- Submissions

Full Text

Environmental Analysis & Ecology Studies

Corporate Solutions to Climate Change

Pooja Khosla*

University of Colorado, USA

*Corresponding author: Pooja Khosla, Director of Data Science Team In Entelligent-A Financial Tech Company and an Instructor at University of Colorado, Boulder, USA

Submission: March 27, 2018;Published: April 24, 2018

ISSN 2578-0336 Volume2 Issue2

Abstract

Climate change is now impacting every country on every continent. Leading European countries are taking action-and even committing real moneyto fight climate change1 . Without action, the world’s average surface temperature is projected to rise over the 21st century and is likely to surpass 3 degrees Celsius this century-with some areas of the world expected to warm even more. In effort to resolve the issues related to climate change we need greater private sector participation. Incentivizing global investors and consumers to direct investments and consumption towards the corporations that are leading the effort towards climate sustainability may accelerate achieving United Nation’s current sustainable development goal (SDG’s) of Climate Action.

Climate Change Impact

Climate change is a threat to our planet’s ecosystem. It can influence rainfall, crop yields, human health, and can impact our energy supply. Climate-related impacts are occurring across the country and over many sectors of our economy. The significant impacts of climate change include changing weather patterns, rising sea level, and more extreme weather events2 . The greenhouse gas emissions are now at their highest levels in history. World’s average surface temperature is projected to rise over the 21st century and is likely to surpass 3 degrees Celsius this century3 . In the past few years, reducing vulnerability to climate change has become a pressing issue for the world’s developing countries. Climate Action is among one of the United Nation’s current sustainable development goals3. Some countries have realized the dreadful impact of climate change and have stepped up to invest in the change towards climate sustainability.

Countries Leading the Sustainably Path

Some European countries such as Denmark, United Kingdom, Portugal, Sweden, Switzerland, etc. are actively seeking and implementing policies to fight climate change. European Parliament has adopted a seven-year budget that directs worth $243 billion investments for climate projects1. This is a great effort however not sufficient to reduce the emissions to the extent needed to keep global warming below 2 degrees Celsius (3.7 Fahrenheit)1. To keep global warming below 2 degrees we need a broader market based solution. We need a solution that can multiply the impact and involves consumers, producers and investors to work together to achieve climate sustainability. Involving consumers and investors as catalysts and making emission reduction profitable for producers and investors can drive the global economy towards climate sustainability.

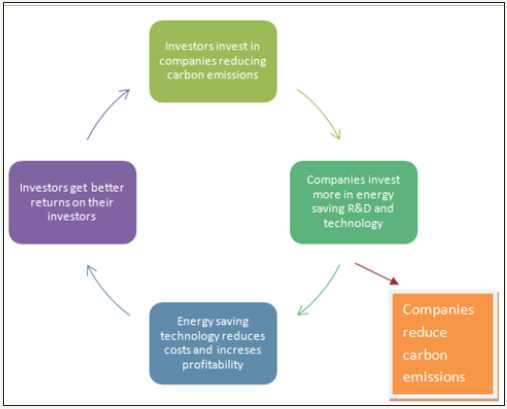

The investment feedback loop in Figure 1 demonstrates how private investors can help channel the investments towards climate sustainability. If investors invest in companies reducing carbon emissions- In order to attract more investments these companies will invest in energy saving research and technologies. This will reduce carbon emissions as well as increase long term profitability. Young et al. in their research confirm that carbon-efficient firms tend to be “good firms” in terms of financial characteristics and corporate governance4 . With increase in long term profitability investors can get better returns on their investment. Global assets under management reached $84.9 trillion in 2016 and will almost double to hit $145.4 trillion in 20255 . Part of these investments can be directed towards climate sustainability. By the end of 2016, there were 1,002 investment funds of all types incorporating environmental, social and governance criteria with more than $2.6 trillion in assets under management (out of a total universe of $8 trillion invested in socially responsible products), according to the US SIF, the Forum for Sustainable and Responsible Investment5.

- Foot Note

1John U (2013) Super Euros: Top 10 climate-change-fighting countries are all in Europe

2The consequences of climate change, global climate change vital signs of the planet.

3(2016) Goal 13: Take urgent action to combat climate change and its impacts.

Figure 1: Private sector climate sustainability investment feedback loop.

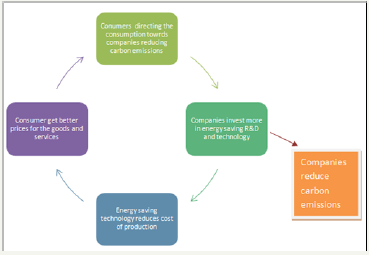

Figure 2: Private sector climate sustainability consumer feedback loop.

The sustainability consumer feedback loop in Figure 2 shows how consumer market choices can be directed towards reducing carbon emissions. If consumers start making their consumption decision based on carbon reductions performance of producers, the demand of these products will increase, producers will invest more in energy saving R&D and technology. This will reduce carbon emissions on one hand and decrease long term cost of production on the other hand. The reduced cost in long term will make prices of these products more attractive to consumers. It has been observed that globally energy efficiency represents about 40% of the greenhouse gas reduction potential and it is extremely attractive upfront investment that pays for itself over time6 . Together carbon educated consumers and investors can ramp up the carbon reduction trajectory. Their decisions can influence and compel the private sector to invest more in clean energy sources and increase energy efficiency. Some private sector companies have stepped up towards climate sustainability.

Emission Reduction and Private Sector Commitments

Private sector has stepped up towards climate sustainability. Apple has a reputation for being cutting edge, a reputation that holds when it comes to going green. Apple’s $848 million energy deal with a solar farm in California enabled the company to power all its operations with renewable energy. In June 2015, Ikea announced it would invest €1 billion in sustainability efforts, including buying renewable energy to power its stores and offices, and implementing sustainable manufacturing. Google is spreading wealth in a variety of projects to cut its waste and carbon footprint. Mega-retailer Wal-Mart has made some key sustainable choices, considering its large market share and consumer reach these choices can have huge ripple effects. There are very many examples showing privates sector commitments towards climate sustainability. Investors and consumers have to reward these commitments by tilting their portfolio and consumption towards the companies demonstrating these commitments towards climate sustainability. If investment and consumption are directed towards the firms reducing emissions and promising climate sustainability Private Sector Climate Sustainability Investment and consumption Feedback Loop (Figure 1 & 2) will exhibit higher global carbon reductions. This way we can use the market power to achieve United Nation’s current sustainable development goal (SDG’s) of Climate Action. This effort from private investors and consumers may speed up the process of reducing the emissions to the extent needed to keep global warming less than 2 degrees.

- Foot Note

4Soh YI, Park KY, Monk AHB (2018) Is ‘Being Green’ rewarded in the market? An empirical investigation of decarbonization risk and stock returns. Stanford Global Project Center Working Paper, p. 61.

5Silvia A (2017) Global assets under management to double by 2025 as the world’s population ages, study says

6https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/Sustainability/PDFs/A_Compelling_Global_Resource. ashx

© 2018 Pooja Khosla. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)