- Submissions

Full Text

Environmental Analysis & Ecology Studies

Federal and State Clean Energy Incentives: New Opportunities for the Implementation of Ground Source Heat Pumps Under Energy Savings Performance Contracts

Samuel Fonseca de Carvalho*

LLM Candidate in Environmental Law, Elisabeth Haub School of Law, Pace University, USA

*Corresponding author:Samuel Fonseca de Carvalho, LLM Candidate in Environmental Law, Elisabeth Haub School of Law, Pace University, USA

Submission: February 02, 2024; Published: March 06, 2024

ISSN 2578-0336 Volume122 Issue1

Abstract

The concern of the U.S. Federal and New York State governments regarding climate change has led to the adoption of energy policies aimed at reducing greenhouse gas emissions. In this context, both governments established financial incentives for the implementation of Ground Source Heat Pump (GSHP) in residences and facilities. Under this framework, this paper aims to analyze how these policies affect customers and Energy Saving Companies (ESCO) under Energy Saving Performance Contracts (ESPC). Additionally, it explores potential opportunities for GSHP projects arising from these policies. The research is structured into three main parts: the first part focuses on ESPC negotiation processes, available business models, and ESCO regulation in NY State. The second part delves into the relevance and operation of GSHP systems, providing case studies of ESCOs implementing them. The third section evaluates financial incentives at federal and state levels for GSHP implementation and their impact on ESPCs. The research methodology employs bibliographic, qualitative, and exploratory methods, supplemented by comparative and inductive approaches. The conclusion of this research demonstrates that many federal and state financial incentives can be used when developing a GSHP ESPC to benefit both customers and ESCOs through the many forms of incentives available that will be significantly influenced by factors such as the ESPC business model, GSHP system performance, customer income, and region of implementation.

Keywords:Energy policies; Financial incentives; Geothermal

Introduction

The Energy Service Company (ESCO) industry is a constantly growing market that plays an important role in energy efficiency and renewable energy promotion. These companies provide energy efficiency services through the use of Energy Savings Performance Contracts (ESPC), contributing significantly to energy transition and economic savings in the United States [1-6]. Under this model, ESCOs commit to designing and implementing energy upgrades, ensuring future energy cost savings that cover project expenses. This approach enables customers to fund energy efficiency without substantial upfront capital. Nonetheless, due to ESCOs bearing project risks and guaranteeing performance, higher costs for implementation and stricter standards for reviewing and negotiating the ESPC are essential for the achievement of a successful project. Within this context, one of ESCO’s services is related to the implementation of Ground Source Heat Pump (GSHP) systems for space heating.

Given the increase in global demand and efforts towards cleaner energy and economic patterns, GSHP systems stand out for their low carbon, energy efficiency, and cost-effectiveness characteristics. Moreover, with the United States’ high CO2 emissions, switching to clean energy is crucial, especially after rejoining the Paris Agreement. Hence, promoting GHP systems in homes offers energy and financial savings, as well as reducing electricity usage for heating [7]. In view of this, the federal and the New York State governments have set goals and measures to incentivize initiatives that contribute to the transition to a new clean energy economy, which includes the installation of GSHP for space heating. Therefore, the purpose of this study is to analyze how the federal and state incentives for ground source heat pumps affect customers and Energy Saving Companies under Energy Saving Performance Contracts, as well as possible new opportunities for the implementation of GSHP projects due to the potential benefits originated from these policies. In order to proceed with the research, this paper is divided into three main parts. The first examines the ESPC negotiation process, available business model options, and ESCO’s NY State regulation. The second part investigates GSHP’s relevance, system of operation, and case studies of how ESCOs have used them. The third section evaluates all the financial incentives available for the implementation of GSHP systems at federal and state levels, as well as how ESPCs can be impacted by them. Finally, the methodology used in the analysis was bibliographic, qualitative, and exploratory, followed by the use of comparative and inductive methods.

Energy Saving Company and Energy Saving Performance Contract

ESCO framework

The Energy Service Company industry has been acknowledged as a promising delivery mechanism for energy efficiency and saving1, as well as for the promotion of renewable energy systems and demand-side load demand2, with a constant market growth3. According to Larsen, ESCO can be defined as “a company that provides energy efficiency-related and other value-added services and for which performance contracting is a core part of its energy efficiency services business [8-15].” In the United States, ESCOimplemented projects provide significant energy and economic savings each year4. Historically, government policies and capital improvement needs of customers have been the main cause of this industry’s growth.

ESCO’s objective to improve energy efficiency is achieved by the development, installation, and financial support of performancebased projects that are executed within a determined period6 through an energy savings performance contract model7. In this business model, there is a long-term contract that establishes ESCO’s responsibility for designing and implementing energy efficiency upgrades for customers and guarantees that they will result in future energy cost savings8, which is expected to be sufficient to reimburse the project installation and financing expenses9. This mechanism allows customers to finance energy efficiency without a relevant up-front capital investment10. Moreover, considering that the customer may assume no risk in case of underperformance of the project over an extended period and that the risk is borne by the ESCO, the cost for the implementation and development may correspond to it and may be higher than a standard energy service contract11. Yet, this framework that transfers the technical and operational risks to the ESCO in return for a higher reward has led to effective “win-win” situations12.

Energy saving performance contract negotiation process

There are six fundamental phases to complete the transaction process of the Energy Saving Performance Contract [16-23]. The first stage is the assessment of the needs and opportunities13. Next, the walk-through audit14. After, the selection of a contractor through an audit and bidding or tender process15. Subsequently, the energy audit and the presentation of the audit report, in which the client may review and base its decision. If the report is favorable and the customer decides to continue the process the fifth step is to negotiate the terms of the energy saving performance contract itself and choose the ESPC business model16. Finally, after the negotiations are finalized and the contract is signed, the project must be executed and the ESCO must perform and implement the energy-saving upgrades and obligations established in the contract17.

Energy savings performance contract models

The Energy Saving Performance Contract should clearly define each party’s roles and responsibilities, as well as explicitly state how the project is expected and guaranteed to perform over the long-term agreement18. Additionally, the main body of the ESPC should contain the major provisions regarding the guarantee, procedures for notification, indemnification clauses, ESCO’s model of compensation, and the length of the contract. The cost-saving guarantee is calculated by comparing a space’s energy usage or cost before and after the project’s upgrade is performed [23-31]. However, in practice, there are many factors that may affect the estimated cost-saving provisions that are beyond the control of the ESCO, such as changes in occupants’ behaviors in the facility, changes in the space infrastructure, variations of energy prices in the electric power market and alteration of weather patterns19. Consequently, the ESPC may establish baseline adjustments in order to reduce the risk to the project’s financial stability.

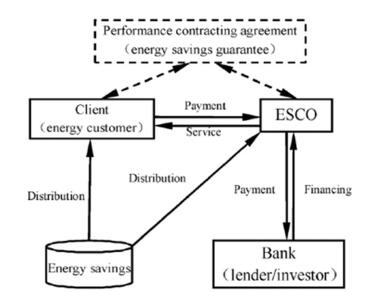

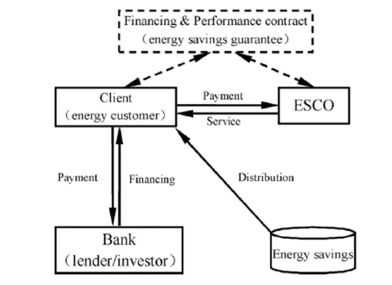

In this context, determining which kind of ESPC model to adopt has an essential impact on the savings of the project, since each one may lead to a different energy saving performance20. There are many business operating models for ESPC projects, however, they can be mainly divided into three styles, the shared saving model, the guaranteed saving model, and the chaffee model21. The first two models represent the most dominant models22, being commonly used in the United States, Canada, Japan, the Republic of Korea, China, and Thailand, for example23. In the shared saving model, also known as “Full Service ESCOs”24, ESCOs sign a financing and performance contract with the customers, being responsible for providing or arranging most or all of the financing needed to implement the energy efficiency project, as well as designing and implementing the project25. Additionally, ESCOs are required to verify the energy savings during the contract term period, as well as provide service throughout the entire process26. In this model, the client does not make a financial contribution to the project, but it receives part of the energy costing savings during the term established in the contract, while the other portion is paid to the ESCO27. Subsequently, after the contract term is over, the customer can keep all the savings28. This financial structure allows customers with a lack of adequate funding to join ESPC projects29, while providing almost “zero risk” to the transaction, resulting in a model with broad applicability30 (Figure 1 & 2).

Figure 1:Shared savings model.

Figure 2:Guaranteed savings model.

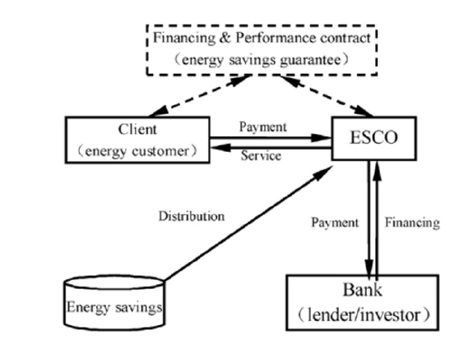

On the other hand, in the guaranteed saving model the ESCO designs and implements the project, however, the financing is done by the customer31. Accordingly, the client contracts a loan with a financial institution to fund the entire ESPC and puts the money borrowed in a balance sheet32. As a result, ESCO’s payment is done by the client, once the performance guarantees are accomplished, and the loan is repaid through the energy cost savings33, which the ESCO’s guarantee is sufficient to cover the debt service assumed34 (Figure 3). Finally, in the Chaffee model, the ESCO is responsible for the implementation and maintenance of the project, while self-financing its operation and receiving all the energy savings if achieved a certain target established in the ESPC, if the company does not meet the agreed target it needs to pay a compensation to the client35. At the end of the contract period, the client earns all the energy savings36. Thus, in this model the ESCO assumes all the financial risk of the project, while at the same time receiving the direct benefits of a successful project and self-financing its activity37

Figure 3:Chaffee model.

New York state ESCO regulation

New York State has instituted precise protocols for ESCOs aiming to be authorized suppliers of electricity and/or natural gas to residential or non-residential consumers in the state. Moreover, stringent obligations and dispute resolution procedures have been established to ensure the protection of consumers’ interests and regulate their engagements with these services. The eligibility requirements set by the New York State in the Uniform Business Practices (UBP) aim to ensure that only the ESCOs that are prepared to comply with rules and regulations and uphold policy goals and expectations are participating in the retail access market. Under this framework, ESCOs are required to disclose relevant information regarding their business methods, including the methods by which they intend to market their products and services to customers, the category/categories of commodity products they intend to provide to customers, describe specific policies and procedures established by the applicant to secure customer data and provide proof of financial assurance38.

To safeguard consumers’ interests and interactions with Energy Service Companies, as well as to ensure a fair, safe, and transparent treatment in Energy Saving Performance Contract transactions, New York State established in art. 22-A (§ 349) of NY General Business Law the “Energy Services Company Consumers Bill of Rights”39. This ESCO consumer’s bill of rights emphasizes the most significant rights that consumers should be aware of before signing an agreement with an ESCO [31-35]. Those rights include a clear description of the services offered by the ESCO, a fair and timely complaint resolution process, receiving energy delivery and 24-hour emergency services from your utility company, clear procedures for switching energy suppliers, including information about the enrollment process, and disclosure, in simple and clear language, of the terms and conditions of the agreement. Further, the State of New York provides a formal dispute resolution process whenever there are disputes involving utilities, ESCOs, and/ or Direct Customers in the State. Nonetheless, it is important to highlight that the parties should in good faith use reasonable efforts to resolve any dispute before invoking the formal process. In the dispute resolution formal procedure, any distribution utility, ESCO, Energy Broker, Energy Consultant, or Direct Customer may initiate the process by providing written notice to the opposing party and Department Staff, including a statement that the UBP dispute resolution process is initiated, a description of the dispute, and a proposed resolution with supporting rationale40. During the process, the Department Staff facilitates the parties’ discussions and assists them in reaching a mutually acceptable resolution on many occasions [36-45]. In the end, if there is no mutual agreement between the parties, any party may request an initial decision from the Department. After this decision, the losing party is allowed to appeal it to the Public Service Commission for a final decision41.

Ground Source Heat Pump

Ground source heat pump relevance

Nowadays, more attention is being given to renewable energy sources in global energy consumption. One of the reasons for that is the energy shortage problem throughout the world, as the pressure on the supply of energy generation and consumption is increasing every year worldwide42. Hence, clean energy plays a significant role in reducing greenhouse gas emissions, controlling pollution, and enhancing sustainable development43. Additionally, the Ground Source Heat Pump is being considered, among other sources of renewable energy, one of the most environmentally safe, energy-efficient, and financially executable options for space heating44. In this context, the United States ranks among the top countries within the G20 in terms of per capita CO2 emissions [46,47]. Hence, substituting fossil fuels with economically feasible, clean, and sustainable energy sources is a priority in the country45. Especially considering that the U.S. has recently re-entered the Paris Agreement and shares the goal of holding the increase in the global average temperature to well below 2 °C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5 °C above pre-industrial levels, as well fostering climate resilience and low greenhouse gas emissions development46. In view of this, encouraging and advancing the utilization of geothermal energy systems presents a sustainable strategy to diminish the nation’s carbon emissions47.

In the residential sector, long-term benefits of geothermal energy system implementation include both energy and financial savings by replacing existing space heating and cooling systems with this new renewable source48. Regarding energy saving, studies have shown that ground source heat pump systems are capable of “saving electricity consumed in the heating and cooling of buildings, ranging between 66% to 80% of its nominal extraction capacity”49. Hence, the financial health of individual consumers is also reflected through the use of this system, where economic savings have been calculated resulting from the GHP use when compared to traditional sources of heating50. Further, in colder climate regions characterized by high heating demands, this system can offer consistent performance during the cold season by installing the heat exchangers at a depth unaffected by surface weather’s seasonal fluctuations once the ground temperature below a depth of a few meters remains almost constant throughout the year51. As a result, considering that a major portion of electricity in the United States is consumed for residential and commercial heating system52, the use of geothermal energy system can significantly contribute to the reduction of fossil fuels use for electricity generation, as well as carbon emissions and per capita carbon footprint53. Consequently, this contributes to mitigating climate change and aids in attaining the climate objectives established by the Paris Agreement.

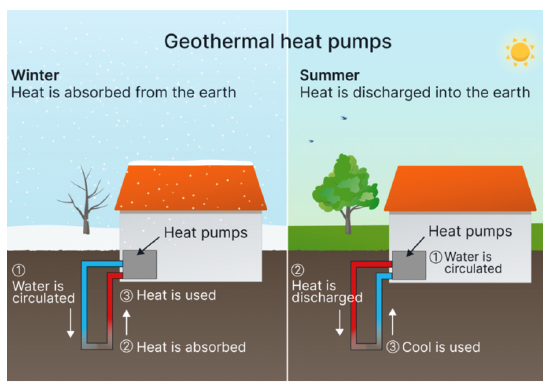

Geothermal heat pump system operation

Geothermal energy system design and technology are diverse and in continuous development. The basic and common factor of all systems is that they “transfer thermal energy from the earth’s subsurface geology, a surface water body, or raw or treated sewage, through a system of heat exchangers and pipes to use as heating and cooling for use in buildings or to supplement industrial processes.”54 This phenomenon happens because the ground temperature below a depth of a few meters remains almost constant throughout the year, which is usually warmer than the ambient weather during the winter and colder than the ambient weather during the summer55. Moreover, the geothermal heat pump system utilizes a ground source heat pump to circulate liquid through loops buried underground, in an aquifer, or connecting to a deep rock reservoir56. The temperature of the liquid then increases as it absorbs heat from the ground or water due to conduction. Subsequently, the fluid is directed to the GSHP to provide the heating or cooling to the end users at the desired temperature. By repeating this process, a large amount of heat can be transferred57. This procedure can be better illustrated in Figure 4.

Figure 4:Photo credit: Alaska Center for Energy and Power. Available at: https://montanarenewables.org/ geothermal/

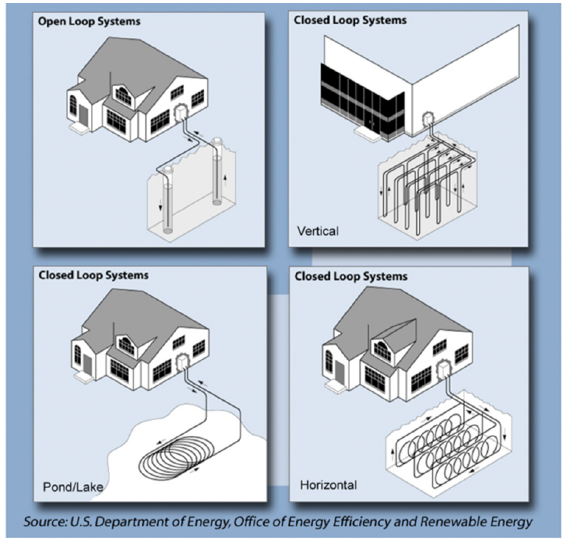

Furthermore, it is relevant to mention that GSHPs are available in four types of loop systems responsible for transferring heat to or from the ground and the building. Among these, three-horizontal, vertical, and pond/lake-operate as closed-loop systems, in which a geothermal heat pump circulates an antifreeze solution through a closed loop that is buried in the ground or submerged in water. The fourth system type is the open-loop option, which will be further explained58. Horizontal loop installations are typically the most cost-effective for residential setups, especially in new constructions with sufficient available land. This method involves burying pipes in trenches excavated using backhoes or chain trenchers. Normally, up to six pipes, often connected in parallel, are buried in each trench. These pipes are spaced at least a foot apart, while the trenches themselves are set at distances ranging between ten to fifteen feet from one another59. Vertical loops are commonly employed in larger-scale geothermal systems, such as those found in commercial buildings, particularly in instances where land is limited or when the soil depth is inadequate for horizontal trenchbased loops. In vertical systems, approximately four-inch diameter holes are drilled around 20 feet apart and reach depths ranging from 100 to 400 feet. Two pipes, linked at the base using a U-bend to create a loop, are inserted into each hole and grouted to enhance efficiency. These vertical loops are then linked using horizontal piping (manifold) placed in trenches and connected to the heat pump within the building60.

Pond/lake loops, often regarded as a cost-effective choice, are implemented in locations with an adequate water body that meets specific minimum criteria for volume, depth, and quality to ensure optimal performance. There, a supply line pipe is run underground from the building to the water and coiled into circles at least eight feet under the surface to prevent freezing and fluid is pumped just as for a conventional closed-loop ground system in order to provide heating or cooling for spaces61. The openloop option uses either well or surface body water as the heat exchange fluid that directly circulates through the geothermal heat pump system. After circulating through the system, the water is reintroduced to the ground through the well, a recharge well, or surface discharge. However, it is important to emphasize that this system is only feasible where there is a sufficient supply of relatively clean water and compliance with all the regulations governing groundwater discharge62. All types of geothermal systems mentioned are illustrated in Figure 5. Therefore, when considering the implementation of a geothermal heat pump system for heating and cooling buildings, it’s important to take into account local conditions and regulations, since the system’s performance can be significantly influenced by geological, climatic, and environmental factors of the region. In addition, the type of system in consideration can also receive different treatments from federal and local regulations, as under some circumstances permits and other authorizations may be required for its implementation, such as drilling wells or handling underground heat exchange fluids. As a result, a due diligence assessment is essential for a successful geothermal heat pump execution and performance.

Figure 5:Photo credit: U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy. Available at https://www.energy.gov/energysaver/geothermal-heat-pumps

ESCO use of geothermal systems

Energy Service Companies are already exploring the opportunities related to the implementation of ground source heat pump projects in their energy savings performance contracts related to the heating and cooling of spaces. Additionally, new business opportunities are constantly arising for ESCOs to participate in the energy market as a result of new efficient energy saving measures and the development of new technologies63. Within this context, even though geothermal system ESPCs are being offered in the market, there is not abundant research regarding their implementation. Some studies, nonetheless, have examined specific cases of its installation in the United States and Spain. The Energy Policy Act of 1992 required the Federal government to become more energy efficient. Thus, President Clinton issued Executive Order 12902 mandating a 30-percent reduction in energy use by Federal agencies by 2005, compared to a 1985 baseline. Under this context, the U.S. Army in Fort Polk, Louisiana, entered into an agreement with an Energy Service Company (ESCO) under an ESPC where 4,003 U. S. Army housing units were to be converted to use GSHP systems. At the time of installation, this project was the nation’s largest completed ESPC. Subsequently, the data shows that the system and other efficiency measures reduced electrical consumption by 26 million kWh or 33% of the pre-retrofit whole house electric consumption, and reduced natural gas consumption by 100%64. Consequently, the success of this project created the momentum to establish ESPCs in the Federal sector, which later led to the adoption of the U.S. Department of Energy Qualified List of Energy Service Companies under the Federal Energy Management Program, where there is a list of all the ESCOs that may compete for ESPCs with federal agencies.

Similarly, in 2009, the University of Central Missouri (UCM) agreed on a $36.1 million energy savings contract with an ESCO for the installation of energy saving measures, including the construction of 150 geothermal wells to provide high-efficiency heating and cooling, with seasonal inspections, maintenance e and repairs to maintainable components over the life of the ESPC. Consequently, this project was able to generate $735,000 in annualized consumption savings, $848,000 in operating and maintenance savings, and $1.5 million in avoided annual capital improvements65. In Spain, the research conducted examined geothermal source heat pumps under energy services companies’ finance schemes to increase energy efficiency and production in stockbreeding facilities. This study was proposed since farms in the region needed heating devices to maintain thermal comfort in the interior, to ensure adequate conditions for animals to achieve good productivity, and these facilities usually have no access to natural gas networks66. Hence, farmers expected that the ESCO could provide energy-saving measures using GSHP and reduce energy costs while increasing meat production and improving the facility’s competitiveness. The results suggest that ESCOs can provide energy efficiency improvements and financial aid under an ESPC to possibly spread the use of GSHP in the farming sector, achieving an increase in productivity and competitiveness as a consequence of optimal climatic conditions, low energy consumption, and cost reduction. Additionally, a reduction of 89% of CO2 emissions was observed, consequently, of carbon footprint, which leads to an improvement in international market accessibility67.

Therefore, considering the energy saving benefits that geothermal systems promote when implemented for heating and cooling, ESCOs are already applying this mechanism under energy saving performance contracts around the world. Also, given the constant development of new highly efficient technologies in GSHPs and the constant growth of the ESCO industry and market in the United States, it is expected the further use by consumers of this system for heating and cooling of buildings under ESPCs, along with the increasing demand for clean energy source consumption.

Federal and State Incentives for Geothermal ESCOS

Federal and State concern over climate change and the urgent need for an energy transition has led to the adoption of public policies that aim to reduce greenhouse gas emissions, drive critical building and transportation electrification, secure climate justice, and advance the Country’s and State’s commitment to a cleaner and sustainable economy. In view of this, both governments have created financial incentives for the implementation of ground source heat pumps, as a manner to reduce GHG emissions and promote more efficient practices for space heating.

Federal incentives

On August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law, marking the most significant and largest federal response to climate change and commitment to build a new clean energy economy in the nation’s history. The IRA aims to deliver results through a combination of grants, loans, rebates, incentives, and other investments to support the deployment of clean energy, clean vehicles, clean buildings, and clean manufacturing. Moreover, consistent with the preliminary analysis of IRA impacts on emissions and the energy system, it is indicated the Act would potentially lead the United States to achieve a 32% to 42% reduction in Greenhouse Gas (GHG) emissions by 2030 compared to 2005 levels. Additionally, this reduction estimate is 6 to 11 percentage points less than the projection without the IRA, closing the gap towards fulfilling its Nationally Determined Contribution target under the Paris Agreement, which aims to halve economy-wide GHG emissions by 203068. Under this framework, the IRA establishes multiple financial incentives in the form of tax credits and rebates for the implementation of geothermal heat pumps for the heating of residences and commercial buildings. These incentives can be further explored by ESCOs when negotiating energy saving performance contracts with customers. Hence, five IRA incentives may contribute to better financing of ESCO ground source heat pump projects.

First, the Energy Efficient Home Improvement Credit under 26USCS § 25C allows residences that made qualified energyefficient improvements after January 1, 2023, to qualify for a tax credit of up to $3,200. This credit is limited to $1,200 for energy property costs for certain energy efficient home improvements, with limits on doors ($250 per door and $500 total), windows ($600), and home energy audits ($150). Additionally, a separate cap of 30% up to $2,000 is applicable for the category of heat pumps and heat pump water heater installations. Further, according to this section, the heat pump system must meet or exceed the highest performance tier set by the Consortium for Energy Efficiency. In order for residents to qualify for this credit, their home must be located in the United States, serve as their primary residence, and have undergone certain improvements, thus excluding the participation of newly constructed homes69.

Secondly, the Residential Clean Energy Property Credit under 26 U.S.C.S. § 25D equals 30% of the costs of new, qualified clean energy property for a residence installed anytime from 2022 through 2032, including geothermal heat pump property expenditures. The term “qualified geothermal heat pump property expenditure means an expenditure for qualified Geothermal Heat Pump (GHP) property installed on or in connection with a dwelling unit located in the United States and used as a residence by the taxpayer”70. In addition, qualified GHP property means “any equipment which uses the ground or groundwater as a thermal energy source to heat the dwelling unit (…) or as a thermal energy sink to cool such dwelling unit, and meets the requirements of the Energy Star program which are in effect at the time that the expenditure for such equipment is made”71.

Thirdly, the Home Owner Managing Energy Savings (HOMES) Rebate was included in Section 50121 of the IRA, offering rebates for energy-efficiency upgrades retrofits that improve the overall energy performance of a Single-Family Home (SFH) or Multifamily Building (MFB) through September 203172. Hence, retrofits that result in energy savings ranging from 20% to 35% are eligible for rebates at 80%, capped at a maximum of $4,000 per dwelling unit73. Conversely, if the energy savings reach at least 35%, the cap increases to $8,000 per dwelling unit. However, as of now, the program has not been made available74. Fourthly, through the High- Efficiency Electric Home Rebate Program (HEEHRP), the Secretary is mandated to allocate grants to State energy offices and Indian Tribes to institute a high-efficiency electric home rebate program. This program covers 100 percent of electrification project costs, up to $14,000, for low-income households and 50 percent of costs, also up to $14,000, for moderate-income households. Additionally, for the acquisition of an appliance as part of a qualified electrification project, the maximum amount allowable is $8,000 for a heat pump designed for space heating. However, a rebate of up to $500 per heat pump installation may be accessible for contractors. It is important to note that the purchased GSHP must comply with the Energy Star program’s requirements. Lastly, this program restricts the combination of federal rebate programs75.

Fifth, the Commercial Buildings Energy Efficient tax deduction, as detailed in 26 USCS § 179D, allows building owners to claim tax deductions amounting to $.50 per square foot, along with an additional $.02 for each percentage point above 25% energy reduction, not to exceed $1.00 per square foot. This deduction applies when property owners introduce Energy-Efficient Commercial Building Property (EECBP), which must be installed in a building within the United States and meet specific guidelines outlined in Reference Standard 90.1 by the American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE). To qualify for this deduction, the installation should be part of a plan aimed at reducing the total annual energy and power costs for these systems by 25% or more compared to a reference building meeting the minimum requirements set by Reference Standard 90.176. Similarly, the section provisions tax deduction for Energy-Efficient Commercial Building Retrofit Property (EEBRP) as well, however, it pends final guidance and regulation for the specific amount of deduction77. Finally, the Advanced Energy Project Credit under 26 USCS § 48C provides tax credits an amount equal to 30 percent of qualified investment costs for projects that meet prevailing wage and apprenticeship requirements and 6% for projects that don’t meet prevailing wage and apprenticeship requirements with respect to any qualifying advanced energy project of the taxpayer. Among the qualifying projects, are eligible those that re-equip an industrial or manufacturing facility with equipment designed to reduce greenhouse gas emissions by at least 20 percent through the installation of low-or zero-carbon process heat systems or carbon capture, transport, utilization, and storage systems78.

In this context, ESCOs can benefit from these financial incentives in many forms when developing geothermal heat pump energy saving performance contracts with customers. For instance, under a guaranteed saving model, considering that the project is financed by the client who needs to obtain loans with a financial institution, he can submit an application for receiving tax credits from the Energy Efficient Home Improvement Credit Program as well as rebates from the High-Efficiency Electric Home Rebate Program. Consequently, these benefits will increase the customer’s budget to implement the GSHP project while lessening the amount of loan needed, if any, to repay the ESCO. Another example can be illustrated by taking advantage of the Advanced Energy Project Credit program. If the energy saving measures accomplished by the ESCO in a facility reduces greenhouse gas emission by at least 20 percent, as occurred in the Spain case study mentioned in the previous topic, then the client would be eligible to receive a 30% tax credit if in compliance with the prevailing wage and apprenticeship requirements. As a result, under this scenario, the investment necessary for the implementation of the project would diminish, potentially affecting the time normally set in an ESPC since it would take less time for the client to repay the lowered capital “borrowed” when compared to a non-credit benefit scheme. Furthermore, this situation provides more safety under the ESPC, considering that part of ESCO’s financial payback will be indirectly ensured by the government and the client will need less funds or less time unearning the energy savings, depending on the ESPC business model.

New York state incentives

The Climate Leadership and Community Protection Act (Climate Act) was enacted in New York State in 2019. Regarded as one of the most ambitious climate laws in the nation, it endeavors to implement a comprehensive set of measures to reduce economywide greenhouse gas emissions by 40% by 2030 and by 85% by 2050 from 1990 levels. Additionally, the Act aims to enhance the resilience of New York communities, adapting them to a changing climate and setting the foundation for collaboration among citizens, communities, businesses, schools, and government entities towards a green economy and build a climate-proof future for the state79. In this context, to help achieve the State’s climate goal, the NY developed the New York State Clean Heat Statewide Heat Pump Program, which is a collaborative effort between the New York Electric Utilities and the New York State Energy Research & Development Authority (NYSERDA) (collectively, Joint Efficiency Providers). This program is designed to provide customers, contractors, and other heat pump solution providers with a consistent experience and business environment throughout New York State, by fostering a range of initiatives and incentives to advance the adoption of efficient electric heat pump systems that are used for space and water heating80. Regarding the financial incentives, there are three main forms of geothermal heat pump support instituted by the program, tax credits, loans, and rebates. Each will be further explored.

New York tax credits incentives: New York State Geothermal Energy System Credit grants homeowners tax credit equal to 25% of the qualified geothermal energy system expenditures, limited to $5,000. To qualify for the tax credit the GSHP equipment and associated expenditures must be installed at the taxpayer residential property located in New York State and placed into service after January 1, 2022. Additionally, the credit can only be claimed for one geothermal energy system in a tax year and if it represents more than the amount of tax the resident owns, he will not receive a refund for the balance, but may apply any remaining credit amount to the income tax for the next five years81. The GSHP expenditures that qualify for tax credits include materials, labor costs properly allocated to on-site preparation, assembly, and original installation; architectural and engineering services; and designs and plans directly related to the construction or installation of the geothermal energy system equipment82. Under this scheme, ESCOs can benefit from this tax credit when developing geothermal heat pump energy saving performance contracts with customers similar to the example given using federal tax incentives. In other words, under a guaranteed saving model, a client who is responsible for paying for the GSHP installation can apply for tax credits from the New York State Geothermal Energy System Credit, as well as the Energy Efficient Home Improvement Credit Program, despite any other federal or state rebates available. As a result, the customer may be eligible for a 25% state tax credit up to $ 5,000 and a federal tax credit up to $3,200, totalizing a tax incentive of $ 8,200 for the implementation of a clean heating device. Moreover, this scheme, as in others that gain from economic government incentives, contributes to a win-win case for both ESCO and clients since the ESPC between the parties will become either lower-priced or the contract time will be reduced due to public fiscal stimulus.

New York loans incentives: Another type of economic incentive set by the NY state for the installation of GHP projects was the Green Jobs-Green New York (GJGNY) Residential Financing Program, which helps to finance energy audits and energy efficiency retrofits or improvements for the owners of residential one- to fourfamily buildings up to $25,000 in loans. The program offers three types of loans, the On-Bill Recovery (OBR), the Smart Energy, and the Renewable Energy Tax Credit Bridge. First, the On-bill recovery loan allows customers to receive amounts from $1,500-$25,000 with loan terms of 5, 10, or 15 years. Loan payments are paid as part of customers’ utility bills and estimated average monthly energy cost savings must be greater than monthly loan payments to use this type of incentive. In order for homeowners to be eligible they must use the loan for the installation of the geothermal system and they must be served by a participating utility of the state, such as Central Hudson Gas & Electric, Con Edison, PSEG-Long Island, NYSEG, National Grid, Orange & Rockland, and Rochester Gas & Electric. Moreover, the loan balance may be transferred to the new owner when the home is sold as long as written notice is provided to the new owner83. Secondly, the Smart Energy loan is a traditional loan that customers repay monthly via check or automatic payment (ACH). Equally to the OBR, loans are available from $1,500 - $25,000 with terms of 5, 10, or 15 years; and they must be used for the installation of the GHP. However, in this scheme, in case of selling or transfer of the property, the former owner remains responsible for the balance of the loan84.

Finally, the Renewable Energy Tax Credit Bridge loan is a shortterm loan product that enables customers to cover part of the cost of the ground source heat pump installation. This loan is based on the potential federal or state income tax credits or NYC Real Property Tax Abatement the system may be eligible for, but it cannot exceed the maximum amount eligible for the combined tax credits. Further, the Bridge Loan accrues interest on the remaining principal amount at an approved interest rate until it’s fully repaid, while interests start accruing from the date the loan amount is disbursed to the contractor indicated in the Bridge Loan note. No monthly payments are mandatory, and the loan must be repaid within 2 years from the date the system is installed. Additionally, homeowners can repay the Bridge Loan using the savings realized from the GHP or any other income source, such as the OBR and Smart Energy Loans85.

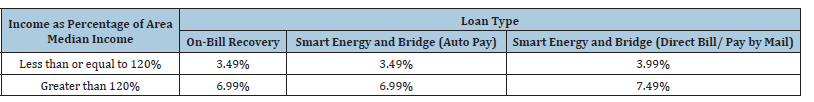

Here is a table 1 presenting GJGNY residential loan fund interest rates. Under this framework, customers can benefit from the loan incentives provided by the NY State when entering into a geothermal energy saving performance contract with ESCOs, depending on the model of the EPSC. Given that loan interest rates fluctuate between 3.49% and 7.49%, contingent upon the loan type and the homeowner’s income compared to the area’s median income, they typically remain lower than loans from private financial institutions. This situation can be advantageous for clients involved in a guaranteed savings model. Clients hold responsibility for negotiating loans from financial institutions to initiate the ESPS. Hence, they have the choice to opt into it with a private financial institution or apply for loans offered by GJGNY, which might present an interest rate as low as 3.49% under the On-Bill Recovery loan, specifically for individuals earning up to 120% of the area median income.

Table 1:Source: NYSERDA, Green Jobs-Green New York 2023 Annual Report, New York State (2023).

New York rebate incentives: The New York State provides rebates as a financial incentive for the installation of geothermal heat pump systems designed for both heating and cooling purposes. In order to apply for those incentives, GSHP installers, designers, and drillers, such as ESCOs, must first become ‘Participating Contractors.’ This involves submitting a Participating Contractor Application that specifies the service territories where they intend to work, along with a Contractor Participation Agreement for each designated territory. Upon approval, applicants will receive notification of their approval from the Designated Utility, granting them eligibility to seek incentives within the Program. Further, the rebate amounts for projects are paid directly to the Participating Contractor, who is required to transfer these incentives to the customer, potentially deducting an optional Contractor Reward. Nonetheless, Participating Contractors also have the option to request that the project incentive be paid to an alternate payee86. Among the many types of eligible rebate heating systems, this topic will focus on ground source heat pump systems that are considered full load. A full load GSHP is defined as a system installed as a building’s primary heating source, with a total system heating capacity that satisfies at least 90% of the BHL at design conditions, in accordance with applicable code, and can distribute heat adequately across all occupied spaces87. Within this context, to qualify for incentives under Category 3 (full-load GSHPs) the GSHP must meet specific criteria: it should utilize a closed-loop ground heat exchanger circulating a water/antifreeze mixture or a direct expansion ground heat exchanger, consist solely of individual heat pump appliances that are ENERGY STAR certified and meet or surpass ENERGY STAR Tier 3 Geothermal Heat Pump Key Product Criteria, possess a total system heating capacity ranging from 90% to 120% of BHL (Building Heat Load), and have a total system heating capacity below 300,000 Btu/h88.

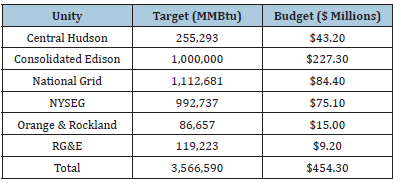

Furthermore, this incentive is regulated under the New York State’s Clean Heat Program, where its Implementation Plan describes the initial steps that the Electric Utilities will take, in conjunction with NYSERDA, to expand existing heat pump programs and, in other instances, establish new heat pump programs as part of the new statewide framework89. In practical terms, each utility is given a budget and a target and is responsible for establishing its own rebate programs, including the amount of incentive provided to customers and Contractors to meet those targets. Accordingly, six utilities participate in the program, Central Hudson, Consolidated Edison, National Grid, NYSEG, Orange & Rockland, and RG&E; with the following targets and budgets (Table 2).

Table 2:Source: New York State Energy Research and Development Authority. ‘NYS Clean Heat: Statewide Heat Pump Program Implementation Plan’. New York State, March 2020.

According to the New York State Clean Heat Program 2022 Annual Report, Central Hudson was able to provide incentives for the installation of 84 full-load geothermal heat pump systems in its grid region90. In addition, the utility established a rebate of $2,000 per 10,000 BTUH of full-load heating capacity, where $500 of the total amount could be allocated to the contractor91. Consolidated Edison managed to provide rebates for the implementation of 130 GSHP projects in its grid region92. Also, the incentive the utility grants for residential geothermal projects located outside of a disadvantaged community is $35,000 per building or 50% of project costs, whichever is lower, and for geothermal projects located within a disadvantaged community is $45,000 per building or 70% of project costs, whichever is less93. National Grid was responsible for financially helping 114 customers with the installation of GSHP in its grid region94. Further, it set the rebate of $1,500 per 10,000 BTUH of full load heating capacity, of which $500 of the total incentive could be allocated for the contractor reward95. NYSEG and RG&E conceded the GSHP installation economic benefit to 176 and 84 homeowners, respectively, last year96. Both of their rebate rates were $1,500 per 10,000 BTUH of full load heating capacity, with the allowance of an apportion of $500 for the contractor of the GSHP project97. Lastly, Orange & Rockland offered GSHP implementation rebates for 6 projects, while providing $2,000 per 10,000 BTUH of full-load heating capacity98. Here, equally, each participating contractor may retain up to the participating contractor’s reward amount. Given all the government green financial benefits examined, the rebate program adds even more incentives for residencies to transition to a cleaner, more efficient, and low-carbon heating space system. In this sense, the current favorable context for the implementation of ground source heat pump systems has a significant impact on new energy savings performance contracts between customers and ESCO, where shorter contracts, lower requirements for private loans, and the reduction of the cost of these negotiations are expected because of the federal and state GSHP incentive programs.

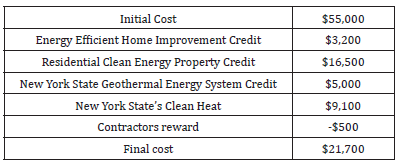

One example that can demonstrate the notorious effect of these policies in ESPCs is a $55,000 GSHP closed-loop project (45,500 Btuh) that is agreed to be implemented in 2023 by an ESCO under a guaranteed savings model in a house that has Central Hudson as its utility and the homeowner pays $15,000 annually in federal taxes and $8,000 in state taxes. Initially, the customer could apply for a $3,200 federal tax credit under the Energy Efficient Home Improvement Credit program, when in compliance with the program’s requirements. Secondly, under the Residential Clean Energy Property Credit program, he could receive 30% of the cost of installation of the GHP, which in this case represents $16,500. Thirdly, he could apply for a state credit of $5,000 pursuant to the New York State Geothermal Energy System Credit program. Fourthly, he could use the rebate established by Central Hudson in the amount of $8,600 considering the Contractors Rewards. After applying all these incentives, the final cost of the GSHP project would be $21,700. Nevertheless, the homeowner could still apply for GJGNY loans to meet the final expense (Table 3). Therefore, following the utilization of all relevant federal and state incentives in this situation, the initial cost of the ESPS GSHP project, originally set at $55,000, has now been reduced to $21,700. This marked alteration profoundly influences the risk associated with the energy saving performance contract for ESCOs. Acknowledging this change is pivotal during ESPC negotiations, as it presents an opportunity for both parties to leverage this revised situation to their advantage.

Table 3:

Conclusion

The Energy Service Company industry promotes important changes in residential and facility energy use, providing energy cost-efficiency renewable energy while reducing carbon emissions when compared to pre-retrofit patterns of energy consumption. In the U.S., ESCOs are growing in the market and contributing to energy and economic savings annually. ESCOs develop their performance-based projects within a defined period through the use of Energy Savings Performance Contracts. By using ESPCs, customers can finance the energy upgrades implemented by the ESCO through future energy cost savings, without the need for upfront investments. However, for successful project completion, there are many factors to be considered and a careful approach towards all the reviewing and negotiating processes of the ESPC is an essential part of it.

Under this scheme, determining the ESPC model to be implemented is one of the most important phases of the negotiation process, since it can affect the types of financial benefits a customer may receive under federal and state clean energy incentives. Hence, ESPC projects primarily follow three models: shared savings, guaranteed savings, and the Chaffee model. Under the shared savings model, ESCOs fund, design, and execute projects without the client’s initial financial input, sharing energy cost savings during the contract and giving all savings to the client post-contract. This model suits those lacking funds and poses minimal risk. In the guaranteed savings model, the client finances the project through a loan, the ESCO implements it, and the client repays the loan through the energy cost savings provided by the project. Conversely, in the Chaffee model, ESCOs self-finance projects, bearing all financial risks and gaining full savings on success or compensating the client if targets aren’t met, providing self-financing benefits but with higher risks. In addition, to safeguard consumer interest, the New York State has established specific procedures for ESCOs to participate in the electricity supply market, including disclosing detailed business practices, pricing, marketing strategies, commodity offerings, and the methods used to secure customers. This information is relevant because it enhances transparency with consumers and promotes competitiveness in the market. Also, the state offers a formal dispute resolution process involving utilities, ESCOs, and Direct Customers. Parties are encouraged to resolve disputes amicably, and if unresolved, the Department facilitates discussions and may provide a final decision, which strengthens business security and consumer protection.

Furthermore, the installation of a ground source heat pump for spacing heating is demonstrating great potential and value as an energy saving measure to be implemented by an ESCO through an ESPC. The reason for that is the highly cost-efficient, low-carbon, and clean energy characteristics of GSHPs. However, successful implementation of GSHPs necessitates an extensive understanding of local conditions and regulations since they may directly affect the project operation and energy performance. In addition, there are some case studies conducted in the U.S. and Spain that highlight GSHP’s success in reducing GHG emissions and enhancing energy efficiency under energy saving performance contracts. Consequently, with the ESCO market’s constant growth, the advance of GSHP technologies, and the outstanding results of GSHP use in ESPC, wider adoption of this heating mechanism is anticipated, aligning with the escalating demand for clean energy sources. Moreover, federal and state governments’ growing concern over climate change and the urgent necessity for an energy transition has prompted the adoption of public policies to reduce greenhouse gas emissions, promote cleaner energy use, and enhance efforts for a sustainable economy. Among these policies, governmental bodies have introduced financial incentives to encourage the adoption of ground source heat pumps. In the federal framework, the Inflation Reduction Act introduces tax credits, rebates, and programs. The Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit provide tax credit opportunities for clients who adopt energy-efficient GSHP installations that meet Energy Star program requirements in their residences. Moreover, Home Owner Managing Energy Savings and High-Efficiency Electric Home Rebate programs establish the concession of generous rebates for GSHP projects. For building and industry facilities, the IRA instituted the Commercial Buildings Energy Efficient Tax Deduction and the Advanced Energy Project Credit, which both provide tax credits for qualified GSHP investments that meet certain reduction rates of energy cost or GHG emission.

In the State’s scheme, the Climate Leadership and Community Protection Act sets the goal of reducing greenhouse gas emissions and the NYS Clean Heat Program provides economic incentives to foster access to efficient electric heat pump systems for space and water heating, by offering tax credits, loans, and rebates. In this context, the Geothermal Energy System Credit program is responsible for granting homeowners a tax credit of up to 25% of qualified expenditures, limited to $5,000 for GSHP installations. Additionally, the Green Jobs - Green New York Residential Financing Program offers loans up to $25,000 for GSHP implementation and energy audits, retrofits, or improvements related to it, through various schemes like On-bill Recovery, Smart Energy, and Renewable Energy Tax Credit Bridge loans. Furthermore, the NYS Clean Heat Program provides rebates for the installation of GSHP systems designed for both heating and cooling purposes. This incentive program is administrated by State utilities, where each one of them is responsible for determining the amount of rebate provided to customers and the process of application. Generally, the rebates are paid directly to Participations Contractors, who are required to transfer these incentives to the customer project balance, potentially deducting an optional Contractor Reward.

As a result, many federal and state financial incentives can be used when developing a GSHP ESPC to benefit both customers and ESCOs through the many forms of incentives available that will be significantly influenced by factors such as the ESPC business model, GSHP system performance, customer income, and region of implementation. Additionally, some of the potential effects and advantages of this new business scenario may include the reduced risk of the ESPC project, the amount of loan taken for the project development, and the reduction of the contract term for energy saving sharing or payments. Therefore, this study concludes that federal and New York State climate-economic incentives for the installation of ground source heat pumps for space heating created new business opportunities and can positively influence GSHP energy savings performance contracts both for ESCOs and customers, while a detailed and careful analysis of the factors that influence the public incentives available and the ESPC negotiation process are vital for the implementation of a successful GSHP ESPC project.

References

- Gheysari AF, Holländer HM, Maghoul P, Shalaby A (2021) Sustainability, climate resiliency, and mitigation capacity of geothermal heat pump systems in cold regions. Geothermics 9: 101979-101989.

- Arif Hepbasli (2005) Thermodynamic analysis of a ground-source heat pump system for district heating. International Journal of Energy Research 29(7): 671-687.

- Biagio Morrone, Gaetano Coppola, Vincenzo Raucci (2014) Energy and economic savings using geothermal heat pumps in different climates. Energy Conversion and Management 88: 189-198.

- Air-source heat pump incentives, Central Hudson Gas & Electric Corporation, New York, USA.

- (2015) Adoption of the Paris Agreement, Conference of the Parties, Paris, France.

- Congressional Research Service (2023) The inflation reduction act: Financial incentives for residential energy efficiency and electrification projects, congressional research service.

- (2019) Exhibit C: Investment-grade energy audit and project development proposal, Connecticut Department of Energy & Environmental Protection, Connecticut, USA.

- Save thousands with geothermal system, Consolidated Edison Company of New York, New York, USA.

- Hart CA (2010) Energy savings performance contracts legal and financial considerations. In: Andrea Kramer, Peter Fusaro (Eds.), Energy and Environmental Project Finance Law and Taxation: New Investment Techniques, Matthew Bender publisher, New York, USA, pp. 253-280.

- Hart CA (2021) Overcoming legal and regulatory barriers to district geothermal in New York State, Pace Energy and Climate Center, New York, USA, pp. 1-55.

- Borge-Diez D, Colmenar-Santos A, Pérez-Molina C, López-Rey A (2015) Geothermal source heat pumps under energy services companies finance scheme to increase energy efficiency and production in stockbreeding facilities. Energy 88: 821-836.

- Elizabeth Stuart, Peter LH, Pablo CJ, Charles GA, Gilligan Donald (2016) US Energy Service Company (ESCO) industry: Recent market trends, LBL Publications, California, USA.

- Stuart Elizabeth, Hanus NL, Carvallo JP, Larsen PH (2021) US ESCO industry: Industry size and recent market trends, Lawrence Berkeley National Laboratory, California, USA.

- Tax Credits for Commercial Buildings, Energy Star, USA.

- Geothermal Heating and Cooling: Introduction, Finger Lakes Institute, Hobart & William Smith Colleges, New York, USA.

- Janez P (2007) Renewable energy sources and the realities of setting an energy agenda. Science 315(5813): 810-811.

- John B, Geoffrey B, Maxwell B, Dallas B, Maya D, et al. (2023) Emissions and energy impacts of the inflation reduction act. Science 380(6652): 1324-1327.

- John W Lund, Freeston DH, Boyd TL (2005) Direct application of geothermal energy: 2005 worldwide review. Geothermics 34(6): 691-727.

- Kathrin Hofer, Dilip Limaye, Jas Singh (216) Fostering the development of ESCO markets for energy efficiency. World Bank Group, New Hampshire, USA.

- Luciano De Tommasi, Sotiris Papadelis, Ruchi Agrawal, Padraig Lyons (2022) Analysis of business models for delivering energy efficiency through smart energy services to the European commercial rented sector. Open Research Europe, pp. 131-145.

- New York Consolidated Laws, General Business Law-GBS 349, Deceptive acts and practices unlawful.

- Statewide Heat Pump Program, National Grid, London, UK.

- New York State Climate Action Council (2022) Scoping plan executive summary, New York, USA.

- New York State Department of Taxation and Finance (2023) Instructions for form IT-267 geothermal energy system credit. New York, USA.

- New York State Energy Research and Development Authority (2020) NYS clean heat: Statewide heat pump program implementation plan, New York, USA.

- New York state clean heat program, NYSEG, New York, USA.

- (2023) New York state clean heat program 2022 annual report, NYSERDA, New York, USA.

- (2023) NYS clean heat statewide heat pump program manual, NYSERDA, New York, USA.

- (2023) Residential financing programs, NYSERDA, New York, USA.

- Olga Macías, Sarah Noyé, Nagore Tellado, Ignacio Torrens, Pablo De Agustín, et al. (2019) Analysis of building energy upgrade technologies for implementing the dual energy efficiency and demand response scheme for non-residential buildings. MATEC Web of Conferences 282: 1-6.

- Heat pump incentives, Orange & Rockland, New York, USA.

- Paolo Bertoldi, Boza-Kiss B (2017) Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy 107: 345-355.

- Pengpeng Xu, Hon-Wan EQ, Kun Qian Q (2011) Success factors of Energy Performance Contracting (EPC) for Sustainable Building Energy Efficiency Retrofit (BEER) of hotel buildings in China. Energy Policy 39(11): 7389-7398.

- State of New York Public Service Commission (2020) Uniform business practices case 98-M-1343, State of New York Public Service Commission, New York, USA.

- Tiancheng Shang, Kai Zhang, Peihong Liu, Ziwei Chen (2017) A review of energy performance contracting business models: Status and recommendation. Sustainable Cities and Society 34: 203-210.

- Tiancheng Shang, Kai Zhang, Peihong Liu, Ziwei Chen, Xiangpeng Li, et al. (2015) What to allocate and how to allocate? benefit allocation in shared savings energy performance contracting projects. Energy 91: 60-71.

- (1999) Geothermal heat pumps for federal buildings, US Department of Energy, USA.

- (2011) Guide to geothermal heat pumps, US Department of Energy, USA.

- Home energy rebates programs, US Department of Energy, USA.

- (2015) Residential energy consumption survey 2015, US Energy Information Administration, USA.

- Trane heating & air conditioning, University of Central Missouri, Missouri, USA.

- Wenjie Zhang, Hongping Yuan (2019) A bibliometric analysis of energy performance contracting research from 2008 to 2018. Sustainability 11(13): 3548-3568.

- 26 U.S.C.S. 179D.

- 26 U.S.C.S. 25D.

- 26 U.S.C.S. 48C.

- 26 USCS 25C.

- 42 U.S.C.S. 18795.

© 2024 © Samuel Fonseca de Carvalho. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)