- Submissions

Full Text

Environmental Analysis & Ecology Studies

Energy and Economy: the Environmental Impact of Benefits and Penalties

Nuno Domingues*

Department of ADEM, ISEL, Portugal

*Corresponding author: Nuno Domingues, Department of ADEM, ISEL, Rua Conselheiro Emídio Navarro, Lisboa, Portugal

Submission: June 15, 2018; Published: August 01, 2018

ISSN 2578-0336 Volume3 Issue4

Abstract

Times are changing for a while in a significant number of Countries, especially on the way energy is traded. Energy has turned to a commodity traded on market. The price signal has been increased in importance to guide consumption. Governments have the responsibility to implement and guarantee the success of the international agreements and their own goals. However, the financial and the economical issues are crucial and can undermine it. This paper explains how to use market based instruments to avoid or mitigate it, focusing also on how sustainable consumption can be achieved.

Introduction

In January 2007, the European Commission proposed an integrated energy and climate change package to cut greenhouse gas emissions. The energy package aimed establishing a new Energy Policy for Europe to combat climate change and boost the EU’s energy security and competitiveness.

The package is based on three main pillars:

- A true internal energy market. This allows energy users to freely choose their electricity and gas supplier and to trigger the huge capitals needed in energy.

- Accelerating the shift to low carbon energy. This maintains the EU’s position as a world leader in renewable energy, proposing that at least 20% of the EU’s energy needs shall be met by renewable energy sources by 2020.

- Energy efficiency this aims to save 20% of primary energy consumption by 2020. This is a previous objective of the Commission. It also proposes increasing the use of fuel-efficient vehicles for transport; tougher standards and better labelling on appliances; improved energy performance of the EU’s existing buildings; and improved efficiency of heat and electricity generation, transmission and distribution.

- In March 2007, the European Council accepted most of these proposals and agreed on actions to develop a sustainable integrated European climate and energy policy. The resulting policy pursues the following three objectives:

- increasing security of supply.

- ensuring the competitiveness of European economies and the availability of affordable energy

- Promoting environmental sustainability and combating climate change.

To meet these objectives the European Council adopted a comprehensive energy Action Plan for the period 2007-2009, comprising priority actions in the following areas:

- An internal market for gas and electricity

- Security of supply

- International energy policy

- Energy efficiency and renewable energies

- Energy technologies.

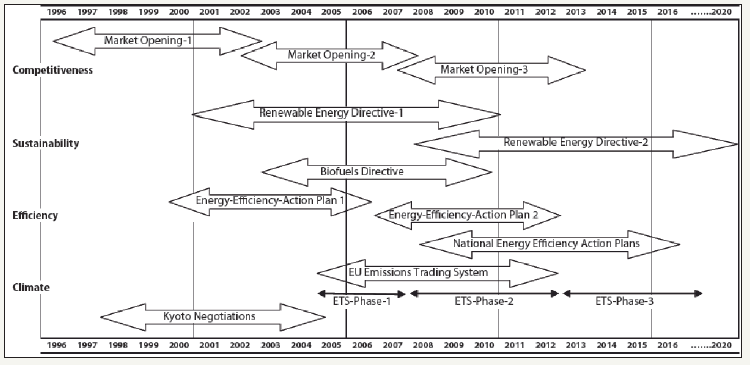

In January 2008, the European Commission presented further proposals to fight climate change and promote renewable energy, including legally enforceable targets for Member States. Figure 1 presents the major steps on the EU energy policy. Before these measures, there were several Countries already concerned with the BAU scenario, considering that the environment is a scarce resource, which can be destroyed by continuing use without market prices reflect their scarcity. The level of use of natural resources, on the one hand, and the capacity and resilience of ecosystems, on the other hand, determines the level of scarcity, for each particular case [1].

This raises a problem of decision making for the scarce resources allocation, whose availability (in quantity or in quality) is not enough to satisfy (within a given timeframe) the entire demand. In many cases the environmental resources (e.g., air and biodiversity) do not go through market, and therefore the price of the products doesn’t reflect its economic value. In other cases, existing markets cannot promote their efficient allocation. While it is recognized that individuals and societies are guided by several objectives, economists mostly focus its analysis on the concept of economic efficiency, for the definition of goals and the design of policy instruments environment. Assuming that a market is to efficiently decide how much to produce, decide who gets to produce, decide who gets to consume and moving cash from consumers to producers, what is needed is a price on carbon (and equivalents), forces to stimulate technology and innovation, funding for first-of-a-kind and early scale and connectivity between international markets, they used Market Based Instruments (MBI) to achieve a decarbonised economy, promote renewable energies on production and energy efficiency on consumption. This MBI, that covers an extensive range of taxation or pricing instruments, could raise revenues, while simultaneously furthering environmental and social goals. There are two main approaches in using MBI:

figure 1: EU energy policy.

- Reforming the tax system by a focus only on the energy consumption and environment impact factors

- Shifting the tax burden from employment, family budget and capital (economic goods) to pollution, resource depletion and waste (environmental bad), mainly known as Environmental Fiscal Reform (EFR). EFR is also called ecological fiscal reform, green fiscal reform, green fiscal swap or green fiscal shifting, and aims an environmental improvement coupled with an economic benefit [2,3]. Also, EFR can contribute to help to achieve the Millennium Development Goals of «halving absolute poverty by the year 2015 and reversing the loss of environmental resources.

EFR includes the following instruments:

- Taxes on natural resource use to reduce the inefficient exploitation of publicly owned or controlled natural resources resulting from operators not paying a price that reflects the full value of the resources they extract.

- User charges or fees and subsidy reform to improve the provision and quality of basic services such as water and electricity, while providing incentives to reduce any unintentional environmental effects arising from their inefficient use.

- Environmentally related taxes to make polluters (industrial activities, motor vehicles, waste generators) pay for the “external costs” of their activities, and encourage them to reduce these activities to a level that is more socially desirable.

The use of economic instruments in environmental policy has been defended by the scientific community and also by governments, as evidenced by the results of the work produced in Eco 1992, the studies on economic instruments for environment by Organisation for Economic Co-operation and Development (OECD) or by World Trade Organization (WTO) and by non-government actors, as European Environmental Bureau (EEB) and Green Budget Europe (GBE) [4,5]. In the European Union, the allusion to the use of economic instruments has been the subject of the Delors White Paper on employment in 1993 and in other successive programs. In 2001 it was created the 6th Environmental Action Programme, which intends to address concrete measures for nature conservation and economic development with effective market regulation and economic instruments. The environmental goal in most Countries consists of reducing carbon emissions. Among various measures to achieve these objectives, several European countries have adopted a carbon/energy tax.

Taxes on resource use, resource rents, or the removal of environmentally harmful subsidies can also be used to finance an EFR. With Environmental Fiscal reform occur a full revenue-recycling that can make the tail of the dog (of climate policy) wag; a double dividend can arise when Environmental Fiscal replaces other distortionary tax; inflationary effects on labour salaries can be neutralised when Environmental Fiscal replaces social security contributions or another employer cost. To be more successful and to ensure a coherent proposed mix of pricing or tax instruments, a reform process should be integrated into other ongoing nation al processes (more general reforms to the tax system, existing and planned interventions in other policy areas, for instance). The potential of EFR to achieve goals depends on many factors, including:

- The design of the instrument

- How it is implemented and enforced, this in turn depending on administrative capacity, corruption, etc.

- How consumers and producers respond, as reflected by the elasticity of demand and supply.

Evaluation (social, financial, technical and environmental) involves the complex task of analysing the mix of instruments and quantifying the expected fiscal, environmental and social benefits. However the impacts of existing and proposed policies and their beneficiaries is vital to assess the effectiveness and efficiency of each instrument in meeting its stated objectives, to identify potential winners and losers from the reform process, to quantify the extent of the gains and losses and possible compensation measures, to raise public awareness by providing accurate information, to establish the implementation phases and to help to redesign the reform. In addition, an evaluation is a good way to identify opportunities and to weaken groups that (for reasons of self-interest) could resist reforms. Finally, evaluation can help to identify winners and losers, anticipating the occurrence of costs and benefits, allowing for the mitigation and/ or softening undesired impacts on the livelihoods of families. This in turn helps establish whether there is room to improve the design and implementation of the instrument, both to help meet existing objectives and when applying the same instrument to similar problems in the future. It also generates information that can be made available to stakeholders, which provides a vehicle for public consultation and can enhance accountability and public support. While the goals are easily identified, it raises the awareness of the complexity to model agents’ self-interest, their interactions, the available instruments and the real impact. Dynamical systems, such as the one studied in the present thesis, have several characteristics that can be summarised as:

- The identification of causal relationships: stimulus and response.

- The own delay and inertia behaviour of the system: the decision-makers take time to assimilation of new information and reformulating knowledge (perceptions) and there is a lag between the notification and enforcement of judgments.

- The importance of behaviour over time.

- Non-linearity, That inhibits the proportions between stimuli and responses and misleads intuition.

- The complexity of the interactions.

The Influence of Incentives in the Economy

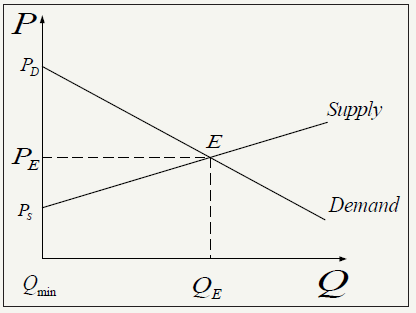

The market price, PE , and quantity, QE , is set by the market equilibrium (point E), obtained by the intersection of the demand and the supply curves, as illustrated in Figure 2. The area PD EE represents the consumer’s welfare because consumers were willing to pay more but they are paying less. The area PE ES represents the producer’s surplus because consumers were willing to receive less but they are receiving more. Consumers demand (Q) will take account the price of electricity (P) and the family budget (I) plus benefits (B) and minus the penalties (A). The simplest way to understand how incentives (benefits and penalties) influence the market behaviour is by partial equilibrium analysis. This type of analysis considers only the directly impact on the equilibrium price (and thereafter, the market price and quantity), by the proposed incentive (and thereafter, the costs and the supply curve). Considering environmental impact, the lack of a damage penalty has the same effect as the introduction of a benefit and the removal of a harmful benefit has the same effect as the introduction of a penalty. The introduction of a penalty will aggravate the supply curve illustrated previous in Figure 2. At market closure, the market equilibrium will be at a higher price and lower quantity. Figure 3 illustrates the impact of price and penalty on market. The difference PA − PE is related to the impact externalities (or the expense that was supported by the Government, in the case of an incentive removed) that were not being paid. The difference QA −QE is related to the fewer consumers willing to pay the higher prices (or the right prices). The consumer’s welfare reduced by the area PA AEPE i.e., the difference between the area PD EE and the area PD PA .

figure 2: Market behaviour.

figure 3: Impact of price and penalty on market.

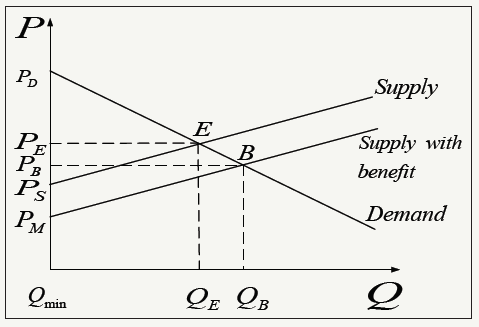

This fact seems negative but, in fact, it’s positive. One should know that the difference PA − PE related to the impact externality is paid by all or increases the national debt. When price adjustment is made, there is transparency (consumers know the cost of the consumption), the pollution is paid by polluters and the extra money can be used to mitigate the impacts, invest in overall efficiency or reduce the debt. The producer’s surplus reduced (as it was expected) from the area PS PE to the area PN PA . This can influence the producers to invest in better processes, energy and products to avoid or reduce the penalty factor and, thereby, increase their surplus. As in the consumer’s analyses, the remaining budget will be for the Government. The introduction of a benefit will lower the supply curve. At market closure, the market equilibrium will be at a lower price and higher quantity. The difference PE − PB is related to the subsidy. The difference QA −QE is related to the more consumers willing to pay the lower prices (or the subsidised prices). Figure 4 illustrates the impact of price and benefit on market. The consumer’s welfare increased by the area PEEBPB i.e., from the area PDPE to the area PD PB . This fact seems positive but, in fact, it’s negative because the price adjustment is paid by all and not by consumers in tax, national debt and/or degradation in overall efficiency. The producer’s surplus increases (as it was expected) from the area PE E5 to the area PB BM . This can influence the producers to postpone capitals in better processes, energy and products to avoid or reduce the penalty factor and, thereby, increase their surplus. As in the consumer’s analyses, the remaining budget will be supported by the Government.

figure 4: Impact of price and benefit on market.

In order for agents to make conscious decisions, the markets must give good information, including the full cost of the products. Subsidies therefore tend to take the form of price controls where the provision of a good or service is priced at a level below the full cost of supplying it [6,7]. For industry and services, in general, reforms increase the costs of production. When these costs cannot be completely transmitted to suppliers, consumers, Government or third parties, there are potential losses of competitiveness. However, these short-term costs may encourage investments on more energy savings, environmentally and economically efficient production and innovation in the longer-term. Larger companies are keener to do it (because even small per unit better performance will return in great global cost decreases) but other companies could have less affordability.

Conclusion

The energy consumption is getting more and more related to economics and market. Market based instruments have a key role to guide the market agents on their decisions. Thereby, their correct use can help to accomplish a desired goal and honor an international agreement. Also, the correct design and implementation is a strong guidance for sustainable consumption.

References

- Benoît Bosquet (2000) Survey Environmental tax reform: does it work? A survey of the empirical evidence. Ecological Economics 34(1): 19-32.

- Claudius Schmidt-Faber, DG Taxation, Customs Union (2003) Environmental Taxes in the European Union 1980-2001. Statistics in focus.

- http://www.geota.pt/rfa/docs/Report%20EFR%20Workshop%20 January%2013-14%202006.pdf

- http://www.geota.pt/rfa/docs/instrumentos_economicos.pdf

- http://www.ecotax.info/EEBposition.pdf

- http://www.erec.org/index.php?id=141

- http://www.ecocouncil.dk/english

© 2018 Nuno Domingues. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)