- Submissions

Full Text

Strategies in Accounting and Management

Thriving Amidst Turbulence: Unveiling the Resilience of Conglomerates in Economic Downturns

Rachele Anconetani1*, Maurizio Dallocchio2, Federico Pippo3 and Riccardo Picone2

1Department of Management, University of Turin, Italy

2Department of Finance - Bocconi University, Italy

3Department of Corporate Finance and Real Estate, SDA Bocconi School of Management, Milan, Italy

*Corresponding author:Rachele Anconetani, Department of Management, University of Turin, Italy

Submission:January 17, 2024;Published: March 04, 2024

ISSN:2770-6648Volume4 Issue4

Abstract

This study analyses the market performance of U.S. conglomerates during economic downturns, focusing on the benefits of diversification and Internal Capital Markets (ICMs). Spanning from 2000 to 2022, the research demonstrates that diversified conglomerates consistently outperform the market in recessions. The key finding is that ICMs act as alternative capital sources, facilitating resource reallocation and mitigating financial constraints in external markets, thereby enhancing conglomerate performance during downturns. Challenging the traditional view of a ‘conglomerate discount’, the paper highlights the overlooked strategic advantages of conglomerate structures, particularly during adverse economic conditions. The empirical analysis reveals that conglomerates, through diversification and effective use of ICMs, achieve reduced return variability and better investment opportunities, leading to market outperformance. In summary, the study offers new insights into the rationale behind conglomerate structures, underscoring their resilience and strategic advantage in economic downturns, and contributes to a more nuanced understanding of the ongoing adoption of diversification strategies by companies.

Introduction

The conglomerate structure, a subject of longstanding intrigue in the financial community, continues to be hotly debated. Despite extensive literature contributions by renowned authors, a definitive stance on the impact of diversification on firm performance and value still needs to be discovered. This polarized discourse oscillates between critiques of conglomerate structures, citing adverse valuation effects, and proponents underscoring their strategic advantages. Our study seeks to enrich this debate by exploring a relatively underexplored dimension: the resilience of conglomerates during economic downturns.

The prevalent academic narrative since the 1990s has been sceptical of conglomerates, mainly due to the “conglomerate discount” theory. This scepticism persists despite the historical prevalence of diversified structures among large U.S. firms and their ongoing use in business. Our paper addresses the paradox of the widespread adoption of conglomerates against the backdrop of their perceived disadvantages. Specifically, we investigate whether the conglomerate structure, with its distinct features, offers a competitive edge during recessions, aiding firms in navigating industry distress and financial constraints.

To this end, we conduct an empirical analysis focusing on U.S. conglomerates from 2000 to 2022. This period encompasses several significant recessionary phases, providing a rich context for our investigation. Our research delves into whether conglomerates outperform the market during economic downturns and whether such performance is contingent on credit market conditions and the efficacy of internal capital markets. In doing so, we aim to ascertain if diversification is a crisis-time advantage, enabling firms to demonstrate greater resilience and outperform their counterparts. Moreover, we explore whether this potential advantage can be attributed to the strategic role of internal capital markets, as Stein [1] suggested. Rather than viewing the positive and negative models of conglomerates as conflicting hypotheses, our study aims to contextualize the value addition of internal capital markets during economic recessions, potentially highlighting the bright side of the conglomerate structure.

Literature Review

The study of conglomerates has attracted significant scholarly attention, delving into their structure’s intricate details and facets. These entities, characterised by their diversified operations, have been debated, particularly concerning the value implications of their diversification strategies. Historically, the evolution of conglomerates has been closely linked to regulatory changes post- 1950, with a notable shift from horizontal and vertical mergers to conglomerate mergers Copeland 2005. This shift brought about a new era of academic inquiry focused on the economic rationale behind conglomerates. Initial research in this domain highlighted the financial synergies inherent in conglomerates, especially regarding improved access to capital markets and enhanced debt capacity. Pioneering studies by Lewellen [2] and later by Flannery, Rangan, and O’Connor 1993 emphasised the coinsurance effect, revealing how the combination of businesses with imperfectly correlated earnings streams could benefit conglomerates by expanding their debt-carrying capacity. Further exploration into the economies of capital costs by Levy and Sernat 1970 and Stapleton 1982 shed light on how diversification could lead to significant reductions in capital costs. These studies underscored the importance of understanding merging firms’ relative risks and earnings correlation in determining the post-merger debt capacity. The benefits of conglomerates extend beyond financial synergies. Research has consistently shown that diversification within conglomerates leads to risk reduction, echoing the advantages of a diversified investment portfolio. This effect contributes to a heightened level of predictability in returns and a notably diminished likelihood of default. Moreover, conglomerates have been recognised for their management efficiency, primarily attributed to centralised management’s role in fostering cooperation and efficient resource allocation across various business units [3,4].

However, conglomerates face notable drawbacks, particularly regarding their internal capital market dynamics. The literature has pointed out cross-subsidisation and excessive investments in less profitable opportunities [5,6]. These issues often stem from the complex governance structures within conglomerates, where differences in interests between central and divisional management can lead to suboptimal decision-making [7]. One of the most debated topics in conglomerate research has been the conglomerate discount phenomenon. Studies by Lang [8] and Berger [9] have shown that conglomerates tend to be undervalued in the market compared to focused firms. This discount has been attributed to overinvestment and cross-subsidisation complexities within conglomerates. Despite these challenges, conglomerates have demonstrated remarkable resilience during economic downturns. Their diversified structure and internal capital markets provide a strategic advantage against external financial constraints, as evidenced in the works of Aivazian [10] and Gopalan [11]. In conclusion, conglomerates present a multifaceted subject in strategic management, offering both challenges and opportunities. Their evolution, influenced by shifts in strategic focus and regulatory environments, has led to a nuanced understanding of their role in the modern economic context. The dichotomy of their structure, offering benefits like risk reduction and management efficiency against challenges like internal capital market inefficiencies and governance issues, remains a rich area for scholarly exploration. The resilience of conglomerates during economic downturns, in particular, highlights the strategic significance of diversification and internal capital markets, offering avenues for further research in emerging markets and the face of rapidly evolving global economic landscapes.

Methodology and Data Description

Data description

In this study, we delve into the dynamics of conglomerate performance during periods of economic distress, with a particular focus on the influence of credit market conditions. Emphasizing the role played by internal capital markets, our research pivots around two core questions: Do conglomerates overperform the market in times of economic distress? And is this overperformance dependent on the state of credit markets? To address these queries, we have developed a two-pronged analysis centered on the U.S. market, spanning the years from 2000 to 2022. The empirical research is anchored in an in-depth analysis of the performance of conglomerates in the United States during key periods of economic downturn, specifically in 2001, 2008-2009, and 2020. To facilitate a nuanced comparison with the market portfolio, we have constructed a ‘Conglomerate Index’ (CI), comprising a selection of diversified firms. This index is designed to represent conglomerate behavior over time, allowing us to isolate the variances in performance due to the utilization of internal capital markets. Data for this study were meticulously gathered using the Screener function of the Refinitiv Workspace database. Our focus was on U.S. companies primarily listed on the New York Stock Exchange (NYSE) and actively trading from 2000 to 2022. We followed the methodological footsteps of seminal studies like Berger [9] and Yan [12], applying stringent criteria to curate our sample. Companies whose primary operations are in the financial services (SIC codes 6000-6999) and utilities sectors (4900-4999) were excluded to avoid skewing results due to industry-specific characteristics. Following Maksimovic [13], and Duchin [14], we defined conglomerates as firms operating in multiple business segments, as indicated by their 3-digit SIC codes, hence creating a list of 415 conglomerates for our analysis.

To construct the Conglomerates Index (CI), we computed the daily logarithmic rates of return for these 415 firms, utilizing their market capitalization as weights in the index calculation. This approach allowed us to create a robust index that effectively mirrors the performance of U.S. conglomerates over the specified period. In order to draw meaningful comparisons between conglomerate performance and the broader market, we selected the Standard & Poor’s 500 Index (S&P500) and the NYSE Composite Index (NYSEC) as representations of the market portfolio. These indices were chosen due to their comprehensive coverage of U.S. equities and relevance to our sample’s characteristics. Central to our analysis is the Conglomerates Overperformance (COP) metric, which measures the daily extra-performance of the CI against both the S&P500 and NYSE Composite. This differential performance is key in assessing whether conglomerates indeed outperform market indices during economic downturns. The National Bureau of Economic Research’s (NBER) Recession Indicator plays a crucial role in this study, providing an objective demarcation of recessionary periods within our analysis timeframe. This indicator is relevant for pinpointing the exact duration of economic downturns, crucial for assessing conglomerate performance during these periods. Finally, to understand the influence of credit market conditions on conglomerate performance, we introduce the High Yield Bond Rate (HYBR) as a proxy for external credit market constraints. This rate, reflective of the conditions in the lending market, is particularly pertinent for understanding how conglomerates navigate financial constraints, a factor hypothesized to influence their relative performance against market indices.

Methodologies

Conglomerate overperformance during recession: The first empirical examination addresses the question: Do conglomerates overperform the market during economic distress? This inquiry is rooted in the literature on conglomerates, particularly regarding their potential competitive advantages during recessions due to internal capital markets. We analyse the extra-performance of U.S. conglomerates over market portfolios - specifically the S&P500 and NYSE Composite - across both crisis and expansion periods, testing for statistically significant outperformance.

The analysis compares the performances of conglomerates

and market portfolios during recessions and expansions using

the Conglomerates Overperformance (COP) variable. This

methodology, though differing slightly from existing literature,

aims to isolate the impact of internal capital markets by comparing

two highly diversified indexes: our Conglomerate Index and

a standard market index. This comparison assumes that both

indexes face similar systematic risks due to their diversified

nature. To test the first empirical research, we conducted a

t-tests to examine if conglomerates exhibit significantly higher

average performance during economic downturns, as compared

to expansions. The analysis begins with a segregation of the COP

variables into recessionary and expansionary periods, followed

by a t-test evaluating the significance of conglomerates’ average

overperformance. The hypotheses tested are:

1. H0: μCOP = 0 (COP mean is equal to 0)

2. H1: μCOP > 0 (COP mean is greater than 0)

A similar approach is taken for both the S&P500 and NYSE

Composite market portfolios. The analysis then extends to

comparing conglomerates’ extra-performance during economic

downturns and expansions. We use one-tailed t-tests to examine

whether the average excess return of diversified firms over the

market is significantly positive during both periods. Lastly, we

compare the average overperformance during recessions against

that during expansions using an Independent Samples t Test. This

test, preceded by Levene’s Test for Equality of Variances, evaluates

if conglomerates’ extra-performance during crises is statistically

higher than during expansions, thus indicating a specific advantage

of the conglomerate structure during economic downturns. ‘After

having examined if the homogeneity of variances of the two

subgroups could be assumed or not in the test, the Independent

Samples t Test is conducted. Then, the hypothesis considered are:

1. H0: μCOP_crisis = μCOP_expansion (the population means of COP_

crisis and COP_expansion are equal)

2. H1: μCOP_crisis > μCOP_expansion (the population mean of COP_

crisis is higher than the mean of COP_expansion)

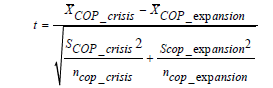

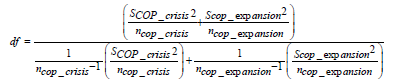

The one-tailed test is performed for both market portfolios (S&P500 and NYSE Composite). In addition, the level of significance assumed is 5%. Given the relevance of the Independent Samples t Test for our research, we believe it is appropriate to examine in higher detail the test statistics for this test. In particular, when the two independent samples are assumed to be drawn from populations with unequal variances (with equal variances not assumed, as it is the case in our analysis after having checked with the Levene’s Test), the test statistic t is computed as:

where x stands for the mean of each sample, n for the sample size (i.e. number of observations) of each sample, and for the standard deviation of each sample. The calculated t value is then compared to the critical t value from the one-tailed T-student distribution with degrees of freedom:

Now, after having computed the relevant values, if the calculated t value is higher than the critical t value, the null hypothesis is rejected. In conclusion, this first analysis allows us to understand if conglomerates demonstrate to outperform the market during periods of crisis and expansion. In addition, if they prove to have higher performance throughout both periods, we investigate if the extra-performances during recessions are significantly higher than the extra-performances during expansions, confirming the original hypothesis of conglomerates resulting to be more resilient during periods of crisis.

Influence of credit market conditions on conglomerates overperformance: In our second empirical analysis, we delve deeper into a possible explanation for conglomerates’ overperformance during periods of economic downturn. While the first study ascertained whether conglomerates generally perform better during recessions, this analysis explores if credit market conditions significantly influence conglomerate performance, positing that this could be a key factor during crises due to the unique advantages of internal capital markets. Our objective is to address whether conglomerates’ overperformance is influenced by credit market conditions, and hence, by the role played by the internal capital market.

This analysis specifically investigates whether credit market conditions, exemplified by the High Yield Bond Rate (HYBR), are significant drivers of conglomerates’ overperformance. Literature suggests that internal capital markets, which allow resource allocation among different business units, provide conglomerates with a unique advantage, especially during economic downturns when external financing becomes more challenging. Our analysis aims to empirically test this theory, examining if credit market conditions are a significant driver of conglomerates’ overperformance. At first glance, this analysis may appear as a simple extension of the first. However, while it is expected that credit conditions worsen during recessions, this study provides a more nuanced examination by not strictly adhering to recessionary and expansionary periods. It seeks to empirically validate the hypothesis that internal capital markets are particularly effective during challenging credit conditions, thereby influencing conglomerates’ ability to outperform the market.

Unlike the recession indicator, the pattern of credit market conditions (HYBR) does not perfectly align with economic downturns. Thus, employing a simple linear regression with HYBR as the independent variable allows for a more accurate analysis of credit condition variability. This approach also addresses the persistence of difficult credit conditions beyond defined recession periods. To maintain focus and avoid the issues of collinearity, we opted for a univariate linear regression, employing HYBR as the sole independent variable. In this second empirical analysis, we aim to determine whether internal capital markets are an advantage for conglomerates, explaining their overperformance and resilience during downturns. The analysis involves a univariate linear regression with the COP variable (representing conglomerates’ overperformance over S&P500 and NYSE Composite indexes) as the dependent variable and HYBR (representing credit market conditions) as the independent variable. The time series for both variables covers 2000 to 2022, and we aim to test whether HYBR is a significant driver of conglomerate overperformance. Before conducting the regression, we conducted necessary econometric checks to ensure the robustness of the results. This involved adjusting the independent variable to account for its stochastic trend, as indicated by ADF and PP tests. We then differentiated the variables to ensure stationarity.

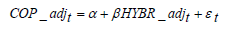

The regression model is expressed as:

where COP_adjt indicates the extra-performance of conglomerates over market portfolio at time t (with COP_adj being the dependent variable, or response), α stands for the model’s intercepts, β for the regression coefficient, HYBR_adjt indicates the credit market condition - represented by the high-yield bond rate - at time t (with HYBR_adj being the independent, or explanatory, variable), and ԑt stands for the accidental error term for the single observation. Also, in this case, as always done, the single linear regression is developed twice, considering COP over both market. portfolios (S&P500 and NYSE Composite).

Results

Conglomerates overperformance during recessions

This first analysis is centered on the study of the COP variable and is developed through different t-tests testing the significance of the average COP in different types of periods and of the difference of COP’s means between times of crisis and expansion. The first step of the analysis is the investigation of conglomerates’ overperformance throughout the entire time series. As exhibited in Table 1, the average COP is significantly higher than 0 both for S&P500 and NYSE Composite indexes even considering a level of significance of 1%. In particular, the average daily overperformance above S&P500 is 0.015%, while it is 0.018% if comparing conglomerates with NYSE Composite. Then, it suggests that on average conglomerates tend to outperform the market portfolios (both S&P and NYSE) as a general statement, regardless of the period considered. After having analyzed the daily overperformance throughout the whole sample, given the focus of our analysis on the conglomerates’ performance during periods of economic downturn, it is important to investigate extra-performance during periods of recession, defined according to NBER Recession Indicator. In this case, the empirical study showed that during crises the daily average overperformance proves to be higher than the one observed in the whole sample. In particular, the mean of the daily COP_crisis over the S&P500 index is 0.046%; while the average daily extra-performance over the NYSE Composite during recessions is 0.064%. As Table 1 shows, both means prove to be significantly higher than 0 with a level of significance of 5%, rejecting the null hypothesis and confirming how on average during recessions conglomerates tend to outperform the market. Before reaching rushed conclusions on the ability of conglomerates to outperform the market specifically during crises, it is important to see if such ability can be noticed also during periods of expansion, as defined by NBER. Therefore, a t-test is conducted accordingly. The analysis shows that also in expansion periods there is evidence that conglomerates significantly outperform the market. In fact, Table 1 illustrates the average conglomerates daily overperformance in expansions (which is equal to 0.012% above S&P500 and 0.013% above NYSE Composite) and presents the corresponding p-values, which are significant for both results even at a level of significance of 1%. Then, empirical data proves that conglomerates on average tend to outperform the market also during periods of expansion, even if exhibiting a lower average extra-performance compared to periods of recession.

Table 1:Results of t-tests on Conglomerates Overperformance. Notes: Level of significance: ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level.

Now, after having noticed that conglomerates tend to present on average a positive extra-performance over the market both in periods of distress and in periods of expansion, we are interested in understanding if the ability of conglomerates to outperform the market is specifically accentuate and emphasized during periods of distress, suggesting a specific benefit of conglomerate structure during such periods. The analysis is performed through an Independent Sample t Test. As far as the COP above S&P500 index is concerned, the average extra-performance during crisis exceeds the average overperformance during expansions by 0.034%. However, as shown in Table 2, the difference is not significantly higher than 0 at a level of significance of 5% (but only at a level of significance of 10%). On the contrary, as regards COP over NYSE Composite, the difference between the average extra-performances during crisis and expansion is equal to 0.052%. In this case, p-value results to be low and the result is statistically significant at a level of confidence of 5%. Therefore, the empirical research proved that there is statistical evidence supporting that on average conglomerates outperform their specific market portfolio (NYSE Conglomerates) during periods of economic downturn more compared to their extra-performance exhibited during periods of expansion. Similar evidence can be found with a lower level of significance (10%) also related to COP above S&P500 index. The initial phase of this study provided critical insights, transcending the immediate scope of the formulated research question. Specifically, it analysed the excess returns of conglomerates over an extensive period (2000- 2022), rather than exclusively focusing on recessionary phases. This comprehensive approach revealed that conglomerates, on average, demonstrate superior daily performance compared to market portfolios. These findings corroborate existing literature suggesting that diversified firms generally outperform focused firms. This study enriches the body of knowledge by introducing an alternative methodological perspective.

Table 2:Results of Levene’s Test and Independent Sample t Test. Notes: Level of significance: ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level.

The results indicate that conglomerates consistently outperform the market across various economic conditions, both in periods of recession and expansion. This overarching trend was further examined by focusing on recessionary periods. The analysis confirmed that conglomerates tend to achieve higher absolute returns compared to market portfolios during these times, thereby addressing the specific research question posed for this segment of the study. Given the broad-based nature of the diversification benefits observed, it became essential to ascertain whether these findings were unique to recessionary periods or merely reflective of a more general trend. Subsequent analysis during expansionary periods yielded similar results, suggesting significant excess returns for conglomerates in these phases as well. This comprehensive examination, encompassing three distinct t-tests, suggests a consistent trend of conglomerates outperforming the market in both recessionary and expansionary phases. However, this does not inherently highlight any specific advantages of conglomerates during economic downturns. Nevertheless, the study observed a significantly higher absolute daily excess return for conglomerates during recessions compared to expansions. This led to a revaluation of the preliminary interpretation. An Independent Sample t Test, comparing the excess returns in these two distinct periods, provided a pivotal insight. It confirmed that conglomerates not only consistently outperform the market across various economic cycles but also exhibit significantly higher excess returns during recessions as compared to expansion periods. This pattern was particularly evident when examining returns against the NYSE Composite Index, which served as a benchmark for our conglomerate sample. The statistical evidence from this test underscores the enhanced performance of conglomerates during recessions relative to expansion periods. However, the application of this analysis to the S&P 500 Index did not yield results with comparable statistical significance at the conventional 5% confidence level, achieving significance only at the 10% level. This discrepancy could be attributed to the inherent differences between the S&P 500, which predominantly represents large-cap U.S. companies, and our more diverse sample of conglomerates listed on the NYSE. A future study focusing on a sample of largecap conglomerates across various U.S. exchanges might provide insights with greater statistical significance. Despite this limitation, the alignment between our sample and the NYSE Composite Index suggests that our findings may offer broader implications for understanding the performance dynamics of conglomerates compared to their market counterparts in strategic management contexts.

Influence of credit market conditions on conglomerates overperformance

The second analysis is structured to investigate if credit market conditions might be considered a significant driver for conglomerates’ excess return above market portfolios. Accordingly, we run a linear regression using the conglomerate overperformance, indicated by the variable COP (both over S&P and NYSE), as dependent variable and the credit market conditions, represented by the variable HYBR, as independent variable. However, the regression can be conducted only after having adjusted the variables by performing a first-order differentiation in order to ensure the robustness of regression’s results. Then Table 3 exhibits the results of the regressions run considering COP compared to both S&P500 and NYSE Composite. In particular, the analysis shows a positive regression coefficient in both cases (which is equal to 5.407e-03 for the COP over S&P500 and 9.321e- 03 for the COP above NYSEC). In addition, in both regressions there is evidence that the coefficient is statistically significant at all levels of confidence (due to very low p-values). Therefore, it is possible to notice how credit market conditions have a significant influence on conglomerate extra-performance. In fact, the significantly positive coefficient suggests that there is evidence that higher HYBR induces also higher COP, conglomerates overperformance above market portfolios. In other words, when financial constraints are higher, diversified firms tend to outperform more the market portfolio thanks to the role played by internal capital markets. The subsequent analysis investigates a potential driver of conglomerates’ outperformance, focusing specifically on the role of Internal Capital Markets (ICMs). This focus stems from insights gleaned from our comprehensive literature review, which identifies the ICM as a crucial factor for diversified firms, particularly during economic recessions. It is critical to note that the benefits of ICMs become particularly significant under adverse external credit conditions, as they enable conglomerates to reallocate financial resources internally, bypassing external credit constraints. In this study, we employed a univariate linear regression analysis to examine whether ICMs contribute significantly to conglomerates’ excess returns, especially in the context of fluctuating credit market conditions. This method extends our initial analysis and seeks empirical evidence supporting the hypothesis that ICMs are instrumental in conglomerates’ enhanced performance during recessions. The results of our analysis indicate a positive correlation between deteriorating credit market conditions and the relative outperformance of conglomerates. Specifically, when credit market conditions worsen, as indicated by higher High-Yield Bond Rates (HYBR) and more expensive external financing, conglomerates tend to outperform the market more significantly. In contrast, when credit market conditions are more favourable, the extent of conglomerates’ outperformance is less pronounced. Although these findings are derived from a relatively straightforward analytical approach, they highlight the conditional value of ICMs: they are particularly beneficial under significant credit constraints, while their importance lessens in more stable financial environments.

Table 3:Results of the Univariate Linear Regression. Notes: Level of significance: ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level.

The presence of ICMs emerges as a critical element that endows conglomerates with excess value. In times of negative external market conditions, the ability to utilize internal capital sources, thereby avoiding external credit limitations, provides a considerable strategic advantage. Conversely, in positive credit climates, while ICMs continue to offer an alternative source of finance, their strategic significance is reduced due to the relative ease of acquiring external capital. In conclusion, this analysis supports the significant role of ICMs as an additional capital source, especially during periods of unfavourable credit market conditions, influencing conglomerates’ ability to outperform the market. It addresses the specific research question of whether conglomerates’ outperformance is dependent on credit market conditions. Our findings confirm the hypothesis that conglomerates’ superior performance is significantly influenced by these conditions, as they can benefit from ICMs during times of credit crunch and high financing costs. Thus, we establish ICMs as a key determinant of conglomerate overperformance, particularly in challenging financial contexts.

Conclusion

The analyses, though differing in perspectives, converge on the central theme of conglomerates’ market outperformance during economic downturns, examining both the market outcomes and their underlying explanations. The first analysis leads to the inference that diversification acts as a competitive edge during recessions, with diversified firms consistently outperforming the market in times of distress. Building upon this, the second analysis extends the narrative by providing empirical support for the mechanisms driving the observed outcomes in the first study. Specifically, the results indicate that internal capital markets (ICMs), by serving as an alternative capital source and circumventing financial constraints in external markets, are pivotal in enabling conglomerates to outperform the market. Moreover, drawing from insights by Gopalan [11], ICMs offer an added advantage during crises. Due to the diversified structure of conglomerates, they facilitate flexible resource reallocation towards sectors with more promising investment and growth opportunities, mitigating potential financial limitations. Consequently, given their enhanced value during recessions, ICMs are implicated in the significant extra-performance of conglomerates compared to markets during economic downturns. This study contributes novel insights to the literature on conglomerates’ structural rationale. The empirical evidence suggests that the conglomerate structure, particularly due to its internal capital markets and diversified nature, confers a distinct advantage in recessionary periods, leading to resilience and market outperformance.

Our investigation builds upon the foundational work of Lang [8] and Berger [9], who primarily associated conglomerate structures with the concept of a ‘conglomerate discount’. While much of the diversification literature has focused on this market valuation discount, our paper argues that this perspective may overshadow a more nuanced understanding of the advantages and drawbacks of conglomerate structures. The historical prevalence of diversification strategies, especially in the 1970s and to some extent today, suggests underlying benefits that render the conglomerate structure appealing for many companies. Our research delves into these potential benefits, examining whether the features of conglomerates, notably diversification and ICMs, enable exceptional resilience during economic downturns. We provide a theoretical background on diversified companies, defining conglomerates, discussing their historical use, and emphasizing their key characteristics crucial for interpreting our analysis results. We also review existing literature on the advantages and drawbacks of diversified structures and ICMs, highlighting findings on conglomerates’ corporate valuation and performance, particularly during recessions. The empirical analysis, covering the period from 2000 to 2022, demonstrates that U.S. conglomerates generally outperform market portfolios in daily market returns, with this outperformance being more pronounced during economic downturns. The role of ICMs and diversification in enabling this performance becomes apparent, particularly during adverse credit market conditions. ICMs provide an alternative capital source, allowing conglomerates to internally reallocate funds for investment opportunities without relying on external credit markets [15]. Furthermore, diversification across industries with varying recession impacts and imperfectly correlated revenue streams helps conglomerates reduce return variability and exploit arbitrage opportunities, focusing investments in more promising sectors. Our study offers significant insights into the rationale behind conglomerate structures and their widespread adoption. It highlights how diversification, particularly through the mechanism of ICMs, can be a strategic advantage during economic downturns, ensuring greater resilience and market outperformance. This finding underscores a potentially influential factor in the historical and ongoing adoption of diversification strategies by companies.

References

- Stein J (2003) Agency, information and corporate investment, In: Handbook of the Economics of Finance, edited by: George Constantinides, Milton Harris and René Stulz, Elsevier, pp. 111-165.

- Lewellen WG (1971) A pure financial rationale for the conglomerate merger. The Journal of Finance 26(2): 521-537.

- Chandler AD (1977).

- Tremblay VJ, Tremblay CH (2012) Horizontal, vertical, and conglomerate mergers, In: New perspectives on industrial organization, chapter 18, springer texts in business and economics, pp. 521-568.

- Meyer M, Milgrom P, Roberts J (1992) Organizational prospects, influence costs, and ownership changes. Journal of Economics and Management Strategy 1(1): 9-35.

- Jensen MC (1986) Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review 76(2): 323-329.

- McNeil C, Niehaus G, Powers E (2002) Management turnover in subsidiaries of conglomerates versus stand-alone firms. Journal of Financial Economics 72(1): 63-96.

- Lang L, Stulz R (1994) Tobin’s q, corporate diversification, and firm performance. Journal of Political Economy 102(6): 1248-1280.

- Berger P, Ofek E (1995) Diversification’s effect on firm value. Journal of Financial Economics 37(1): 39-66.

- Aivazian VA, Rahaman MM, Zhou S (2019) Does corporate diversification provide insurance against economic disruptions? Journal of Business Research 100: 218-233.

- Gopalan R, Xie K (2011) Conglomerates and industry distress. The Review of Financial Studies 24(11): 3642-3687.

- Yan A (2006) Value of conglomerates and capital market conditions. Financial Management 35(4): 5-30.

- Maksimovic V, Phillips G (2008) Do conglomerate firms allocate resources inefficiently across industries? Theory and Evidence. Journal of Finance 57(2): 721-767.

- Duchin R, Goldberg A, Sosyura D (2017) Spillovers inside conglomerates: Incentives and capital. The Review of Financial Studies 30(5): 1696-1743.

- Copeland TE, Weston JF (1988) Financial theory and corporate policy, (3rd edn), Addison-Wesley, New York, USA.

© 2024 Rachele Anconetani. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.png)

.png)

.png)