- Submissions

Full Text

Approaches in Poultry, Dairy & Veterinary Sciences

Factors Affecting Milk and Milk Product Export by Ethiopia. A Review

Assefa Bezie*

Ethiopian Meat and Dairy Industry Development Institute, Ethiopia

*Corresponding author:Assefa Bezie, Milk and Milk Product Research Processing Industry Development Directorate, Ethiopian Meat and Dairy Industry Development Institute (EMDIDI), Ethiopia

Submission: May 09, 2019;Published: August 05, 2019

ISSN: 2576-9162 Volume6 Issue3

Abstract

This Review article concerns on the types and quantity of milk products produced in Ethiopia and imported and exported products by Ethiopia, to review factors affecting milk and milk product export. The dairy industry is one of the most important components of the world food system and is undergoing dramatic change at the current time. Exports are forecast to expand across all the main dairy commodities, namely butter, cheese, Whole Milk Powder (WMP) and Skim Milk Powder (SMP). However, data of the Ethiopian Revenue and Customs Authority indicate that the country is a net importer of milk and its derivatives. Presently the value of exported dairy products is very low. The major dairy products in Ethiopia include traditional and industrially produced products. However, “Between “2013 to 2017, the country spent over 48.61 million US Dollar to import various milk and milk products. Ethiopia is not known to export dairy products. Informal marketing channels, poor quality product, fully unimplemented and unfitted of International standards and requirements, Absence of quality-based payments, unlicensed traders, Recent Power Cut and Lack of dairy policy were the main factors that affect milk and milk products export by Ethiopia. The government should be made regulatory laws which guided and controlled illegal traders who entered the domestic and international markets. Formulate dairy and milk product policies to enhanced export performance. Encourage and support the processors to substitute imported products and to export quality milk and milk products worldwide.

Keywords: Dairy; Dairy industry; Export factors; Import; Market channels; Milk product

Abbreviations: FAO: Food and Agriculture Organization of the United Nations; IFAMA: International Food and Agribusiness Management Review; EN: European Parliament; MOA: Ministry of Agriculture; ILRI: International Livestock Research Institute; WB: World Bank; UNIDO: United Nations Industrial Development Organization; SNV: Netherlands Development Organization; UNDP: United Nations Development Program; GDP: Growth Domestic Product; ITC: International Trade Center; GOE: Government of Ethiopia; LA: Lighting Africa

Introduction

World consumption of fresh dairy products and processed dairy products is poised to grow by 2.1% p.a. and 1.7% p.a. respectively, over the next decade. Consumption dynamics differ considerably between developed and developing countries [1]. Around 82% of world exports of dairy products come from developed countries [2]. There are substantial policy differences among the dominant world dairy exporters that will play a key role in determining the outcome of their intensifying competition in the current world dairy trading environment [3]. The main dairy commodities that are traded on global markets are Whole Milk Powder (WMP), Skimmed Milk Powder (SMP), butter, and cheese and whey powder (Figure 1). In recent years, considerable growth has occurred in fresh dairy trade (not only products like yogurts and cream but also liquid milk) [4]. Cheese is a key commodity in global dairy trade. The main importers of cheese are Germany, Italy, France, Spain, and the Netherlands. The main exporters are Germany, France, The Netherlands, Denmark, Belgium, and Ireland. Cheese from the EU is exported mainly to the US, Russia, and Japan; these three count for 50 percent of global destinations. Saudi-Arabia and Switzerland are also significant trading partners for cheese. The main yoghurt and dessert importers are Germany, The Netherlands, France, Spain, and Italy. The main exporters are Germany, Belgium, France, Austria, and Spain. Less than 1percent of yoghurt in the EU is coming from third countries or going to third countries [5].

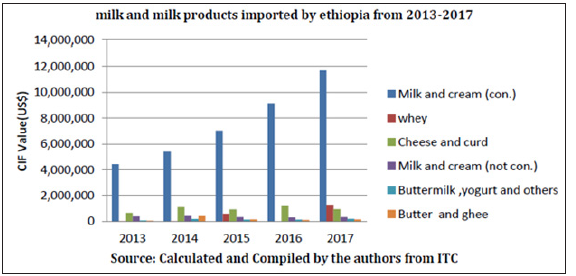

Figure 1:milk and milk products imported by Ethiopia from 2013-2017.

Milk powder is traded internationally at higher volumes than liquid milk products, since liquid products are bulky and often perishable, making them costly to ship and store [6]. New Zealand is the global market leader for whole milk powder (i.e. fat content exceeds 1.5 percent); the EU is a close second, followed by Argentina and Australia. New Zealand is also a global market leader for skimmed milk powder (low fat) followed by the EU, Australia, and the US (Table 1). The US, in particular, improved its position in 2004. Algeria is the most important destination for milk powder, followed by China, Mexico, Philippines, Saudi Arabia, Malaysia, and Indonesia [5]. UHT milk is common in some countries with scarce domestic milk production, poor transportation infrastructure, or a lack of refrigeration [6]. China is becoming an important market for exports and foreign direct investment for dairy processors [5]. However, data of the Ethiopian Revenue and Customs Authority indicate that the country is a net importer of milk and its derivatives. Between 2006 to 2010, the country spent over 678.75 million birr to import various products [7].

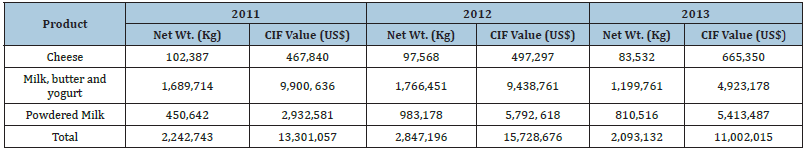

Table 1:Import of milk and milk products in weight and in value.

Source: Zijlstra et al. [15].

Figure 2:milk and milk products exported by ethiopia from 2013-2017. As described in the figure above, the milk and milk product export performance in Ethiopia is too low and not as to the potential.

As is common in other African countries (e.g., Kenya and Uganda), dairy products in Ethiopia are channeled to consumers through both formal and informal dairy marketing systems [8- 10]. The informal market involves direct delivery of fresh milk by producers to consumer in the immediate neighborhood and sale to itinerant traders or individuals in nearby towns [11,12]. Cow milk, camel milk and butter are the main commodities entering the dairy value chains [9]. Of the total milk produced, around 40 percent is allocated for butter while only 9 percent is for cheese [8]. The exchange rate devaluations in other words, against other currencies such as dollars cheaper imports from other countries and thus can be expected to impact positively on the domestic exports [13]. Exports are forecast to expand across all the main dairy commodities, namely butter, cheese, Whole Milk Powder (WMP) and Skim Milk Powder (SMP) [14]. Presently the value of exported dairy products by Ethiopia is very low [15]. Therefore, the main objectives of this paper are to identify the types and quantity of milk and milk products produced in Ethiopia, to differentiate imported and exported products by Ethiopia and to Review factors affecting milk and milk product export by Ethiopia (Figure 2).

Milk Production in Ethiopia

The livestock sector contributes 19% of the GDP, and 16-19% of the foreign exchange earnings of the country [16]. Dairy production is one of livestock production system prevalent in Ethiopia Tegegne et al. [17]. Milk production in Ethiopia is largely from by the smallholder farmers in the high lands and pastoralists in lowland areas of the countries [18]. The rural dairy system, which includes the Pastoral system, Agro-pastoral system and Mixed crop livestock system, contributes 98% of total production, while the Urban and peri-urban systems and Commercial system contribute only 2% of the total national milk production Zijlstra et al. [15].The information obtained from Beyene et al. [19] also indicted that Dairy production in producers’ level is dominated by smallholders with an average of 2 dairy cows per household in study areas. The production of milk and milk products at national level is coming from smallholder farmers using the local milking cows. In Addis and its surrounding milk shed semi-commercial and small periurban producers also make significant contribution for the overall production [20]. Ethiopia produces 5.2 billion liters of milk per year. The total annual cow and camel milk production is 5,030 million liters out of which 80% is cow milk and the remaining 20%, or 997 million liters, is camel milk. In addition, there is production of 152 million liters of goat milk, but only very small quantities enter the value chain Shapiro et al. [9]. Dairy cooperative and unions play a significant role in ensuring sustainable supply of raw milk to the dairy industry by coordinating the flow of milk from the members and assisting them by supplying the required dairy farm inputs Bekuma et al. [12]; Yilma et al. [21].

Current functional dairy processor industries and types of milk products in Ethiopia

The development of the dairy industry in Ethiopia is at a very early stage [22]. Every year new processing plants are established Zijlstra et al. [15]. There are about 35 active dairy processors in the country AACCSA [20]. This result higher than the report of EMDIDI [23] that showed there are thirty-two formal sector dairy processors in Ethiopia and Land O’Lakes [11] which indicated there are 18 registered milk processors in the greater Addis milk shed. The processors collect raw milk from dairy farms, private milk collectors, cooperatives and unions. After collected, the raw milk transported to the processing plant and processed into pasteurized milk, cheese, butter and yogurt [15, 20]. The major dairy products in Ethiopia include traditional and industrially produced products. The traditional products are sour milk, ‘irgo’ (fermented milk), cooking butter and ‘ayib’ (cottage cheese). Industrial products include pasteurized milk, skimmed milk, yoghurt, fermented milk, table and cooking butter, cheese, cream and ice cream [7,24].

Fresh cheeses are characterized by a usually high moisture content and no or short ripening periods. The fresh cheese production technique is based on coagulation of milk casein by the addition of a product able to produce curds, either of animal or vegetable origin [25].The major marketable dairy product is butter which has a relatively longer shelf life as compared to fresh whole milk [7]. This result agrees with the report of Aysheshim et al. [26] where butter is one of the most desired dairy products produced. Similarly, this confirms the result of Mohamed et al. [8] who indicated that Butter is the most widely consumed milk product in Ethiopia.

Imported milk and milk products by Ethiopia

In the years 2005 and 2006, the foreign currency reserves of Ethiopia declined sharply because of a rapid rise in imports and higher public spending [27,28] Expenditure on powdered milk accounted for 79.6%, followed by cream, 12.9% and cheese 4.3% [7,29]. Import is increased from about 3.1 million USD in the year 2001 to the level of 9.3 million in the year 2008, which is about 300% growth from what is has been in 2001 [27].

Export milk and milk products by Ethiopia

Ethiopia is not known to export dairy products. However, some insignificant quantities of milk and butter are exported to a few countries. Butter is mainly exported to Djibouti and South Africa (targeting the Ethiopians in Diaspora), while milk is solely exported to Somalia from the South Eastern Region of the country [21]. The volume and value of the export is declining in recent years [27].

Factors Affecting Milk and Milk Products Export by Ethiopia

Informal marketing channels and poor quality product

The analysis of dairy marketing channels is assumed to provide a systematic knowledge of the flow of dairy and its products from their production areas to their final end-users [30]. the milk and milk products pass through different marketing agents before reaching the end users. To tackle constraints and access available opportunities by value chain actors, it is necessary to identify the main value chain actors and functions involved in the entire value chain. The main functions in milk value chain are collection, wholesaling, processing, retailing and consumption whereas the major actors in milk value chain are processors, traders (collectors, wholesalers, retailers and Cafe/Hotel owners), and consumers [31]. The result agrees with several authors such as Ketema et al. [32]; Abu Kuffa [33].

Informal marketing: In the informal market, milk may pass from producers to consumers directly or it may pass through two or more market agents to local consumers and neighboring countries (Somaliland and Kenya) consumers. The informal system is characterized by no licensing requirement to operate, low cost of operations, high producer price compared to formal market and no regulation of operations. The informal (traditional) milk channel has remained dominant in Ethiopia [11,34]. In the case of camel milk, it is reported that 100,000 liters are exported informally every day to Somalia and Djibouti and camel milk processing plants are coming up. In cross-border and domestic informal camel milk subchains, the prices paid to producers are almost the same, although generally less than for cow milk, but the total margins for camel milk are quite high, 175% for the cross-border sub-chain and 135% for the domestic sub-chain. Most actors get attractive returns in these camel milk systems. Informal camel milk exporters receive 50% of the gross margin, followed by food service providers (Somali restaurants) who receive 44%, traders 39%, and retailers 28.6% [9].On the other hand, evaluation of the prevailing dairy products marketing systems and identification of its constraints would assist to design appropriate improvement strategies. Marketing of dairy products, therefore, requires as much emphasis as for the production of milk. [12].

Poor quality product: The sanitation problem was observed in the way products were handled. Farmers take their cheese mainly using plastic bags and small buckets and transactions take place using food packing cans (especially 1kg marmalade packing cans). Butter is taken to the market using similar materials but the measurement is usually a pile of the product over small coffee cups. The hygiene of materials used to take products to the market and measurement cans are points of concern from the public health perspective. The plastic bags and buckets used to carry cheese and butter to market are not visually attractive and clean. There is a need to inspect the appropriateness of the marmalade cans to measure cheese and replace it with other more appropriate units [30]. According to SNV [35] there is no official hygienic regulation set for smallholder dairy products that are sold in different parts of the country. This indicates that the health of the dairy consuming community is not secured. Frequently, quality control measures have been directed more at penalties for adulteration and poor milk composition, than at protecting public health. As Reported by SNV [36] milk quality control is the use of various tests to ensure that milk and milk products are safe, healthy, and meet the standards for chemical composition, purity, and levels of bacteria and other microorganisms. Milk and milk products should be stored in clean conditions at appropriate temperature and humidity to prevent deterioration or permit maturation. UNDP [37] reported that in order to reach major export growth targets and to be able to compete, penetrate and grow in overseas markets, it is necessary to manufacture quality products in substantial quantities competitively.

Fully unimplemented and unfitted of International standards and requirements

Dairy demand and export opportunities could also be affected by the outcome of various free trade agreements (FTA) and regional trade agreements (RTA) currently under discussion [38]. The importing country has three mechanisms for enforcing that dairy shipments indeed meet its legal requirements: through certification, prior approval of handlers, and testing of the endproduct. Process standards are used as a benchmark to judge whether a food has been produced in a manner to be fit for human consumption or trade [29,39]. Fulfilling the stringent requirements and the “Sanitary and Phytosanitary Agreement (SPS Agreement) of the World Trade Organization (WTO) should be complied and basic if we are exporting milk and dairy products [40]. A report by Achterbosch [5] revealed that there are standards for particular products, including milk powders and cream powder, cream, butter, cheese, and processed cheese, whey cheeses, milk fat products, evaporated milks, fermented milks, sweetened condensed milk, dairy fat spreads, infant formula, and whey powder. To be competitive with these high value products, the envisaged such as powder milk, butter, cheese etc. should meet the international requirements in order to enter world market and to fetch higher prices [10,22].

Absence of quality based payments

Since there is no quality-based payments for milk producers, milk supplied by farmers were sometimes adulterated with hot water and mixed with evening milk, which was below the required quality set by the cooperative [30]. The quality standards set by the Ethiopian Quality and Standards Authority are not enforced and no mandatory certification or regular inspection and quality control are not in place [35,40]. Manufacturers of milk powder have especial interests in raw milk with a high content of protein, as this determines the yield per kg of raw milk. Cheese manufactures are interested in the fat, protein and casein contents, because these components determine the cheese yield [35]. As a report Abu Kuffa [33] Indicated that quality-based payment was enhanced quality of milk supplied to processors at the same time as encouraging them to produce more and quality milk.

Unlicensed traders

This is the case for the butter market where most of the traders are informal while only few of them are licensed. This means the licensed traders pay taxes and compete with non-tax payers in the market, distorting the normal working environment of the business [30].Similarly, Land O’Lakes [11] reported that the main player in the informal sector is the “milk traders” who buys directly from farmers and sell directly to an end market such as small milk bars, cafés, and milk shops. As reported by Bekuma et al. [12] Dairy owners as a result sell their milk and milk products informally to unlicensed vendors, retailers or village consumers.

Recent power cut

Ethiopia has faced the worst power cut in its recent history. For about six months, there was a power cut for almost 50% of the daytime. As a result of this many of the processors were using generators, which cost them higher than the regular electric power source. The power cut also affects the shops and small kiosks that do not have a power backup. When there is no power, they do not collect packed milks as refrigerators are not working SNV [40]. According to WB [41], Frequent power outages-lasting from 30 minutes up to an entire day resulted in dissatisfaction with electricity service. In Ethiopia, overall electricity access is very low compared to the African average [42].

Lack of dairy policy

No specific policy Instruments put forward for accelerating the growth of the industry. For instance, there are no regulations so far for milk collection, processing and marketing [22]. There are still areas where government policies distort the dairy sub-sector. The GOE has a restrictive foreign exchange policy which can make it a difficult process [11].

Conclusion and Recommendation

Conclusion

In the years 2005 and 2006, the foreign currency reserves of Ethiopia declined sharply because of a rapid rise in imports and higher public spending. Import is increased from about 3.1 million USD in the year 2001 to the level of 9.3 million in the year 2008, which is about 300% growth from what is has been in 2001. “Between” 2013 to 2017, the country spent over 48.61 million US Dollar to import various milk and milk products. The volume and value of the export is declining in recent years. The major dairy products in Ethiopia include traditional and industrially produced products. The traditional products are sour milk, ‘irgo’ (fermented milk), cooking butter and ‘ayib’ (cottage cheese). Industrial products include pasteurized milk, skimmed milk, yoghurt, fermented milk, table and cooking butter, cheese, and cream and ice cream. Fulfilling the stringent requirements and the “Sanitary and Phytosanitary Agreement” (SPS Agreement) of the World Trade Organization (WTO) should be complied and basic if we are exporting milk and dairy products.

Recommendation

Based on the results from this review and personal observations, the dairy and dairy product export performance in Ethiopia is too low and not as to the potential. Therefore, the following recommendations are forwarded to develop and to enhance export performance.

A. The government should be made regulatory laws which guided and controlled illegal traders who entered the domestic and international markets.

B. Formulate dairy and milk product policies to enhanced export performance.

C. There should be quality based payments on fat, protein, density and other composition of milk to prevent adulteration on raw milk that supplied to processor and consumer and to keep end product quality.

D. Encourage credit institutions for Technical and financial support to the producers and processors to produce quality milk and milk products.

E. Encourage and support the processors to substitute imported products and to export quality milk and milk products worldwide.

F. Since informal market was dominated and distributed the formal market and business of the country, all the actors in the dairy value chain should be have licensed and entered the formal marketing channels.

G. Implementation of international standards such as Hazard Analysis Critical Control Point/HACCP/, Food Safety and Quality Management Systems and Good manufacturing Practice at the dairy industries were mandatory to export through producing quality and safe products.

H. To solve market constraints and challenges which happened in the domestic market and to generate foreign currency to the country by export milk and milk products, the dairy processor plants should be had different

I. certificates which confirmed their products were safe for consumption.

J. A strong strategy and policy are necessary to create a strong linkage among dairy cooperatives, research centers, universities and domestic as well as international markets.

K. Organize small holder dairy farmers through cooperatives is one tool to supply all potential raw milks for processing plants and to utilize the resources wisely.

L. Attracting the potential investors through investment to engage on the dairy industry to produce milk powder, skimmed powder and other dairy Varity is one Intervention to reduce imported such dairy products and to enhanced the national economy by minimized expenditures that spent for foreign currency.

M. Supporting and capacitating the small holder dairy farmers and producers to organize at cooperatives level is crucial to control and eliminate informal marketing channels.

Encourage and strengthen the milk collection centers, cooperatives, collectors and processors for sustainable dairy industry development.

References

- (2018) OECD/Food and Agriculture Organization of the United Nations, Dairy and dairy products. In: OECD-FAO Agricultural Outlook 2018-2027, OECD Publishing, Paris/Food and Agriculture Organization of the United Nations, Rome, Italy.

- (2017) OECD/Food and Agriculture Organization of the United Nations, Dairy and Dairy Products. In: OECD-FAO Agricultural Outlook 2017-2026, OECD Publishing, Paris.

- Peter V (2016) Global dairy trade: Where are we, how did we get here and where are we Going? IFAMA 19(Issue B): 27-36.

- Guillaume R (2014) Trends in EU-third countries trade of milk and dairy products. EN, pp. 3-34.

- Achterbosch T (2007) Between safety and commerce: How sanitary measures affect global dairy trade. International Food & Agricultural Trade policy Council. pp. 2-47.

- Cessna J, Kuberka L, Christopher GD, Hoskin R (2016) Growth of U.S. dairy exports. A Report from the economic research service, pp. 1-57.

- (2013) Dairy value chain vision and strategy for Ethiopia. Addis Ababa, Ethiopia: Ministry of Agriculture and International Livestock Research Institute, MoA and ILRI, Africa.

- Mohamed AAM, Ehui S, Assefa Y (2004) Dairy development in Ethiopia, Africa, pp. 1-58.

- Shapiro BI, Gebru G, Desta S, Negassa A, Nigussie K, et al. (2017) Ethiopia livestock sector analysis. ILRI Project Report. Nairobi, Kenya: International Livestock Research Institute (ILRI), Africa, pp. 1-103.

- Ghilu S, Yilma Z, Banerjee S (2012) Quality and marketing of milk and milk products in Ethiopia: Assessment of quality and marketing of milk and milk products in the central highlands of Ethiopia, Africa.

- (2010) The next stage in dairy development for Ethiopia, Land O'Lakes, USA.

- Bekuma A, Galmessa U, Fita L (2018) Dairy Products Marketing Systems and its Constraints in Gimbi District, West Wollega Zone, Oromia, Ethiopia J Vet Sci Technol 9: 556.

- Yazdaninasab A, Aghapour MS (2016) Factors affecting the dairy industry's products export in Iran. International Journal of Advanced Biotechnology and Research (IJBR) 7(4): 26-30.

- (2018) Dairy market review. FAO, Rome, Italy, pp. 1-27.

- Zijlstra J (2015) Business Opportunities Report Dairy #2 in the series written for the Ethiopian Netherlands business event Rijswijk, The Netherlands, Europe.

- (2012) MoA (Ministry of Agriculture). 2011/12 (2004 E.C) Performance assessment report on the growth and transformation agenda in the spheres of agriculture, Malaysia.

- Tegegne A, Gebremedhin B, Hoekstra D, Belay B, Mekasha Y (2013) Smallholder dairy production and marketing systems in Ethiopia: IPMS experiences and opportunities for market-oriented development. IPMS (Improving Productivity and Market Success) of Ethiopian Farmers Project Working Paper 31. Nairobi: ILRI, Africa.

- (2009) Value chain analysis of milk and milk products in Borena pastoralist area. Care Ethiopia, Africa.

- Beyene B, Geta E, Mitiku A (2016) Value chain analysis of dairy products in esssera district dawro zone, Southern Ethiopia. Industrial Engineering Letters 6(6): 2224-6096.

- (2016) AACCSA (Addis Ababa Chamber of Commerce and Sectorial Associations). Value chain Study on Dairy Industry in Ethiopia Final report to by TAP consultancy Services, Africa.

- Yilma Z, Emannuelle GB, Ameha S (2011) A Review of the Ethiopian dairy sector (Ed.), Rudolf F Food and Agriculture Organization of the United Nations, Sub Regional Office for Eastern Africa (FAO/SFE), Addis Ababa, Ethiopia, pp. 81.

- (2004) Analysis of high-value export. A Review of manufacturing Activities with high-value Exports Growth Potential in Ethiopia. Market structure, costs, constraints, competitions and opportunities. WB, Africa.

- (2017) EMDIDI (Ethiopian Meat and Dairy Industry Development Institute). Feasibility Study for the Establishment of Milk Processing Plant with Capacity of 100,000 Lit/Day. Ethiopia, Africa, pp. 1-17.

- Asresie A, Yilma Z, Seifu E, Zemedu L, Eshetu M et al. (2018) Handling, processing, utilization and marketing of ayib (Ethiopian traditional cottage cheese) varieties produced in selected areas of eastern gojjam, northwestern highlands of Ethiopia. Open Journal of Animal Sciences 8(1): 51-73.

- Silvana M, Mariangela C, Crovetto GM, Riccardo F, Andrea M, et al. (2018) Typical dairy products in Africa from local animal resources. Italian Journal of Animal Science 17(3): 740-754.

- Aysheshim B, Beyene F, Eshetu M (2015) Handling, processing and marketing of cow milk in urban and peri urban area of Dangila Town, Western Amhara Region, Ethiopia. Glob J Food Sci Technol 3(3): 159-174.

- (2009) The impact of global economic & financial crises on the Ethiopian dairy industry. Least Developed countries ministerial conference, Vienna international center, UNIDO (United Nation Industrial Development organization), Australia.

- Pritchard B (2001) Current global trends in the dairy industry.

- Gezu T, Zelalem Y (2018) Dairy trade in Ethiopia: Current scenario and way forward-review. Dairy and Vet Sci J 8(1): 555728.

- Mesay Y, Begna B, Teklewold T, Lemma E, Etana T, et al. (2012) Analysis of the dairy value chain in Lemu Bilbilo District in the Arsi Highlands of Ethiopia, Africa.

- Tegene Ali (2017) Value chain analysis of milk: The case of dessie zuria district, Sourh Wollo Zone, Northern Ethiopia. Africa, pp. 1-122.

- Ketema M, Aman M, Seifu E, Getachew T, Hawaz E, et al. (2016) The dairy value chain and factors affecting choices of milk channels in Harar and Dire Dawa areas Eastern Ethiopia. p. 9.

- Abu KM (2012) Value chain and Quality of Milk in Sululta and Welmera werdas, Oromia Special Zone Surrounding Addi Ababa, Oromia, Ethiopia.

- Feleke G (2003) Milk and dairy products, post-harvest losses and food safety in sub-Saharan Africa and the near east. A Review of the Small-Scale Dairy Sector-Ethiopia. FAO Prevention of Food Losses Program. FAO, Rome, Italy.

- (2010) Quality factors that affect Ethiopian formal milk business: Experiences from selected dairy potential areas, Netherlands Development Organization. SNV, Addis Ababa, Ethiopia.

- (2017) Hygienic and quality milk production. Training Package for Dairy Extension workers, SNV, Africa.

- (2017) Manufacturing Export performance in Ethiopia. UNDP, Africa.

- (2016) Dairy and dairy products in OECD-FAO Agricultural Outlook 2016-2025. OECD Publishing, Paris.

- (2016) A milk SA publication compiled by the milk producer’s organization. LACTODATA Statistics 19(1).

- (2009) Dairy policy inventory of Ethiopia. SNV Ethiopia, pp. 1-23.

- (2016) Beyond electricity access: Output-based aid and rural electrification in Ethiopia. World Bank, Washington, USA.

- (2012) Policy Report Note Ethiopia. Lighting Africa, Africa.

© 2019 Assefa Bezie. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)