- Submissions

Full Text

Archaeology & Anthropology:Open Access

Revisiting Real Exchange Rate Fundamentals

Oluremi Ogun*

Professor of Economics, Nigeria

*Corresponding author:Oluremi Ogun, Professor of Economics, Nigeria

Submission: June 19, 2019;Published: June 24, 2019

ISSN: 2581-1949 Volume3 Issue2

Abstract

This paper presented a critical appraisal of the justifications for the choice of particular variables as real exchange rate fundamentals. The model-based approach was focused. The criteria for the exercise centered on the nature of variables and the pattern of effect. The cases for exchange control, trade restrictions and government expenditure on untradeable goods as long run fundamentals were tenuous and could hardly be defended theoretically while capital flows were found admissible only after some adjustments. Productivity growth differentials boasted impeccable credentials and should not be ignored. All the variables making the final list satisfied the established ground rules.

Keywords:Real exchange rate; Fundamentals; Non-technical approach

Introduction

Real exchange rate (RER) differs from its nominal variant in that it measures relative changes in the real value of two currencies. Hence, it is not only a powerful resource allocator forcing resource movement between sectors, it also represents a potent influence on the growth of international trade. A decline in RER is usually interpreted in terms of real appreciation squeezing the tradable goods sector (via relative competitiveness) and vice versa. Further, the somewhat omnibus influence of RER on other relative prices supplies an additional boost to its resource allocation attribute. Other things given, whenever the RER is in equilibrium, there results simultaneous occurrence of internal and external equilibria. Hence, RER movements have implications for inflation, unemployment and balance of payments that are important foci of stabilization policy objectives in all open economies.

This paper takes a critical look at the issue of RER fundamentals with a view to assessing misplacements and possible omissions as well as necessary gap filling. In order to achieve this aim, it presents sequentially in sections, a review of approaches to RER determination; a presentation on the model approach to RER equilibrium and disequilibrium; a critical appraisal of variables in extant long run RER formulations and some concluding observations. A non-technical approach is generally adopted in the paper.

Approaches to Real Exchange Rate

The relevant key theoretical issues are discussed under distinct headings below.

Exchange rate equations with nominal and real disturbances

This approach centers on the impact of nominal and real disturbances on RER determination focusing mainly on developing countries. The argument is that in the short run, both real and nominal factors are important influences on the behavior of exchange rate; however, only the real variables matters in the long run. These models include [1,2].

In Khan & Montiel [1], the dynamics of real exchange rate is induced by households’ asset accumulation behavior. In the model, given the current value of the real private financial wealth, the RER and the real wage always adjust to restore equilibrium in the labor and untradeable goods market. However, the RER and real wage values that would clear the market rests on the future evolution of the economy, given the assumption of perfect foresight for economic agents. Khan & Montiel [1] identify changes in the composition of government spending, imposition of import tariffs and export tax, terms of trade disturbances, taxfinanced increase in government spending on importable goods and increase in international real interest rate (RIR) as long run determinants of RER while nominal devaluation is the only short run determinant.

The purchasing power parity theory

According to this approach, there is a tendency for movement in the NER between two countries to equalize changes in the ratio of the countries’ price levels, thereby leaving the RER unchanged. According to the relative version, NER would adjust to inflation differentials across countries. This version is more empirically tested because prices were mostly measured in indices rather than levels. It depends on arbitrage condition, which ensures that market forces would equalize prices, so that the law of one price (LOOP) holds if the commodities are expressed in one currency. However, purchasing power parity’s (PPP’s) proposition that the equilibrium RER is a constant has been questioned since the fundamentals of the equilibrium real exchange rate change in line with world conditions [3], while its inability to appropriately account for the short run movements in (real) exchange rate has been emphasized in the literature [4-6].

Productivity approach

This approach can be categorized as a flow approach as it affects RER primarily through the short run trade balance [7]. In an effort to explain the deviations in absolute PPP, [8,9] argue that productivity differential between two countries influence movement in exchange rate. According to them, there are technological differences among countries and these differences are not the same across sectors. Technological advancement is higher in the traded goods sector than the untraded goods sector. Therefore, by assumption, prices in the traded goods sector equal the marginal cost. With LOOP holding, prices would equalize across countries. However, in the untraded goods sector where LOOP does not hold, increased productivity in the traded goods sector would lead to rise in real wages causing an increase in the prices of untraded goods. Hence, other things being equal, the economy with higher productivity level in traded goods would be characterized by higher wages and prices in the untraded goods sector and thus appreciating the RER [10,11].

MacDonald & Ricci [11] extends the analysis to include productivity in the distribution sector. They do not assume that the distribution sector acts only through the untraded goods sector as is common in the literature. Instead, high productivity in the traded and untraded goods sectors would appreciate and depreciate RER respectively. But, higher relative productivity in the distribution sector would appreciate the RER if the distribution sector performs a bigger role in delivering goods to the traded goods sector than to consumers.

Macroeconomic balance approach

This approach emphasizes equilibrium exchange rate. It dates back to as far as [12] (cited in [13]) who defines equilibrium RER (ERER) as “the path needed to achieve simultaneous internal and external balance by some date in the medium run future and maintains balance thereafter”. The approach is also referred to as the underlying balance approach. There are various versions of the approach [7,14-18]. These are medium to long run RER models. The approach views sustainable RER as the rate that ensured simultaneous attainment of internal and external balance. Internal balance is attained when the economy is at full employment with low inflation (non-accelerating inflation rate of unemployment), while external balance holds when the underlying current account is equal to the capital account target, often described as the sustainable net flow of resources (capital) when the countries are in their internal balance.

Exchange rate equations

These are collection of theoretical models that tend to analyze the long run behavioral relationship between RER and its fundamentals, especially for developing countries. The pioneering work in this approach for developing countries is [16]. The other prominent contributions are [7,19]. The three works differ in some important respects.

Flow approach: Edwards [16] model is conditioned on sectoral capital flows. It employs an intertemporal framework in which the ERER does not only depend on the current value of the fundamentals but also on the expected future evolution of these variables. The central idea of the model is that the ERER responds to real disturbances. The ERER is therefore, “the relative price of tradable to untradable that, for given sustainable (equilibrium) values of the other relevant variables such as taxes, international prices, net capital flows and technology, results in the simultaneous attainment of internal and external equilibrium”. Internal equilibrium held when the untraded goods market clears in the present period and is expected to clear in the future and external equilibrium is attained when the current account balances in the present and future periods are compatible with long run sustainable capital flows. Hence, the path that defines the ERER is a function of its current fundamentals as well as the expected future changes in these fundamentals.

Stock approach: Montiel [18] argues that at one end, assumption of full adjustment in the economy’s net creditor position allows for the conditioning of the long run equilibrium real exchange rate (LRER) on external interest rate, while at the other end, conditioning LRER on the stock of net international debt implies that the capital stock is evolving over time, though very slowly. However, while some analysts do not key into the former, they do not take the latter extreme position either but adopt the sustainable level of net capital inflow (a flow rather than a stock approach). Therefore, “the common procedure of conditioning the LRER on a ‘sustainable’ level of net capital inflows can be understood as a special case of the latter in which the adjustment in the economy’s net creditor position implied by the ongoing net capital inflow is small (in other words, the rate of adjustment of the net creditor position is slow)” [18]. Hence, in contrast to Edwards [16], Montiel [18] assumes that the economy’s net creditor position has fully adjusted in the long run. Thus, LRER is conditioned on external interest rate rather on net capital inflow.

Accordingly, Montiel [18] defines the LRER “as the real exchange rate that is compatible with steady-state equilibrium for the economy’s net international creditor position, conditioned on the permanent values of a variety of policy and exogenous variables”. This definition, therefore, implied that the predetermined variable, the stock of net foreign indebtedness or exogenously determined sustainable net capital inflow in some models, has fully adjusted or reached its steady state before the long run. By implication, Montiel [18] takes a different position and treats capital flow as an endogenous variable that is simultaneously determined with the short run equilibrium exchange rate. Consequently, for the external balance (defined as the current account that equals the net capital inflow necessary to sustain the steady-state value of the economy’s net international creditor position), the model adopts the ‘stock’ rather than the ‘flow’ approach, which indicates that the economy’s net international creditor position does not appear among the set of fundamentals.

Barajas et al. [20] extend the Montiel [18] model to include worker’s remittances. They argue that, though, remittance inflow would follow the conventional view (that is, appreciating the RER), its effect would be mitigated by the share of tradable goods in consumption, if the remittance inflow is induced (that is, when remittance is endogenous in the model and is an inverse function of domestic households’ income), etc.

Stock-flow approach: A hybrid of the “flow” and “stock” approaches is Faruqee [7]’s “stock-flow” model. It builds on the asset price model of Mussa [21]. Assuming internal balance would hold in the long run, the model includes stock-flow adjustment of net external position based on sustainability of current account for the external balance. The model consists of two economies that engage in the trade of two imperfect substitutable goods and one financial asset. Hence, it integrates the permanent structural components of current and capital accounts that underlain each country’s net trade and net asset positions as determinants of that country’s long run RER resulting in two basic types of fundamental shocks as influential to RER movement: those that affect the short run trade balance (flow shocks) and those that affect the long run net foreign asset position (stock disturbances). The trade side determinants include productivity differentials affecting the relative price of untraded goods or commodity price shocks that affect terms of trade.

In the stock-flow model of Aglietta et al. [22], there is the argument that, though, most studies neglect indicators of non-price competitiveness, they are important in influencing foreign trade performance. Hence, their theoretical model captures this factor as a determinant of RER.

Fundamental equilibrium real exchange rate

The fundamental equilibrium exchange rate (FEER) model (Williamson [14,15]) is based on flow rather than stock equilibrium. It is an important and the most popular concept for estimating the RER under this approach in advanced countries. Clark & MacDonald [23] and MacDonald [24] note that, although the FEER is not a theory per se, the in-built assumption that the actual RER would converge to FEER, has embedded in it, the theory of medium run current account determination.

The FEER approach has two distinguishing features. First, it supposes that developed economies mostly engage in trading in differentiated goods that are sold in imperfectly competitive markets, hence, the demand curves for individual firms and economies’ products are downward sloping. As a consequence of the assumption of imperfect competitive market, the net trade is specified as a function of RER, with the RER defined in terms of output or traded goods, rather than in terms of consumer prices. Second, FEER is only a medium-term equilibrium concept. Williamson [15] defines the FEER concept as RER that ensures simultaneous attainment of internal and external equilibria. As an underlying balance model, all variables are assumed to have reached their steady state in the medium term, except asset stock. Hence, to estimate the ERER, it utilized fundamentals at their medium-term equilibrium values (e.g. trend output). FEER is believed to be a normative approach.

Natural real exchange rate approach

The natural real exchange rate (NATREX) model, Stein [25,26], is another version of the macroeconomic balance approach that is consistent with the “stock-flow” framework based on the inclusion of stock in the flow relationship [24]. It is not a theory but like the FEER, it is a concept for calculating RER path. The internal balance defines the rate of capacity utilization at its long run stationary mean, while the external balance is where the ratio of the foreign debt/GDP stabilizes at their long-term level [27]. Implicitly, simultaneous attainment of internal and external balance is an absolute requirement for macroeconomic balance. Hence, under the model, sustainable capital is assumed to be equal to the difference between social savings and planned investment. While the former implies a medium run equilibrium, the later indicates a long run equilibrium.

MacDonald [24] points out that the difference between medium run and long run equilibria lies in the evolution of net foreign assets and capital stock, such that in the medium run, the current account might be non-zero to the extent that the difference between ex ante savings and investment are non-zero but for the long run, the NFA and the capital stock are constant and the current account is zero. However, in both the medium and long run, internal balance is assumed to hold always. Three fundamental determinants have been identified as important in the movement of key endogenous variables (investment, savings, and flows of foreign debt and capital) in the model. These are time preferences given by ratio of social consumption (private and government), exogenous TOT and productivity.

Behavioral equilibrium exchange rate

The behavioral equilibrium exchange rate (BEER) is a short to medium-term framework that is premised on the behavioral relationship between RER and economic fundamentals. However, unlike the exchange rate equations discussed above, it does not assess the RER based on macroeconomic balance. Theoretically, the starting point of the analysis is the risk-adjusted uncovered interest rate parity condition. The actual RER is then specified as a function of unobservable expected RER, RIR differential and the risk premium. The model assumes that the unobservable expected exchange rate to be basically determined by long run economic fundamentals.

The Model Approach to Real Exchange Rate

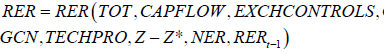

Apart from the PPP and the allied productivity approaches, all the other approaches reviewed in the preceding section were semblance of the model approach. Thus, beginning with the macroeconomic balance approach in this paper, exchange rate equations (primarily, specified RER fundamentals) that often derives from an admixture of theories, are usually estimated in order to generate the equilibrium RER from which when necessary, RER misalignment series could be obtained. From around the late 1980s, the flow approach associated with Williamson [14,15] & Edwards [3,16] had become the most popular model-based RER method. A typical RER equation under the approach looks thus:

Where, RER is real exchange rate, TOT is terms of trade, CAPFOW is international capital flows, EXCHCONTROLS is exchange controls, GCN is government expenditure on untradeable goods, TECHPRO is technological progress, Z-Z* is a measure of macroeconomic imbalances often represented by excess money creation, NER is nominal exchange rate and RERt-1 is lagged RER. In this expression, TOT, CAPFLOW, EXCHCONTROLS, GCN (sometimes, TECHPRO) are deemed to be RER fundamentals generating long run effects on the variable while the rest that is, NER, Z-Z* and RERt-1, are nominal variables with short run effects1 .

FOOT NOTE

1The partial effects of the explanatory variables were in parenthesis as follows: TOT (+/-); CAPFLOW (-); EXCHCONTROLS (-); GCN (-); TECHPRO (-); Z-Z* (-); NER (+), and lagged RER (+). By implication, improving terms of trade, increasing capital inflow, rising exchange controls, increasing technological progress appreciate the RER while growing nominal exchange rate and own lag would generate depreciating effect.

Generating the misalignment series (RERM) under this approach is usually via the equation:

RERM = [(ERER - RER) / RER]*100

Where, ERER is the equilibrium RER generated as the fitted series in a RER regression involving only the fundamentals as the explanatory variables.

An Appraisal

Some ground rules are apposite. Firstly, any policy or exogenous development that changes only the domestic price level and the NER in the same direction would not qualify to be classed as long run fundamental. The simple reason being that, such effect cancels out in the long run leaving the ERER ultimately unchanged. Secondly, policy and/or exogenous development generating only transitory effects would also not be a credible fundamental. In line with Montiel [18], long run RER is viewed as deriving from the sustainable values of RER fundamentals, that is,

Where, the expression in bracket represents the sustainable values of the fundamentals. Unlike Montiel [18] however, the concern in this paper is with only the sustainable values of long run fundamentals. Thus, no short run fundamental is considered. In the ensuing analysis, only the case of bilateral RER is considered; qualification(s) deemed necessary in the case of multilateral RER are indicated.

Exchange control

Rather than an ideal component of deregulation, exchange control is an aberration. It causes distortion in the economic system by driving a wedge between free market prices and the protected price level. It invariably gives birth to a regime of at least, dual exchange rates - an official exchange rate and a parallel market rate. In some countries, there is also an autonomous market rate. The established practice is to proxy exchange control by the parallel market rate [3,28,29]. The idea behind this practice appears to be the recognition that when eventually the control is done away with, NER (in this case, the official rate) would converge to its long run value (that is sustainable value) that the parallel market rate represents.

In the period preceding the widespread transition to market economy by developing countries as well as the early days of the reforms, multiple exchange rate system was the common practice. Accordingly, RER frameworks incorporating exchange control could hardly be faulted. However, it would amount to gross misrepresentation to apply the same framework to developed market economies.

The point of emphasis under this variable is this, ‘exchange control’ is inconsistent with the notion of long run and ought not to merit a place in the relevant model. Rather, than the variable, an outright patronage of the parallel market rate should be more appropriate. In this case, NER would no longer enter as an explanatory variable even with its short run status. The parallel market rate would be specified as a short run variable and would also be the relevant NER measure in the computation of observed RER. This would then constitute a universal specification for all market economies as well as definitions of RER2 .

FOOT NOTE

2For the advanced market economies, parallel market rate hardly existed hence, the market rate index would be the relevant measure of NER in observed RER computation and the allied RER equation. The outcome would be consistent with the use of parallel rate in the relevant model for hitherto regulated economies.

Capital flows

Montiel [18] provides the springboard to launch the discussion in this section. In the paper, when capital flows are defined broadly to include external debt, the repayment warranted implied that capital flows would not generate a permanent effect on RER and thus should best be treated as a short run determinant. In this paper, the aggregative definition of capital flows in Montiel [18] is relaxed; such flows are seen more in the form of foreign direct investments that consist of both portfolio and direct investments. Given their transitory nature, capital flows connected with portfolio investment are more likely to generate short run effect on RER. On the other hand, those flows connected with direct investment might produce a different type of effect under certain circumstances. Where the recipient country is a committed and stable market economy that is reputed for policy credibility and political stability, other things given, the likelihood of sudden capital withdrawal becomes narrowed. Hence, such capital inflows could take on the nature of permanent flows and would most likely generate permanent or long run effect on RER. The initial price effect of the inflow would be dampened by the increased supply from the output of the investment. With both NER and domestic price level trending in different directions, a permanent effect on RER is inevitable. Thus, if capital flows (other than external debt) could be conveniently separated into short and long term flows as with portfolio and direct investment flows, the long term component might qualify as a long run fundamental as long as concerns over policy credibility and political stability of the recipient country do not arise3. The case of multilateral RER is not likely to be different from the espoused scenario.

FOOT NOTE

3A similar outcome is most likely where external debt is contracted for industrial development; if the emergent industries were efficient and the work force very productive, repaying the debt should not be a problem while the effect of high productivity growth on RER could be permanent. Some temporary liquidity support from the central bank might be necessary for this outcome. Alternatively, a sinking fund or an amortization scheme by which a fraction of the debt is paid into a dedicated foreign account annually towards eventual settlement could effectively shield the RER from a whiplash. In general, however, for most developing countries, this outcome would be an exception rather than the norm given their poor record of management of external resources and low labor force productivity

Productivity growth

Productivity growth is a long run growth driver and thus could influence long run RER in the sense that differential productivity growth affects the foreign and domestic price levels as well as the NER differently. In most model-based RER specifications, productivity growth differential is often excluded from taxonomy of long run fundamentals perhaps in order to distance the approach from the PPP doctrine4 . The position of this paper is that, if the concern was with sustainable long run RER, productivity growth should be a formidable fundamental5. In this sense, a key long run determinant of productivity growth, technological progress (TECHPRO) that is usually proxy by trend GDP would need be specified as a long run fundamental . However, as productivity growth differentials is the target, the trend GDP for the domestic economy would need to be subtracted from its foreign counterpart or counterparts as the case might be, that is, whether bilateral or multilateral RER is targeted. The average of all the bilateral differentials would apply in the case of multilateral RER.

FOOT NOTE

4The emphasis here is on productivity growth differentials and not just the peculiar ‘productivity differentials’ of the PPP and the productivity approaches; productivity is a level concept and unless sustained dynamically, its differential would be unlikely to produce any significant difference in pattern of effect.

5The fitted series from a regression of time on nominal GDP could constitute a more proximate technological progress series.

6Even the differentiated RER impact necessitated by the possible difference in the definition of RER analyzed in [31] in a fashion somewhat similar to [32,33], would only hold in the short run as the pass-through of tariff imposition to both domestic price level and NER should be complete in the long run.

7The two scenarios would equally well apply to the case of any other trade restrictive measure.

Trade restrictions

The most prominent among these is tariff imposition. Though an instrument of trade policy, it is nevertheless a violation of the free trade philosophy. Usually, it works by making imports more costly than domestic production. Thus, while causing aggregate demand to rise, it could also engender resource movement in favor of domestic production. Hence, it is a major component of the infant industry’s protection. However, in the context of long run RER, its effect appears to be unambiguous regardless of the nature of policy. Where the policy imposition is an occasional occurrence, its effect would be akin to a one-shot adjustment in the price level with offsetting movement in the NER. Also, when the policy takes the form of annual occurrence, it would change the NER and the domestic price level in the same direction thereby leaving the long run RER ultimately unchanged . Both scenario drive home the point that, price level changes, even when sustained, could not be a long run RER fundamental . The case of multilateral RER is unlikely to be any different under both assumptions.

Government expenditure on untradeable goods’ sector

Compared with the tradable goods sector, untradeable goods tend to enjoy a greater patronage of the government in expenditure matters. Expansionary fiscal policy which usually translates to relatively greater demand for untradeable goods, raises the price of untradeable relative to that of tradable. Thus, with a relatively larger marginal propensity to spend on the part of the government, the relative price of untradeable would rise. A similar effect would result from increase in public servants’ wages or/and indirect taxation [30]. However, it appears that under both mechanisms of fiscal expansion, there is an exaggeration of the true impact of such fiscal expansion. Fiscal expansion could cause price level increase but at best, such an effect would only be level in nature. By implication, such fiscal expansion could only also generate level effect on long run RER. Again, this outcome generalizes to price level effect which if sustained could only cause both domestic price level and NER to trend in the same direction and ultimately growing by the same proportion. Government expenditure therefore can only be a short run determinant of RER. This outcome applies to all definitions of RER.

Conclusion

Five traditional long run fundamentals of RER were reexamined for status credibility. The cases for exchange control, trade restrictions and government expenditure on untradeable goods were rather tenuous leading to recommendation for downgrade to short run status. Capital flows were found admissible only after adjustment. Direct investment flows that largely reflected permanent capital flows were found credible and thus recommended. The cases of portfolio investment flows and external debt of developing countries were not as strong and could not therefore be placed on the same pedestal.

One variable that was usually omitted from the model-based long run RER specifications, but which was found to be a crucial long run fundamental was productivity growth differentials. Its credentials were impeccable and as such, there is no credible justification for its exclusion. In all, the long run fundamentals of RER implied by this appraisal are, terms of trade, direct investment flows and productivity growth differentials. While not necessarily exhaustive or optimal, the list altogether avoided the Type I kind of error-listing as a long run fundamental what was actually only a short run determinant in the cases of exchange control, trade restrictions and government expenditure on untradeable, and possibly Type II error as well as the error of omission in the case of productivity growth differentials.

References

- Khan MS, PJ Montiel (1987) Real exchange rate dynamics in a small, primary-exporting country. IMF Staff Papers 34(4): 681-710.

- Edwards S (1988) Real and monetary determinants of real exchange rate behavior: Theory and evidence from developing countries. Journal of Development Economics 29(3): 311-341.

- Edwards S (1989a) Exchange rate misalignment in developing countries. World Bank Research Observer 4(1): 3-21.

- Meese RA, Rogoff K (1983) Empirical exchange rate models of the seventies: Do they fit out of sample? Journal of International Economics 14(1-2): 3-24.

- Cheung YW, Chinn M, Pascua AG (2005) Empirical exchange rate models of the nineties: Are any fit to survive? Journal of International Money and Finance 24: 1150-1175.

- Kilian L, Taylor MP (2003) Why is it so difficult to beat the random walk forecast of exchange rates? Journal of International Economics 60(1): 85–107.

- Faruqee H (1995) Long-run determinants of the real exchange rate: A stock-flow perspective. IMF Staff Papers 42(1): 80-107.

- Balassa B (1964) The purchasing-power parity doctrine: A reappraisal. Journal of Political Economy 72(6): 584-596.

- Samuelson PA (1964) Theoretical notes on trade problems. The Review of Economics and Statistics 46(2): 145-154.

- De Gregorio J, Wolf HC (1994) Terms of trade, productivity and the real exchange rate. NBER Working Paper No. 4807.

- MacDonald R, Ricci LA (2005) The real exchange rate and the Balassa– Samuelson effect: The role of the distribution sector. Pacific Economic Review 10(1): 29-48.

- Nurkse R (1945) Conditions on international monetary equilibrium. Essays in International Finance 4 (Spring), Princeton, NJ: Princeton University Press, USA.

- Raimundo S, Elbadawi I (2004) Theory and empirics of real exchange rates in developing countries. Documentos de Trabajo 324, Instituto de Economia. Pontificia Universidad Cato´ lica de Chile, Chile.

- Williamson J (1985) The exchange rate system. Policy Analyses in International Economics 5, Institute for International Economics, Washington DC, USA.

- Williamson J (1994) Estimates of FEERs. In: Williamson J (Ed.), Estimating equilibrium exchange rates, Institute for International Economics, Washington DC, USA, pp. 177-244.

- Edwards S (1989b) Real exchange rates, devaluation and adjustment: Exchange rate policy in developing countries. Cambridge MIT Press, MA, USA.

- Isard P, Faruque H (1998) Exchange rate assessment: Extension of the macroeconomic balance approach. IMF Occasional Paper No. 167.

- Montiel PJ (1999a) The long-run equilibrium real exchange rate: Conceptual issues and empirical research. In: Hinkle LE, Montiel PJ (Eds.), Exchange rate misalignment: Concepts and measurement for developing countries, Oxford University Press, Oxford, UK, pp. 219-263.

- Montiel PJ (1999b) Determinants of the long-run equilibrium real exchange rate: An analytical model. In L.E. Hinkle &. P.J. Montiel (eds.), Exchange rate misalignment: Concepts and measurement for developing countries, Oxford University Press, Oxford, UK, pp. 264-290.

- Barajas A, Chami R, Hakura DS, Montiel P (2011) Workers’ remittances and the equilibrium real exchange rates: Theory and evidence. Economia 11(2): 45-99.

- Mussa ML (1984) The theory of exchange rate determination. In: Bilson JFO, Marston RC (Eds.), Exchange rate theory and practice, University of Chicago Press, Chicago, USA, pp. 13-78.

- Aglietta M, Baulant C, Virginie C (1998) Why the euro will be strong: An approach based on equilibrium exchange rates. Revue Economique 49(3): 721-731.

- Clark PB, McDonald R (1998) Exchange rate and economic fundamentals: A methodological comparisons of BEERs and FEERs. IMF Working Paper 98/67.

- MacDonald R (2000) Concepts to calculate equilibrium real exchange rate: An overview. Discussion Paper Economic Research Group 3/00, Deutsche Bundesbank.

- Stein JL (1994) The natural real exchange rate of the US dollar and determinants of capital flows. In: Williamson J (Ed.), Estimating equilibrium exchange rates, Institute for International Economics, Washington DC, USA, pp. 133-176.

- Stein JL (1999) The evolution of the real value of the US dollar relative to the G7 currencies. In: MacDonald R, Stein JL (Eds.), Equilibrium exchange rates, Kluwer, Amsterdam, The Netherlands, pp. 67-102.

- Bouoiyour J, Serge R (2005) Exchange rate regime, real exchange rate, trade flows and foreign direct investments: The case of Morocco. African Development Review 17(2): 302-334.

- Ghura D, Grennes TJ (1993) The real exchange rate and macroeconomic performance in Sub-Saharan Africa. Journal of Development Economics 42(1): 155-174.

- Elbadawi IA (1994) Estimating long run equilibrium exchange rates. In: Williamson J (Ed.), Estimating equilibrium real exchange rates, Institute for International Economics, Washington DC, USA, pp. 93-131.

- Cottani JA, Cavallo DF, Khan MS (1990) Real exchange rate behavior and economic performance in LDCs. Economic Development and Cultural Change 39(1): 61-76.

- Khan M, Ostry J (1992) Response of the equilibrium real exchange rate to real disturbances in developing countries. World Development 20(9): 1325-1334.

- Edwards S, JD Ostry (1990) Anticipated protectionist policies, real exchange rates and the current account. Journal of International Money and Finance 9(2): 206-219.

- Ostry JD (1991) Tariffs, real exchange rates and the trade balance in a two-country world. European Economic Review 35(5): 1127-1142.

© 2019 Oluremi Ogun. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.jpg)

.png)

.png)

.png)