- Submissions

Full Text

Strategies in Accounting and Management

Do IFRS Adoption Enhance the Financial Reporting Quality of DFM Listed Companies

Mohammed Noor Almehairi, Abdulla Ketait, Rashid AlQassim and Rihab Grassa*

Higher Colleges of Technology, United Arab Emirates

*Corresponding author: Rihab Grassa, Higher Colleges of Technology, United Arab Emirates

Submission:June 12, 2020Published: December 20, 2021

ISSN:2770-6648Volume3 Issue2

Abstract

Different accounting standards may lead to differences in financial reporting and its quality even with same set of accounting data. Previous studies acquired through cross-country analyses show that the adoption of International Financial Reporting Standards (IFRS) improves considerably the financial reporting quality and comparability and thereby favorable economic consequences. In this research, we try to assess whether the quality of the financial reporting of listed non-financial companies in Dubai Financial Market (DFM) has been improved after the adoption of the IFRS or not. More precisely, we look in this research to the five fundamental characteristics of the accounting information, which are: (1) relevance, (2) faithful representation, (3) understandability, (4) comparability and (5) timeliness. For this purpose, we used a qualitative approach developed by the Nijmegen Centre of Economics (Nice). Our sample consist of all nonfinancial companies listed on DFM observed over the period from 2015 to 2018. By all counts, our research finding provide evidence that it is no wonder that the adoption of IFRS has increased the quality of financial reporting from year to year. The outcomes proved that the qualitative factors of relevance, understandability, and comparability level increased considerably after IFRS adoption. The findings of this paper could lead to high level of awareness about the importance of financial reporting quality. Higher level of IFRS compliance play a significant role in attracting global investors’ interest to the local markets, especially in a developing country like the UAE.

Keywords: IFRS; Financial reporting quality; DFM; Nice; UAE

Introduction

Nowadays the modern economies rely on cross-border transactions. More than a third

of financial transactions occur cross-border and that number is expected to keep growing

as the world economy grows. Therefore, applying international standards promoting higher

level of transparency, accountability and efficiency would help investors diversify and extend

their investment cross-border. The international financial reporting standards (IFRS) is a

comprehensive international accounting framework developed to uniform financial reporting

and disclosure across the world. Today, more than 120 countries adopted IFRS and make it

mandatory for companies operating in their economies [1]. Rousse [2] argue that the main

objective of IFRS is to bring a higher level of transparency, accountability and efficiency to

the financial markets around the world, as well as provides guidance on how the statements

should be prepared. Previous studies discussed the important role played by IFRS to improve

transparency and guaranty better comparability of financial reports [3-12]. Indeed, IFRS

requirements urge companies to increase the level and quality of information disclosed in the

financial report, which in turn help decision-makers by allowing them to better understand

competitors’ financial reports and thereby enhances information transfers across many

firms and across countries. The UAE has adopted the IFRS on 1 July 2015. Since that date, all

listed companies have to prepare their financial statements according to IFRS. Other firms are encouraged to use IFRS as well, except for certain government

entities where International Public Sector Accounting Standards

(IPSAS) is applied (IFRS.Org).

Launched as a public institution with an independent legal

entity under Decree 14/2000 issued by the Government of Dubai,

Dubai Financial Market (DFM) began its operations on 26 March

2000. On 27 December 2005, the Executive Council of Dubai chose

to transform DFM into a public shareholding company with a

capital of AED 8 billion split into 8 billion shares. The public offering

was satisfied with a high need that surpassed all expectations,

with agreements that amounted to AED 201 billion DFM. Within

a short period, DFM has quickly evolved into a leading financial

market beyond the GCC region. Its constant and strategic actions

have strengthened Dubai as a center of supremacy in this area of

the world and enriched its front position as a strong capital market

hub that embraces the best global exercises to meet the evolving

demands of its investors regionally and globally. DFM functions as

a secondary market for the trading of securities issued by public

shareholding companies, mutual funds, local public institutions,

and bonds issued by federal or local governments, as well as any

other domestic or foreign DFM approved financial instruments.

Therefore, it looks interesting to assess the effect of IFRS adoption

on financial reporting quality of listed companies in DFM and to

what extend IFRS promote the transparency of financial reporting

of these companies. Using a sample of 20 listed non-companies in

DFM observed over the period 2015-2018, we employ in this study

a qualitative approach based on a financial reporting quality index

developed by Nijmegen Center for Economics (NICE). Our paper

findings reveal that the characteristics of accounting information

namely relevance, faithful presentation, understandability and

comparability has increased considerably year over year after the

adoption of IFRS, which implies in turn, that financial reporting

quality increased considerably from year over year. The reminder

of the paper is organized as follows. Section 2 reviews the relevant

prior studies. Section 3 describes sample selection, data sources

and variables’ definition and methodology. Section 4 highlights

the research methodology and discusses the results. Section 5

concludes the paper and offer some recommendations.

Literature Review

Previous studies discussed the effect of IFRS adoption on the

quality of financial reporting and accounting information. Schipper

[13] debates that IFRS help to improve financial statement

comparability and allow investors and firms to make better

investment decisions. Indeed, greater comparability increases the

information available to decision-makers by allowing them to better

understand competitors’ financial reports and thereby enhances

information transfers across many firms and across countries.

By encouraging managers to prepare financial statements based

on the essence of an economic transaction rather than a set of

relatively inflexible rules, IFRS can ensure that managers account

for like transactions in a like manner and dissimilar transactions

differently. Barth [14] argue that IFRS adoption increase

significantly the comparability of financial statements across

IFRS firms and a size-and industry-matched sample of US firms.

Moreover, the comparability across IFRS and US firms is generally

higher when the adoption of IFRS is mandatory. The authors provide

evidence that 23 mandatory IFRS adoption and the international

co-ordination of accounting regulations have improved the global

comparability of accounting information. Healy [15], Leuz [16],

Daske [17] show that the asymmetry of information decreased

considerably after the adoption of IFRS due to the increase of the

financial reporting quality. Alali [18], Karampinis [19] argue that

by implementing IFRS, the financial statement presented became

more relevant for two main reasons. First, IFRS are widely used.

Second, IFRS employs the fair value method, which reflect the real

economic situation of the company.

Jayaraman [10] document that IFRS-induced improvements

in accounting comparability are around three times larger within

euro-adopter countries than in other EU countries. They conclude

that IFRS adoption is better at improving reporting comparability

when the underlying economic environments are similar. Cascino

[7] report that the comparability effect of mandatory IFRS adoption

is mainly observed for public firms. Yip and Young conclude that

IFRS adoption improves the cross-country comparability of

financial information by making reports of similar firms look more

alike but does not make reports of firms with different economic

activities appear any more dissimilar. However, they note that

comparability improvements are primarily observed only in firm

pairs from countries with the same legal origin (measured as either

common- or code-law countries). Nijam [20], taking into account

many factors including such as, value relevance, disclosure quality,

and cost of capital, show that different environments can affect

the decision of adoption of IFRS. As an example, the adoption of

IFRS in the UK has strengthened the quality of reporting. Loannis

[21] argue that IFRS require providers of the financial statements

to disclose greater information compared to domestic GAAP

standards, that will allow the users of these financial statements to

be able to have a better idea of what these firms are actually doing

and their real standings in the market. As well as having a more

in-depth disclosure requirements, the evaluation of the reporting

quality of these companies depends on more information like the

volume of information and their decision usefulness. In relation

to the cost of capital, the adoption of IFRS has proven that it will

improve the situation of the cost of capital for companies, as it will

have better economic consequences especially if the companies

adopt the IFRS voluntarily, before it is applied mandatorily by the

government of a specific country. Yurisandi [3] examine the effect

of the adoption of IFRS on the quality of the financial reporting for

a sample of listed companies in the Indonesian Stock Exchange

with the highest market capitalization, and covering the period

from 2009 to 2013, with 2009-2010 being the pre-IFRS period

and the 2012-2013 period is considered the post-IFRS period. The

paper findings provide evidence that quality of financial reporting

enhanced considerably after IFRS adoption. Van Beest [4] discusses

the effect of IFRS on Relevance, Representational Faithfulness, Understandability, Comparability, and Timeliness. The paper

findings shows that the adoption of IFRS standards has increased

the financial reporting quality across all these factors except for

Representational Faithfulness which had shown a negative trend,

and the Timeliness had a very small change and it was not significant.

While the effect of IFRS adoption on the financial reporting quality

have been discussed widely on developed countries, little is known

about its impact on the UAE companies. Therefore, we extend

previous research on the field by assessing the effect of IFRS

adoption on the reporting quality of listed companies in DFM.

Material and Method

To assess the effect of IFRS adoption on the financial reporting quality of DFM listed non-financial companies, we employed a qualitative index developed by Nijmegen Centre for Economics (Nice) developed by van Beest [4] and used by previous studies such as: Yurisandi [3]. Nice developed a comprehensive five point Likert scale financial reporting quality index based on IASB and FASB requirements regarding the qualities of the disclosed accounting information, which are relevance, faithful representation, understandability, comparability and timeliness. The qualitative characteristic of relevance, faithful representation, understandability, comparability, verifiability and timeliness were operationalized into to 21 questions with a 5-point Likert scale option. However, verifiability and timeliness are the two qualitative characteristics not captured by Nice model were added into the model. The 5-point Likert scale options attracts between a minimum score of 1 point (poor position) and a maximum score of 5points (excellent position). Table 1 provide a full description of Nice reporting quality index. A t- test was utilised for the data analysis. Indeed, the t-test allows reporting quality a continuous dependent variable to scale against categorical variable reporting regime. In testing the hypothesis, the means scores generated through Nice reporting quality index were compared over the years of observation. Moreover, the test was carried out at 5% level of significance. Our sample consists of listed companies in DFM. The firms included in our sample, have to satisfy the three conditions: First, it has to belong to a non-financial sector. Financial companies firms such as banks, insurance firms and investment firms are excluded because their reports are not comparable to those of non-financial firms. Second, this study focuses on financial reports and not other media of financial communications such as interim reports. Third, the non-financial firm, has to have at least one annual report, from 2015-2018. We choose 2018 as the end year for the study because some listed companies did not publish yet the financial report of 2019. Our sample consisted of 20 non-financial companies.

Table 1: Nice Index.

Result and Discussion

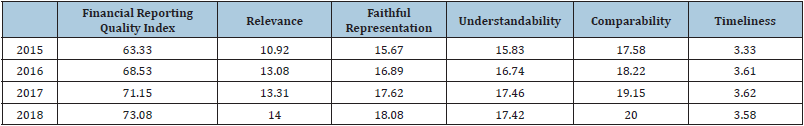

Table 2A & 2B report our main descriptive statistics for our sample. As reported in Table 2A, the financial reporting quality index has increased from 63.33 in 2015 to 73.08 in 2018 showing a higher level of reporting quality especially for relevance, faithful representation, understandability and comparability. Table 2B reports the descriptive statistics for our sample. The average financial reporting quality index is 69.2 (median is 69.5) the average Relevance score is 12.87 (median is 13), the average Faithful representation score is 17.10 (median is 17), the average Understandability score is 16.9 (median is 17). The average Comparability score is 18.77, a median of 17.5, a minimum of 13, a maximum of 28, and a standard deviation of 3.68. The average Timeliness score is of 3.54 (median is 4). The Timeliness score for our listed companies varies from 1 to 5.

Table 2A: The evolution of the financial reporting quality during 2015-2018.

Table 2B: Descriptive statistics.

Table 3 reports our main findings of T-test of variation of the Financial Reporting Quality index after IFRS adoption. According to Table 3, the overall financial reporting quality index has increased from year to year after the IFRS adoption. The results are significant at a level of 1%. The same finding is reported for the components of the financial reporting quality index: relevance, faithful representation, understandability and comparability. However, we did not observe a difference for timeliness quality after the adoption of IFRS. Indeed, after the adoption of IFRS in 2015, companies need more time to prepare its financial statements according to IFRS presentation and disclosure requirements. The passage from pre IFRS to post IFRS, will be costly for companies and may require longer time for companies to respond to IFRS requirements. Our findings are in line with Barth [5] findings showing that the accounting quality increased considerably after the implementation of international accounting standards because of the increasing from timely loss recognition and the value relevance. Yurisandi [3] report that financial reporting quality has improved extensively after the adoption of IFRS in Indonesia compared to the pre IFRS implementation. Beest [4] provide evidence that the relevance of the financial reporting using IFRS increased when we compared with those using US GAAP. Indeed, the information disclosed in the financial statements prepared according to international accounting standards, reflect better the real economic condition and financial position of companies comparing those prepared according to US GAAP. Therefore, the character of faithful presentation of the financial reporting is more visible after IFRS adoption [22].

Table 3: T-test- Financial reporting quality over 2015-2018.

***Significant at 1%.

Conclusion

In this paper we try to assess whether there is an increase in

financial reporting quality after the adoption of IFRS or not for a

sample of non-financial companies listed in DFM during the period

2015-2018. Using the Nice financial reporting index, our study

provides evidence the characteristics of accounting information

namely relevance, faithful presentation, understandability and

comparability has increased considerably year over year after the

adoption of IFRS, which implies in turn, that financial reporting

quality increased considerably from year over year. Our paper

contributes to the literature on financial reporting in general and in

the UAE context in particular. Indeed, this is the first paper assessing

the effect of IFRS adoption on the quality of financial reporting of

listed companies in UAE. Our findings may be considered as a pilot to

serve as the basis for further research discussing the determinants

of financial reporting quality after the adoption of IFRS.

As regards the practical implications of our research, our

finding seems to be useful for both preparers and users of annual

reports, for regulators and policy makers. Indeed, the results of this

paper could lead to high level of awareness about the importance

of financial reporting quality. Higher level of IFRS compliance play

a significant role in attracting global investors’ interest to the local

markets, especially in a developing country like the UAE. Therefore,

DFM listed companies have to work further on improving the level

of financial reporting quality by disclosing of more information

related to business risk and opportunities to help investors to make

relevant investment decisions.

References

- Bragg S (2019) What is IFRS?

- Rouse M (2011) What is IFRS (International Financial Reporting Standards)?

- Yurisandi T, Puspitasari E (2015) Financial reporting quality-before and after IFRS adoption using nice qualitative characteristics measurement. Procedia-Social and Behavioural Sciences 211(25): 644-652.

- Beest F Van, Braam G, Boelens S (2009) Qualitative of financial reporting: Measuring qualitative characteristics. Nice Working Paper, pp. 09-108.

- Barth ME, Landsman WR, Lang M (2008) International accounting standards and accounting quality. Journal of Accounting Research 46(3): 467-498.

- De Franco G, Kothari SP, Verdi RS (2011) The benefits of financial statement comparability. Journal of Accounting Research 49(4): 895-931.

- Cascino S, Gassen J (2015) What drives the comparability effect of mandatory IFRS adoption?. Review of Accounting Studies 20(1): 242-282.

- Young S, Zeng Y (2015) Accounting comparability and the accuracy of peer-based valuation models. The Accounting Review 90(6): 2571-2601.

- Brochet F, Jagolinzer AD, Riedl EJ (2013) Mandatory IFRS adoption and financial statement comparability. Contemporary Accounting Research 30(4): 1373-1400.

- Jayaraman S, Verdi R (2013) The effect of economic integration on accounting comparability: Evidence from the adoption of the euro. Working paper, pp.35.

- Bodle KA, Cybinski PJ, Reza Monem R (2016) Effect of IFRS adoption on financial reporting quality: Evidence from bankruptcy prediction. Accounting Research Journal 29(3): 292-312.

- Jibril RS (2019) The impact of International Financial Reporting Standard (IFRS) Adoption on accounting quality in Nigerian listed money deposit banks. Applied Finance and Accounting 5(1): 49-57.

- Schipper K (2003) Principles-based accounting standards. Accounting Horizons 17(1): 61-72.

- Barth ME, Landsman WR, Lang M, Williams C (2012) Are IFRS-based and US GAAP- based accounting amounts comparable? Journal of Accounting and Economics 54(1): 68-93.

- Healy P, Wahlen J (1999) A review of the earnings management literature and its implications for standard settings, Accounting Horizons 13(4): 365-383.

- Leuz C, Verrechia RE (2000) The economic consequence of increased disclosures. Journal of Accounting Research 38: 91-124.

- Daske Hl (2008) Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research 46(5): 1085-1142.

- Alali FA, Foote PS (2012) The value relevance of international financial reporting standards: Empirical evidence in an emerging market. The International Journal of Accounting 47(1): 85-108.

- Karampinis N, Hevas DL (2011) Mandating IFRS in an unfavorable environment: The Greek experience. The International Journal of Accounting 46(3): 304-332.

- Nijam HM, Jahfer A (2016) IFRS adoption and financial reporting quality: A review of evidence in different jurisdictions. International Letters of Social and Humanistic Sciences 69: 93-106.

- Loannis T, Dionysia D (2014) Value relevance of IFRS mandatory disclosure requirements. Journal of Applied Accounting Research 15(1): 22-42.

- Nice Working Paper.

© 2021 Rihab Grassa. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and build upon your work non-commercially.

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

a Creative Commons Attribution 4.0 International License. Based on a work at www.crimsonpublishers.com.

Best viewed in

.jpg)

Editorial Board Registrations

Editorial Board Registrations Submit your Article

Submit your Article Refer a Friend

Refer a Friend Advertise With Us

Advertise With Us

.jpg)

.jpg)

.bmp)

.jpg)

.png)

.jpg)

.png)

.png)

.png)