- Submissions

Full Text

COJ Technical & Scientific Research

Financial Crisis of 2008 in the United States: A Conceptual Study

Orts Cardador Jaime*

Department of Business Management and Marketing, University of Huelva, Spain

*Corresponding author:Orts Cardador Jaime, Department of Business Management and Marketing, Faculty of Business Sciences and Tourism, University of Huelva, 21004 Huelva, Spain

Submission: June 22, 2023; Published: August 23, 2023

Volume4 Issue3August , 2023

Abstract

In 2008, one of the worldwide biggest economic crises began due to the real-estate market in the United States of America (USA) as a result of the high-risk mortgage loans (sub-prime). The negative consequences of these assets were transferred to the financial activities of the developed countries, for instance, in Europe. The trigger of this fact was Lehman Brothers’ bankruptcy on the 15th of September of 2008 which caused the biggest economic crisis since the big crash of 1929 in the main industrialized countries as these countries owned these sub-prime loans. The main consequences of this bankruptcy were interbank illiquidity, credit crunch, and, a general lack of the main guarantees of the banks, among others. During the last decade it has been collected the main causes by the literature, from a laxer legal system with the operations of the banks, to the drop-in interest rates or a greater exposure to financial derivatives. Hence, the main purpose of this paper is to analyze the main reasons the literature recognizes as triggers of this crisis, the repeal of the Glass-Stegall Act, the introduction of the Gramm-Leach-Bliley Act and the Commodity Futures Modernization allowed banks for merging with a greater facility and for exposing to sub-prime mortgages due to greater ease of carrying out transactions with financial derivatives. Finally, we collect the consequences which it had for the economic system such as the intervention of a range of financial institutions or the financial support for the purpose of allowing greater solvency in the financial system. The immediate consequences were the collapse of the main economic indicators (such as the National Association of Home Builders Housing Market Index, the Case-Shiller United States Home Price Index or the ABX index), different fusions and acquisitions between banks, the purchase of the 80% of AIG´s assets by the FED, financial assistance to the GSEs (Fannie Mae and Freddie Mac), and, the introduction of the Troubled Asset Relief Program (TARP) so as to clean up the balances of the banks. Finally, the Government enacted the Dodd-Frank Act so that the consumed could be protected.

Keywords: Economic crisis; Sub-prime Mortgages; Bankruptcy; USA; Europe; Banks; Financial Derivatives; Glass-stegall act; Gramm-leach-bliley act; Commodity futures modernization; Fannie mae and Freddie mac

Introduction

The financial crisis of 2008 (called the Great Recession) has been a challenge for the developed countries at the beginning of the century, becoming the biggest financial crisis since the Great Depression of 1929. The literature collects a series of causes such as a lack of regulation of financial products, the sub-prime mortgages, a world food crisis, a general rise in the prices of raw materials or, in general, failures in the economic regulation. The immediate consequences were an unprecedented wave of defaults and mortgage foreclosure, the bankruptcy of financial institutions and the spread to the rest of the world, especially in Europe. Nowadays, the effects are still being present, in a context of contraction of liquidity and capital, structural unemployment rate and a greater competition from developed countries which did not suffer the same effects, such as Russia, China, Brazil or India. The main purpose of this paper is to analyze from a theoretical framework the possible causes which led up to the sub-prime mortgages from a legal point of view, namely, how the change in regulation led up to an expansion of sub-prime mortgages and financial derivatives and from an economic viewpoint, that is, how these mortgages and financial derivatives induced the economic crisis. Finally, we analyze the negative consequences, such as the collapse of the main banks and the worsening of the main economic indicators and how the government coped to mitigate these consequences, through economic injections or an improvement in the regulation of these financial derivatives.

Antecedents

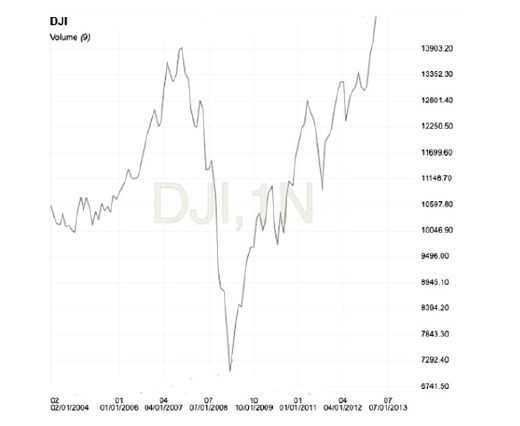

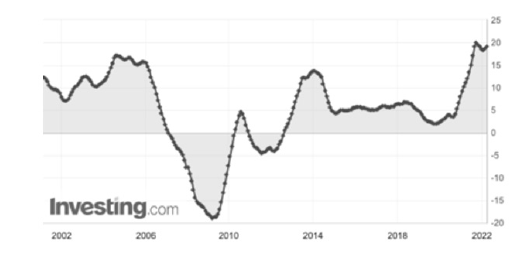

In 2008, one of the worldwide biggest economic crisis began due to the real-estate market in the United States of America (USA) as a result of the high-risk mortgage loans (sub-prime). The negative consequences of these assets were transferred to the financial activities of the developed countries, for instance, in Europe. The trigger of this fact was Lehman Brothers’ bankruptcy on the 15th of September of 2008 which caused the biggest economic crisis since the big crash of 1929 in the main industrialized countries as these countries owned these sub-prime loans. The main consequences of this bankruptcy were interbank illiquidity, credit crunch, and, a general lack of the main guarantees of the banks, among others. They had a negative effect, the family and business heritage [1]. Vallejo-Zamudio [2] explains that the Stock Index Down Jones in USA reflected the behavior of the thirty most important and representative industrial companies, falling down 500 points (around 44%). We can see this fall in the (Figure 1). In the next chapter, we are going to analyze the reason behind this economic crisis in USA. Many authors discuss that the financial deregulation in the 70 and 80 allowed to create derivative financial instruments which have negative consequences in the stability of the countries and the business as it created economic bubbles that increased the financial speculation. For instance, we can see these problems in the economic crisis in Mexico (1994), in Asia (1997), the punto.com crisis in 2000 or the current crisis in USA and in Europe (2008) (Soto-Esquivel, 2010). Other authors consider that the monetary and financial systems had not been able to stop the accumulation of unsustainable credits and assets [1].

Figure 1:Stock Index Down Jone´S Decline and the decline of the STOCK INDEX DOWN JONE´S during the economic crisis of 2008.

Causes

In this chapter we analyze the four main big causes which the literature has recognized how trigger of this economic crisis in the USA. The monetary politics [3], the revocation of the Glass- Stegall Act (GSA) the introduction of the Gramm-Leach-Bliley Act in 1999 [4]. The introduction of Commodity Futures Modernization Act in 2000 [5] and, the creation of the Government-Sponsored Enterprises (GSEs), such as Fannie Mae and Freddie Mac [6].

The monetary politics

In the early 2000, the Federal Reserve reduced the interest rate from the 6.5% to the 1% triggering a similar reduction in the mortgage interest from the 8% to the 2.5% and the interest rates from the 7% to the 4% (Federal Reserve Board (FRB) [7,8]. This general reduction of the interest rates allowed for a massive purchase of real state as a result of a massive monetary liquidity and a lack of supervision in the sub-prime mortgages [9].

The revocation of the glass-stegall act and the introduction of the gramm-leach-bliley act

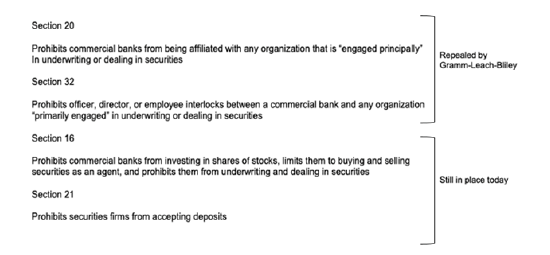

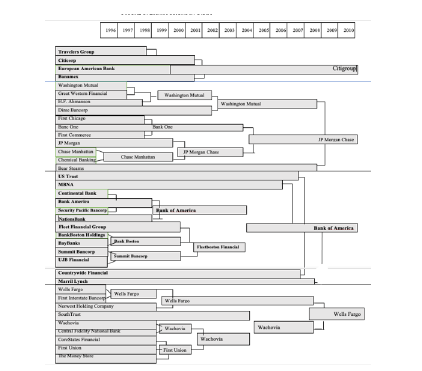

The Glass-Stegall Act, a legislation which was created in 1933 by Franklin D. Roosevelt, set up a separation between commercial bank and investment bank. It resulted in the ban of the commercial bank to operate on the stock market and issue values as well as in the prohibition on investment banks accepting deposits from clients (section 16, 20, 21 and 32), how we can see in (Figure 2). However, in 1987, Alan Greenspan was appointed like the director of the FED. He was known because of his neoliberal ideas, for example, he placed trust in the reduction of the deficit, the derivative financial instruments or cutting in public spending. In this context, it was born Citygroup as a result of the fusion between Citicorps and Travelers. Nevertheless, this fusion was illegal due to the Glass-Stegall Act. Hence, it had a big pressure to abolish this act, and in November of 1999 the President Bill Clinton signed the Gramm-Leach-Bliley Act because of Republican Senator Phil Gramm, Republican USA House of Representatives Jim Leach and Republican Thomas Bliley sponsored the bill) [6]. This act enabled that commercial banks had functions like investment banks and vice versa as the commercial banks could affiliate with the investment banks (how we can see in the revocation of the section 20 and 23 of the Glass-Stegall Act). However, the investment banks still had the ban to accept deposits and the commercial banks and they could not invest in stocks and securities (section 16 and 21). Consequently, as the commercial banks had functions like investment banks and vice versa, there was a wave of fusions between commercial and investment banks due to the abolition of the section 20 and 32 [10]. Afterward, there was a wave of fusions and purchases between banks. One example could be, in 2000, when Chase Manhattan (a commercial bank) bought JP Morgan (an investment bank), and it was born JP Morgan Chase, which, at the same time, in 2004, bought Bank One (an investment bank). The consequence was a consolidation which has set up the six largest banks in America, in which they grew their assets from about 20% of GDP in 1997 to more than 60% of GDP in 2008 [11]. Hence, White LJ [12] explains: “As of February 25, 2010, there were 534 financial holding companies registered in the United States. Forty of those were formed by large foreign banks with headquarters outside the United States, most of which had never been bound by restrictions like Glass-Steagall and thus had been an amalgam of commercial banking and investment banking even before the GLBA” (p.11). We can see these fusions and purchases in (Figure 3). However, other authors [6,12] suggest that the derogation of the GBA did not suppose a big change in the investment in debt securities.

Figure 2:The Derogation of the Glass-Stegall Act and the changes introduced by the Gramm-Leach-Billey.

Figure 3:Bank Fusions in USA and the different fusions which are introduced in the U.S.A due to the derogation of the Glass-Stegall act

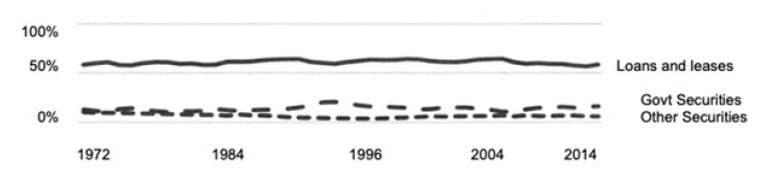

It was produced since the section 16 continued to allow a bank to acquire for its own account investment securities as well as because of the approbation of the Secondary Mortgage Market Enhancement Act of 1984 which enabled banks to invest in (but not underwrite) mortgage-related securities, subject to limits the Office of the Comptroller of the Currency. Therefore, Mahoney [6] explains this process. When mortgage pass-through securities were first sold around 1970, banks had clear authority to sell mortgages, to securitize them with Ginnie Mae´s assistance and underwrite the resulting securities, and to invest in, underwrite, and deal in mortgage-backed securities issued by Fannie Mac and Freddie Mac. Furthermore, that GLBA did not affect bank securities investments can be seen as clear since (Figure 4), which plots three key categories of bank assets (loans and leases, government securities, and nongovernment securities) as a percent of total assets over time for the universe of domestic commercial banks (p. 257 and 258). However, the major problem was the derogation of Sections 20 and 32 in the Glass-Steagall Act, which authorized bank holding companies to conduct a comprehensive spectrum of financial activities. Therefore, universal banking services could be offered through a unique ownership structure [13]. Consequently, a European Central Bank study analyzed if that commercial banks’ involvement in investment banking activities due to the GLBA had an impact in the crisis considering the investment banks underwrote riskier securities. The conclusions suggest that the universal bank had a higher default rate than pure invest companies [14]. Therefore, if this universal bank had not existed, there would have been less risk in the inversions because this banks underestimated default risk.

Figure 4:Selected Assets of Commercial Banks, % Of Total and bank securities investments in three key categories of bank assets (loans and leases, government securities, and nongovernment securities).

The introduction of the commodity futures modernization act

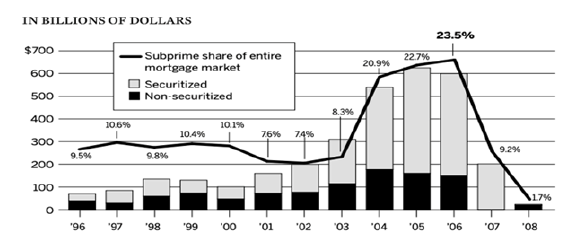

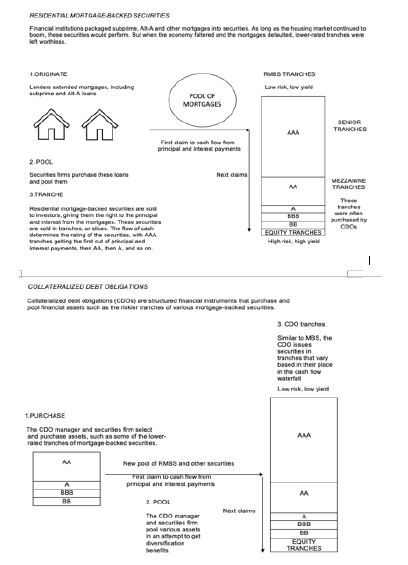

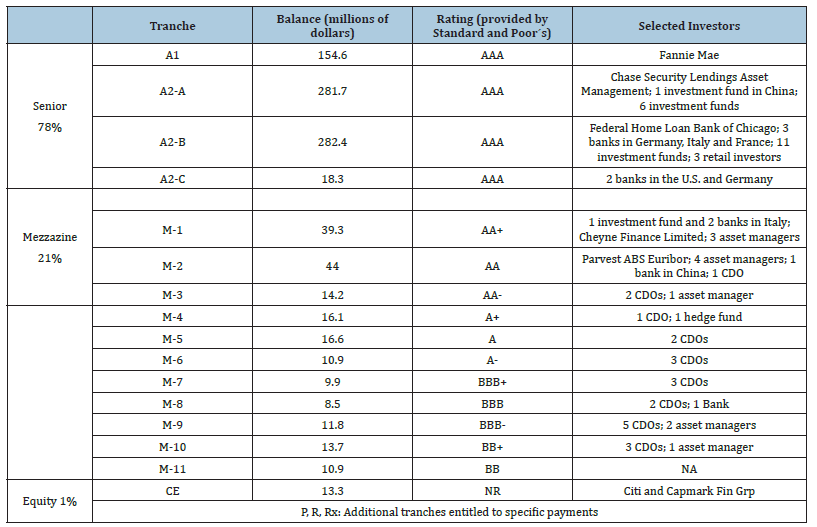

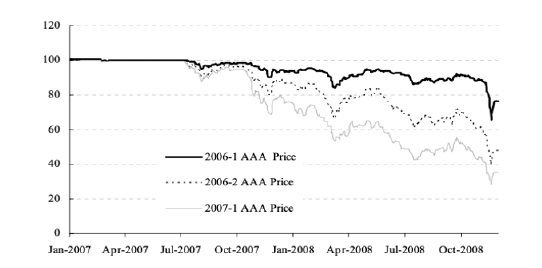

The Congress signed the Commodity Futures Modernization Act in 2000, which in essence deregulated the over the counter derivatives market. Due to this fact OTC derivatives rapidly spiraled out of control and sub-prime originations increased from 70 billion of dollars in 1996 to 100 billion of dollars in 2000 [15], how Figure 5 shows, due to these precedents, it started a complex process which created this economic crisis due to the mortgage default. In the first place, Independent Agents offered mortgages to people that were not able to handle of the payment (called Ninjas, No Incomes, No Jobs and Assets) and later these mortgages were sold to the banks. Moreover, these mortgages had long grace periods and high interest rates in comparison with the prime debtors, which have a good financial coverage. In the second place, the prime and sub-prime mortgages were sold to the securities firms, for example, Bearn Stearns Lehman Brothers, Goldman Sachs and Citygroup. These mortgages were grouped in a package called Mortgage-Backed Securities (MBS) which created bonds supported by these mortgages, with different levels of quality. Subsequently, these MBS were sold to the investors and regrouped to create the Collateralized Debt Obligation (CDO). Then they were sold to the international financial market such as investment fund and pension fund [8]. Meanwhile, the companies (AIG) sold protection to investors in these innovative mortgage securities. As a result, it was created the Credit Default Swap (CDS). This CDS was purchased by the CDO´s owner, first to protect their inversion in the CDO, and other investors and, second, to speculate if the mortgage was unpaid [15-17]. This process is showed in the Figure 6. The risk rating agency (Moody´s, Standard and Poors and Fitch, among others) has the leading role in this process. Firstly, they assigned ratings to the MBS, which are structured in different levels, for instance, in S&P’s classification system, which assigns ratings such as “AAA” (the highest rating for the safest investments), “AA” (less safe than AAA), “A,” “BBB,” and “BB,” and further distinguishes ratings with “+” and “–”. To illustrate it, Citygroup created the MBS called CMLTI 2006-NC2 (Figure 7) which had 19 tranches with different ratings. In these instruments, the senior tranches represented most of the value of the MBS following the mezzanine and equity tranches. The senior tranches were safer than mezzanine tranches and these last safer than equity tranches. After each tranche was sold to a selected investor, for example, the entire tripled rated A1 tranche was bought by Fannie Mae or the other triple-A-rated tranches were sold to 20 institutional investors around the world. However, the issue was that the creators of CDOs bought tranches rated below triple-A and nearly all of those rated below AA [15]. Approximately 80% of these CDO tranches would be ratter triple-A despite the fact that they generally comprised the lower-rated tranches of mortgage-backed securities (Table 1) [14,15]. At last, this CDOs created another instrument called synthetic or hybrid CDOs, which contained other CDOs. For instance, Goldman Sachs issued 318 MBSs (about a quarter were sub-prime) with a total of 184 billion of dollars, 63 CDOs with a total of 32 billion of dollars and 22 synthetic CDOs with a total of 32 billion of dollars.

Figure 5:Sub-prime mortgage originations and the rise in sub-prime mortgage originations since 2004.

Figure 6:The securitization process and the securitization process in the context of the crisis of 2008.

Figure 7:National Association of Home Builders (NAHB) housing market index and the fall of a 60% between 2005 to 2009 in the National Association of Home Builders (NAHB) Housing Market Index.

Table 1:CMLTI 2006-NC2 MBS (An example of a financial derivative).

The government-sponsored entities

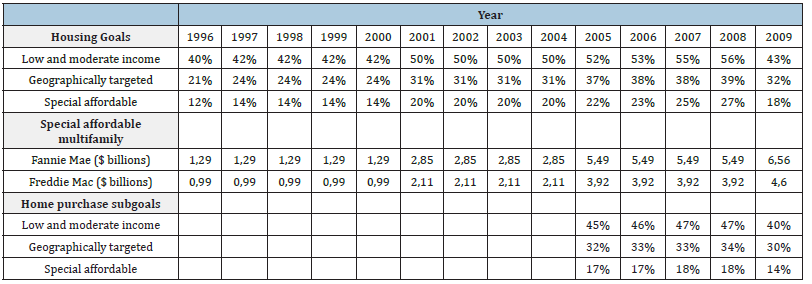

Finally, the literature suggests creating of the Government- Sponsored Entities (GSEs), such as Fannie Mae and Freddie Mac. First of all, in 1938, the Federal National Mortgage Association (Fannie Mae) was established in 1938 in the context of the Gran Depression to raise levels of home ownership, which had the purpose to offer new loans to lenders. In 1968, The Housing and Urban Development Act reorganized Fannie Mae from a mixed ownership corporation to a private company. The consequence was the removal from the federal budget and gave it the power to issue securities collateralized by mortgages (CMO). Moreover, this act enabled that the institution purchased mortgages came from low and moderate income. Finally, the Government National Mortgage Association (Ginnie Mae) was created because of this act, and it purchased MBS insured by federal agencies like the Federal Housing Administration (FHA)1. In 1970, the Congress passed the Emergency Home Finance Act, which created Freddie Mac. This institution had a similar objective to Freddie Mac one as it purchased long-term mortgages from banks, increasing their ability to establish new mortgages and reducing their risk. On the other hand, this act enabled Fannie Mae and Freddie Mac to operate with mortgages not guaranteed by the federal government [6,18]. In 1992, the Congress signed the Housing and Community Development Act of 1992, which had the objective to facilitate the financing of housing for low-income and moderate-income families. As a result, in 2008, the GSEs had an initial goal to purchase these mortgages, with an initial of a 30% and increased to a 56% as we can observe in the graphic 8. The main consequence was that in the beginning of the 2000, these institutions expanded their purchases in Alt-A mortgages (in this classification the risk falls between prime and sub-prime), with a lack of documentation of borrower´s incomes, and in sub-prime mortgages. Due to this fact, in 2003 the GSEs began to rapidly increase their property in MBS. However, in 2007 and 2008 the GSEs experienced huge credit losses because the MBS started to have a rapid deterioration of the value of their MBS, which had composed 19% of their investments. In 2007, Fannie Mae reported a negative 8,3% ROE and Freddie Mac a negative 21% ROE and in 2008, both GSEs had negative core capital positions. Finally, they voluntarily entered conservatorship2 under Federal Housing Finance Agency (FHFA)3 [6,19].

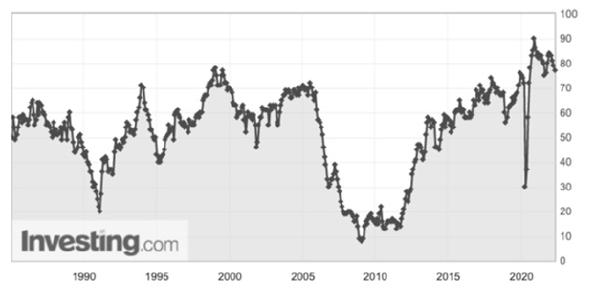

Consequence

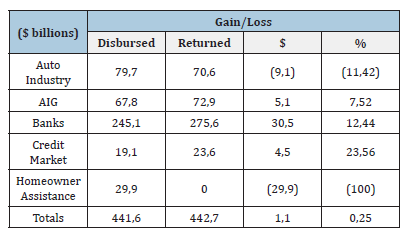

Many financial institutions started to have issues due to the downfall of the real-estate market over the course of 2007. They had large amount of money invested in high risky mortgage [8]. The first consequences can be seen in a fall of a 60% between 2005 to 2009 in the National Association of Home Builders (NAHB) Housing Market Index, which was based on the expectation that the home builders had about the housing market, how we can observe in the Figure 7, a fall of a 19% between 2005 to 2009 of the Case-Shiller United States Home Price Index (HPI), which is based in the change on the value of the USA real-estate market, how we can be showed in Figure 8, and a fall of a 30%, 60% and 70%, respectively, between 2007 to 2008 of the ABX index, which is based on the price of CDS, in this case, on different AAA tranches of MBS, how we can observe in the (Figure 9). Due to these precedents, the financial system started to have serious issues. For instance, in February 2007, New Century Financial Corporation, an institution which generated mortgage loans through its subsidiaries (New Century Mortgage Corporation and Home 123 Corporation), reported mortgage credit losses (their assets lost an 90% of value) due to the investment banks called off the financing and it filed for bankruptcy in April. Secondly, HSBC, the largest sub-prime lender in EU declared a 1,8 billion of dollars in losses. Thirdly, Fremont, another institution which generated mortgage loans, stopped originating sub-prime loans after receiving a cease-and-desist order from the Federal Deposit Insurance Corporation, an independent agency which was created by the Congress of USA to maintain the stability in the financial system [8,15]. In the fourth place, Bear Stearns, one of the biggest investment banks in the US reported that the 60% of the High-Grade fund´s collateral was sub-prime mortgage-backed CDOs by April 2007. In July 2007, their sub-prime hedge funds had lost more than 90% of its value and they declared their bankruptcy. Finally, JP Morgan Chase bought Bear Stearns with two dollars per asset. In the fifth place, Merrill Lynch was acquired by Bank of America by 44 billion of dollars due to the exposition in sub-prime mortgages. Finally, Goldman Sachs provided billion of dollars in loans to mortgage lenders (commercial banks like Ameriquest, Long Beach, Fremont, New Century, and Countrywide) and it had in their position MBS (about a quarter were sub-prime), CDOs and synthetic or hybrid CDOs. In April 2010, the SEC charged it by fraud due to sub-prime market [8,15]. The biggest issue started when the fourth biggest investment bank in the U.S. (Lehman Brother) lost six billion of dollars and the 73% of its value in assets in the first half-year of 2008. Hence, in September 12, 2008, experts from the biggest banks had a meeting at the Federal Reserve to ponder the future of this bank due to their insolvency. Later, in September 15, 2008, it was declared in bankruptcy after that the purchases by Barclays and Bank of America had fallen apart. Consequently, the Down Jones plummeted 500 points and 700 billion of dollars in value from investment portfolios disappeared. Moreover, this issue was transmitted to the subsidiaries which this bank had in foreign countries [8,15]. In the same vein, in the years before the economic crisis AIG, one of the biggest insurance companies in the world, wrote 19 billion of dollars in CDS that protected CDO, which was backed mostly by sub-prime mortgages. Moreover, other investors speculated instead of this CDS, if the mortgage was unpaid [20]. However, as opposed to Lehman Brothers, the FED purchased 80% of their assets and it granted a loan of 85 billion of dollars [21]. Other institutions which have been engaged were Fannie Mae and Freddie Mac. In 2007 and in 2008, both GSEs reported continued losses. Hence, the entered conservatorship under FHFA and the Treasure Department and Federal Reserve created the Troubled Asset Relief Program and Term Asset-Backed Securities Loan Facility in order to purchase MBS and GSE debt [19,22] explains the treasury department spent 59.8 billion of dollars on capital injections in proffered stocks and both institutions spent 77 billion of dollars in debt issuances and 567 billion of dollars in MBS. Lastly, the Treasury Department contracted with both GSEs to act as financial agents to implement the Making Home Affordable (MHA) program, in which the borrowers, who participate in the program, receive a new loan with mortgage payments that should be more affordable in the long term (p.232). Finally, the Government introduced legislative changes. Firstly, in October 2008, the Government signed the Troubled Asset Relief Program (TARP) in order to purchase the toxic assets that the banks had in their balances. In this program, the Treasury provided the authority to spend as much as 700 billion of dollars, of which finally were spent 441 billion of dollars and it retrieved 442 billion, as suggested in the Table 2 (US Department of the Treasury (USDT). Secondly, in February 2009 the Government signed the American Recovery and Reinvestment Act which supposed another 787 billion of dollars in tax cuts and government spending [15]. Finally, in July 2010 the Government signed the Dodd-Frank Act which protected the consumer as the (Table 3) companies which sold securitized assets had to provide information or establish more requirements on capital and level of indebtedness in the banks [23-31].

Figure 8:Case-Shiller United States Home Price Index (HPI)and the fall of a 19% between 2005 to 2009 of the Case- Shiller United States Home Price Index (HPI).

Figure 9:Prices of Aaa of Abx Index and the fall of a 30%, 60% and 70%, respectively, between 2007 to 2008 of the ABX index.

Table 2:Levels of the Affordable Housing Goals for Fannie Mae and Freddie Mac since 1996 (Levels of the Affordable Housing Goals for Fannie Mae and Freddie Mac since 1996)..

Table 3:Troubled asset relief program (the consequences of the introduction of the Troubled Asset Relief Program).

Conclusion

In this paper we have analyzed the reasons which led up to the sub-prime mortgage crisis and the consequences resulted on the United States financial market. Firstly, the reduction in interest rates and mortgage interest allowed to a massive purchase of real state. Secondly, the revocation of The Glass-Steagall Act and the introduction of The Gramm-Leach-Bliley Act which induced to a wave of merges and purchases between banks. Therefore, this fact together with the enactment of the Commodity Futures Modernization Act, which in essence deregulated the financial derivatives (CDOs, MBS and CDS), enabled a greater exposure of these assets and sub-prime mortgages. The immediate consequences were, the collapse of the main economic indicators (such as the National Association of Home Builders Housing Market Index, the Case-Shiller United States Home Price Index or the ABX index) different fusions and acquisitions between banks, the purchase of the 80% of AIG´s assets by the FED, financial assistance to the GSEs (Fannie Mae and Freddie Mac), and, the introduction of the Troubled Asset Relief Program (TARP) so as to clean up the balances of the banks. Finally, the Government enacted the Dodd-Frank Act so that the consumed could be protected. This paper has collected the main arguments of the literature about the causes of the financial crisis of 2008 in the US in order to make an approximation towards the complex structure of financial derivatives and the legal structure which enabled this fact. Nevertheless, this paper has limitations, for instance, future empirical studies should qualitatively demonstrate the true scope of financial derivatives, the relationship between the repeal of the Gramm-Leach-Bliley Act, the enactment of the Commodity Futures Modernization Act, a greater exposure to subprime mortgages, or the effects of the crisis in Europe.

References

- Ambriz IDV (2017) The importance of the overaccumulation of savings in the financial crisis of 2007: Some aspects to consider for the US economy. Economía Informa 404: 25-36.

- Vallejo ZL (2011) The financial crisis genesis and repercussions. Apuntes del Cenes 29(49): 9-39.

- Barcelata CH (2010) The financial crisis in the United States. Revista Contribuciones a la Economí

- Wallison P (2011) Did the “Repeal” of glass-steagall have any role in the financial crisis? not guilty. not even close. Financial Market Regulation pp. 19-29.

- Arévalo AAF (2019) Effects of the glass-steagall act on financial markets: origin and repeal. Econógrafos Escuela de Economía 141: 2-15.

- Mahoney P (2018) Deregulation and the subprime crisis. Virginia Law Review 104(2): 235-300.

- Federal Reserve Board (2008) Statistical supplement to the federal reserve bulletin.

- Pineda SL (2011) The financial crisis in the United States and the international regulatory response. Revista Aequitas 1:129-214.

- Ugarte E, León J, Parra G (2017 The liquidity trap, history and research trends: A bibliometric analysis. Revista UNAM 48(190): 165-188.

- Rubini H (2009) The financial crisis in the United States. Actualidad Económica 19(68): 9-25.

- Dungey M, Jacobs JP (2015) The internationalisation of financial crises: Banking and currency crises 1883–2008. The North American Journal of Economics and Finance 32: 29-47.

- White L (2010) The gramm-leach-bliley act of 1999: A bridge too far? Or not far enough? Suffolk University Law Review, 43(4).

- Carpenter D, Murphy E, Murphy M (2016) The glass-steagall act: A legal and policy analysis. Congressional Research Service.

- Focarelly D, Marques ID, Franco PA (2011) Are universal banks better underwriters? Evidence from the last days of the glass-steagall act. Working Paper Series European Central Bank 1287.

- Government of the United States (2011) The financial crisis inquiry report. Official Government Edition.

- Guerra P, Marysergia E, Rivero DLM (2015) Subprime mortgage crisis and its impact on the Venezuelan economy. Economía 15(40): 11-46.

- Martín S, Márques ID (2011) Securitization: Instruments and implications. The Oxford Handbook of Banking 1: 599-629.

- Federal Housing Finance Agency (2011) A brief history of the housing government-sponsored enterprises. OIG Publications.

- Di Venti T (2009) Fannie Mae and Freddie Mac: Past, present, and future. Economí 11(3): 231-242.

- Torrero MA (2011) La crisis financiera internacional: Cuarto añ Marcial Pons pp. 25-36.

- Pozzi S (2008) The US comes to the rescue of AIG to avoid a new bankruptcy. Global Financial Crisis.

- Frame WS, Fuster A, Tracy J, Vickery J (2015) The rescue of fannie mae and freddie mac. Journal of Economic Perspectives 29(2): 25-52.

- Martín MMR (2011) Securitization in Europe during the crisis. Comisión Nacional Mercado de Valores.

- Bloomberg (2023) Prices of AAA of ABX index.

- Chouliara D (2020) The financial services modernization Act of 1999. American Predatory Lending.

- Citigroup (2006) Citigroup mortgage loan trust asset-backed certificates: Series 2006-NC2.

- Investing (2023) United States-Non-seasonally adjusted S&P/Case-Shiller 20 House Price Index-YoY.

- Investing (2023) United States-National Association of Home Builders (NAHB) housing market index.

- Investing (2023) Stock index down Zone.

- Lin M (2008) Glass-steagall act: Did its repeal cause the financial crisis?

- US Department of Treasury (2008) Troubled Assets Relief Program (TARP).

© 2023 Orts Cardador Jaime. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)