For that, it is important to establish contacts with supermarkets, see Figure 1.

Figure 1:Opinion of the consumers about the difficulty for consumers to differentiate between flour brands.

The supermarket managers are not aware of the producers of flour having alternative sales channels. However, everyone agrees that it is difficult for wholesalers to change suppliers. The number of brands presented in one supermarket is between one and eight at the same time, with more variety in supermarkets in Maceió. Both regional supermarkets had only one flour supplier. Managers are not aware of alternative suppliers, or they are of the opinion that others simply do not exist.

All supermarket managers, who were interviewed, believed that they could switch between suppliers. However, two of six recognized a degree of difficulty due to the limited supply, low quality and appearance of the alternatives. Furthermore, all supermarket managers are of the opinion that the dependence on buyers of flour producers is strong.

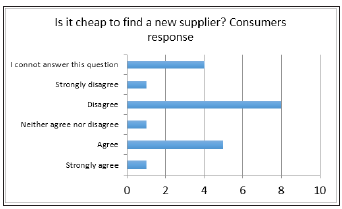

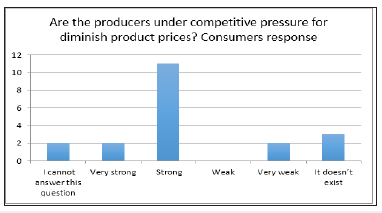

Finding a new supplier always entails costs-direct costs, such as the opportunity cost in terms of time, communication costs and travel costs; and indirect costs, for example probability to break relations with existing suppliers, which can lead to a loss of discounts or special contracts. According to five of six of the interviewed supermarket managers, it is relatively expensive to find a new wholesaler of cassava flour. As the Figure 2 below shows, consumers have a similar estimation of the market reality as the supermarket managers. These conditions do not support the power of buyers. A combination of these factors, the variety of the manioc flour use and the large number of potential buyers shows that the power of buyers can be described as poor or average, like demonstrated in Figure 3 & 4.

Figure 2:Consumer views on the economic feasibility of finding a new supplier of flour.

Figure 3:Feedback from consumers about the pressure faced by producers in relation to lower prices because of competition.

Power of the suppliers

The importance: Just like a powerful consumer can influence the profit distribution among the participants of the production chain, suppliers can have a strong influence, too. On the one hand they can maintain high prices while providing low quality and on the other reduce production costs, but harming the flour plant.

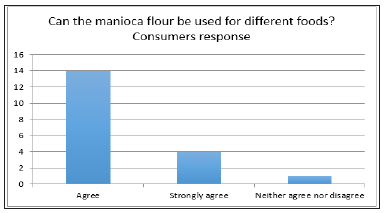

Figure 4:Consumer views on the use of manioc flour in food manufacturing.

Evaluation of the influence: While the focus of this study is the flour of the manioc plant, the influence of the raw material on the final product is strong. The most important raw material in the flour production process is the manioc plant. Its quality, price and availability are important factors for the production of flour. The weekly price analysis of manioc flour and manioc plant in the Northeast of Brazil between 2012 and 2014 shows that the correlation between the two is positive, but not very strong-0.31. However, the correlation between the varieties of flour is much stronger. For example, the correlation between the thicker and thinner flour is 0.99. This means that the flour producers cannot pass the instability of manioc flour prices to consumers. Hence, the producers are effectively taking the risk of price instability and inflation. Therefore, the power of suppliers is of great importance for the competitiveness in the observed market. The main suppliers of flour are farmers who grow manioc.

So, in order to understand their power, it is important to have knowledge of their production process. Generally, manioc is planted in June or July, in the rainy season of the region. The soil gets ploughed and the plants are sown from stem clones. A year later, in the next rainy season, the plants have already reached its final size. The roots develop rapidly. The tubers, accumulating carbohydrates, produce 1 to 5kg roots on average. These roots are the raw material and are used to manufacture flour, “goma” and “fecula de tapioca”. The bark of the root is used to feed cattle and for soil fertilization. The leafs are very rich in protein and therefore are used as animal feed, milled in forage near the stems. Producers’ costs are relatively constant and vary little from year to year. The risks for the producers depend on geographical location. However, some of the greatest risks are the temperature of the soil (fertility), plague and rain. According to the interviewed manioc producers, it is relatively easy to enter the market, but any increase in production requires additional costs. New producers can attract wholesalers easily and the government policy helps other producers entering the market. But producers have few alternative sales channels. The dependence on the producer with current middlemen is strong. It is difficult for producers to sell directly to consumers. The dependence on middlemen is great today because it has no flour factory in the region, or trade events to sell own settlement products. Producers do not know the competitive advantages of other producers. For a farmer it is difficult to enter the industry since buying one hectare of land and simple equipment costs between R$ 30,000.00 and R$ 60,000.00.

After increasing production to two hectare, which is, for instance, enough to produce 28-30 tons at one settlement. Furthermore, the producers need to lower the price to be able to sell any product. Estimates of production costs vary between R$ 2500 and R$ 3500 per hectare. Producers consider these costs as high. The properties of the manioc plant depend on the variety since some grow better than others. This means that different producers can focus on the different market segments, such as the producers themselves reported. Farmers do not believe that there is a replacement on the market that could offer a better product at a lower price.The region has 70-80 producers of manioc and 1-4 brokers, who buy the product in bulk. 1.5-2 years after harvesting the manioc lose its validity.

Producers consider neighbouring regions as competitors. Producers anticipate difficulties of selling manioc in the future due to the closure of illegal “houses of flour”. Furthermore, some farmers believe that the price may decrease. This will result in less production of manioc, but the existence of producers from other regions will solve this problem regarding to the flour mills. The few advantages that suppliers have, are the following: 80% of the interviewed producers agree that they could keep prices low for some time to protect the market. They also believe that there could be other producers who try to enter the industry. However, they reported that they believe working in a team with their neighbours and that they would help newcomers to integrate into the industry. The suppliers in the industry are weak, which is a positive factor for flour mills. Moreover, the low correlation of flour price with the price of manioc implies that there are diversification benefits for both products that are produced by the same group.

The rivalry among existing competitors

Importance: A large degree of rivalry between competitors in the industry limits the yield of plants. To understand this factor, one must understand the intensity of competition, and the basis of it.

Evaluation of the influence: In supermarket chains, there is a way to choose the supplier. This decision is made by the entire network control agencies located in another city, for example, in São Paulo. Some supermarkets have no direct supply, only multi-brand suppliers. In general, according to supermarket managers, the shelf life of manioc flour is between 30 days and 3 months. The industrial flour loses quality in the manufacturing process, especially in regard to taste. At the same time, according to consumers, the today’s market is very competitive.

Manioc flour is a result of several factors-the cultivated variety, the form of processing and storage time. 95% of the responding consumers agree that manioc flour can be used to prepare different foods. 100% of supermarket managers are of the same opinion. According to 66% of supermarket managers, the product is not differentiated. Responding consumers are divided into two almost equal groups-53% of them reported that the flour brands are differentiated, while 47% did not differ between various brands of flour. This punctuates for the existence of two different types of consumers that suppliers can serve. Few consumers reported that different brands already have their high profile in the market. Also, new brands often appear. Most of the responding supermarket managers agree that producers compete in different attributes which means low levels of competition in the industry. Consumers are divided into two groups-those who claim that producers compete on the same attributes and those who disagree.

However, there are more consumers who support the second opinion. This may mean that this group has strong preferences, while the other group does not. At the same time, there is no consensus among responding supermarket managers about the possibility of producers to focus on different market segments. On the contrary, as can be seen in the following Figure 5, the majority of consumers surveyed believe that producers could focus on different segments, Figure 5. As the following diagrams show, the surveyed consumers and supermarket managers agreed that manioc flour is not the same across the market. It is remarkable that the five respondents, all do not differentiate between different types of flour, four were found in Maceió. All buyers elsewhere have preferences, and managers of the supermarket know it, see Figure 6a & 6b.

On the one hand product price is important to consumers, on the other they believe that the pressure on producers to cut prices is strong. 100% of responding supermarket managers agree. As a result, we need to control the costs of production to maintain the competitiveness of the product. Consumers report that the product constitutes a large part of their costs for food. At the same time, the product does not constitute a large part of the costs of supermarkets. Hence, end consumers are much more sensitive to price than are intermediaries in form of supermarkets. This means that the flour should be sold directly to markets. For this, the marketing costs will be important to maintain or increase the profit margin. This strategy will require a careful approach to the particular stage of the production chain.

According to the supermarket managers, it is possible to differentiate the product through the appearance, texture, colour and price. Consumers also distinguish between different types of flour and choose preferences in terms of taste, smell, weight and origin of the product. According to consumers, the main differences between the products are the flavor (normal flour and sour flour, for example), the thickness, the colour (white or yellow), the form of the preparation (microwave or manual oven) the texture (fine, medium or coarse), the particle size and the aroma. The hygiene in the production was mentioned only by one of the interviewed consumers, which means that this concern is less important than the taste, which was mentioned by most of them, Figure 7-9. The most important attributes for consumers are the quality and the flavor, which were mentioned by them all, while the price only concerns a small part (two of fourteen). The supermarket managers are not aware of the exact number of competitors in the market but agree that they are rare. They do not recognize that the flour producers are engaged in the industry, as can be seen in the following Figure 10. In conclusion, the combination of the factors is characteristically for an industry with a low level of competition. However, flour has as one of the main selling points supermarkets Degaspari et al. [3].

The threats and risks of new ventures

The Importance: When the threats of new ventures are likely, the profits of producers already will be limited. It is necessary to maintain low prices, the control over costs and often to invest more to maintain competitiveness and ward off potential competitors. To understand this force, we must distinguish between the possibility of new competitors entering the industry and the number of producers who are entering indeed. The latter case is not important because even the possibility makes the actual producers feel the negative pressure. Two factors affect this force-the barriers to entry the market and the expectation of retaliation.

Evaluation of the inducement: The supermarket managers do not know how much it costs for a wholesale to change its manioc flour suppliers. Furthermore, they do not know the advantages of existing suppliers more specific than the price and quality. This facilitates the entry of new competitors into the market and prevents the attempts of producers to protect and strengthen their position. As shown in the Figure 10 below, 50% of supermarket managers agree that the manioc flour market is declining, while only 16% think that the market is growing. Despite showing some obvious problems for manioc flour producers, it also indicates a lack of interest in the kind of potential competitors who want to enter the market, providing an automatic defense mechanism for producers who manage to survive in these conditions.

On the other hand, 70% of the producers claim that manioc flour industry is decreasing. This is good for the flour producers which are already in the business since there is less probability of new competitors entering the market. This supports the opinion that the threat of new enterprises in this industry is weak, Figure 11. Unlike these results, Smolinski et al. [4] demonstrate in their study that the organic market is growing in both terms the supply of goods and in the number of farmers.

The threats of substitutes

The importance: Replacement products are goods that fulfill the same function as the analyzed manioc flour. It is important to note that it is not always the appearance of the product that determines the degree of suitability of the product as a replacement, but the use of the product by the potential buyer. For example, toys and sweets are substitute products; both are purchased for children as gifts and can reduce the income of the particular producers. So, it is important to determine which products can replace manioc flour from the consumer perspective. One supermarket manager responded that there are already alternative products and that habits have changed. Examples of these products are “goma de tapioca”, “cuscus flour” and “crumbly farofa”, which are in the opinion of the manger more accepted products.

Evaluation of the inducement: Consumers mention “goma”, “sequilhos”, “farofa”, rice, maize flour and “tapioca mass” as potential substitutes. Maize flour and tapioca mass occupy the most important position as they have been described more than others. As the Figure 12 below shows, managers of supermarkets agree that there are not many substitutes for manioc flour that would be better. However, 66% think that they could change between substitutes and 33% recognize the difficulties this may cause. This combination means that substitute products exist, but do not have an apparent problem for producers of manioc flour Figure 12 & 13. Consumers agree with supermarket managers on the subject of availability of substitutes that can offer better quality for a lower price. The supermarket managers believe it is very difficult to find substitute products, as can be seen in the following Figure 14. Consumers agree with this statement. Hence, the producers have more power in the market, Figure 14-16 and 93% of the consumers agree that the use of quality flour is important for them, like demonstrated in Figure 17.

Changes in industry structure: The supermarket managers believe that the producers of flour are small and medium suppliers and farmer cooperatives. Buyers are local people. The urban population buys it in supermarkets and others prefer street market, according to a supermarket manager. The latter believes that the biggest threats of flour market are other supermarket chains, but 33% of them do not know the geography of competition.

Recent changes mentioned by supermarket managers were the appearance of products, the lack of suppliers, the enhancement of manioc flour by client absence, the emergence of industrialized product without additives and gluten. The managers believe that likely future changes are an increased number of suppliers, increased production and greater availability of the product for a better price. The supermarket managers identified the producers of “farofa” as potential competitors of manioc flour producers. Another trend mentioned by the managers of supermarkets, that can worry the traditional flour producers, is the emergence of packaged and industrialized flour.

Conclusion

A combination of all factors shows that the manioc flour production industry is attractive for producers since all five forces benefit them. Thus, we can consider that an investment would lead to an adequate development in the scope of this study.

References

- Porter ME (1947) Competitive strategy: Techniques for industry and competition analysis. Trad Elizabeth Maria de Pinto Braga. (2nd edn), Brazil.

- Folegatti MI, Matsuura S, Fernando CAU (2008) Cassava and derivatives soul cross: Embrapa cassava and fruit. Market Research on Cassava (flour and starch).

- Degáspari CH, Mottin F, Blinder EW (2009) Consumer behavior in the cereal bar market. Letters and Arts 17(1): 49-58.

- Ricardo S, Eziquiel G, Augusta PR (2011) Market analysis of organic products: Fair case study in Ponta Grossa PR. Development and Environment 23: 167-182.

© 2019 José Crisólogo De Sales Silva. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)